Lines, Lights and Legacies - This week’s Africa Brief focused on some key topics that are driving Africa’s future. Digital payments are surging but related infrastructure needs to be strengthened. The continent continues to talk about the $64B-a-year energy gap to power the 600 million people still without reliable electricity. Maps make headlines too, from the AU’s push to redraw how the world sees Africa’s size to fresh debates over whether borders or leadership hold back prosperity. And in Mali, Timbuktu’s golden-age manuscripts finally return home — even as militants still threaten the city.

Africa Trivia

Which African country borders the largest number of other countries?

A) Zambia

B) DRC

C) Tanzania

D) South Africa

Graphic of the Week

Beyond Borders

This week’s brief is heavy on the maps. The one above is featured in Ken Opalo’s latest essay which argues that Africa should move beyond the idea that colonial-era drawn borders are major problems and focus on improving weak states and changing elite mindsets. According to the piece, the “artificial borders” myth ignores African agency in drawing lines and the Independence Generation’s conscious choice to keep them. Mr. Opalo believes that calls to redraw maps or form a continental superstate are seen as unrealistic and destabilizing.

The Essay’s Case:

Prosperity depends less on borders and more on building strong, inclusive states and identities.

The Real Challenge: Leadership, nation-building and integration — not the lines on the map.

If you don’t mind wading through the academic speak, it’s worth the read: On Africa’s “Arbitrary” Borders And Their Alleged Impacts.

What We Are Reading

Africa: Africa faces a massive energy gap (600 million people lack reliable power) forcing governments to juggle aging grids, renewables and even nuclear as they seek $64B investment a year to deliver affordable electricity without deepening inequality (Financial Times); The African Union supports a campaign to adopt the Equal Earth map to reflect the continent’s true size and reshape global perceptions (Bloomberg).

Côte d’Ivoire: President Ouattara, 83, is running for a disputed fourth term, fueling protests and heightening risks of violence ahead of October’s election (Economist).

Egypt’s state grain buyer agreed to purchase 200,000+ tons of French wheat plus smaller cargos from Ukraine and Romania (Reuters).

Ethiopia: Safaricom plans to grow its subscribers from 10 to 70 million in five years by expanding M-PESA and network coverage (Semafor).

Ghana: 300,000 cocoa farmers are threatening to bar regulator COCOBOD from their farms over low prices and smuggle their crop to Côte d’Ivoire and Togo (Reuters).

Kenya: Government plans to repurchase $3.5B of local bonds by issuing longer-term securities to ease debt repayments (Bloomberg); Government plans to raise $250–$500M through a diaspora bond to ease fiscal pressures and fund infrastructure (Bloomberg); UN plans to relocate key agencies to Nairobi, raising hopes of growth but fears of worsening inequality (Al Jazeera).

Mali: Ex-Prime Minister Maiga has been charged with embezzlement and jailed as junta cracks down on dissent (Al Jazeera).

Mozambique: AfDB commits $40M to launch a green infrastructure fund aiming to unlock $10B in sustainable projects across Africa (AfDB).

Nigeria: Manufacturers are shifting to local sourcing to survive currency devaluations and reduce reliance on imports (Financial Times); 25+ rescued, dozens still missing after a boat carrying more than 50 people capsized in Sokoto state’s River Goronyo (BBC Africa); Gunmen killed at least 27 worshippers in a mosque attack in Katsina state (Al Jazeera).

Senegal: IMF mission visits to assess hidden debt and stalled loan program as government seeks new funding to stabilize finances (Bloomberg).

Somalia: More than 1,600 diphtheria cases and 87 deaths reported as vaccine shortages and aid cuts worsen outbreak (Reuters).

South Sudan: Exiles freed from Sudanese prisons return home but face overcrowded transit camps (AP News).

Tanzania: Court bans live coverage of opposition leader Tundu Lissu’s treason trial to protect prosecution witnesses (Reuters).

Togo: Ex-defense minister urged the military to back citizens in calls for President Gnassingbé to step down after decades of family rule (Bloomberg).

Uganda inaugurated its first large-scale gold mine, a $250M investment from a Chinese company (Reuters).

Zambia: A massive Zambia mine spill in February has recently sparked a U.S.–China blame game, leaving Lusaka juggling environmental fallout and its hunger for copper investment (Bloomberg).

Geopolitics in Africa

Source: New York Times

This week, the African Union backed a campaign to drop the 16th-century Mercator map, which shrinks Africa and South America while inflating Europe and Greenland.

Activists call it “the world’s longest disinformation campaign,” shaping education, media and policy by portraying Africa as marginal.

The AU endorsed the Equal Earth map, which shows Africa’s real scale and wants it used in classrooms and by global institutions.

As one Oxford Analytics note put it: “By accurately depicting Africa’s true scale, the campaign aims to reshape global perceptions, encouraging more informed investment decisions.” Wouldn’t it be great if a map fixed the problem?

Business & Finance in Africa

Bond Push Begins

Source: Financial Times

According to a Financial Times article this week, Africa has 19% of the world’s development banks but less than 1% of the $23T in assets. Earlier this year, President Trump cut $550M in U.S. funding to AfDB’s grant arm (ADF) and the UK and Germany are also cutting aid. To fill the gap, ADF plans to issue $5B in bonds every three years starting in 2027. Afreximbank and Trade and Development Bank (TDB) are considering similar strategies, but without “preferred creditor” status, investors are wary.

The Challenge:

The plan means ADF will borrow at market rates with the intent to lend affordably to poor nations — a tough equation as debt distress spreads.

Risk-sharing with private investors may help but could undercut AfDB's credibility as a public lender.

Why It Matters: Africa’s pivot from aid to markets must be done carefully to unlock capital while not deepening the debt trap. Read more: Financial Times.

Japan’s Play: Tokyo is offering low-cost public loans to swap Africa’s pricey debt for concessional credit — a modest backstop as U.S. and European aid dries up, but far from China’s scale.

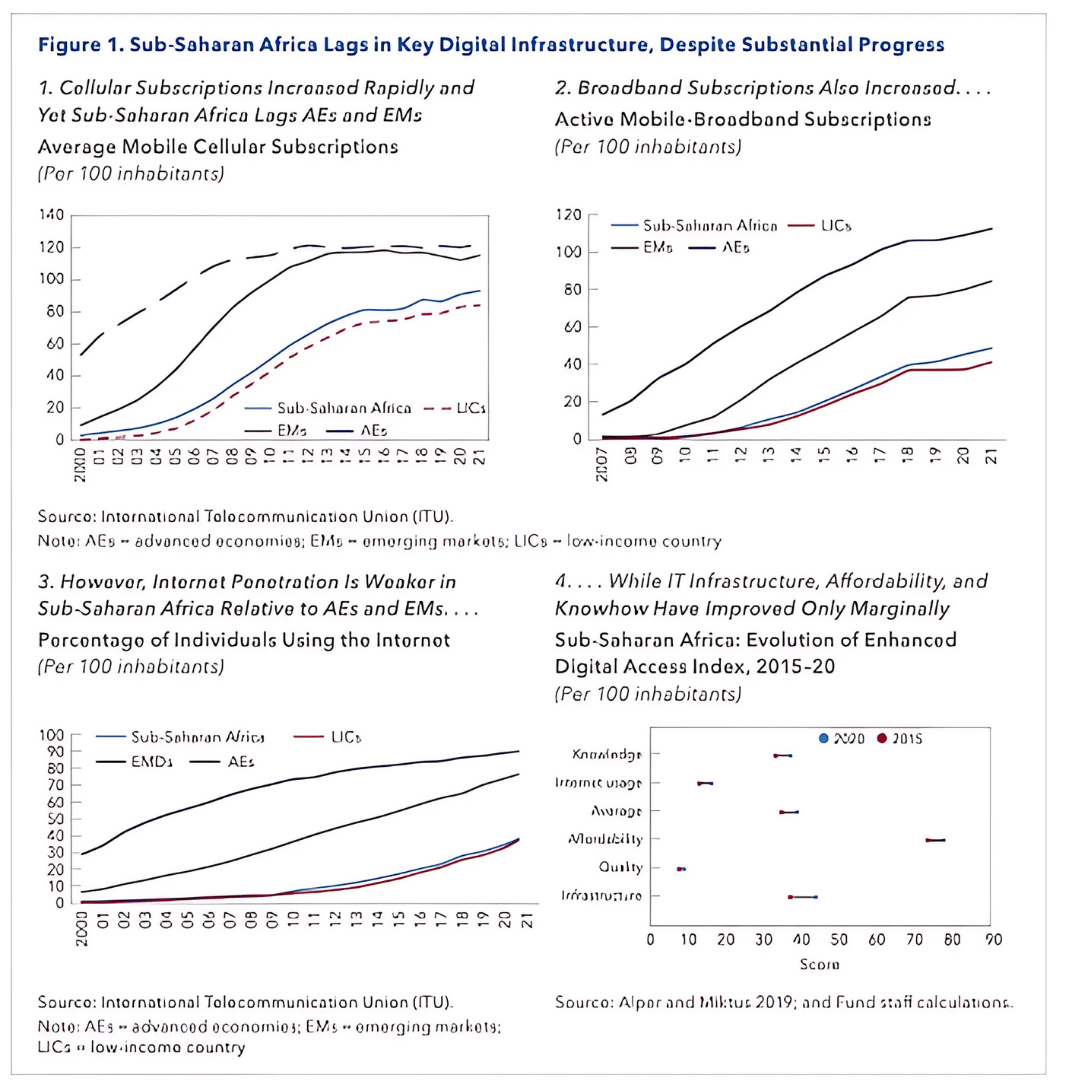

Unlocking Digital’s Potential

Source: IMF

We have talked about it before. Sub-Saharan Africa has the highest mobile money penetration globally; in some countries, mobile money accounts outnumber bank accounts. Going a bit deeper, an IMF report Digital Payment Innovations in Sub-Saharan Africa says:

Digital Surge: COVID-19 accelerated adoption of e-wallets, QR codes and instant payments, boosting cross-border trade and financial inclusion.

Uneven Access: Gaps persist between urban vs. rural, men vs. women and large vs. small firms.

Costs + Trust: High transaction fees, weak consumer protection and patchy digital infrastructure slow scale.

Policy Play: Stronger regulation, interoperability and investment in digital IDs and broadband are critical to unlocking the next wave.

The Bottom Line: Digital payments in Africa already lead the world in penetration (e.g., Kenya, Ghana), but their future as the “financial backbone” hinges on:

Cheaper Access: Lower transaction costs, better infrastructure.

Stronger Protections: Regulation, dispute resolution, data security.

Without those, digital finance risks deepening inequalities instead of broadening inclusion.

Africa’s Commodity Trap

Source: UNCTAD

The 2025 UNCTAD State of Commodity Dependence report lays bare Africa’s heavy reliance on raw exports. Despite global trade growth, the continent remains hampered by commodity cycles, with diversification lagging.

Key Insights

Widespread Dependence: 46 of 54 countries (85%) are commodity-dependent.

Regional Extremes: Middle and Western Africa — 100% dependent.

High Intensity: Many countries earn 80%+ of export revenues from commodities.

Sectoral Spread: Africa tops global dependence in energy (11 nations), mining (20) and agriculture (15).

Falling Returns: Export earnings shrank 5.6% over the past decade, led by oil declines in Nigeria, Angola and Algeria.

Why It Matters: Africa’s resilience and growth remain vulnerable to price shocks; breaking the cycle requires moving into value addition and diversification.

Source: UNCTAD

Explorations in Africa

Timbuktu: Manuscripts Amid Militants

After 13 years in exile, Timbuktu’s famed manuscripts— 27,000+ works on law, astronomy, medicine and more—are returning from Bamako (AP and Guardian).

In 2012, locals smuggled them out in rice sacks on donkeys, boats and motorbikes, saving them from jihadists who burned 4,000 manuscripts and destroyed UNESCO-listed mausoleums.

Malian forces, backed by Russia-linked troops, currently hold the city, but jihadists still control the surrounding region and staged deadly attacks as recently as June 2025 (Guardian).

The first 200 crates (5.5 tons) just arrived home by plane; more will follow, seen as “a bridge between the past and the future,” Mali’s education minister said.

Source: PBS News

Why It Matters:

The manuscripts reflect Mali’s intellectual golden age and global heritage—but their return comes as jihadists still menace the region.

Local leaders stress the next chapter: protecting, digitizing and studying these treasures so they continue to “enlighten Mali, Africa and the world.”

For me, I hope it soon becomes safe enough to pilgrimage to this legendary place. Read more: PBS News.

Africa Trivia

Answer: B) DRC (Nine neighbors: Angola, Burundi, Central African Republic, Republic of the Congo, Rwanda, Sudan, Tanzania, Uganda and Zambia.) Source: World Atlas.

See you next week!

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too! Email us at ([email protected]) if you have some scuttlebutt we should follow up on.