We are learning a lot this week in Lagos. If you haven’t been (in a while), my advice: Come see for yourself!

This week’s Africa news summary: There’s good momentum for climate.

Too Long; Didn’t Read

Africa - Climate Tech leads start-up funding in 2024, showing resilience amid global downturn. (Africa: The Big Deal)

EU - The European Peace Facility may double funding to €40M for Rwandan forces in Mozambique to secure gas project. (Bloomberg)

Ghana - Restructure $13B in Eurobonds to manage $43.6B debt. (Bloomberg)

Ivory Coast - Eni plans to sell a 30% stake in its oil and gas project to raise $8B. (Bloomberg)

Kenya - Lawmakers vote to retain controversial budget measures amidst protests. (Bloomberg)

Namibia - Aims to become a global green hydrogen hub with significant European investment. (Bloomberg)

Rwanda - Qatar Airways is acquiring 49% stake in RwandAir to expand its fleet and operations. (FT)

Somaliland - Ongoing push for statehood is highlighted this week in The Economist.

South Africa - Ramaphosa’s inauguration and coalition with DA boosts markets and investor confidence. (FT)

Sudan - Ongoing war causing humanitarian crisis; 9.2 million displaced; famine risk and worse. (New York Times)

Tanzania - Launches real estate venture in Nairobi to make diplomatic presence sustainable. (The Citizen)

Zimbabwe - Plans to require businesses to pay part of taxes in ZiG to stabilize currency. (Bloomberg)

If this email was forwarded to you, sign up here to get it in your inbox every Friday.

Graphic of the Week

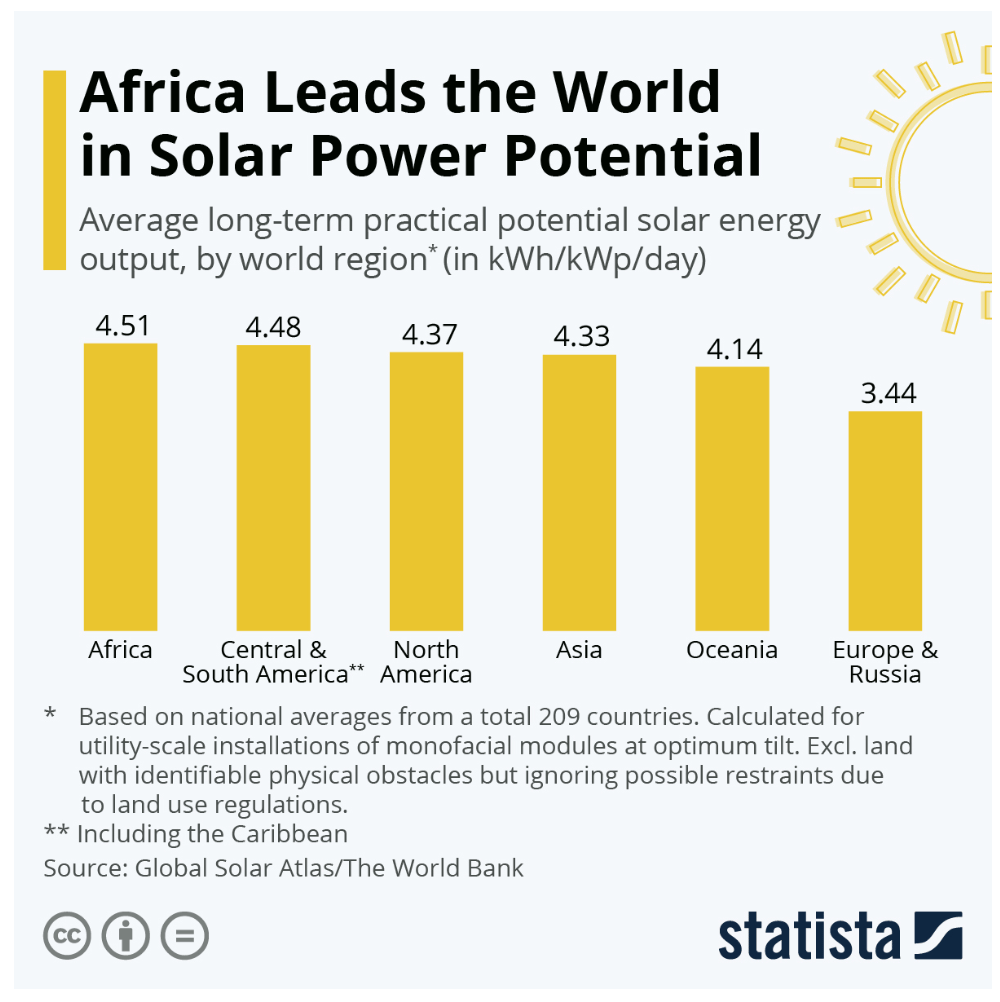

In Context: Global oil demand is slowing and is expected to plateau by 2030. While China, the rest of Asia and India see oil demand growing until 2030, advanced economies of the Americas and Europe see oil demand dropping dramatically by 2030 in favor of other sources like natural gas and renewables. Africa is capable of addressing the needs of both emerging and advanced economies. The continent sits on 125 billion barrels of proven oil reserves, is home to 620 trillion cubic feet of proven gas reserves (7.5% of global reserves worth about $2.3T in today’s prices), 84% of which are in the pre-production stage and has an estimated capacity for 60% of the world’s best solar (10 terawatt), hydropower (35 gigawatt), wind (110 gigawatt), and geothermal energy sources (15 gigawatt). (International Energy Agency) (Forbes)

Want more on Africa’s untapped energy potential? Don’t miss Andrew Larsen’s analysis below.

Climate in Africa

Funding Surges for Climate Tech

In Context: In 2024, Climate Tech leads Africa’s start-up funding, representing 45% ($325M) of total investments so far. This marks an all-time high since tracking began in 2019. While overall startup funding in Africa has decreased, reflecting a global downturn, Climate Tech has shown remarkable resilience and growth. (Africa: The Big Deal)

And the opportunity: an estimated 600 million people on the continent lack reliable electricity and solar power is emerging as a solution. The continent saw a record installation of solar capacity in 2023, driven by private firms bypassing unreliable national grids, wrote The Economist recently. As costs of solar panels and battery storage plummet, decentralized renewable energy systems are transforming African economies.

And there is skepticism but…Namibia aims to become a global hub for green hydrogen production, leveraging its abundant solar and wind resources to power electrolyzers which split water into hydrogen and oxygen. With significant European investments, including a €500 million loan from the European Investment Bank, Namibia's Cleanergy Solutions are pushing forward despite challenges and skepticism about the project’s commercial viability. The government and international backers are optimistic about Namibia's potential to decarbonize European industry and boost its own economic growth. (Bloomberg) And one more thing: Namibia tops the World Economic Forum's list of best African countries for women in 2024, with significant gains in political representation and literacy rates. (Business Insider Africa)

Aiming to use proceeds for further growth, African Infrastructure Investment Managers Ltd. (AIIM), owned by Old Mutual Ltd., is in early talks with potential investors, including BlackRock Inc. and Norway's Norfund AS, to sell a stake in its renewable energy businesses, one of Africa's largest. AIIM's renewable energy portfolio, which includes projects generating or building over 2,800 megawatts of power, forms a significant part of its $2.8 billion in assets under management. This move comes amid increasing interest and deals in Africa's renewable energy sector, where demand for wind and solar energy is rapidly growing. (Bloomberg)

Happy to see all the movement this week in Climate in Africa.

Business & Finance in Africa

It’s a story we all know. As Western firms like Diageo are exiting Nigeria (and other parts of the continent) due to forex instability and a host of other challenges, Asian and local firms are buying assets, localizing their supply chains and capitalizing on the large market opportunities. Nigeria's volatile naira and high inflation make it tough for companies relying on imports, but firms producing locally are expanding their market presence. (Bloomberg) Read Ken Opalo’s analysis for the whole story.

Eni Spa, an Italian oil company, plans to sell up to a 30% stake (valued at about €1B) in its Ivory Coast oil and gas project as part of an effort to raise $8B. The Ivory Coast discovery in 2022 increased the fossil fuel resources found in the area by about 25% and boosted the country’s foreign investment potential. (Bloomberg)

Kenya is tempering tax plans amidst protests. Lawmakers aligned with President William Ruto voted to keep most of the controversial budget measures aimed at raising $2.4B in revenue. The government plans to drop some proposed taxes, including value-added tax on bread and a wealth levy on motor vehicles. Police used tear gas and arrested 300 protesters demanding the government scrap its tax plan. (Bloomberg) For more on the protests read “A Tik Tok Revolution?” (Africa Is A Country)

Ghana is in talks to restructure $13B in Eurobonds. The talks aim to reach an agreement after earlier negotiations stalled in April. The efforts are crucial as Ghana seeks to restructure $43.6B in debt. (Bloomberg)

Tanzania is building real estate in Nairobi, an ambitious venture between the National Social Security Fund (NSSF) and Tanzania's Ministry of Foreign Affairs. The project aims to bring sustainability to Tanzania's diplomatic presence in Kenya. The country owns 101 embassy properties worldwide and currently spends 29B Tanzanian Shillings (~$11M) on them annually. The country plans to pursue similar projects in other cities and hopes to generate around $14M annually. (The Citizen)

Zimbabwe plans to require businesses to pay part of their taxes in ZiG according to Finance Minister. This measure is part of a broader effort to enhance the currency's stability and prevent it from devaluing like its predecessors. The ZiG, introduced on April 5, replaced the Zimbabwean dollar and is backed by 2.5 tons of gold and $100M in foreign currency reserves. (Bloomberg)

Democracy in Africa

Unity Boosts South African Markets

South Africa's currency and stock market surged this week after Cyril Ramaphosa's second-term inauguration as president, following a power-sharing deal with the opposition Democratic Alliance (DA). The Johannesburg Stock Exchange rose 1.2% and the rand strengthened to R17.9 against the dollar, driven by investor optimism over the ANC-DA coalition. This partnership avoided feared coalitions with other parties widely seen to be more radical, boosting market confidence. The DA's involvement is expected to drive reforms and economic growth. However, analysts warn of challenges in maintaining fiscal discipline and implementing policies amid coalition politics. (FT) For now though, President Ramaphosa is focused on building his cabinet. (Bloomberg).

The Economist sheds further light on what Ziyanda Stuurman said to us a few weeks ago. The election is a testament to South Africa’s strength as a young democracy.

Keep an eye on upcoming Africa’s elections, on the African Argument’s Interactive Map. Next up: Mauritania on June 29 and then Rwanda July 15.

Peace & Security in Africa

EU funding Gas Project’s Security

The European Union may double its funding to €40M for the Rwandan Defense Force (RDF) to combat jihadists in Mozambique’s Cabo Delgado province to ensure the $20B TotalEnergies liquefied natural gas (LNG) project resumes. Since 2022 about €20M in funding has been provided from the ironically named European Peace Facility for the RDF and other regional forces to regain control of the territory. This funding underscores Europe’s critical need for new energy sources after Russia cut much of its energy delivery in May 2022 due to the Russia-Ukraine war. (Bloomberg) (Brookings) (European Council) Oh, and Kenya Airways resumed Nairobi > Maputo flights this week. Perhaps another indicator the world wants this Cabo Delgado gas project to work.

Somaliland’s Struggle for Statehood

In The Economist this week, Somaliland claims Ethiopia will be the first country to grant it recognition in exchange for sea access. These claims and the memorandum signed in January have outraged Somalia, which expelled the Ethiopian ambassador and threatened to do the same to Ethiopian soldiers fighting al-Shabab. Somaliland President Muse Bihi Abdi’s argument for statehood highlights Somaliland’s historical and political differences from Somalia. Despite its de facto independence, no country has recognized Somaliland.

Sudan Still at War & Worse

Meanwhile, the war in Sudan shows no sign of letting up and Human Rights Watch reports signs of ethnic and possible genocide. The year-long war between rival generals, has driven 9.2 million people from their homes and pushed the nation towards famine. The military, led by General al-Burhan, and the Rapid Support Forces, led by General Hamdan, continue to clash, causing untold suffering and drawing in international involvement. (New York Times) For an analysis of the war’s context, read Josh Parker Allen’s piece from October 2023.

China in Africa

Dominating Minerals > Batteries

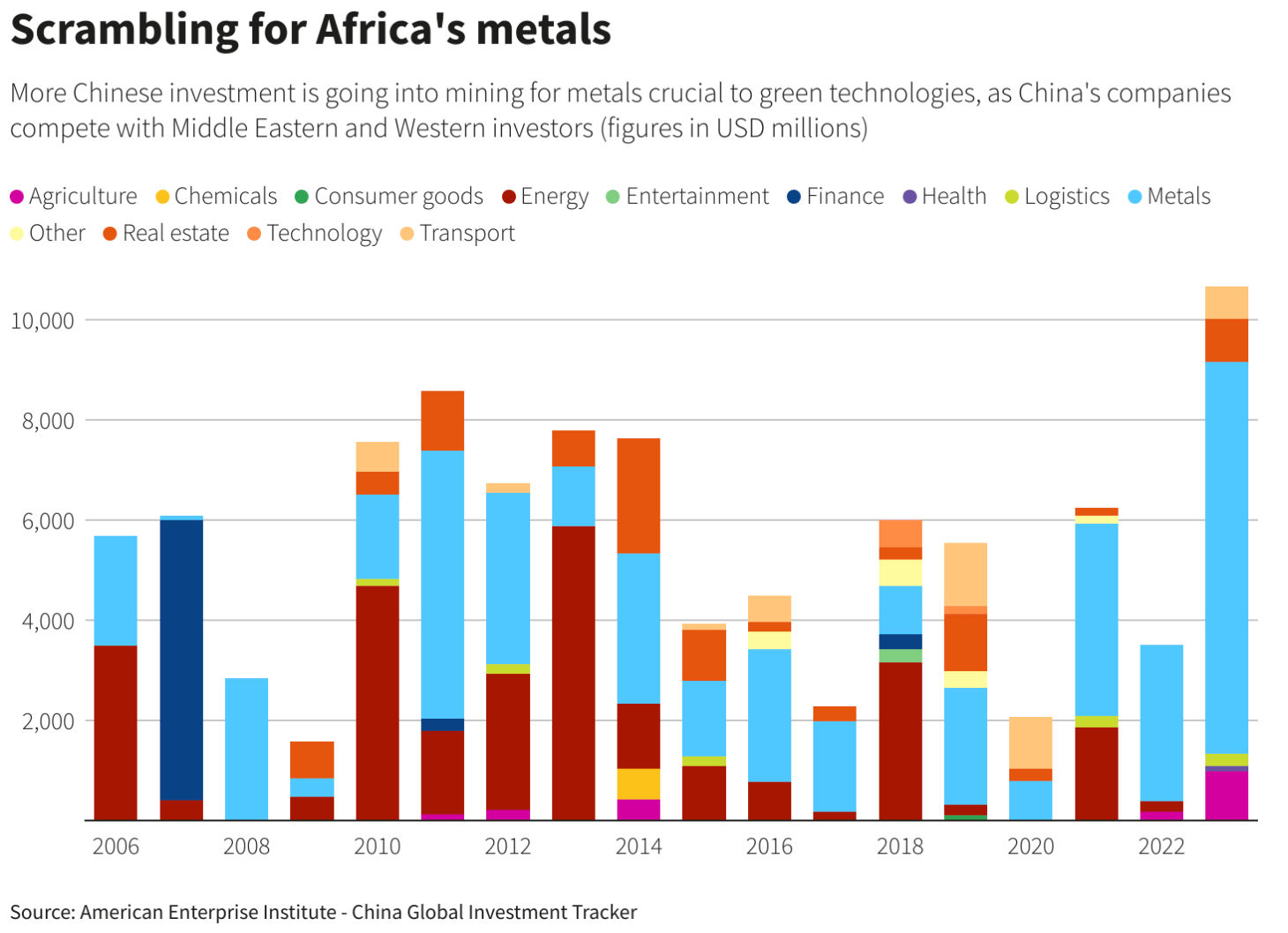

In Context: As we’ve featured in the June 7 edition of the brief , in two decades, China's influence in Africa has surged, becoming the top supplier to more than thirty nations as of 2020. In early 2024, Chinese imports from Africa rose 8% to $29.42 billion, driven by key minerals and strategic tariff cuts. This booming trade relationship and significant infrastructure investments highlight China’s deepening economic ties with Africa and its interest in dominating the mineral and metal markets crucial for the global energy transition. (Statistica) (LeBrief)

It’s in the news again: China is building a battery supply chain in Morocco to support Europe’s electric car industry, as Europe struggles to develop its own. Morocco’s proximity to Europe and phosphate reserves, essential for efficient and cost-effective LFP batteries, make it an ideal supplier. China's global dominance in battery production and access to raw materials, combined with Europe’s lagging technology and investment shifts to the US and Canada, emphasizes the challenges Europe faces in creating its own battery supply chain (Bloomberg). For the full context, read Josh Parker Allen’s Closer Look which provides the wider context for China’s hold on North Africa.

Travel in Africa

Increasing Capacity in African Travel

Qatar Airways is acquiring a 49% stake in RwandAir, a deal that has been in progress for five years. This partnership is set to enhance Rwanda's aviation sector, enabling RwandAir to expand its fleet and operations. The agreement, expected to finalize by July, will also help RwandAir improve regional connectivity through a code-share arrangement. Additionally, Qatar Airways is investing in Rwanda's new Bugesera International Airport, aiming to make Kigali a major transit hub in Africa by 2027. (FT)

Go Deeper…

More on Africa’s Energy Potential…

As highlighted in our Graphic of the Week today, with 125 billion barrels of proven oil reserves, 620 trillion cubic feet of gas reserves, and vast renewable energy potential, Africa is well-positioned to meet the diverse energy needs of both emerging and advanced economies. But it’s complicated.

Before Russia invaded Ukraine, Europe imported 40% of its gas from Russia. Now Africa has the potential to fill the void. We can see why the EU wants to protect Mozambique’s LNG projects! Other large projects are underway, including in Senegal, Mauritania, Nigeria and Tanzania and recent discoveries of gas have been found in Namibia and Ivory Coast. Africa has significant reserves to become a global LNG exporter.

African energy producers have the potential to address a portion of unmet demand in both emerging and advanced markets, increasing economic resilience and decreasing dependence on oil export. For example, Nigeria depends on oil exports for 90% of its foreign exchange revenues, making its entire economy vulnerable to energy demand shifts and external shocks. The following efforts on behalf of African oil and energy exporters would help maximize potential:

Decarbonize oil supply chains: Sub-Saharan African countries often have limited infrastructure like pipelines and railroads, forcing them to rely on trucks for transport. At least 83% of Africa's oil products are transported on trucks. This undermines profits and decreases investment potential.

Unlock untapped energy resources including renewables and Liquified Natural Gas (LNG): Africa sits on 60% of total global renewable energy potential with planned solar farm capacity for 141K megawatts (MW). Moreover, several large LNG projects are already underway, including in Mozambique, Senegal, Mauritania, Nigeria and Tanzania to increase Africa's LNG potential.

Secure and finish projects: African countries have historically struggled to complete large infrastructure projects including energy development ones due to insecurity and corruption. TotalEnergies SE's LNG project in Mozambique is just one example. To rise as a global energy powerhouse, African nations need to prove they can secure projects and finish them within a predetermined time frame to attract further investment.

Read more about Africa’s role in the global energy transition here: McKinsey and Company. (30 minute read)

P.S. Thoughts on this format? Email us at [email protected]. Thanks Andrew Larsen for your shedding light on Africa’s role in the energy transition, etc. this week! And get that Ph.D. done Josh Parker Allen so we can have more of those great deep dives. This is Laura Davis, signing off from Nigeria (enjoy Lagos in 12 photos). You’ll find me next week somewhere in Nairobi, Kenya.