It’s a tad embarrassing, but Matt and I couldn’t help but watch Casablanca in the evenings after packed days exploring Morocco’s startup ecosystem. We are soaking in as much learning as we can this week in the great and beautiful city of Casablanca! Our takeaways after two weeks: 1) football is bringing a massive economic boom; 2) an economic wall across North Africa is a huge opportunity; 3) expect a windfall from too much tourism in Spain; and 4) Moroccan’s love of their monarch has positive repercussions. Read more and download Startup Ecosystem Factsheet.

TL;DR

Basketball Boom - Luanda claimed the title this week in Kigali. (The New Times)

Blueprint to Fix Debt - Ruto and Kagame propose a blueprint that includes 40-year, low interest loans, to help solve Africa’s debt issues. (The East African)

Ethiopia - Boeing will establish its African headquarters in Ethiopia. (The Africa Report)

Exclusive - Election expert Ziyanda Stuurman discusses the hopeful mood and political maturity in South Africa post-election. (See Africa Brief Exclusive Below)

Kenya - Kenya holds lending rates steady and is planning a $1B eurobond buyback. (Bloomberg)

Malaria Fight = Growth - Reducing malaria by 90% could boost African GDP by $126.9B. (AllAfrica)

Olympics - Egypt aims to host the 2036 Olympic games. (MSN)

Rwanda - Predictable elections are expected in Rwanda on July 15. (The New York Times)

Senegal - Investor confidence is growing. Senegal sold $750M in sovereign debt. (Bloomberg)

South Africa - Investors anticipate a market-friendly government post-election. (Bloomberg)

South Korea - The country pledged $24B in aid and export financing. (Reuters)

Stability Leaders - Mauritius, Seychelles, Tunisia, Morocco and Botswana are among the top 10 most stable African countries. (Business Insider Africa)

If this email was forwarded to you, sign up here to get it in your inbox every Friday.

Graphic of the Week

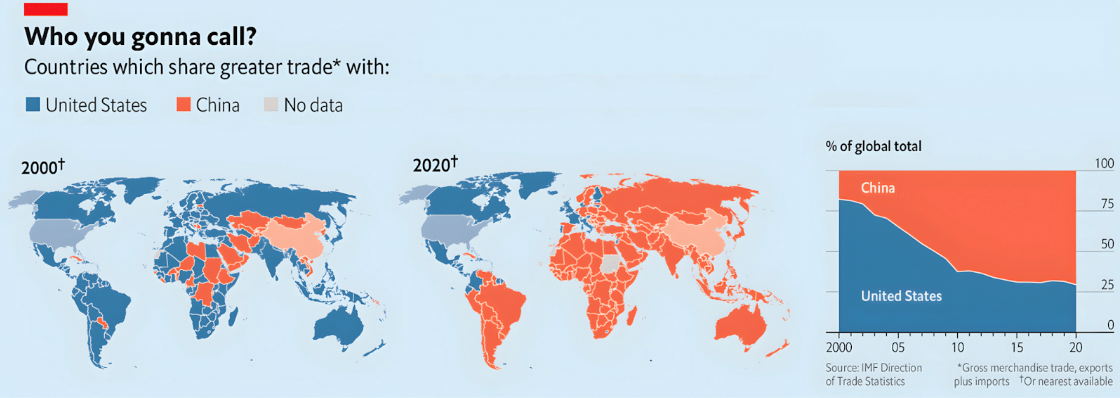

A 20 Year American Flop

In 2013, China launched the Belt and Road Initiative. Some say the strategy was aimed specifically at continuing to erode the United States’ global economic dominance. Africa, a crucial emerging market, saw a surge in Chinese investments. Over the past 11 years, Chinese companies have built ports, hydropower plants, and railways across Africa, primarily funded by sovereign loans. Lending to Africa peaked at $28.4B in 2016, mostly in rigid sovereign and commercial loans from Chinese banks. Many projects turned unprofitable, and COVID-19 shifted China's focus back home.

Despite a decline during COVID-19, Chinese investments surged by 114% in 2023. Now, instead of sovereign loans, China is pushing for public-private partnerships, equity investments with Chinese firms holding a controlling stake, and extractive trade to diversify and ensure profitability.

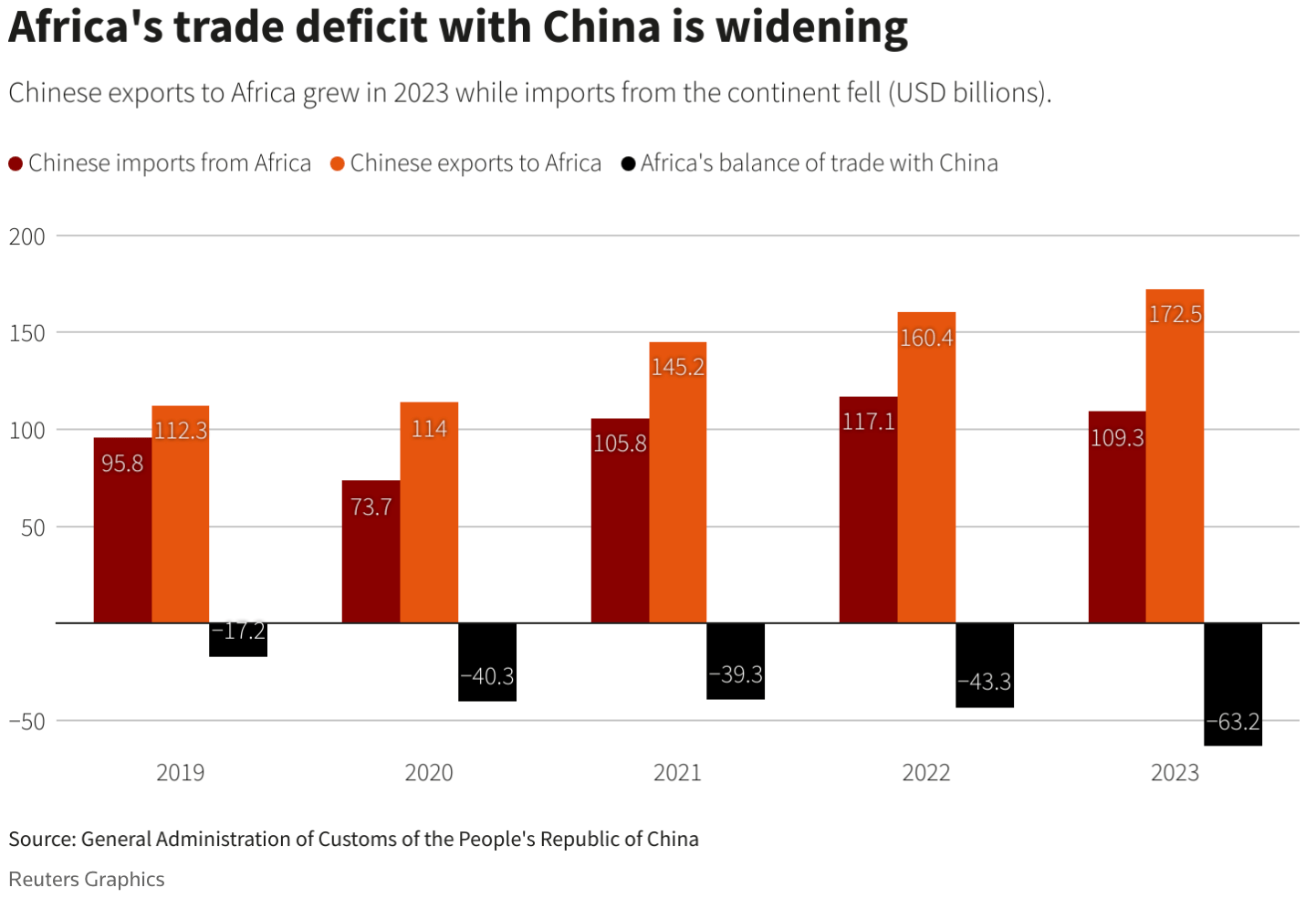

China's relationship with Africa is increasingly extractive, focusing on minerals critical to the global energy transition. This control and predatory approach is creating a growing trade deficit for African countries, echoing colonial-era trade dynamics, according to Reuters.

Business & Finance in Africa

Fans Are Not The Only Ones Getting Excited

Derivatives for World Cup Glory - Morocco plans to add derivatives trading to its capital market in 2024 as part of major financial reforms to support infrastructure projects and preparations for co-hosting the 2030 World Cup. The reforms aim to increase capital market contributions from 10% to 25% of the economy, with new legislation expected this year to optimize and attract more retail and foreign investors. Despite economic challenges, Morocco's stock market has gained momentum following the World Cup announcement and the country plans to invest heavily in strategic projects.

Taking Control and Turning the Tide!

Blueprint to Fix Africa's Debt - African leaders are working together on a financial blueprint to address the mismatches with the international financial system, and its inadequacy for Africa amid recent global crises. The blueprint indicates the need for long-term financing, low interest rates and non-returnable grants, among other products. With Africa's debt reaching $1.152T and multiple countries in or at high risk of debt distress, the new framework emphasizes long-term, low-interest financing, greater access, and climate-sensitive solutions. The African Development Bank (AfDB) and leaders like Kenyan President William Ruto and Rwandan President Paul Kagame are advocating for these reforms to mobilize resources and prioritize Africa's interests, aiming to transform the continent's economic landscape. “For us in Africa, we are hard-pressed to see that there is change in the design of these institutions (IMF)...the way the institutions are set up benefits some parts of the world,” said President Kagame at the presidential panel discussion.

Tinubu's Fight for Approval Rating Boost - Nigeria plans to suspend import levies on staple foods for six months to combat soaring inflation. President Bola Tinubu may also halt borrowing from the central bank and suspend some value-added taxes to ease the cost of living. These measures come as inflation hits 33.7%, the highest in 28 years. The plan aims to provide low-interest loans to key sectors, improve outputs and stabilize prices.

Africa's Stability - The Fund for Peace rates the top 10 most stable African countries in 2023 as: Mauritius, Seychelles, Botswana, Cape Verde, Namibia, Ghana, Gabon, Tunisia, Morocco and São Tomé and Príncipe. According to the 2023 Fragile States Index these nations rate well across various conflict risk indicators, including security, economic development, and human rights.

Senegal Bonds Signal Confidence - Senegal became the fourth sub-Saharan African nation to tap the bond market this year, raising $750M in debt which will mature in 2031 at a 7.75% coupon rate which is the annual interest rate paid by the issuer. The bond sale indicates a growing investor confidence in Senegal's new government following political instability earlier this year when former President Macky Sall postponed elections and considered extending his term, leading to mass protests. After opposition leader Bassirou Diomaye Faye won the March elections, market sentiment improved significantly. Despite initial uncertainties about Faye's policies, the successful bond issuance shows renewed market optimism.

Boeing Bets on Ethiopia - The company announced it will establish its African headquarters in Ethiopia. This decision concludes speculation about potential locations, such as South Africa and Kenya. In 2023, Boeing entered a joint venture with Ethiopia to manufacture certain aircraft parts in the African nation. The new headquarters in Ethiopia is expected to create more than 300 new jobs.

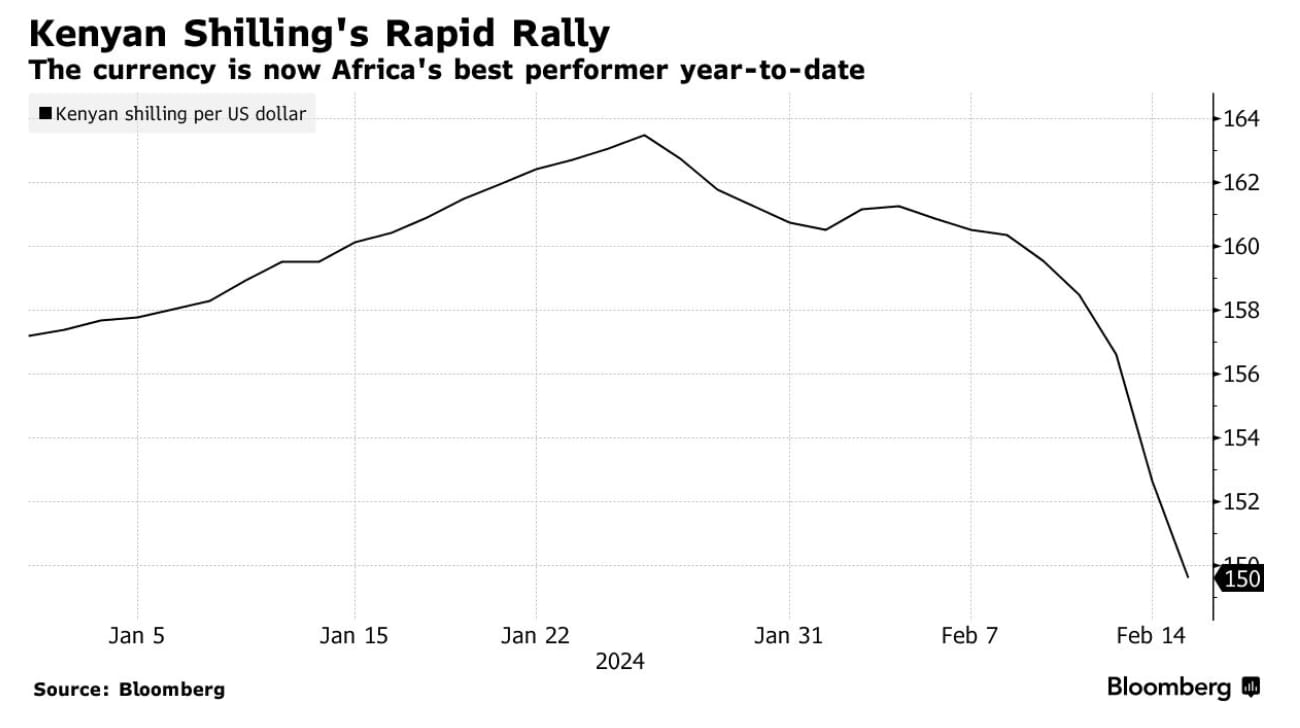

Kenya's Rate Gamble - Kenya holds lending rates steady at 13% but may cut them soon. The currency appreciated 10% since August, reversing four years of decline after refinancing June 2024 bonds and a $1.2B World Bank loan. Inflation rose to 5.1% in May due to El Niño floods increasing food prices. Kenya also plans a $1B early eurobond buyback this year, totaling $2.5B, to ease debt payments from 2028 to 2031, as per the World Bank.

Rand Surged After Election - South African assets are rebounding, fueled by investor confidence that the country will emerge from coalition talks with a market-friendly government, likely including the Democratic Alliance, a known market-friendly party. The South African Rand surged 1.6% on Monday, its biggest one-day gain since Dec. 14 after the ruling African National Congress failed to secure a majority for the first time in 30 years. South African bonds were the top performers in the Bloomberg Index on emerging market bonds. Moreover, the FTSE/JSE All Share index ended Monday as the second-best performing equity gauge in dollar terms among the 92 indexes monitored by Bloomberg. More on South Africa’s election below. Signs later in the week indicate confidence may have its ups and downs.

Democracy in Africa

South Africa Shows the World How to Run a Respectful Election

Where It Stands in SA. Exclusive Q&A - You likely have done your own reading this past week on the results from the South African elections. If not, read NYT’s, What’s Next for South Africa After Voters Rebuked Its Reigning Party? And rather than providing our take on the article, this week we thought we’d bring you some exclusive insights from South African election expert and Senior Analysis for the Eurasia Group, Ziyanda Stuurman. Here some quick hits from our recent chat:

Q: What do you think the mainstream international media is missing about the SA election results? A: The mainstream media is missing the fact that these election results are evidence of the ANC’s ‘broad church’ appeal…fading and no real alternative is taking its place. South Africa is a very heterogenous and diverse country and the rise of parties mobilizing on the basis of identity first could start a dangerous trend for future elections.

Q: What do you see as the most hopeful part of the election story? A: The fact that South Africans have respected each other’s political choices. There have been no outbursts of political violence even after the major ruling party of the last 30 years lost control of government. I think that is a clear sign of a maturing democracy and electorate.

Q: What is the general mood across the country, post election? A: I think the general mood is hopeful. A lot of people trust that the leaders that have been elected understand the gravity of the moment they are in (in negotiating the formation of a new government) so there is a lot of hope and trust in them to form one that puts South Africans first.

On our radar next? Rwanda’s predictable elections on July 15.

U.S. in Africa

U.S. Pushes for Binance Exec's Release - U.S. lawmakers urge President Biden to push for release of Tigran Gambaryan, a Binance executive and U.S. citizen, held in Nigeria since April. They claim Nigeria is detaining Gambaryan on baseless charges to extort Binance, highlighting the conflict between Nigeria and the cryptocurrency exchange over compliance and tax issues. Nigerian authorities deny wrongful detention claims, maintaining that Gambaryan committed a crime.

Asia in Africa

Korea Courts Africa for its Minerals - South Korean President Yoon Suk Yeol and African leaders agreed to boost trade and business ties, launching a "critical minerals dialogue" for sustainable resource development. South Korea pledged $10 billion in aid and $14 billion in export financing to tap Africa's mineral wealth and market potential. Initiatives include agricultural support, tech education, and infrastructure investments.

Health in Africa

Malaria Fight = Africa Growth - New research from Oxford Economics Africa reveals that achieving the Sustainable Development Goal of reducing malaria by 90% by 2030 could boost African GDP by $126.9B. This could include a $31B rise in exports, benefiting countries like Nigeria, Kenya and Angola. Experts project that continued investment from G7 nations to eradicate malaria will not only save lives but also strengthen economies and health systems.

Culture in Africa

Soak in the Beauty

Tangier, A Cultural Crossroads - Since I am in Morocco, I couldn’t help soaking in this gorgeous article in FT called Inside the Homes of Tangier’s Tastemakers. Turns out there is much more to explore on my next trip to Morocco.

Sports in Africa

The Only Thing Higher than Players' Jumps are the Viewer Ratings

BAL: Africa's Basketball Boom - The Basketball Africa League (BAL), launched in 2019, is an NBA program to promote the game of basketball on the African continent. The league aims to retain local talent and draw global interest, featuring 12 teams from 12 countries with record interest this season. This past weekend, the league’s fifth season concluded with Angola’s Club Atletico Petroleos de Luanda defeating Libya's Al Ahly Ly Sporting Club 107 - 94 in the season’s finals at BK Arena in Kigali, Rwanda. Read more about the league’s impact in Africa in Forbes.

Egypt Eyes Paris Gold - Egypt is sending its largest-ever delegation to the Paris Olympics, aiming to surpass its record medal haul from Tokyo, and bolster its bid to host the 2036 games. With more than 150 athletes expected to represent, the country is also working to showcase its modern sports infrastructure and Olympic readiness. Egypt’s investment in sports facilities and a strong preparation effort underline its ambition on the global stage.

P.S. We hope you enjoyed the Brief! Reach out if you have ideas or feedback ([email protected]) or want to chat about Morocco. Andrew Larsen did the heavy lifting again this week with constant love and support from Josh Parker Allen in Oxford, Nihal Grii (and her hospitable family) in Morocco and Antony Maina in Kenya. This is Laura Davis, signing off from Casablanca. See you next week, Cairo, Egypt.

About: The Africa Brief aims to provide accurate and insightful information and opinions related to Africa’s macro trends. We hope to stay apolitical and present information in a balanced and objective manner. If you have feedback for us, please email [email protected].

Disclaimer: This newsletter provides general information only and is not investment advice. It does not consider any subscriber’s individual investment objectives, financial situation or means. It does not offer investment recommendations or solicitations. Consult your financial, legal and tax advisors before acting on any information in this newsletter. The Africa Brief is not responsible for actions taken based on this newsletter. Opinions herein may change based on economic and market conditions. Data from third-party providers is obtained from what are considered reliable sources but accuracy cannot be guaranteed.