Africa’s cash is moving faster than its politics. This week’s Brief tracks the $2T crypto current flowing through the continent. From new crypto laws to smarter spending, grounded leaders, rising planes and patient elephants, it’s always good to follow the flow.

Africa Trivia

How much of Africa’s domestic capital is locked in government debt and short-term securities?

A) 50%

B) 60%

C) 70%

D) 85%

Graphic of the Week

The $2T Crypto Current

Source: IMF Working Paper

The IMF’s Decrypting Crypto (July 2025) is supposedly the first study to use AI to track where $2T in stablecoins actually flowed in 2024, and Africa is relevant.

What the study found

As expected, stablecoin activity was highest in North America ($633B) and Asia-Pacific ($519B), but Africa and the Middle East ranked second globally relative to GDP (6.7%), showing how quickly the region is embracing digital dollars.

In Africa, only 14% of flows stayed within the region, suggesting that most activity supports cross-border remittances, trade and dollar access.

Users leaned heavily on Binance (74%) over Coinbase (26%) and favored Tether’s USDT (57%) over USDC (43%), reflecting Africa’s tilt toward emerging market exchanges and tokens.

Average transaction size: $13,108; median: $100—evidence that small-value transfers drive much of the activity.

Globally, $54B in net outflows from North America show that stablecoins are now meeting global dollar demand, especially when local currencies weaken.

The March 2023 U.S. banking crisis sharply disrupted flows from North America, exposing how closely crypto rails depend on traditional banks.

Why it matters for Africa: The data confirms what’s visible on the ground. Africans are using stablecoins as a digital dollar lifeline—for remittances, trade and inflation protection. But it also signals new dependencies. As access to exchanges and off-ramps shapes who can move money, Africa’s financial future may hinge as much on crypto connectivity as on banking reform.

Here’s a quick rundown of African countries that have begun regulating virtual assets.

Enacted frameworks

Mauritius: Full regime for virtual assets and token issuers under the Virtual Asset and Initial Token Offering Services Act, with licensing by the Financial Services Commission (covers stablecoin issuers too) (Charlton's Quantum, Zitadelleag).

Botswana: Virtual Assets Act, 2022, in force; licensing of Virtual Asset Service Providers (VASP) under the Non-Bank Financial Institutions Regulatory Authority (Botswana Laws, Webber Wentzel).

Namibia: Virtual Assets Act, 2023 in force with detailed rules (custody, capital, disclosure, cybersecurity). Bank of Namibia is the regulator (Afriwise, Bowmans Law).

New or near-final laws

Kenya: The parliament passed the Virtual Asset Service Providers Bill in October 2025. It creates licensing for exchanges under the Capital Markets Authority (CMA) and assigns stablecoin licensing to the Central Bank (awaiting presidential assent) (Reuters, Parliament of Kenya).

Rwanda: In March 2025, the National Bank of Rwanda and the CMA introduced a draft framework for virtual assets and VASPs (The New Times).

Morocco: A nationwide ban remains, but Bank Al-Maghrib has prepared a draft crypto law now moving through adoption; Central Bank Digital Currency work is also underway (Reuters).

Exploring or signaling next steps

Ethiopia: Crypto remains illegal for payments, but the National Bank of Ethiopia and Financial Intelligence Service are developing a framework to regulate virtual assets and VASPs as part of new anti-money laundering reforms (AI Invest).

Ghana: The Bank of Ghana required VASPs operating in the country to register by August 15, 2025, ahead of the planned VASP Act expected later this year (Bank of Ghana).

Zambia: Authorities have flagged a forthcoming framework; public materials note draft work on crypto and stablecoins for stakeholder review in 2025 (ZamBanker).

Still prohibitive

Egypt: Trading and promotion require a Central Bank of Egypt license, which has not been issued; effectively, a prohibition remains in place (ICLG Business Reports).

And for those still asking, “how do the flows actually work?”:

Source: IMF Working Paper

What We Are Reading

Africa: GSMA and six major mobile operators proposed $30 4G smartphones to improve affordability and connect millions still offline (Tech Cabal); the West African Development Bank raised €1B through a 15-year bond to fund high-impact projects across the West African Economic and Monetary Union (The Kenyan Wall Street).

Cameroon: At least 20 protesters are arrested after disputed presidential elections as tensions rose over alleged fraud and President Biya’s expected victory (AP News).

Côte d’Ivoire: Youth frustration grew as 83-year-old President Ouattara announced plans for a fourth term amid poverty, inequality and opposition crackdowns (AP News).

Egypt: The EU and Egypt held a summit in Brussels to strengthen trade, migration and Gaza peace cooperation (RFI).

Ethiopia announced it is in talks with China to convert part of its $5.4B debt into yuan-denominated loans, following Kenya’s example to reduce costs and boost trade connectivity (Bloomberg).

Kenya: President Ruto signed the Virtual Asset Service Providers Bill into law, giving the Capital Markets Authority power to license, audit and regulate crypto firms to boost transparency and curb financial crimes (Citizen Digital); Tether, the company behind the world’s largest stablecoin USDT, invested in fintech startup Kotani Pay to expand crypto access and improve cross-border payments across Africa (The Kenyan Wall Street); Kenya Airways partnered with Qatar Airways to offer codeshare flights to 19 destinations, boosting travel across Africa, the Middle East and Asia (Qatar Airways).

Madagascar: The African Union suspended Madagascar after a military takeover that ousted President Rajoelina (ISS).

Morocco: The government approved a draft law offering financial support for young candidates and reserving seats for women to boost political inclusion amid youth-led protests (Morocco World News).

Nigeria: A fuel tanker explosion in Niger State killed at least 35 people, with officials blaming poor road conditions and the lack of pipelines for frequent fuel transport accidents (Al Jazeera).

Rwanda: Spiro secured $100M from Afreximbank’s FEDA to expand its electric motorcycle and battery-swapping network across Africa (The Kenyan Wall Street).

South Africa: Critics said that the ANC’s affirmative action policy enriches elites and hollows services, fueling record inequality, 43% joblessness and 1.2% growth, eroding the party to 40% and coalition rule as voters shift to rivals (WSJ).

Tunisia: A general strike paralyzed the city of Gabes as tens of thousands protested pollution from a state phosphate plant, accusing the government of worsening health and environmental crises (Reuters).

Business & Finance in Africa

Spend Smart, Grow Fast

Source: IMF

A new IMF Fiscal Monitor analysis (October 2025) finds that governments could boost growth by up to one-third simply by spending smarter, not necessarily spending more.

What happened: Reviewing 174 economies, the IMF found that reallocating just 1% of GDP from low-impact consumption (normal government operations) to infrastructure or education can raise long-term output by as much as 3% to 6% in developing economies. Improving spending efficiency by 10 percentage points can add another 1.4% in growth.

Africa lens: Rwanda stands out. With modest spending (rising from $150 to $420 per person over two decades), it achieved triple electricity use, 20 more years of life expectancy and near-universal phone and school access by focusing on efficient, accountable spending.

Why it matters: Many African countries face tight budgets, rising debt and young populations eager for progress. Making every dollar count through smarter allocation, transparency and performance-based budgeting could turn efficiency into Africa’s most powerful growth strategy.

Empty African Skies

Source: McKinsey & Co.

A new McKinsey report Small Planes, Big Changes: The Evolving Business of Regional Aviation (2025) finds Africa is the only region in the world where short-haul air travel has fully recovered to pre-pandemic levels, yet it still represents the smallest share of global seats.

What happened: Of about 6,000 regional aircraft flying worldwide, only a fraction operate in Africa. Even so, the continent has restored turboprop and regional jet activity faster than any other region, showing both resilience and untapped demand.

Why it matters: Regional aircraft are lifelines for remote towns and secondary cities, connecting where roads and rail cannot. Africa’s recovery shows the demand is there—what is missing is investment to match it.

The takeaway: Africa is flying again but from a low base. The continent’s full recovery and small global footprint make it the biggest runway for growth in regional aviation.

Optimizing $4B

Source: UBA

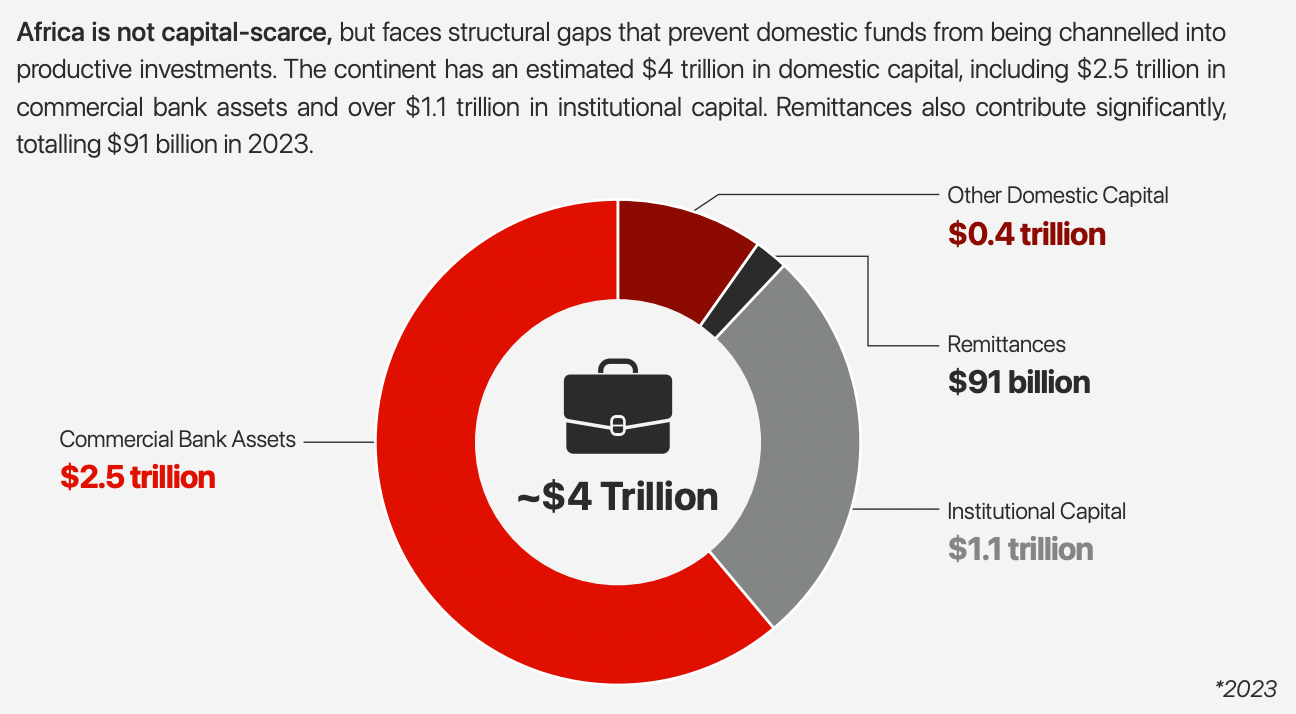

We often cover Africa’s digital and financial evolution, and it’s interesting to see an African bank weigh in. A white paper, Banking on Africa by United Bank for Africa (UBA), echoes a growing consensus that the continent’s future depends on reframing capital away from aid and toward African-led investment and innovation.

What happened: The report says Africa attracts a growing share of global capital flows, about $97B in FDI in 2024, but its banking sector remains small, just 3% of global assets. UBA calls for mobilizing domestic capital, leveraging fintech and building regional integration to fund Africa’s own growth.

Why it matters: With aid declining and global debt pressures rising, the paper argues that Africa’s next phase must be financed by Africans, for Africans. Digital banking, blended finance and youth-driven entrepreneurship are central to that shift.

Source: Semafor

Democracy in Africa

Africa’s Big Men

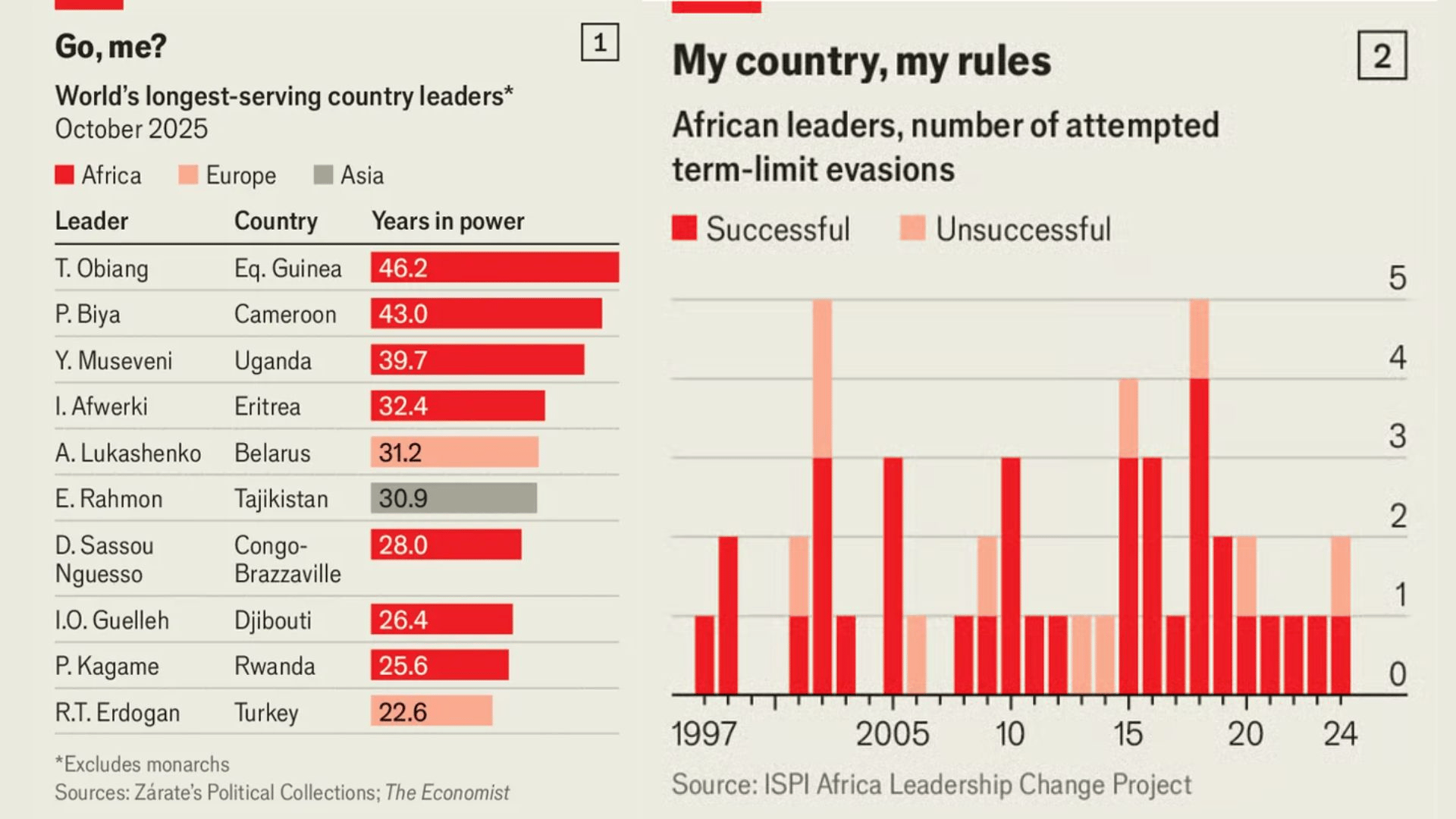

A recent article in The Economist says Africa’s “big men” are not fading; they are sadly multiplying. Leaders such as President Biya, 92, in Cameroon and President Museveni in Uganda are part of a new wave of leaders for life who extend their rule through constitutional changes, patronage and populism.

Source: The Economist

What happened: Since 2000, there have been 44 attempts to remove term limits in Africa and about three-fourths have succeeded. Seven of the world’s 10 longest-serving non-royal leaders are African. Some, including President Biya, govern from abroad, while others, such as President Obiang in Equatorial Guinea and President Ouattara in Côte d’Ivoire, have rewritten constitutions or positioned heirs to hold on to power.

Why it matters: Many of these leaders cite economic growth and stability to justify their rule, but long tenure often brings corruption, repression and weaker institutions. Personal rule discourages investment and makes transitions riskier once leaders leave office.

Africa’s Industry Shift

Source: Bloomberg

A new Bloomberg Businessweek report, An Investor’s Guide to Africa, highlights six industries drawing growing investor attention in Africa: agriculture, critical minerals, data centers, renewable energy, oil and gas and manufacturing.

What happened: Global investors have committed tens of billions of dollars to African projects this year as trade realigns under U.S. tariffs and China’s $30.5B in new construction contracts. And as we have said, the African Continental Free Trade Area (AfCFTA), expected to be fully operational by 2035, could open a $3.4T market.

Why it matters: Africa holds 30% of the world’s critical mineral reserves and 60% of land suitable for solar energy, yet accounts for less than 2% of global manufacturing and data center capacity. The continent’s young population and rapid urbanization continue to attract interest, though investors face challenges including infrastructure gaps, policy uncertainty and high debt burdens.

The takeaway: The report finds that while risks remain, Africa’s key sectors are seeing steady investment as countries pursue diversified growth and trade integration.

Tech & Society in Africa

Next Gen Rising

The past month delivered two stark examples of how African leaders are responding (or failing to respond) to youth demands. Across the continent, young people are asking for jobs, dignity and a voice and the results could not be more different.

Morocco’s pivot: Weeks of Gen Z–led protests over jobs, schools and corruption shook the country. King Mohammed VI responded with a variety of initiatives, including reforms to fund up to 75% of campaign costs for candidates under 35, inviting youth into politics while urging faster action on jobs, health and education. It’s an attempt to channel frustration into participation, even as police detain hundreds in ongoing clashes.

Madagascar’s fall: In Antananarivo, young protesters faced no running water at the country’s top university for several months with no response. President Andry Rajoelina, once a youthful reformer himself, fled the country after losing the army’s support. A colonel now leads a transitional government promising elections within two years.

Why it matters: In today’s world, more than 60% of Africans are under 25, and governments that fail to listen to their young people risk collapse. Morocco is betting on inclusion. Madagascar ignored its youth and faced a coup. The continent’s next generation isn’t waiting for their turn, they’re taking it.

Read more: Reuters (Morocco), Morocco World News, Reuters (Madagascar), The Guardian

Explorations in Africa

Giants of Grace

Source: The Guardian

In Kenya’s Tsavo and Oldonyiro, elephants still trace ancient migration routes shaped by seasonal rains, but new highways, railways and fences are cutting them off. Once, poaching was the biggest threat; today, human-elephant conflict kills more elephants and people than ivory hunters ever did, according to The Guardian.

Tsavo, Kenya’s largest protected area, shelters about 17,000 elephants, including Goshi, one of fewer than 30 “super-tuskers” left in Africa. These giants, with tusks weighing more than 100 pounds each, roam landscapes now fractured by the Mombasa-Nairobi highway and the Chinese-built SGR railway.

Far north in Oldonyiro, a Samburu community of 3,000 lives inside a key migration corridor. Families guard fields through the night, but innovation brings hope: beehive fences cut crop raids by 86%, keeping elephants away while producing honey and pollinating crops.

Across Kenya, farmers, herders and conservationists are finding ways to coexist with the continent’s giants, proof that beauty and survival can still share the same ground.

Trivia Answer

Answer: D) According to UBA, 85% of Africa’s domestic financial assets are tied up in government debt and short-term securities. This crowding-out effect limits credit to businesses and infrastructure, starving the private sector of long-term capital. The report argues that too much liquidity is recycling through treasury bills instead of fueling growth, innovation and job creation, leaving African economies over-financed by debt but underfunded for development. Read more: Banking on Africa - White Paper - UBA.

Missed last week’s Brief? Read about the New Bank: Mobile. We’re growing and hope we’re adding value. Tell us how to make The Africa Brief better. Please share it and send ideas or feedback to [email protected]. We love hearing from you!