Africa is entering 2026 with a mix of pressure and possibility. Aid is retreating just as financing needs rise. Cities are swelling faster than budgets. Growth is stabilizing, but not fast enough to absorb people, jobs or shocks. This week’s Brief pulls those threads together, from a stark look at how aid cuts really hit national budgets, to why Africa’s $6T in natural resource wealth is back at the center of the financing conversation. Add in a fragile macro rebound, a rewired U.S. health strategy, election tensions in Uganda and a reminder of why Africa still tops the global travel wish list, and you get another fascinating week.

Did You Know?

Africa’s natural resource wealth is valued at more than $6T.

Graphic of the Week

How Big is the Budget Shock?

Source: Brookings Institute

This week’s graphic sits in the essay Leveraging Africa’s Natural Resource Wealth to Bridge the Financing Gap in Brookings Foresight Africa 2026. It makes a simple but powerful point: as global aid retreats, the impact on African countries is uneven and often most severe where aid makes up a meaningful share of national income, not where the headline dollar cuts are largest.

The wider narrative is clear and compelling. Africa is entering a phase where external financing is shrinking just as investment needs are rising, forcing a faster pivot toward domestic resource mobilization.

My spidey sense is that there are some countries on the continent that are going to achieve real momentum with local resource mobilization. Let’s go 2026!

What We Are Reading

Angolan government extended a $1B JPMorgan debt facility for three years and secured an additional $500M in financing at a lower interest rate (Reuters).

Beninese government plans to market a dollar-denominated sukuk bond and other debt securities after hiring global banks to diversify funding sources and tap new investors (Bloomberg).

Burundi: More than 50 Congolese refugees died in Burundi from cholera, malnutrition and related causes amid an influx of 100,000 fleeing eastern DR Congo (The New Times).

DR Congo: The Central Bank said it will keep selling dollars, including a $50M intervention this month, to curb currency speculation and stabilize the franc amid parallel-market pressures. (Bloomberg).

Ethiopian Airlines launched the construction of a $12.5B, four-runway Bishoftu International Airport near Addis Ababa, aiming to handle 110 million passengers a year by 2030 (Business Insider Africa).

Kenya opened trade talks with China, securing a preliminary deal granting 98.2% zero-duty market entry for Kenyan goods despite U.S. pressure (Bloomberg).

Mozambique: Opposition leader Venâncio Mondlane said Africa’s liberation-era parties, including Frelimo, are losing young voters after failing to deliver jobs and growth, signaling a broader generational shift in African politics (FT).

Nigeria: In Lagos, booming construction has fueled massive sand dredging in the lagoon, reshaping the coastline and pricing out fishing livelihoods as demand for concrete surges and environmental damage mounts (AP News); Set to pass law regulating AI and digital platforms to tighten oversight of the growing tech sector (Bloomberg).

Somalian government canceled all security, defense and port agreements with the UAE, citing violations of sovereignty and constitutional authority (Bloomberg).

Sudan: Women face the worst of the hunger crisis with millions food insecure and besieged cities nearing famine (Reuters).

Uganda: President Museveni, who has ruled Uganda since 1986, is seeking a seventh term after scrapping term limits, even as questions mount over corruption, succession and his health at age 81 (Reuters); Bobi Wine warned that Uganda risks another stolen election, arguing the long-ruling regime relies on repression and manipulation to preserve power as voters head to the January 15 poll (FT); The country shut down public internet access nationwide starting January 13 ahead of elections, blocking most online services, and as of January 16 connectivity remained largely restricted to limited critical systems (Human Rights Watch).

Zambia: The kwacha fell 0.4% to 19.60 per dollar, its first decline in 18 trading days, ending a rally that had delivered about 13% gains (Bloomberg).

Africa Outlook

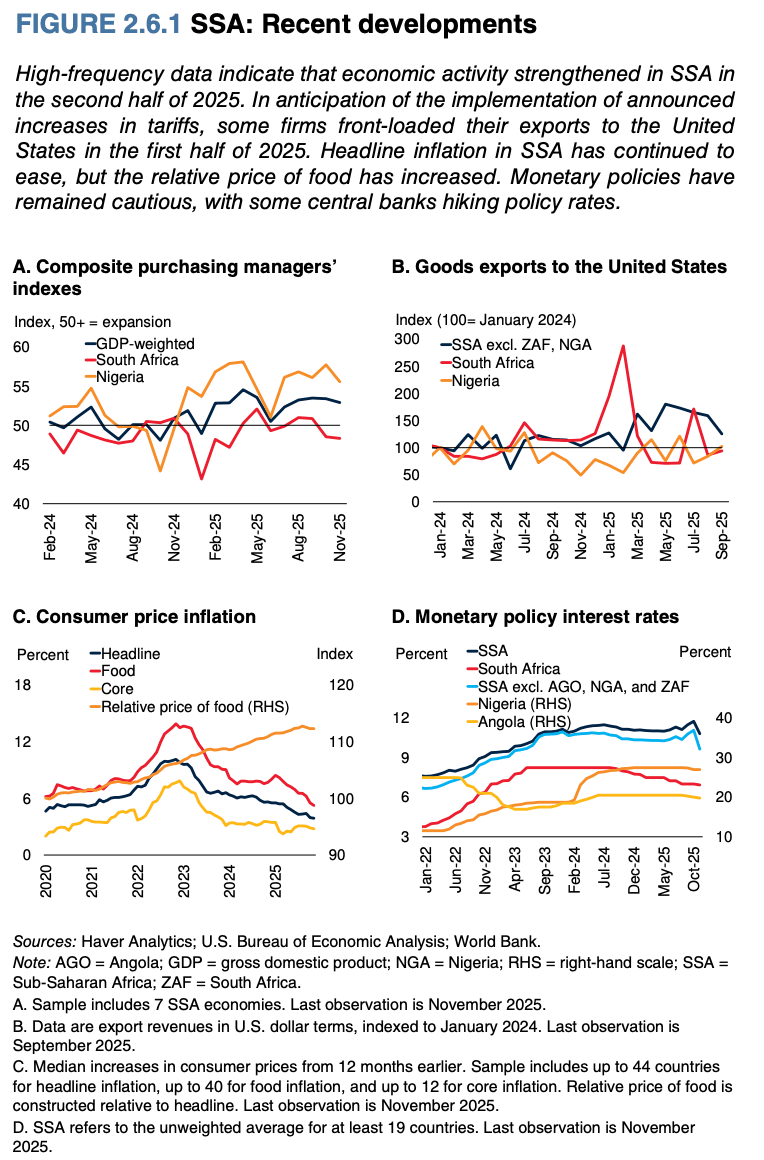

Africa’s Fragile Rebound

Source: World Bank

According to the World Bank’s Global Economic Prospects, January 2026, growth in sub-Saharan Africa (SSA) is stabilizing, but the recovery remains uneven and vulnerable as fiscal space tightens, external support declines and global growth slows.

The summary

Sub-Saharan Africa growth is projected to strengthen modestly in 2025–26, helped by easing inflation, better harvests and stronger services in large economies like Nigeria and Ethiopia.

Per capita income gains remain weak, leaving Africa furthest from closing the gap with advanced economies.

Food insecurity worsened, with nearly 280 million undernourished people, even as global hunger trends improved.

ODA to Africa is falling again, increasing vulnerability just as buffers are already thin.

Why it matters

Growth is too slow to absorb Africa’s labor force, with job creation lagging demographics.

Falling aid and higher interest costs are forcing fiscal consolidation at the worst moment.

Commodity exporters get a short-term lift, but volatility risks remain high.

Tech & Society in Africa

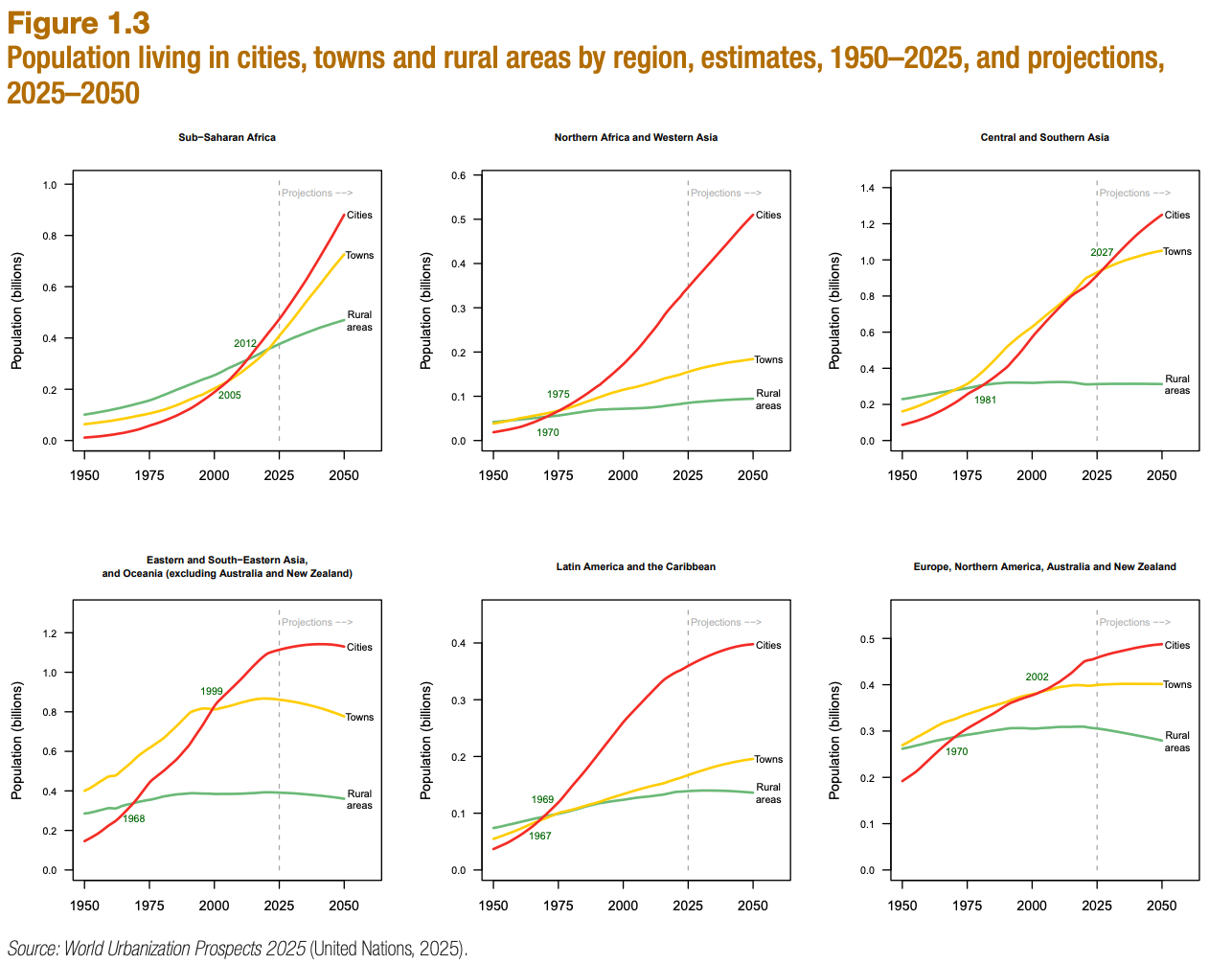

The Urban Surge

Source: UNDESA

Sorry the graphics are so small. SSA is top left. What the report says? Africa’s cities are growing faster than any region on earth, reshaping where people live, work and consume.

What happened

Africa adds ~680 million urban residents by 2050, the fastest urban growth globally.

The urban share rises from ~45% today to ~60%, with secondary cities absorbing much of the surge.

Most African cities are densifying, not sprawling, defying the common narrative.

Source: UNDESA (SSA is bottom right)

Why it matters

A compressed demand shock for housing, transport, power, water, health and payments.

Density favors tech-enabled, infrastructure-light models over traditional build-first approaches.

City growth continues to outpace planning and budgets, amplifying both risk and upside.

Read more: UNDESA World Urbanization Prospects 2025

U.S. in Africa

Aid. Rewired. Hardball

Source: U.S. Department of State

Geopolitics with syringes, satellites and supply chains: The above graphic is included in the $11B America First Global Health Strategy. A provocative piece to say the least. More relevant perhaps is Axios article that breaks down the plan behind all the health deals in the news the last months (Zipline, Uganda, Kenya, etc.). The Trump administration is rolling out the new strategy to replace USAID, sending money directly to governments, health providers and drugmakers, mostly in Africa. This is a hard pivot in U.S. soft power from previous administrations. Fewer NGOs. More bilateral deals. Health aid tied explicitly to U.S. strategic and business interests.

The details

Marco Rubio has signed 15 health deals with African countries, targeting HIV/AIDS, malaria, TB and maternal health.

The U.S. commits $11.1B over five years. Partner countries pledge $12.2B in matching funds and performance targets.

The State Department wants 50 country agreements within months.

Officials argue USAID’s NGO-heavy model sent up to 70% of funds to middlemen, limiting durability and local capacity.

Between the lines: The new approach emphasizes pooled procurement, U.S. drugs, diagnostics, nets and tech, with third-party auditors watching the money.

The pushback: Former USAID leaders warn the plan risks corruption, weak data and catastrophic failures, arguing many systems lack the capacity to manage large direct flows of cash.

Bottom line

In this new world, health aid now doubles as leverage for the Trump administration. Deals intersect with mining access, LNG interests, critical minerals, drones from Zipline, HIV drugs from Gilead and clinic connectivity via Starlink. Read more: Axios.

Explorations in Africa

Africa Travel Temptation

Source: Condé Nast Traveler

Articles like The Best Places to Go in Africa in 2026 from Condé Nast Traveler are crack cocaine for travelers, myself included. This article does not disappoint, offering fresh takes (and beautiful photos) on both familiar and overlooked destinations across the continent. Editors leaned on writers across Africa to spotlight what’s opening up, being restored or quietly having a moment. Less hype. More access. Fewer crowds (for now).

A few teasers

A long-closed North African giant is finally opening to travelers.

A southern African safari frontier promises wildlife without traffic jams.

An ancient city gets a glow-up after years of restoration.

A bush-to-beach route makes morning game drives and sunset swims possible.

A creative neighborhood signals where Africa’s urban culture is heading next.

I hope your 2026 plans include a “new for you” African destination. Gabon and Madagascar are at the top of my list.

Thanks for reading. If you missed last week’s edition, take a look back at Africa’s Waterway Potential. I appreciated all the bantering on my LinkedIn, too. Keep the comments and opinions coming. We’d also love to hear from you at [email protected].