Thanks for being with us in 2025 and happy New Year! If last year was any indication, 2026 will be just as consequential for the continent, so we hope you follow along with us. I have not yet put together my own Africa predictions for the year but fortunately, there is no shortage of smart thinking out there. This week, I point you to Semafor on Africa-U.S. relations, Ken Opalo’s 11 predictions and Techcabal’s take on why 2026 will force African tech to grow up. I summarize another piece below and will dig into more institutional forecasts and reports in the weeks ahead. For a practical rundown of key elections and conferences across Africa, Semafor’s calendar is also worth a look. The Africa Brief is back. Let’s get going, 2026!

Did You Know?

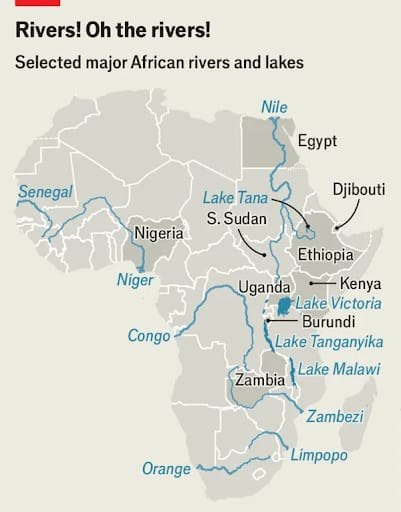

Water transport in Africa is up to 60% cheaper, yet 80% of the continent’s freight still moves by road. Source: The Economist.

Graphic of the Week

Africa’s Waterway Potential

Source: The Economist

Africa moves most of its goods the hard way. Despite vast rivers and lakes, waterborne transport remains deeply underused, quietly inflating costs and constraining trade across the continent.

Why It Matters

Water transport is 30% to 60% cheaper than road or rail, yet 80% of African freight still moves by road.

Africa’s transport costs are up to 5x higher than in the U.S., helping keep intra-African trade at just 16%.

Neglected rivers and lakes, from the Nile to the Great Lakes, have quietly throttled regional trade and growth.

What’s Changing

The African Development Bank is backing a $12B inland waterway corridor from Lake Victoria to the Mediterranean.

East Africa is reviving lake transport and cross-border coordination, with early wins like fuel moving via Lake Victoria.

Africa’s rivers once moved economies. Reopening them could be one of the continent’s cheapest, most overlooked growth plays. Read more: The Economist.

What We Are Reading

Africa: IMF projects Africa’s growth could surpass Asia in 2026 at 4.4% despite conflict and debt, driven by commodity prices and a weak dollar, though per capita gains remain modest (FT); Rail investment surges as countries expand networks to cut logistics costs, boost trade and create jobs (Bloomberg).

Botswana: Plans embassy in Moscow and invites Russian investment in rare earths and diamonds (Reuters).

Central African Republic: President Touadéra won a third term with 76% of the vote after an election boycotted by the main opposition following the removal of term limits (AP News).

DR Congo: Rwanda-backed M23 rebels are creating an autonomous zone in eastern Congo, seizing mines and setting up parallel governance despite peace efforts (Bloomberg).

Ethiopia: The country’s defaulted eurobond jumped after the government agreed with bondholders on a restructuring featuring a modest 15% haircut and new repayment terms pending IMF approval (Bloomberg).

Gabon: President Nguema replaces finance minister amid liquidity squeeze and rising debt (Reuters).

Ghana: Annual inflation slowed to 5.4% in December, easing price pressures and raising expectations of an interest-rate cut by the central bank (Bloomberg).

Ivory Coast: U.S. commits $480M to health sector under “America First” global health pact with shared funding responsibility (AP News).

Kenya aims to become a global MICE hub as the 11,000-seat Bomas International Convention Complex nears completion in Nairobi (Dawan)

Morocco: Tourism hits record 19.8 million visitors in 2025, up 14% from 2024, boosting revenue and GDP contribution (Reuters); Fingers crossed for the country's semiquarter game today at 1900.

Rwanda: Trinity Metals’ Nyakabingo mine triples tungsten output, positioning Rwanda as a key global supplier while tackling conflict mineral traceability challenges (FT).

Senegal: Finance minister says IMF debt program progressing quickly after uncovering unreported debts, talks ongoing on budget and financing (Reuters).

Somali: Israel officially recognizes Somaliland, raising regional tensions and complex political risks in the Horn of Africa (African Arguments).

Tunisia’s near-record olive oil harvest is poised to deliver a vital foreign-currency boost, even as political uncertainty and weak reforms limit its longer-term economic impact (FT).

Zimbabwe: Gold rally and rising reserves lift the ZiG to its strongest level against the dollar since January (Bloomberg).

Sports in Africa

AFCON 2025 Quarterfinals

Source: AP (Wow, AFCON fans brought their game. Do not miss the photos here.)

It’s one of the continent’s most popular events. The Africa Cup of Nations in Morocco has reached the quarterfinal stage, with eight heavyweight teams left as defending champions Ivory Coast, sealed the final spot.

Who’s Still In?

Eight of Africa’s top sides remain: Senegal, Mali, Morocco (hosts), Cameroon, Egypt, Nigeria, Algeria and Ivory Coast (defending champions).

The Schedule

Jan. 9: Mali vs Senegal at 5 p.m. local (4 p.m. GMT); Cameroon vs Morocco at 8 p.m. local (7 p.m. GMT)

Jan. 10: Algeria vs Nigeria at 5 p.m. local (4 p.m. GMT): Egypt vs Ivory Coast at 8 p.m. local (7 p.m. GMT)

Who Looks Strong

Nigeria and Algeria are unbeaten so far.

Morocco and Ivory Coast entered as favorites.

Egypt, led by Mohamed Salah, remains a perennial contender.

Brahim Diaz (Morocco) leads with four goals.

Six players have scored 3 goals, including Salah, Osimhen and Mahrez.

AFCON 2025 now enters its most competitive phase, with evenly matched quarterfinals and no clear favorite. Go Morocco! Read more: Aljazeera.

Innovation in Africa

Africa’s Data Backbone

Source: McKinsey

Perhaps it is because I spent the holidays near Data Center Alley in Ashburn, VA, that McKinsey’s report, Building Data Centers for Africa’s Unique Market Dynamics, caught my attention in my post-holiday haze. Africa’s data center market is entering a growth phase, with capacity expected to rise 3.5x to 5.5x by 2030, driven by cloud adoption, mobile data, fintech and early AI use.

According to the Report

Scaling will require $10B to $20B in new investment, unlocking $20B to $30B in revenue.

Africa will not copy global mega-campus models. The winning format is smaller, modular data centers under 50 MW.

Power reliability and fiber access, not power price, are the real constraints.

Carrier-neutral co-location players with anchor tenants are best positioned to win.

Data sovereignty rules fragment demand; regional solutions like “data embassies” could unlock scale.

Bottom Line

Africa’s digital economy will be built on localized, capital-disciplined data infrastructure, not hyperscale imitation. Read more: McKinsey.

Business & Finance in Africa

Kwacha Stress Test

Source: Bloomberg

Zambia’s kwacha has surged into 2026, becoming the world’s best-performing currency, up 10%+ in a month and hitting its strongest level in more than two years.

What’s Driving It

Corporations are converting dollars to pay taxes ahead of a Jan. 10 deadline.

A central bank directive curbs foreign-currency use domestically.

Strong copper prices are boosting FX supply.

Why It’s Fragile

Analysts warn of a mid-January inflection point as the economy returns to full capacity.

Rising corporate demand for dollars could test the rally’s durability.

Continued strength hinges on copper demand staying hot.

According to the article, the kwacha’s rally is real but policy effects and seasonal flows may fade fast. Read more: Bloomberg.

Insights on Africa

2025 Recap and 2026 Test Predicted

Source: Alafarika

The report, 2025 Recap: Public Policy and Geopolitics by Alafarika, shows Africa ending the year with firmer growth, stronger regional integration under AfCFTA and rising investment in energy, minerals and digital infrastructure, even as global conditions tightened. If you want a quick review of the year, it’s a decent one.

As you’ll also remember…

Coups, conflict and contested elections continued to erode trust in state institutions.

Debt stress and high living costs fueled protests across multiple regions.

Reform momentum remained uneven, often driven by external shocks rather than policy choice.

What to watch in 2026

Politics: A heavy election calendar and youth-led pressure will test governments’ legitimacy and capacity to govern.

Security: Conflict risks remain elevated in the Sahel, Sudan and eastern DRC, with spillovers likely.

Economy: Growth near 4%+ hinges on commodity prices, debt management and climate resilience.

Geopolitics: Africa will face more transactional global partners as U.S., China, Russia and Gulf states compete for minerals, ports and influence.

Integration: AfCFTA implementation not ratification, becomes the real test as countries move from ambition to execution.

Africa’s 2026 outlook necessitates that countries on the continent execute strong strategies under pressure.

Explorations in Africa

Threads of Cairo

Source: FT

Downtown Tailors Fade: According to a recent article in FT, Cairo was once a global fashion setter, rivaling London and shaping global styles before Paris was Paris. Today, its famed downtown tailoring houses are disappearing. A handful remain, run by aging master craftsmen, squeezed by fast fashion, rising rents and a vanishing pipeline of apprentices. The most iconic is Samir El Sakka, 89, one of the last tailors in the city who still designs and cuts bespoke suits entirely by hand.

The Human Detail

A suit takes 10 days. The waiting list is three months.

Measurements live on paper. Appointments happen by phone.

The craft survives on trust not technology.

Why it Matters

This is cultural infrastructure quietly eroding, where fast fashion outpaced revolutions, new rent laws threaten historic ateliers and what disappears is more than clothing. It's an urban identity. Read more: FT.

If you are new to the Brief, welcome and look back at 2025’s last graphic of the week, Mapped in Motion. We hope the Africa Brief adds value to your life! Please share it and send content ideas or feedback to [email protected]. We love hearing from you.