It’s been a long but fun week here in Ethiopia and as I sift through the news in the wee hours, this edition feels a little… heavy. From cholera spikes to pirate chases to debt squeezes, the headlines aren’t exactly light reading. But as we say, beneath it all is a continent in motion, building mines, launching data centers, rewriting economic playbooks and proving, once again, that the throughlines are beautifully positive. Dive in.

Africa Trivia

Which is Africa’s largest country by land area?

A) Nigeria

B) Algeria

C) Sudan

D) Democratic Republic of Congo

Graphic of the Week

Compute Is Power

Source: Data Center Map | Created by Datawrapper

Step Change’s exceptional four-hour podcast, The Hidden Backbone, unpacks how data centers evolved from IBM punch cards to AI “gigafactories.” It’s a historic listen that connects technology, power and geopolitics. The show explains how “the cloud” isn’t in the sky, it’s a physical empire that in the U.S. alone consumes nearly 5% of electricity.

Africa, by contrast, hosts less than 2% of global data capacity (~307 MW) and will need about 1,200 MW more by 2030 to stay competitive (Energy News Network). Google, MTN and others are now building “AI-ready” centers in Kenya, Ghana and South Africa (Data Centre Magazine). Most of the current data centers on the continent are not AI-ready.

Why It Matters

Compute is the new oil. Nations are racing to secure chips, power and fiber routes.

Africa’s AI gap. The continent’s 2024 AU AI Strategy warns that Africa’s AI ambitions are bottlenecked by a severe compute deficit: limited high-performance computers, scarce GPUs and too few Tier III and IV data centers. With only 1.8% of the world’s data center capacity and just 10% of its own demand met, the continent cannot scale AI without major investment in compute infrastructure.

Energy challenge. Data centers demand constant, clean power, a major hurdle in markets with grid instability, but some countries are making progress (Bracewell).

Leapfrog potential. With vast solar and geothermal capacity, Africa could design low-carbon, sovereign data hubs from the ground up.

Big Picture: The Step Change podcast is a history lesson worth listening to. It makes the compelling case that data centers are the new factories of the modern world. For Africa, the question isn’t whether to join the race. It’s whether to build, own and power the digital infrastructure that will define the AI age.

What We Are Reading

Africa: New malaria treatments showed high effectiveness in trials, offering hope to cut deaths and boost GDP (Semafor); Gates Foundation pledged $1.4B to help farmers in Africa and South Asia adapt to extreme weather (Semafor); Africa Centres for Disease Control and Prevention (CDC) announced Africa is facing its worst cholera outbreak in 25 years, with 300,000 cases and more than 7,000 deaths so far in 2025 as conflicts and poor access to clean water drive major surges in Angola, Burundi and Sudan (Aljazeera).

DR Congo: Fighting in eastern DR Congo and funding shortages drove tens of thousands from their homes and caused acute hunger, with nearly 25 million people facing severe food insecurity (United Nations).

Guinea: The China-backed $23B Simandou mine began production, poised to transform the global iron ore market and boost Guinea’s economy (Financial Times); Thousands of African migrants returning home through the EU-funded IOM program reported little follow-up support, facing trauma and financial hardship (AP News).

Kenya: Nigerian billionaire Tony Elumelu committed $150M to infrastructure and energy projects to boost investment hub status (The Kenyan Wall Street).

Libya: The UN urged Libya to close migrant detention centers amid abuse allegations and the discovery of mass graves (Reuters).

Mali: The AU chair called for urgent international action as terrorist attacks worsen humanitarian conditions, block supplies and threaten civilian safety (African Union).

Mauritius Commercial Bank led a $400M syndicated loan for Karpowership’s African unit to support ship-mounted power projects and meet rising energy demand across the continent (Bloomberg).

Morocco became the world’s third-largest tomato exporter, surpassing Spain, driven by improved quality, consistent supply and strong European demand (Morocco World News); Morocco and Rwanda strengthened military cooperation during high-level visits, aiming to boost security, stability and peace across Africa (Morocco World News).

Niger’s proposed $170M sale of 1,000 metric tons of uranium to Russia raised security and geopolitical concerns (Le Monde).

Senegal: Prime Minister Sonko rejected the IMF debt restructuring plan, calling it a disgrace and pledging to rely on domestic funding (Reuters); The ruling party dissolved the coalition that brought President Faye to power, deepening political instability as the country struggles to secure new IMF funding amid a debt crisis (Bloomberg).

Somalia: The EU and Indian naval forces seized a pirate “mother ship” off Somalia and freed its Iranian crew, disrupting the group that hijacked a Malta-flagged tanker last week (AP News).

South Africa: President Trump’s boycott of South Africa’s G-20 summit, combined with Putin’s absence and Xi’s uncertainty, threatened to leave the gathering with conspicuous empty seats and weak high-level diplomacy (Bloomberg); The World Bank approved a $925M loan to help South Africa overhaul failing urban services in eight major cities, rewarding municipalities that improve water, power and waste management (Bloomberg).

Sudan: The UN warned that relief operations in North Darfur are on the brink of collapse due to insecurity and funding shortages, leaving thousands of displaced people without food, water or medical aid (AP News).

Zambia’s central bank cut the main lending rate by 25 basis points to 14.25% as inflation fell to 11.9% in October (CNBC Africa).

Zimbabwe: Aliko Dangote announced his plans to invest $1B in cement, power and fuel projects following renewed confidence in the country’s economy (Bloomberg); The UK is set to overtake South Africa as the largest source of remittances to Zimbabwe this year due to increased emigration and professional exodus (Bloomberg).

Business & Finance in Africa

Africa’s Debt Squeeze

Source: The Visual Capitalist

Global debt is rising again. The world’s average debt-to-GDP ratio climbed to 94.7% in 2025, edging back toward pandemic highs, according to the IMF. Japan leads at 230%, with Sudan close behind at 222%, highlighting Africa’s sharp fiscal stress.

Africa stands out, for the wrong reasons. Sudan’s 222% ratio is the second-highest globally. Mozambique ranks in the top 10 at 131%, reflecting conflict, weak growth and heavy external borrowing. Many African governments now spend more on interest payments than on health or education.

But context matters. Africa’s average debt levels remain well below those of rich countries. Advanced economies are sitting at 113% debt-to-GDP, led by Japan, Italy and the United States (124%). Their borrowing is cheaper, longer-term and denominated in their own currencies.

Emerging markets are stuck in the middle. They average 74%, but rising global rates are squeezing countries reliant on foreign lenders. China (84%) and India (81%) account for much of the increase, while African nations face the steepest financing costs of any region.

The bottom line: The world is heavily indebted, but Africa faces the toughest combination of high debt, high rates and slow growth, making fiscal resilience harder to rebuild. Read more: The Visual Capitalist

Geopolitics in Africa

FDI Reality Check

Source: Johns Hopkins

The BBC headline How the U.S. overtook China as Africa's biggest foreign investor is not wrong but it is misleading. The jump happened for one year only.

In 2023, U.S. FDI flows to Africa reached $7.8B, briefly surpassing China’s $4B. New data from Johns Hopkins shows the pattern reversed in 2024. U.S. FDI dropped to negative $2.02B as companies withdrew capital. China invested $3.37B and continues to lead over the long term.

The race is about minerals. Africa holds the cobalt, lithium and rare earths that power EVs, AI data centers and the devices in your hand. China built its lead over two decades. The U.S. is now scrambling to catch up using the Development Finance Corporation (DFC).

Real projects are moving. Rwanda’s Trinity Metals secured a $3.9M DFC grant and now ships ore to U.S. processors. South Africa’s ReElement is building a refinery to keep more value in Africa.

African leaders see leverage. Economist Sepo Haihambo says countries must demand better terms: joint ventures, local equity and more processing at home. No one will negotiate Africa’s interests for them. Read more: China Africa Research Initiative and BBC.

Tech & Society in Africa

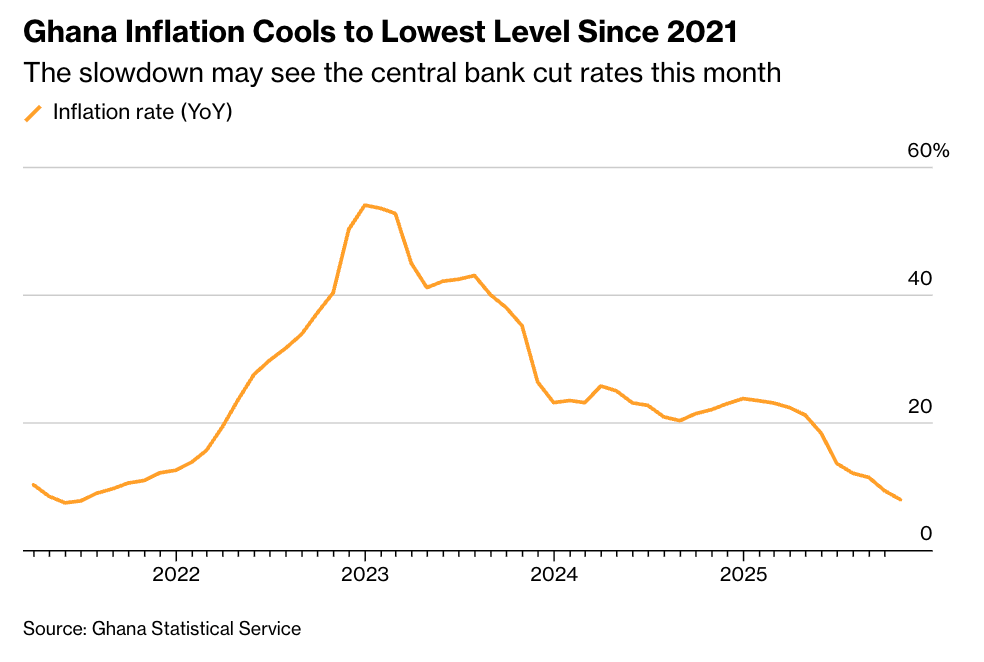

Ghana Stands Tall

Source: Bloomberg

We have a whole lotta Ghana this week. President Mahama of Ghana got a big shoutout in Time recently for a bold self-reliance agenda that is stabilizing the economy, expanding access and positioning Ghana as a model for an Africa less dependent on foreign aid.

President Mahama is making the case that Ghana can stand on its own and he is backing it up with early wins. In six months, he halved inflation, strengthened the cedi by 30% and steadied an economy weighed down by debt, high costs and youth unemployment. His “Resetting Ghana” plan is sweeping: a 24-hour economy to boost productivity, scrapped levies on online purchases and betting wins, free first-year tertiary tuition and free feminine hygiene products for schoolgirls.

To fight joblessness, he plans to train one million coders over four years to power Ghana’s rising tech sector.

He is also pushing for more value to stay in Africa by insisting on local processing, cracking down on illegal mining and launching new regulators to stop gold smuggling.

With USAID cuts and new tariffs hitting the continent, President Mahama argues the moment demands self-reliance. His message: Africa must build its own capacity, trade more with itself under AfCFTA and shape a future no longer constrained by aid dependence. Read more: Time. I just wish cleaning up their beaches was a President John Mahama priority.

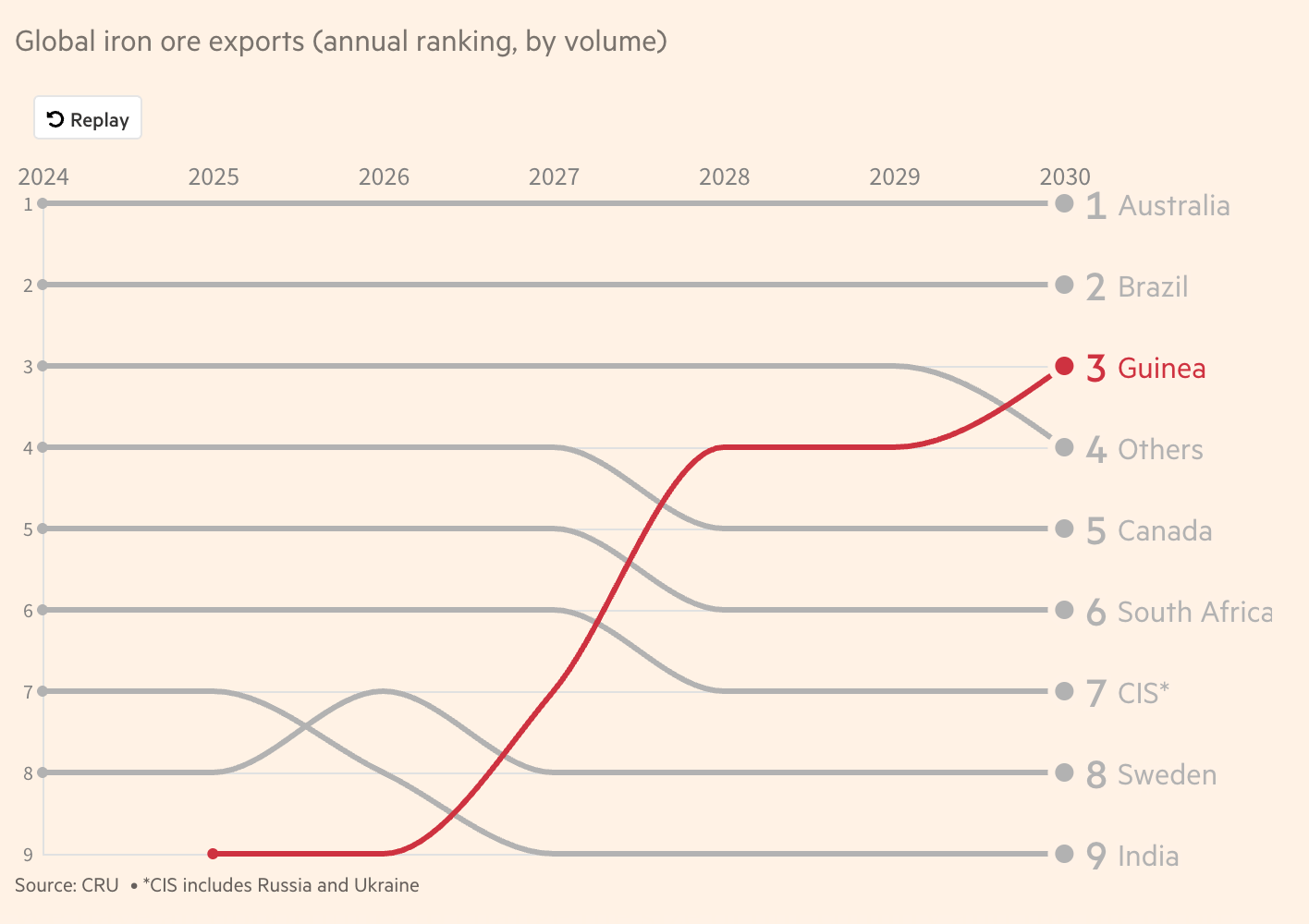

China in Africa

China Hits Iron Jackpot

Source: Financial Times

Guinea’s $23B Simandou mine, supposedly the biggest mining project in history, just launched, promising 120 million tons a year of ultra-high-grade iron ore that could reshape global steelmaking, weaken Australia’s dominance and boost China’s leverage, according to the Financial Times.

After 30 years of scandals and stalled deals, Chinese capital and engineering finally unlocked the project, with Rio Tinto now a minority partner and Guinea holding 15%.

For Guinea, it’s a once-in-a-generation bet: Officials say Simandou could quadruple the economy by 2040 and attract $200B in new infrastructure, from highways to ports and industrial parks. General Mamadi Doumbouya forced rivals to cooperate and tied his presidency to the mine’s success, pushing for local stakes, local benefits and geopolitical balance. Risks remain, including falling prices, job losses and environmental damage, but Simandou is now live and Guinea sees a rare chance to change its national trajectory.

Key stats:

Project cost: $23B

Expected max production: 120 million tons per year

Guinea population: 15 million

Global iron ore share: ~7% at full capacity

China’s seaborne iron ore stake could nearly double in five years

High-grade ore content: 65% iron

Revenue allocation: 5% for schools, 20% from logistics for scholarships

Planned infrastructure: 3,000 km of highways in 15 years

Read more: Financial Times and in Bloomberg: The Shipping Mogul Who Carved a Route to China’s African Mining Prize.

Explorations in Africa

Guarding Ghana’s Threads

Source: House Beautiful

What happened: Ghana has granted geographical indication status to kente cloth, the first step toward global protection through the World Intellectual Property Organization. The designation aims to stop cheap knockoffs from flooding markets and to keep the textile’s identity tied to its Ghanaian roots.

The backstory: Once woven for royalty and later worn by Kwame Nkrumah, Ghana’s first prime minister and president, kente has become a global symbol of Black pride and Pan-African identity, from U.S. graduations to Vogue covers. Its fame has brought imitations, leaving Ghanaian weavers struggling to compete.

The big picture: The move is part of a broader African effort to protect cultural intellectual property. As global brands profit from African creativity, kente’s new status draws a clear line between heritage and hype.

Read more: The New York Times

Africa Trivia Answer

B) Algeria is the largest country in Africa by area, covering about 2,381,741 square kilometers. The top 5 largest countries in Africa by land mass are: 1) Algeria; 2) Democratic Republic of the Congo; 3) Sudan; 4) Libya and 5) Chad. Source: Britannica.

Thanks for reading. If you missed it, last week’s graphic focused on the Franc Zone advantage. If you have a topic you want us to dig into, email us at [email protected] and thanks for all the shares and support.