Leapfrogs and Fault Lines: From mobile money to military coups, this week captures Africa’s opportunities and challenges with innovation surging even as instability wins the day in a few places. Phones are becoming banks, fintechs are rewriting finance and Nigeria’s reforms are reshaping headlines but not yet households. In Sudan, young women are keeping a nation alive; in Madagascar, Gen Z just toppled a president. And from the medinas of Morocco, craftsmanship is making a quiet, soulful comeback.

Africa Trivia

Which dam in Africa creates the reservoir with the largest surface area, and what is that reservoir called?

A. Akosombo Dam (Ghana) – Lake Volta

B. Kariba Dam (Zambia / Zimbabwe) – Lake Kariba

C. Grand Ethiopian Renaissance Dam (Ethiopia) – Millennium Reservoir

D. Cahora Bassa Dam (Mozambique) – Lake Cahora Bassa

Graphic of the Week

The New Bank: Mobile

Source: World Bank Data 360

My colleagues have been playing with World Bank data and I had to share. It shows—plain as day—how mobile money has become much of Africa’s de facto banking system. With few traditional bank or credit card users, millions of Africans now send and spend, save and borrow entirely through their phones. It’s one of the most powerful examples of leapfrog innovation anywhere.

Zooming out, the IMF notes that half of all financial assets globally are now held by nonbanks—fintechs, funds and platforms offering credit and liquidity outside traditional banking systems. From Kenya’s M-Pesa to Wall Street’s private credit funds, the world is being rewired by new forms of finance. What an opportunity and an interesting space for regulators and investors. Be sure to play with the World Bank’s Data360 set and read the IMF’s “Five Megatrends Shaping the Rise of Nonbank Finance.”

What We Are Reading

Africa: The UN’s World Food Program warned that funding cuts could push 14 million people into emergency hunger, slashing aid by 40% in countries including Somalia and Sudan (AP News).

Botswana: Lawmakers are debating a $27B plan to diversify the economy away from diamonds, focusing on transport, water and infrastructure projects through 2030 (Bloomberg); The government is enforcing a rule requiring mining firms to sell 24% of new concessions to local investors to boost domestic ownership and value addition in the diamond sector (Reuters).

Cameroon: Opposition candidate Issa Tchiroma declared victory in the October 12 presidential election and urged President Biya to accept defeat ahead of official results (Reuters).

Egypt: The government announced plans to boost liquefied natural gas exports from the Idku facility between November and March to attract investment and ease European supply shortages (Bloomberg); S&P upgraded Egypt's rating to B, citing economic reforms and GDP growth, while Fitch affirmed its B rating with a stable outlook (Reuters).

Ethiopia: Debt restructuring talks with bondholders collapsed after disagreements over key terms, leaving the country in default and bondholders considering legal action (Reuters).

Kenya: President Ruto announced a $31B, 10-year infrastructure plan funded by the budget, privatization and private investment (Bloomberg); Opposition leader Raila Odinga died at 80 in India, marking the end of a pivotal era in Kenyan politics (The African Perspective); Parliament has passed the Virtual Asset Service Providers Bill, creating the country’s first crypto regulatory framework (The Kenyan WallStreet); KCB and Equity Bank are fast-tracking entry into Ethiopia to tap its liberalizing economy and young market (Semafor).

Madagascar: President Rajoelina went into hiding following threats to his life as youth-led protests over water and power shortages escalated and an army unit sided with the demonstrators (Bloomberg).

Mali: In response to the U.S. visa bond program, Mali announced requirements for American visitors to post bonds up to $10K for business and tourist visas (Reuters).

Malawi: COMESA launched trials of a digital payments system with Zambia to lower transaction costs and promote local currency trade (Semafor).

Morocco: The finance minister called recent Gen Z protests a “wake-up call,” vowing faster reforms and job creation as unrest over inequality and spending priorities intensified (Bloomberg).

Seychelles: Former parliament speaker Patrick Herminie won the presidential run-off, restoring United Seychelles party control (Reuters).

South Africa: Canal+ announced plans for a secondary listing in Johannesburg after acquiring MultiChoice to maintain local investor access and expand its African presence (Reuters); The EU pledged EUR 11.5B for investment in clean energy, infrastructure and pharmaceuticals to boost growth and jobs(Reuters); Moody’s projected South Africa’s economy would grow by just 1% in 2025 and 1.6% in 2026, warning that slow reforms would keep growth below the government’s 3.5% target (Bloomberg).

Tunisia: Protests erupted in Gabes over pollution from the phosphate complex, with police firing tear gas and residents demanding its closure amid health and environmental concerns (Al Jazeera).

Business & Finance in Africa

Money Moves, Africa-Style

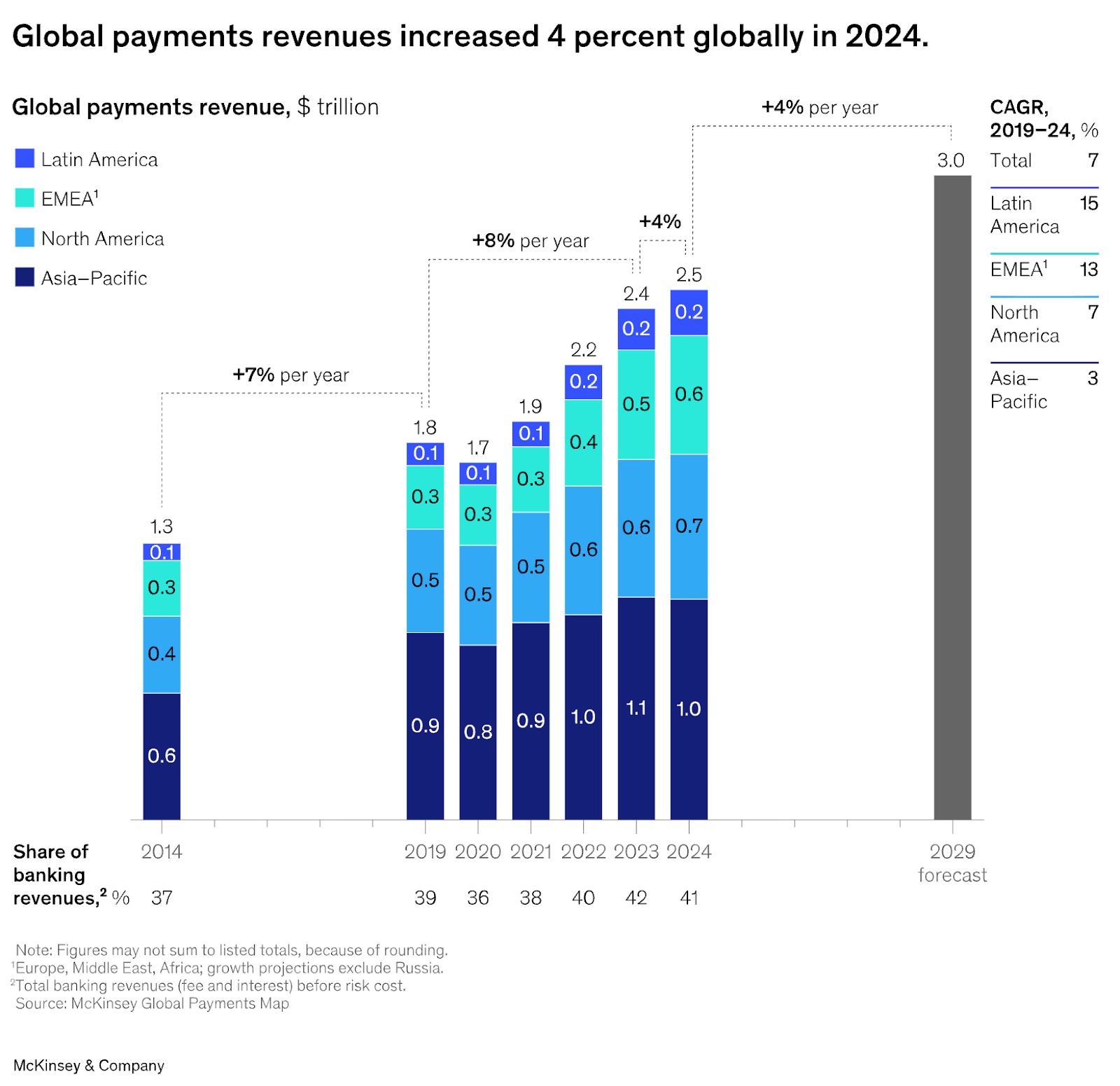

Source: McKinsey & Co.

Continuing on the theme from our graphic of the week, according to The 2025 McKinsey Global Payments Report, Africa really is leapfrogging. With mobile penetration, fintech innovation and bold regulatory reform, the continent is rewriting how money moves — and reshaping its place in global finance.

By the numbers:

Payments surge: Africa’s payments revenue grew about 8% in 2024, outpacing global averages, as fintechs captured nearly half of new transaction value in key markets like Nigeria, Kenya and South Africa.

Cash fading fast: Cash use dropped below 46% of all transactions, down from 60% five years ago, signaling a decisive shift toward digital wallets and instant payments.Mobile money dominance: Africa powers 70% of global mobile money volume — led by Kenya’s M-Pesa, Ghana’s MoMo and fast-growing francophone platforms — moving billions daily.

Cross-border reform: The Pan-African Payment and Settlement System (PAPSS) is cutting regional transfer costs by up to 50%, advancing the AfCFTA’s single-market vision.

AI + cloud on the rise: Banks and fintechs are migrating payments to the cloud, embedding AI to fight fraud, optimize routes and tailor services.

Why it matters: Africa’s digital payments surge is more than a fintech story — it’s a financial transformation in process. Mobile money has become the bank, data the new collateral, and the continent a testbed for the future of global payments. Sources: McKinsey & Co., GSMA, PAPSS

Nigeria Check-In

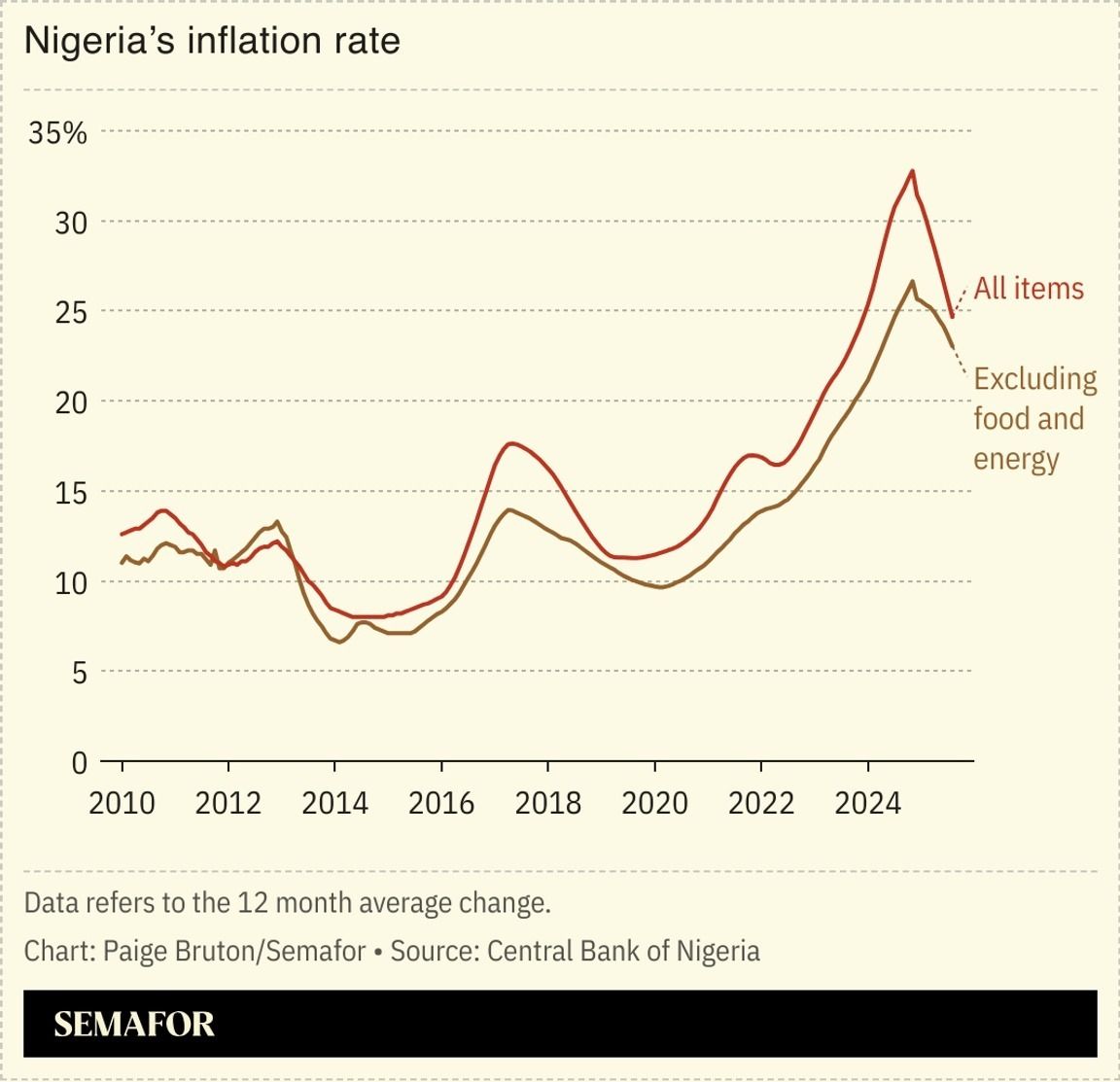

Source: World Bank

A short update on West Africa’s largest economy. The World Bank’s October 2025 Nigeria Development Update says growth is up, but real incomes are still eroding as food prices and poverty climb.

Reforms like fuel subsidy removal, tax improvements and exchange rate unification helped GDP rise 3.9% in early 2025 (up from 3.5% last year). Rebasing the economy this year revealed Nigeria’s GDP is 36.8% larger than previously estimated — and far less oil-dependent, with crude now just 3.9% of GDP.

But progress hasn’t reached households. Poverty is projected to peak at 62% of the population in 2026 — around 141 million Nigerians — before easing slightly. Import bans and high tariffs on staples like sugar (70%), cement (50%) and rice (up to 60%) are keeping food inflation painfully high.

By the numbers:

GDP growth: 3.9% (H1 2025)

Inflation: 33% (2024), easing to 24% in 2025

Poverty: 56% (2024) → 62% (2026)

Foreign reserves: $42B (up from $38B in April 2025)

Public debt: Falling from 42.9% to 39.8% of GDP

Social protection: Covers just 6% of Nigerians (0.14% of GDP vs 1.5% global avg.)

Why it matters: Nigeria’s macro picture looks stronger — rising reserves, lower debt and a rebased economy — but reforms haven’t reached the dinner table. Without easing food inflation and expanding social protection, growth will remain a headline, not a household story. If you follow Nigeria closely, you will want to dig into this report: World Bank, “Nigeria Development Update (Oct 2025).

Source: Semafor

Tech & Society in Africa

Sudan’s Unsung Lifeline

The world needs more stories of community like this. According to The Economist, Sudan’s Emergency Response Rooms (ERRs), which includes 700+ volunteer groups made up mostly of women, are keeping the country alive amid war and famine.

They’ve helped 3 million people with food, water, power and evacuations, often acting as the state itself. Born from 2019’s resistance committees, the ERRs rotate leadership regularly and send 95% of donations straight to communities.

Despite doing more with less, they manage less than 1% of international aid for the country. In a collapsing system, they’re proof that local networks can save lives when the world mostly looks away. Read more: The Economist.

Gen Z’s Malagasy Coup

Source: FT

A water crisis at a university in Madagascar some months ago spiraled into a Gen Z-led uprising, and ended in a military coup. What began as student sit-ins over dry taps turned into months of mass protests that ousted President Andry Rajoelina, a 33-year-old former DJ once seen as a reformer.

The parliament impeached him, soldiers seized power and Colonel Michael Randrianirina now leads a transitional government promising elections within two years. The African Union suspended Madagascar, calling it a coup.

The protests echo youth-driven revolts from Kenya to Bangladesh, fueled by social media and frustration with poverty and power cuts in one of the world’s poorest nations. For many, the military is a temporary hope and a warning: “if they fail, we’ll kick them out too.” Read more: FT

Explorations in Africa

Weaving It Forward

Source: FT

According to The Financial Times, Moroccan rugs are back in style. Once mid-century design icons, the Berber-woven beauties dipped in the 1990s but have surged again, with exports more than doubling to $31.6M in the past decade.

From my own visits to rug shops and weavers in medinas across the country, it’s hard to imagine how they ever went out of vogue. But now, new brands like Beni are blending modern design with centuries-old craftsmanship — offering fair pay, chic studios near Marrakech and shuttle buses for their mostly female weavers. Younger artisans are joining the trade, reviving both craft and community.

The twist? Many “Moroccan” rugs sold globally are made in India or Pakistan. The real ones carry soul, story and tea-soaked tradition. Read more: FT

Africa Trivia Answer

Answer: A. Akosombo Dam (Ghana) – Lake Volta. Constructed between 1961 and 1965, Akosombo Dam impounds the Volta River to form Lake Volta, which covers about 8,502 km² and is widely recognized as the largest man-made lake in the world by surface area. The dam’s hydroelectric complex produces much of Ghana’s electricity and transformed the Volta River basin. Source: Wikipedia

Missed last week’s Brief? Check out our take on the Beijing Advantage. We hope the Africa Brief gives you good context for what’s happening across the continent! Please share it and send content ideas or feedback to [email protected]. We love hearing from you!