Africa’s momentum this week feels eclectic, from fintech rails in Lomé to pharaohs in prime time. The Franc Zone is going digital, a $1.5B fund is building Africa’s future, and new data shows the continent logging on and leveling up. But behind the progress, an ominous warning: cities from Lagos to Nairobi are swelling with young jobseekers, a demographic boom that could make or break Africa’s next decade.

Africa Trivia

Which country ranked as the top-governed African country according to the World Economics Governance Index?

A) Ghana

B) Mauritius

C) Rwanda

D) Botswana

Graphic of the Week

The Franc Zone Advantage

Source: S&P Global

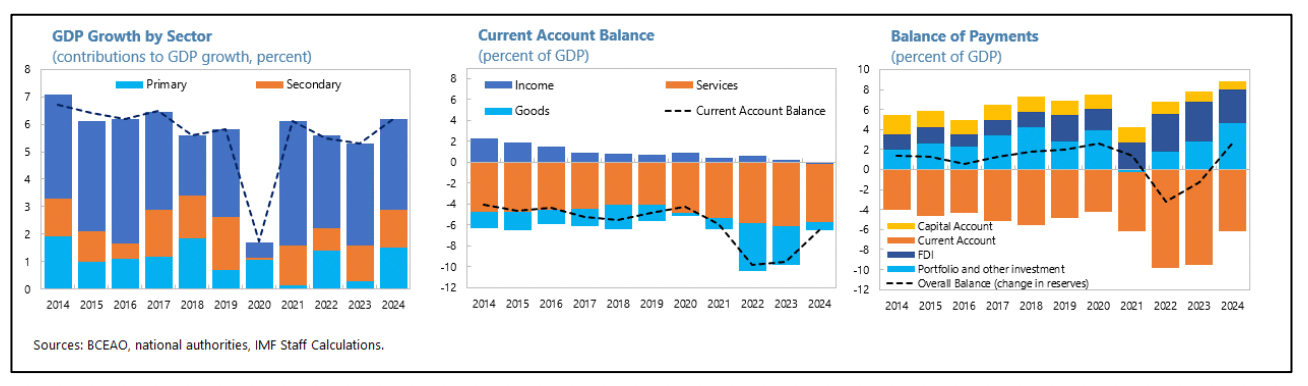

I was in Togo last week, and now I’m curious about everything West African Economic and Monetary Union (WAEMU/UEMOA), an eight-country bloc of roughly 140 million people sharing the CFA franc (XOF) and a single central bank, the Central Bank of West African States (BCEAO). The union seems to be quietly tightening financial integration while modernizing its digital infrastructure. From Dakar to Lomé, UEMOA is rolling out instant payments and pulling fintechs into the formal system under one rulebook.

Why it matters:

Shared rails, shared currency: The BCEAO launched an instant payments platform (PI-SPI) linking all eight members for 24/7 cross-border transactions — a major step toward a unified digital market.

Fintech legitimacy: The BCEAO has now licensed about 30 fintechs, including 10 new approvals in September 2025.

New rulebook: Instruction 001-01-2024, issued in January 2024, introduced tougher standards on capital, governance and compliance for fintechs and payment firms.

Innovation bridge: The BCSF-UEMOA, BCEAO’s fintech unit, tracks 130+ startups and mediates between innovators and regulators — rare coordination on the continent.

Currency credibility: The CFA franc’s peg to the euro has kept inflation among Africa’s lowest and built investor confidence in the zone’s stable members.

Dose of reality:

Uneven integration: Stronger economies like Côte d’Ivoire and Senegal lead, while landlocked states lag.

Security strains: Coups in Mali, Niger and Burkina Faso threaten cohesion and confidence.

French ties linger: The euro peg ensures stability but fuels political resentment over perceived loss of monetary sovereignty.

Quick take: According to fintechs I spoke to last week in Togo like Gozem and Solimi, UEMOA is an incredibly functional monetary union: one currency, one central bank and one fintech framework.

Sources: IMF 2025 West Africa Staff Report, UEMOA, BCEAO (Instruction No. 001-01-2024 PDF, PI-SPI Launch Press Release, Fintech and Digitalization Overview).

Source: IMF

What We Are Reading

Africa: African financial institutions and the African Union launched a $1.5B infrastructure fund to help African countries finance and build their own roads, power grids and digital networks instead of relying on foreign capital (Afreximbank).

Angola: Shell announced it will invest $1B in new offshore oil blocks to help the country maintain production above one million barrels a day (Bloomberg).

DR Congo: Mobile operators, Africell and Vodacom, announced that they are in talks with Starlink to expand internet access in remote areas, following the government's grant of a license to the satellite firm (Semafor); Inflation fell to 2.5% as the currency strengthened and the IMF forecasted economic growth at more than 5% for 2025 and 2026 (Bloomberg).

Egypt: Suez Canal revenues rose 14% from July to October as Red Sea tensions eased and ship traffic increased following the Gaza ceasefire (Reuters); Qatari Diar announced that it will invest $3.5B in Egypt’s Mediterranean tourism and real estate projects, boosting foreign investment and supporting the country’s IMF-backed economic recovery (Bloomberg).

Ethiopia: A U.S. jury began the first civil trial over the 2019 Ethiopian Airlines 737 Max crash to decide how much Boeing must pay victims’ families (AP); Ethiopia’s Afar region says Tigrayan forces have crossed into its territory, seizing villages and attacking civilians in what it calls a violation of the 2022 peace deal that ended the country’s northern war (Al Jazeera).

Guinea: Junta leader Mamady Doumbouya registered to run in December’s presidential election despite earlier pledging not to, after a new constitution allowed his candidacy (Reuters).

Kenya announced its plans to sell $1.32B in bonds to clear road contractor debts and refinance short-term loans backed by the IMF and World Bank (Bloomberg); KCB Group announced that it is acquiring a minority stake in Pesapal to boost digital payments and expand financial inclusion for small and micro enterprises across Kenya and the region (Tech Africa News); Safaricom's half-year profit rose by 55% driven by Kenya growth and smaller Ethiopia loss (Reuters).

Morocco declared October 31 a national holiday to celebrate the UN's backing for its Western Sahara autonomy plan (Barron’s).

Mozambique: The government decided to allocate 7.4% of GDP in 2026 to service public debt, hiring U.S. firm Alvarez & Marsal to help design a debt restructuring plan (360 Mozambique).

Nigerians rejected President Trump’s call for possible U.S. military action over alleged Christian killings, saying the violence affects both Christians and Muslims and stems from local conflicts, not religion (RFI); Nigeria sold $2.35B in 10- and 20-year dollar bonds at lower yields, tapping global markets despite threats of U.S. military action and joining other African countries raising foreign-currency debt (Bloomberg).

Senegal extended talks with the IMF to finalize a new lending program after a debt misreporting scandal led to the suspension of its previous $1.8B facility (Bloomberg).

South Sudan: President Kiir appointed Barnaba Bak Chol as finance minister, the eighth change in five years, amid ongoing economic turmoil and corruption (Bloomberg).

Sudan: France and the UN urged a ceasefire after reports of ethnic atrocities by RSF forces in El-Fasher, where tens of thousands have fled amid escalating violence in Darfur (RFI).

Tanzania: President Hassan was inaugurated after disputed elections marked by protests, internet blackout and reports of intimidation and violence (RFI); Tanzania reopened its border with Zambia after post-election unrest, restoring key copper and cobalt trade routes and regional cargo flows (Bloomberg); AU observers said the October 29 election violated democratic standards with ballot stuffing and exclusion of opposition (Reuters).

Tunisia repatriated 10,000 sub-Saharan African migrants in 2025 under a voluntary return program, insisting it will not become a transit zone to Europe (Reuters).

Business & Finance in Africa

Not Booming, Not Breaking

Source: IMF

I find country-by-country analysis more useful than broad sub-Saharan snapshots but the IMF’s October 2025 Regional Economic Outlook shows a region holding firm — resilient, yet under pressure. Growth is holding at 4.1% in 2025, driven by stabilization efforts in economies like Nigeria and Ethiopia. Several of the world’s fastest-growing countries are African including Benin, Côte d’Ivoire, Ethiopia, Rwanda and Uganda.

Headwinds: Debt remains the region’s biggest drag, with 20 countries in or near distress, while high domestic borrowing costs are squeezing budgets. Aid to Africa is expected to fall by up to 28% in 2025, and tariffs on African exports to the U.S. are rising after the lapse of the African Growth and Opportunity Act (AGOA). Oil exporters face price pressure, while cocoa, coffee and gold producers are benefiting from strong commodity prices.

The fix: The IMF is urging smarter domestic revenue mobilization—through digital tax systems, fewer exemptions and greater transparency—and stronger debt management to reduce costs and rebuild investor confidence.

Source: IMF

Tech & Society in Africa

Africa Logs On

A niche report by a group called Rayda says Africa is emerging as a global hub for remote work, driven by its young, tech-savvy workforce, improving internet connectivity and strong English, French and Arabic language skills.

Source: Rayda

Key findings:

6 hubs lead: Nigeria, Kenya, South Africa, Rwanda, Egypt and Ghana anchor the continent’s remote talent ecosystem.

Top fields: Software development, UI/UX design and data science dominate; 43% of remote roles are in tech.

Main hurdles: Power reliability (37%), internet issues (33%) and isolation.

Upskilling wave: 63% are already training in AI-related skills to stay competitive.

Why it matters: Africa’s combination of youth, cost efficiency and time zone alignment makes it a prime destination for global employers but growth hinges on stronger digital infrastructure, power reliability and inclusive hiring practices to broaden access beyond major cities. Read more: Rayda

Africa’s Urban Youth Test

Source: S&P Global

Confirming what we all know, S&P warns in a recent research piece that sub-Saharan Africa’s fast-growing cities face mounting pressure as millions of young people enter the job market with limited prospects.

Why it matters:

Youth surge: Africa’s urban youth population will soar over the next two decades, the world’s largest and youngest labor force.

Job squeeze: Slower growth, automation and AI could erode employment opportunities, especially in cities like Lagos, Nairobi and Accra.

Instability risk: High youth unemployment has historically fueled unrest, echoing lessons from the Arab Spring.

The big picture: Africa’s demographic dividend can become a democracy dilemma if jobs and digital skills don’t keep pace with population growth. Governments that get job creation right could turn risk into reward. Read more: S&P Global

Explorations in Africa

Pharaohs Go Prime Time

Source: ABC News

After 20 years and $1B, Egypt finally opened the Grand Egyptian Museum beside the Giza pyramids in a lavish gala attended by royals and presidents from 80 countries.

Why it matters:

The world’s largest museum dedicated to a single civilization cements Egypt’s cultural clout and tourism ambitions.

It unveils all 5,000+ treasures of King Tut for the first time since 1922.

Funded largely by Japan, the project anchors Egypt’s plan to double tourists to 30 million by 2030.

Cutting-edge tech like AR and AI add a modern edge to ancient history — Cairo’s new soft-power flex.

Read more from ABC News, and if you love Egypt, be sure to also check out an FT article this week: Our Love Affair with Ancient Egypt will Never Die.

Africa Trivia Answer

Answer: B) Mauritius. On the World Economics Governance Index, Mauritius ranked first among African countries. No big surprise here. Source: World Economics.

Thanks for reading. If you missed it, last week’s graphic focused on powering Africa’s digital leap. If you have a topic you want us to dig into, email us at [email protected] and thanks for all the shares and support.