Dear Friends,

A Wednesday special for you.

Please share far and wide — I hope we can grow this community together.

Tech & Society in Africa

Africa abounds with cases of material and immaterial innovations developed and designed elsewhere that have come to be transformed, sometimes unexpectedly, when adopted and adapted on the continent. Take mobile phones, where M-PESA famously preceded ApplePay and processed some 19.9 billion transactions in 2022. In transport, Toyota’s Hi-Ace minibus’ intended use in developed markets and was to be a transporter for school children, large families, and members of clubs and societies. In much of sub-Saharan Africa, however, ‘minibuses’/’taxis’/’danfos’/’combis’ are ubiquitous and power African public transport systems, commuting millions of people to and from work everyday.

There is no better example of the scale of adoption, adaptation, and innovation to the local African market other than mobile telephony. Today you’ll find roughly 480m unique mobile users on the continent (44% using smartphones) and due to grow to 613m by 2025. Of these users, 272m use mobile money according to GSMA, an industry body. Africa’s mobile money networks are some of the world’s most developed. Its wide scale adoption has meant the integration of millions of the unbanked into the financial system. While the most celebrated of these mobile money systems remains M-PESA, as of 2019 there are some 290 mobile money providers processing $1.9bn USD daily with $22bn USD in circulation at any one time. The developmental dividends of mobile money are significant, giving consumers the opportunity to store their money safely — which in turn encourages savings of some $264 per unique customer annually. Humanitarian organizations have started to disperse funds to some 1.7m people via mobile money partners as an effective and targeted mechanism for humanitarian assistance.

Mobile phone adoption in Africa. Source: Our World in Data

Post-Pandemic Profits

Like the rest of the world, the COVID-19 pandemic only accelerated the move to digital. In the week after the first lockdown was imposed in Rwanda, mobile-money transfers doubled, according to Cenfri. In the same period, a Nigerian payments firm, says the number of customers signing up to use its mobile wallet grew by 330%. MTN, a South African telco giant, says it has experienced a rise in payments across its 16 African markets since the start of the pandemic.

The post-pandemic period then has seen an increase in profits of established telcos and nimble start ups. Indeed, most of the continent’s unicorns (private companies valued over US$1 billion) are fintechs, with four of them — Flutterwave, OPay, Chipper Cash and SendWave — becoming unicorns mid-pandemic in 2021. All indications show that revenues for the fintechs will grow in the near term (see graphic below).

Source: Fintech in Africa

Agritech

Access to mobile telephony and the widespread use of mobile money has resulted in the proliferation of adjacent digital services, including: sending and receiving remittance payments (a major source of funding for African states), SMS/MMS driven tele-health, and C2C, C2B, and B2B payments platforms and service offerings.

One industry rapidly innovating off the back of mobile connectivity is agritech. Agriculture is one of Africa’s most important economic sectors, and according to McKinsey it makes up 23% of the continent’s GDP, providing work for nearly 60% of the economically active population. Despite vast tracts of fertile land, the continent is defined by its food insecurity with a net food importing bill of US$35bn in 2018. With its bulging youth demographic, African farmers will need to feed more mouths.

In this economic environment, agritech has blossomed in sparsely populated communities using connectivity to boost agricultural productivity and the chance to get their products to the formal market. Small-scale farmers in Kenya now access basic agrometeorological information on their semi-smart phones to improve their agricultural activities. While Ghana’s e-Soko provides overall farm management support, helping farmers monitor and analyse their farming records via its data collection tool. Not to be outdone, Nigeria’s FarmCrowdy acts as an online platform that offers farmers advice and enables them to access credit directly from an investor, who in return earns a share of the post-harvest profit.

Still Too Costly

Taking the immense transformative power of mobile networks as a given, what are the trends for the future? In its 2020 Report, GMSA projects that 27% of connections on the continent will be on 4G and 3% on 5G by 2025. Unfortunately the bulk of the connected will only have access to 3G — this while the rest of the world literally speeds ahead. As for market valuations, the mobile industry share of GDP will top US$184bn by 2024, increasing to US$712 billion by 2050. Access to semi-smart and smartphones have increased in large part due to Chinese manufacturers producing affordable products but phones remain expensive proportionate to the average income for the region.

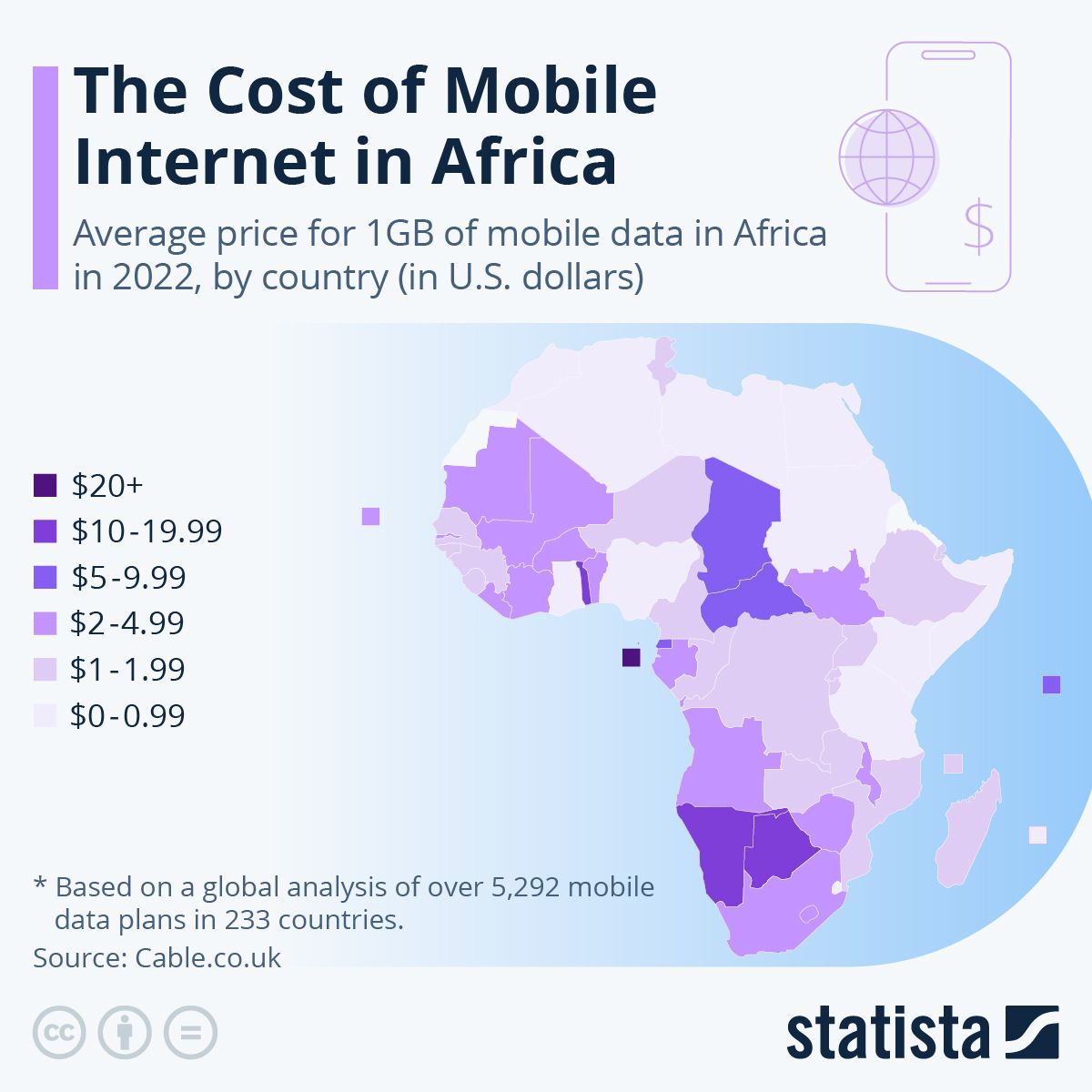

While the cost of cellphones are decreasing, the cost of connectivity remains prohibitive. Sub-Saharan Africa has the most expensive data than any other region. Data costs are high for at least two reasons. First, most African states have a combination of limited fixed line connectivity with high consumption — this makes mobile data the primary means for the population to get online. Simply, constrained bandwidth means higher prices. Second, African governments are desperate for sources of revenue and Africa’s giant telcos have deep pockets. As a result, taxes and fees paid by mobile operators in Sub-Saharan Africa correspond to 26% of the sector's market revenue. This phenomenon is paradigmatic of the rentier African state.

Source: Statista

What of the Future?

Connectivity’s social and economic dividends (positive and negative) are largely self-evident. Connecting a continent as vast as Africa with its creaking infrastructure is less straightforward. Deploying internet infrastructure is expensive and cumbersome. Two monumental projects are underway; Google’s Equiano (named after the 18th-century African abolitionist, Olaudah Equiano) subsea internet cable from Lisbon to Cape Town (connecting to Nigeria) finished its first phase this year. The cable's capacity has not been disclosed but would likely top 200Tb/s.

The 2Africa cable is more ambitious. It will circumnavigate Africa (some 37,000km) connecting to data centers along the way, with the capacity of 180Tb/s and completion scheduled for 2023 or 2024. Facebook, China Mobile, and MTN are a few of 2Africa’s many institutional backers.

Source: Submarine Cable Networks

There are two further complicating factors. First, the continent’s governments find themselves smack-bang in the middle of a geopolitical fight over the future of telecommunications and the internet. This topic is beyond the scope of this humble brief, but for an excellent article on the future of the internet see the FT’s article on ‘China’s controversial mission to reinvent the internet’. This techno-geopolitical fight has real consequences for local policymakers. In digitising and connecting their economies, African governments are under pressure to open their internet markets in the image of either China’s closed system or the United States’ open system. Making this tangible, in January the absolute monarchy of Eswatini (previously Swaziland) became the first African government to sign up to the US-backed “clean network” of countries that promise to abjure Chinese-made 5G kit — although it has reportedly since backtracked.

If navigating the two powers wasn’t challenging enough, the biggest block on Africa’s internet infrastructure boom is its unstable and unreliable access to electricity. Without a stable grid, any move to an internet economy is over before it begins. The Obama era Power Africa initiative should be leveraged in advancing its efforts to connect the continent.

That's it for this special. Please share The Africa Brief.