This week, Africa’s growth story seems to run on two currents: electricity and connectivity. Power grids, remittances and digital platforms are reshaping economies from Nairobi to Lagos—and the next decade’s winners will be those who get digital right.

Africa Trivia

How many countries does the Nile River Basin run through?

A) 7

B) 9

C) 11

D) 13

Graphic of the Week

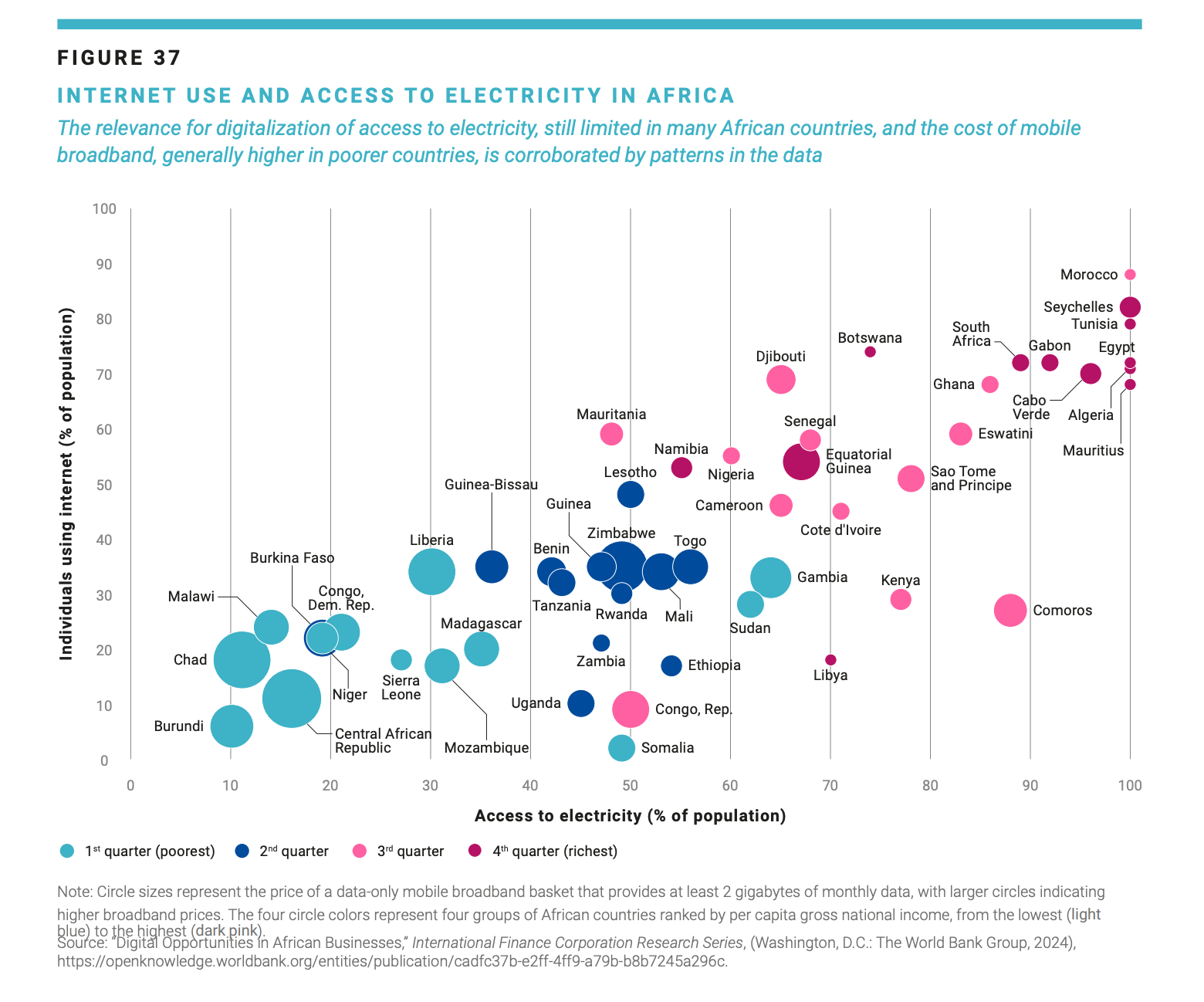

Powering Africa’s Digital Leap

Source: Brookings

The Foresight Africa: Top Priorities for the Continent 2025–2030 report by the Brookings Africa Growth Initiative has a lot of good stuff, including a section on Africa’s power and internet networks.

What the data shows

Powering up: About 600 million Africans still lack electricity but renewable energy growth is accelerating; Kenya already runs on 93% clean power. If you are a long-time reader, you may be sick of hearing those two data points.

Connecting more people: Internet use has climbed to 37%, with mobile penetration reaching 44% as Africans leapfrog to mobile-first access.

Falling barriers: New subsea cables could increase international bandwidth sixfold by 2027, cutting broadband prices and attracting $32B in investment.

Massive potential: The continent needs about $400B in grid investment by 2050 but hopefully that’s also a trillion-dollar opportunity for innovation and infrastructure.

Why it matters: Africa’s digital transformation is accelerating as power grids, data cables and mobile networks converge (and should I add data centers? Don’t miss the Nvidia news). With the right investment and policy mix, fingers crossed, some countries on the continent can turn today’s connectivity gaps into tomorrow’s engines of productivity and inclusion. Nigeria seems to be making some progress.

What We Are Reading

Africa: U.S. chipmaker Nvidia invested in Strive Masiyiwa’s Cassava Technologies to expand its digital infrastructure and build “AI factories” across Africa, marking a major push to tap the continent’s $5B data center opportunity (Semafor); A record 55 African-born or first-generation basketball players are competing in the new NBA season, reflecting the league’s growing investment and talent pipeline from the continent (Semafor); South Africa, Nigeria, Mozambique and Burkina Faso were removed from the Paris-based Financial Action Task Force (FATF) grey list, which will likely boost investor confidence and ease capital flows into their economies (Reuters).

Cameroon: President Biya, 92, declared election winner for an eighth term with 53.66% of the vote amid opposition protests and unrest (The Guardian).

DR Congo: Top African banks announced that they are expanding into the country, drawn by strong economic growth, rising deposits and high banking profits despite ongoing conflict (Semafor).

Djibouti: The parliament voted to scrap the presidential age limit, allowing 77-year-old President Guelleh to seek a sixth term in the 2026 election (RFI).

Kenya: U.S. Vice President JD Vance announced he will visit Nairobi in late November after the G20 summit in South Africa, as Washington’s key East African ally seeks a trade deal while balancing ties with both the U.S. and China. (Reuters).

Mali: Schools and universities have been shut nationwide for two weeks after jihadi militants blocked fuel imports, causing severe shortages and disrupting transport (Al Jazeera).

Morocco: The economy grew in early 2025, driven by a 4.6% rise in agriculture and a 43.4% jump in foreign investment, signaling recovery after years of drought (Morocco World News).

Mozambique: TotalEnergies said costs for its LNG project had increased by $4.5B following a four-year suspension and that it was seeking a 10-year extension to its production deal (Reuters).

Nigeria: A decade-long financial inclusion drive has lifted bank and non-bank account ownership to 64% of adults, expanding domestic savings and digital transactions that officials say are boosting capital formation and helping fund national development (Semafor).

South Africa: China’s BYD announced plans to install 300 new EV charging stations by 2026 to expand its footprint in the country’s growing electric vehicle market (Semafor).

Tanzania: Police in Tanzania fired tear gas to disperse protesters in Dar es Salaam and other cities after a disputed October 29 election marred by violence, internet blackouts and the disqualification of President Hassan’s main challengers (Reuters).

Business & Finance in Africa

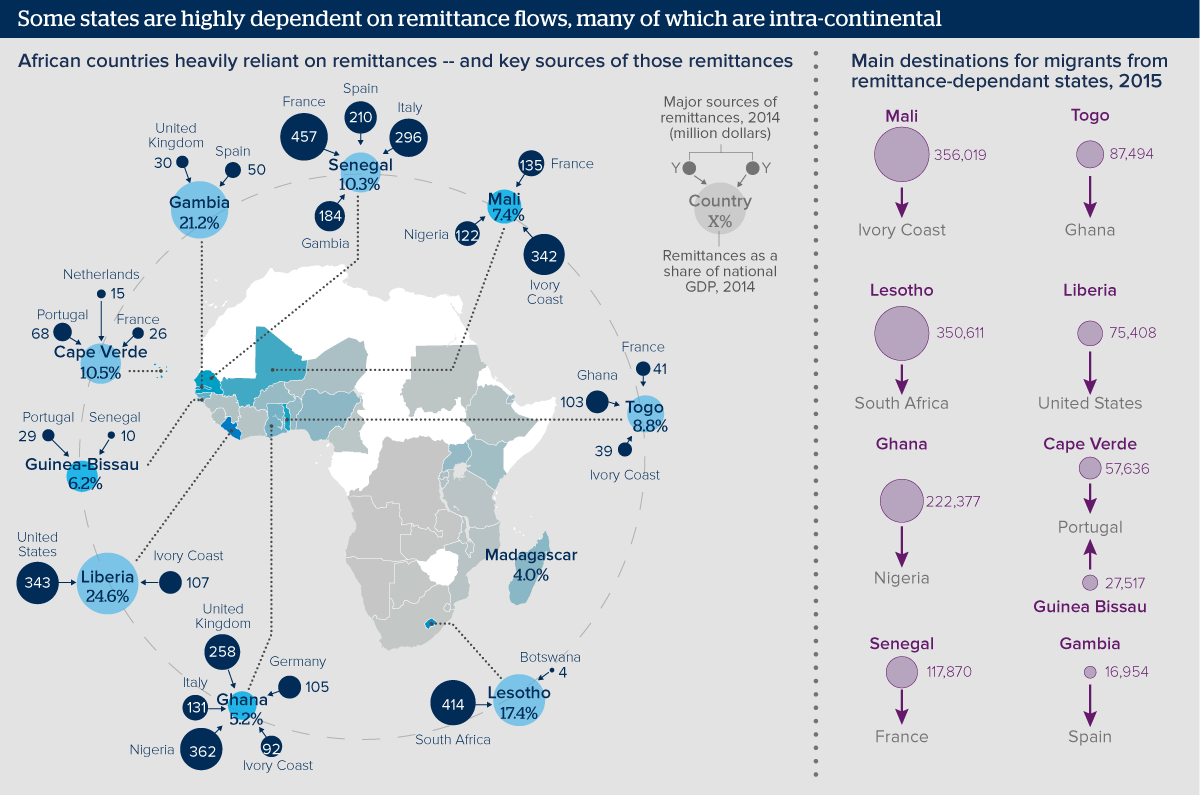

The Power of Africa’s Diaspora

Source: DabaFinance

As global aid patterns shift after the 2025 U.S. Agency for International Development (USAID) pullout, Africa Tomorrow highlights a quieter economic force: remittances. Money sent home by Africans abroad has become one of the continent’s most stable and overlooked financial pillars.

What the data shows

Remittance inflows to Africa nearly doubled from $53B in 2010 to $95B in 2024, rising from 3.6% to 5.1% of gross domestic product.

In 2024, remittances matched foreign direct investment ($97B) and outpaced official aid, making them a top external financing source.

Top recipients: Egypt ($22.7B), Nigeria ($19.8B) and Morocco ($12B) lead the continent, followed by Kenya ($4.9B) and Ghana ($4.6B) (DabaFinance).

About 20% of total flows, roughly $20B in 2023, came from within Africa, led by South Africa–Zimbabwe transfers.

High costs: Sending money to Africa still costs about 5% per transaction, above the United Nations’ 3% Sustainable Development Goal target.

In countries such as DR Congo and Nigeria, billions move off the books, masking real totals and weakening policy data.

What’s next: Fintech, the African Continental Free Trade Area’s digital trade framework and systems such as the Pan-African Payment and Settlement System could cut costs and formalize flows. Linking remittances to savings, insurance, diaspora bonds and investment incentives could turn family support into development finance. The World Bank projects inflows could reach $500B by 2035 if digital rails and policy reforms scale across the continent. Read more: Rethinking remittances: the overlooked billions sustaining African households.

Tech & Society in Africa

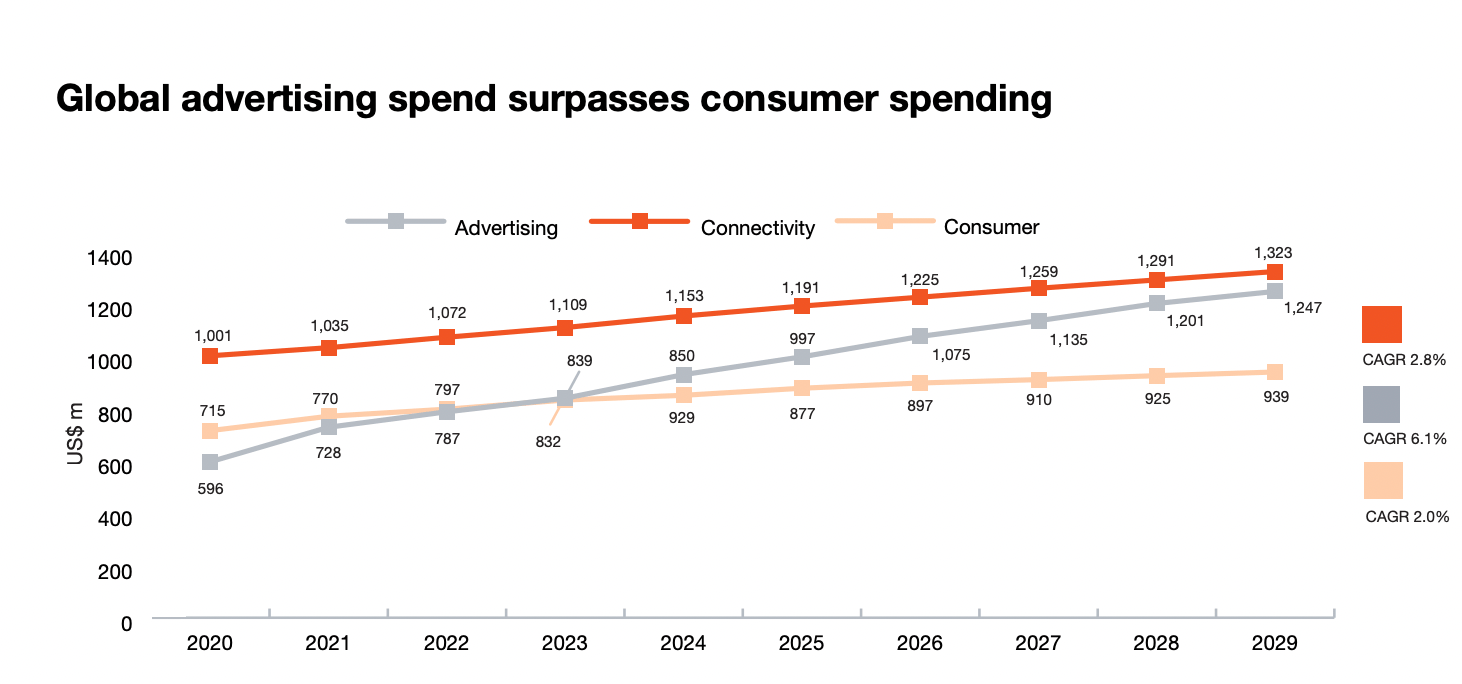

Clicks, Creators and Cash

Source: PWC

PwC’s Africa Entertainment & Media Outlook 2025–2029 paints a picture of a continent leading digital transformation in entertainment and media (E&M), driven by young, connected consumers and mobile-first markets in Nigeria, Kenya and South Africa.

What the data shows

Growth leaders: Nigeria’s E&M revenue grew 11.2% in 2024, followed by Kenya (7.1%) and South Africa (6.2%).

By 2029: Nigeria’s E&M sector is projected to grow at a 7.2% compound annual growth rate (CAGR), with Kenya at 5.2% and South Africa at 3.5%.

Digital surge: Internet advertising dominates, with Kenya posting the fastest growth globally (16% CAGR).

Streaming boom: Over-the-top (OTT) services are expanding rapidly with South Africa leading in subscriptions and Kenya in growth.

Gaming on the rise: E-sports and mobile gaming are expected to surpass traditional TV growth by 2028 in Nigeria.

Connectivity rules: More than 107 million Nigerians are online with mobile access driving nearly all growth.

What’s next: According to the report, generative AI and local content creation are reshaping Africa’s storytelling. Digital ad spend will exceed 80% of all advertising spend by 2029, and the continent’s youthful, mobile-first consumers will keep Africa’s E&M markets among the fastest-growing globally.

Climate in Africa

Forests for the Future

Source: The Economist

This week, The Economist reports from Inganda, a remote village in the Congo Basin where locals are paid to protect forests instead of clearing them. The story runs ahead of COP30 in Brazil this November, as global attention turns to how Africa’s rainforests can shape climate goals.

What’s happening: Africa holds more than 25% of the planet’s intact ecosystems and the Congo Basin is the world’s largest carbon sink after the oceans. Norway’s Community Fund for Forests pays Congolese villages to preserve trees, while Kenyan startup EarthAcre pilots biodiversity credits and carbon payments. These community-led efforts aim to replace colonial-era park models that often excluded locals from environmental benefits.

The challenge: Funding remains thin. According to the article, the global market for biodiversity credits was under $10M in 2024 and pledges to stop deforestation fall $700B short of annual needs. As rich nations waver on green commitments, Africa’s forests are emerging as a test case for climate finance—can protecting nature also sustain livelihoods?

Explorations in Africa

Beauty from the Tide

Source: Vogue

In Zanzibar’s tidal flats, the Mwani Mamas turn seaweed into skincare and struggle into strength, according to a photo essay in Vogue.

The short version: Nine women now earn $250–$300 a month—about seven times more than typical seaweed farmers—producing soaps and serums for Mwani, a sustainable beauty brand that sources all materials locally and offers full benefits, training and flexible loans.

According to the article, this is pole pole beauty—slow, local and empowering. Mwani’s patented seaweed extract is globally recognized and like so many social enterprises on the continent, the real power lies in transforming the community it works in. As one Mama put it, “I have…my own money [now] and that makes me feel so free.” Be sure to enjoy all the beautiful pictures from Zanzibar in Vogue.

Africa Trivia Answer

Answer: C) 11. The Nile River, the world’s longest, flows more than 6,800 kilometers through 11 African countries—Burundi, Democratic Republic of the Congo, Egypt, Eritrea, Ethiopia, Kenya, Rwanda, South Sudan, Sudan, Tanzania and Uganda—from Lake Victoria to the Mediterranean Sea. It has sustained civilizations for millennia and remains a vital lifeline for agriculture, transport and power generation, including Ethiopia’s Grand Ethiopian Renaissance Dam, Africa’s largest hydroelectric project with a capacity of about 6,000 megawatts. Read more: National Geographic.

Thanks for tuning in. If you are catching up, last week’s graphic was on crypto flow to the continent. Let us know if there are topics you’d like us to look into by emailing [email protected]. We are grateful for the many shares.