Africa’s workforce is its superpower — but also a point of great tension. This week, we take a look at the race to export workers and build outsourcing hubs, the surge of Chinese trade, Japan’s new Africa play and the lessons (and warnings) from China’s rise. Plus: banks, planes, viruses, volcanoes — and why Comoros might be the rawest island escape you’ve never considered.

Africa Trivia

Which African island nation produces the most vanilla in the world?

A) Madagascar

B) Comoros

C) Seychelles

D) Mauritius

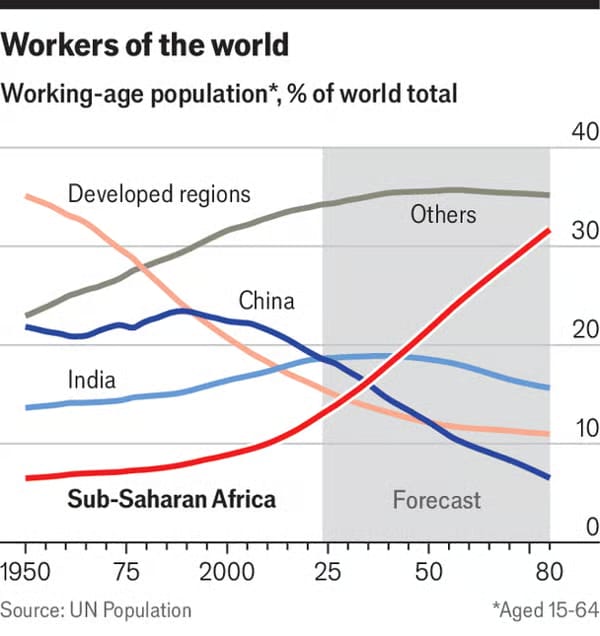

Graphic of the Week

The Labor Arbitrage Dilemma

Source: The Economist

Outsourcing Africa’s Future: These days, Africa is racing to turn its young workforce into an economic edge. Governments are exporting workers and building outsourcing hubs to capture global demand. But the dilemma remains: are these exporting strategies creating prosperity or just exporting excellence?

Country Moves

Kenya plans to send one million workers abroad each year, while launching a Business Process Outsourcing (BPO) strategy to create another one million domestic jobs (Semafor; The Economist).

Uganda approved a National BPO Policy, targeting 150,000 outsourcing jobs by 2030 (Outsource Accelerator).

Egypt is being positioned as a regional outsourcing hub through the Information Technology Industry Development Agency (ITIDA), drawing new investors with scale and cost advantages (ITIDA).

Continent-wide: Africa’s outsourcing industry is valued at $8.85B in 2025, projected to reach $14.75B by 2033, led by South Africa, Nigeria, Ghana, Tunisia and Egypt (DevelopmentAid).

Upside

Remittances and outsourcing revenues diversify economies.

Millions of youth gain global exposure and digital skills.

Potential for Africa to emerge as a global services hub if governments build supportive ecosystems.

Downside

Wage disparities and weak protections enable quiet extraction.

Brain drain hollows out local industries, raising turnover costs for banks and tech firms.

Outsourced jobs are precarious, poorly paid and increasingly at risk of automation (Mastercard Foundation / Caribou Digital).

Why It Matters: Africa’s labor strategy needs to be bold. But without wage floors, digital labor protections and investment in domestic ecosystems, the continent risks repeating history — creating wealth abroad while retaining little at home.

What We Are Reading

Africa: Solar panel imports from China jumped 60% to 15GW and Nigeria overtakes Egypt as No. 2 buyer after South Africa (Bloomberg); Chinese exports to Africa surged 25% to $122B with trade booming in machinery, cars and solar panels (Bloomberg); Japan’s plan to pair Japanese cities with African partners in Mozambique, Nigeria, Ghana and Tanzania sparked xenophobic backlash after false reports claimed it would bring mass African immigration (The Guardian); At TICAD 9, Japan commits $5.5B in loans, floats Indian Ocean–Africa “economic zone,” and promises AI training for 30,000 Africans (AP).

Botswana: President Boko declared a public health emergency after falling diamond revenues dried up medical funds (Bloomberg).

Burkina Faso’s government halts Gates Foundation-backed malaria research using genetically modified organism (GMO) mosquitoes after criticism from anti-Western activists (Bloomberg).

DRC: New central bank governor aims to restore confidence in the franc, reduce dollar reliance and develop local financial markets (Bloomberg).

Egypt: The central bank is expected to cut interest rates by 100 basis points as inflation eases and the Egyptian pound strengthens (Reuters).

Kenya: Kenya Airways plans to raise at least $500M by early 2026 to expand its fleet after posting a H1 loss (Reuters).

Mali: Russia’s Wagner Group has bungled its mission in Mali — worsening violence, alienating the army, failing to grab gold — exposing the limits of Moscow’s African adventure (The Economist).

Mauritius plans to sell a 49% stake in Air Mauritius, with Qatar Airways among potential investors, to boost tourism and improve the airline’s finances (Bloomberg).

Morocco: Morocco’s foreign minister said King Mohammed VI’s new vision puts the sea at the center of national development, tying sovereignty to Africa-focused maritime projects from new ports to the Nigeria-Morocco gas pipeline (Morocco World News).

Mozambique risks losing 37,000 jobs and a third of exports if South32’s Mozal aluminum smelter closes over a power-price dispute (Bloomberg).

Nigeria: Pension regulators plan to raise limits on infrastructure and private equity investments to boost returns amid high inflation and a weak naira (Bloomberg).

Rwanda plans to sell carbon credits to Singapore through projects developed with Climate Bridge Group under the Paris Agreement (Bloomberg).

Senegal: The IMF said it will take weeks to decide on a waiver for the country’s $11B debt misreporting case, delaying a new lending program (Reuters).

Sierra Leone curbed its mpox outbreak with blunt public health messaging, community outreach and rapid government action — a model other African countries struggling with the virus could learn from (The Economist).

South Africa: The rand weakened after a nine-month high as investors await key economic data (Reuters); South Africa’s largest union signed a three-year above-inflation wage deal for 90,000 workers in the motor industry (Bloomberg); Capitec Bank overtook FirstRand to become Africa’s most valuable bank after record profits and a new CEO appointment (Bloomberg).

Zimbabwe: Invictus Energy, an Australian company, plans to sell 19.9% stake to Qatar’s Al Mansour Holdings as part of plans to develop the Cabora Bassa and other oil and gas projects across the continent (Bloomberg).

Japan in Africa

Japan Bets Big

Japan’s Prime Minister Shigeru Ishiba used the Tokyo International Conference on African Development (TICAD) in Yokohama to pitch a new “Indian Ocean–Africa economic zone,” aiming to counter China’s rise and U.S. retreat. Here’s the current state:

Pledged $5.5B in loans with AfDB for sustainable development (AP).

Announced plans to train 30,000 AI experts in Africa over three years (AP).

Extended $169M Samurai financing to Kenya for industry and power upgrades (Reuters).

Promoted low-cost loans as alternatives to Chinese debt, recycling repayments to African borrowers (FT).

Invested $40M in Aavishkaar’s SME supply chain fund to boost resilience (JICA).

Committed to help train 300,000 African workers with Japanese firms, backed by new JICA investment framework (Japan Times).

But Tokyo’s city-pairing plan sparked xenophobic backlash at home, forcing officials to clarify it’s cultural exchange, not immigration (The Guardian).

Why It Matters: Tokyo is scaling up a layered Africa strategy — debt relief, SME financing, digital skills and big-ticket loans — as China cements dominance and Washington pulls back.

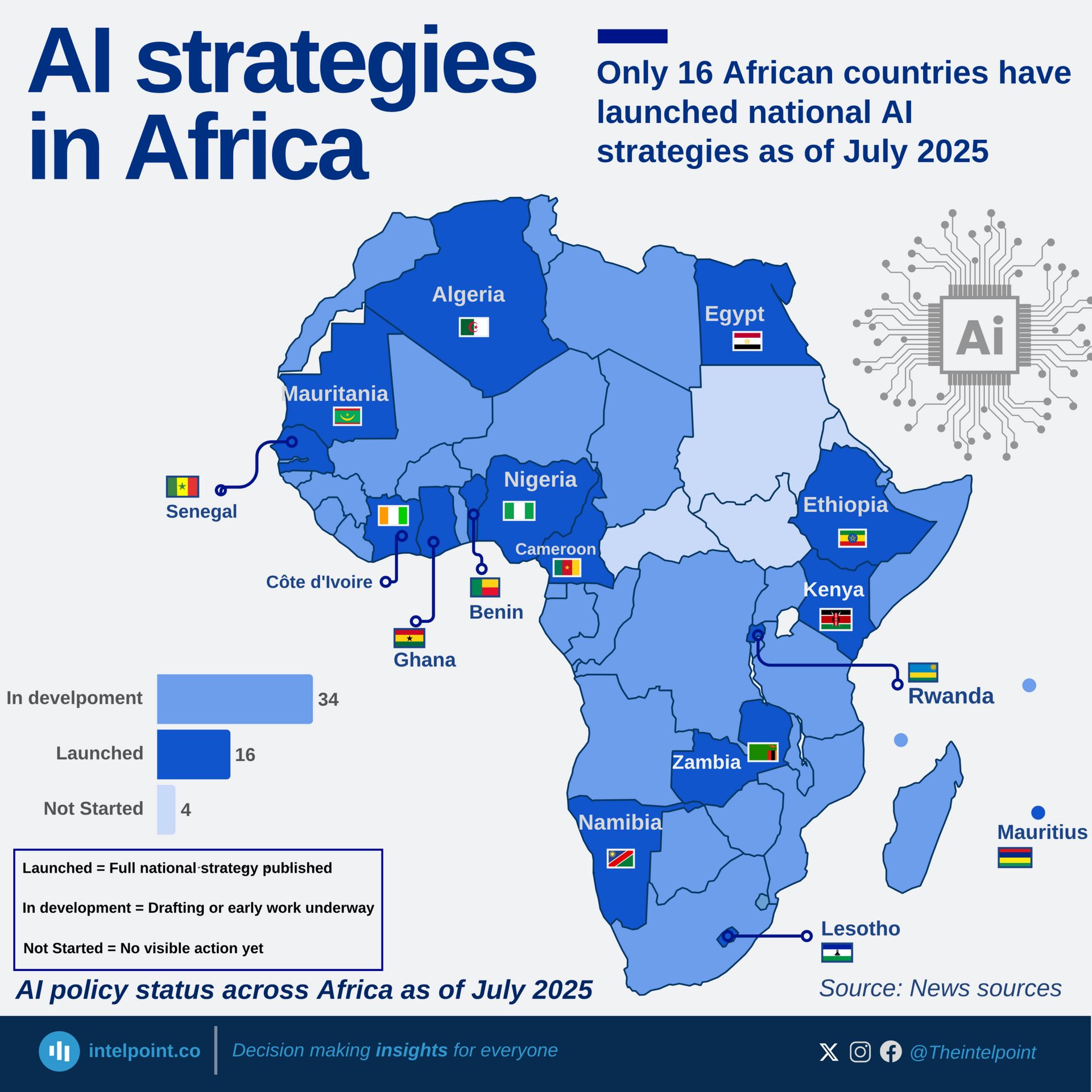

Innovation in Africa

Uneven AI Adoption

Source: Intelpoint

Artificial intelligence adoption in Africa is uneven, with only a handful of countries having launched formal national strategies. The majority of nations remain in early or inactive stages, highlighting a growing divide in readiness for the AI-driven economy. Just 16 out of 54 African countries have launched a national AI strategy (Intelpoint).

Africa’s Global Listings

Source: Intelpoint

About 110 African firms are listed on the London Stock Exchange, spanning 20+ countries — the largest cluster of African companies abroad (TechCabal). On the New York Stock Exchange, only a handful of firms, mostly South African (like AngloGold, Sasol, Jumia), trade via American Depositary Receipts (ADRs). Beyond LSE and NYSE, African companies have limited presence on other global exchanges, often through dual listings.

China in Africa

China Trade Surge

Source: Bloomberg

China’s exports to Africa jumped 25% this year to $122B, outpacing all other markets while U.S. sales slump. Shipments are on track to top $200B for the first time, led by Nigeria, South Africa and Egypt. Machinery (+63%), cars (doubled), steel, batteries and solar panels (imports up 60%) are driving demand.

Why It Matters

Africa is Beijing’s release valve as President Trump’s tariffs squeeze China elsewhere.

President Xi is waiving tariffs on African imports and opening China’s market to farm goods from 19 African states.

The yuan is gaining traction: Kenya eyes debt swaps; Angola and others may follow.

Risk: Africa could see local industries squeezed and debt deepen, but China views the continent as its proving ground for global expansion.

Read more: Bloomberg.

Global Insights for Africa

China’s Economic Playbook

Source: Lex Fridman

This month’s Lex Fridman Podcast features Keyu Jin, economist at LSE and author of The New China Playbook. It’s one of the clearest conversations I have heard on how China actually works — the reforms that drove growth and the contrasts with the United States. I think the lessons will resonate for Africanists, African government leaders and founders alike.

Background on China’s Growth

1978 reforms: Deng Xiaoping’s “reform and opening up” gave farmers autonomy, created special economic zones and set up WTO entry (2001). Each reform wave equaled a decade of growth.

Mayor economy: Centralized politics, decentralized economics. Local mayors competed on GDP growth, real estate and tech (EVs, solar). Incentives fueled rapid expansion.

Today’s shift: According to Keyu Jin, China now needs to move from production-driven boom to consumption to drive continued growth. The real estate bust hurt local finances and households, but the fundamentals (skills, capital, stability) remain strong.

Ideas for the Continent

Incentivize leaders: China’s “mayor model” tied promotions to results. African cities and states could link funding and careers to measurable wins—GDP, jobs, consumption, innovation.

Stay pragmatic: Deng’s “black cat, white cat” mantra was about outcomes over ideology. Policy should prize what works, not just what sounds good.

Blend state + market: China seeded new sectors (EVs, AI, solar) with state backing, then got out of the way and let private firms scale. Perhaps Africa’s green and digital transitions can follow that playbook.

Build mobility: Standardized exams gave poor Chinese kids hope of rising. Africa needs fair, scalable systems that reward talent.

Harness community: China’s growth mixed fierce competition with communal safety nets. Africa’s social fabric can be a strength—if paired with clear incentives.

U.S. vs China: Innovation vs Scale

U.S. edge: Zero-to-one breakthroughs, tolerance for failure, strong IP. Innovation is driven by curiosity and intrinsic motivation. Culture values creativity and signaling “effortless” genius.

China edge: Ferocious competition, fast implementation, scale at speed. Good at taking tech from “1 to N,” cutting costs and diffusing it widely. Copying is acceptable if it leads to success. Entrepreneurs move fast but face ruthless rivals and weaker legal protections.

Cultural contrast: In the U.S., failure is survivable — bankruptcy laws protect risk-takers. In China, failure can mean ruin or even jail. In America, it pays to be colorful (Elon Musk). In China, staying humble and aligned with the state keeps you safe (Jack Ma lesson: “tallest tree gets the most wind”).

“Short, flat, fast”: China’s impatient growth mantra — quick wins, thin margins, rapid exits. It fueled scale and cost-cutting but left gaps in creativity. Africa’s founders will recognize the hustle, but the challenge is pairing that speed with long-term vision.

Why It Matters: China’s rise was formulaic. It was reforms, incentives, pragmatism and scale. For Africa, the lesson is clear: countries that can blend American innovation culture with Chinese execution can unlock growth. Definitely worth a listen for those interested in the differences between the U.S. and China’s influence on Africa.

Explorations in Africa

Along the Coast

Source: The Times

I’ve always wondered about Comoros — the “Islands of the Moon” tucked between Mozambique and Madagascar. Few go. Fewer stay. But according to an article in The Times, those who do find active volcanoes, deserted beaches, turtle hatchlings under moonlight and a culture caught between Africa, Arabia and France. It’s beautiful, raw and underdeveloped— Mauritius without the polish.

Travel Brief: Comoros

Where is it? Three volcanic islands — Grande Comore, Anjouan, Mohéli — in the Indian Ocean between Mozambique and Madagascar.

How to get there? No direct Europe flights. Typical route: Addis Ababa → Moroni.

Best time to visit? May to October. Cooler, drier — and humpback whale season.

Highlights: Hike & camp inside the Karthala volcano; swim with spinner dolphins and migrating whales; spot lemurs, giant tortoises and nesting turtles; and explore Stone Town–style villages and sultans’ palaces.

Need to know: Safe, but limited infrastructure; cash economy, rough roads, frequent delays; tourism just starting — but that’s the magic. Read more: The thrilling under-the-radar alternative to Mauritius.

Economic gap: Comoros’s GDP per capita (PPP) is about $3,463, compared to $32,094 in Mauritius — highlighting how far the “Islands of the Moon” lag behind their Indian Ocean neighbor (World Bank/IMF, via Wikipedia; Mauritius economy).

Source: The Times

Africa Trivia

Answer: A — Madagascar produces ~80% of global vanilla (Wikipedia).

Miss last week’s newsletter? Take a look back at our graphic of the week, Africa’s Ethnic Borders. See you next week! And if you’re enjoying The Africa Brief, please spread the love. Reach us at ([email protected]).