Africa may be burning, booming, borrowing — or just building higher — depending on which headline you read this week. From McKinsey’s productivity “lanes” to billion-dollar startups, shipping bottlenecks and even skyscraper showdowns, the continent is juggling growth and grind. Let’s dive in.

Africa Trivia

The Johannesburg Stock Exchange (JSE) is Africa’s largest stock exchange. Which country hosts the second-largest? Clue: This week I had the pleasure of visiting it.

A) Morocco

B) Nigeria

C) Kenya

D) Egypt

Graphic of the Week

Need More GDP Speed

Source: McKinsey & Company

McKinsey’s Investing in Productivity Growth report could have filled our Graphic of the Week slot ten times over, so if you like economic graphics, be sure to click through. Here’s the Africa angle:

Fast lane (top performers)

Ethiopia and Rwanda — Heavy investment and urban build-out propelled them into the global fast lane.

Middle lane (steady climbers)

Tanzania, Kenya and Uganda — Growing at ~2% a year, double the advanced-economy pace but still centuries from convergence.

Why it matters

Fast-lane economies typically invest 20–40% of GDP, build efficient cities and upgrade services and manufacturing.

Middle-lane peers dabble but don’t sustain the mix; weak institutions, patchy infrastructure and debt limits keep them from sprinting.

Africa’s challenge: turn a handful of standout performers into a continental wave.

What We Are Reading

DR Congo: Fighting with M23 rebels left coffee crops rotting, threatening farmers’ livelihoods and stalling the industry’s recovery (Reuters).

Egypt: President Sisi said Israel’s actions blocked prospects for new Middle East peace treaties and threatened regional security (Reuters).

Equatorial Guinea: The UN court ruled France did not have to return a Paris mansion seized from Vice President Obiang Mangue in a corruption probe (RFI).

Gambia: Police forcibly removed Auditor General Ceesay after he refused a government reshuffle, sparking public backlash (BBC Africa).

Ghana: The government unveiled plans to invest $1.2B in infrastructure this year to boost growth and support economic recovery (Semafor).

Kenya: Foreign investors pulled $13.2B (reportedly for profit taking) from the Nairobi Securities Exchange in mid-September, even as locals drove the market to its best rally since 2003 (The Kenyan Wall Street); Equity Bank announced plans to expand into Ethiopia following recent regulatory changes allowing foreign banks to enter the country’s financial sector (The Kenyan Wall Street).

Malawi: Citizens voted on September 16 in high-stakes elections as President Chakwera sought re-election against Mutharika amid a deepening economic crisis (AP News).

Mali: The U.S. boosted intelligence sharing with the ruling junta despite its ties to Russia as extremist violence escalates across the Sahel (Washington Post).

Nigeria: Children in Gwagwalada battled recurring schistosomiasis (also called bilharzia or “snail fever”) as drug campaigns struggled against poverty, limited access to clean water and looming global health funding cuts (The New York Times); The government suspended a 4% import levy after business backlash over rising costs and inflation concerns (Reuters); Inflation eased to 20.1% in August from 21.9% in July, raising prospects of central bank rate cuts (Reuters).

South Africa: The rand held steady and bonds gained after a survey showed long-term inflation expectations dropped to a record low (Reuters); Banks slammed the government for withdrawing proposed credit law changes meant to boost small business lending, calling it a setback driven by political pressure (Bloomberg).

South Sudan: The opposition urged supporters to mobilize after Riek Machar was indicted and suspended as first vice president (AP News). Note: First was not a typo, the country has 5 VPs.

Tanzania: The electoral commission disqualified opposition candidate Luhaga Mpina for the second time, leaving President Hassan largely unchallenged in next month’s election (Reuters).

Zambia: The IMF extended its loan program by three months to January 2026, while a longer one-year extension request is pending review (Reuters).

Business & Finance in Africa

Big Funded Few

Source: Africa the Big Deal

Max Cuvellier’s Inside Africa’s Top 100 Most Funded Startups crunches 4,000+ deals since 2019 and reveals who’s hogging the cash. To make the list, a company had to raise $36M+ since 2019; $100M+ lands you in the Top 30; $310M+ to crack the Top 10. Only MNT-Halan has crossed the billion-dollar line.

Top dogs

Sun King: $877M (45% equity / 55% debt)

d.light: $617M (mostly debt)

Opay: $570M (equity-heavy)

TymeBank: $530M

The Top 100 sucked up 69% of all African startup funding since 2019 — $12.8B of $18.7B raised. They took 86% of all debt raised across the continent. No big surprises, Africa’s funding landscape is heavily concentrated with a few giants dominating. The article doesn’t say it, but would be interesting to see what % of that was raised from 2020 to 2022 when funding slowed.

Debt Trap Rising

Source: Semafor

A Moody’s report featured in Reuters this week says borrowing costs have surged for banks, companies and governments in Kenya, Nigeria and South Africa over the past five years — driven by policy missteps, weak markets and inflation.

Why it matters

Costs bite everywhere: High local and foreign rates squeeze growth, even as aid loans soften the blow.

South Africa spiral: Deeper markets mean lower relative rates but fiscal strains risk a cycle of high rates and low investment.

Kenya strain: Overborrowing + shallow markets leave little room for private credit.

Nigeria crunch: High inflation + low savings keep cheap credit scarce.

Global edge? Spreads over U.S. Treasuries have eased since 2022 but still hover at ~500 bps for Kenya and Nigeria.

The result: Africa’s biggest economies are paying more for money while investing less in growth. Read more: Semafor, Reuters.

Ports Potential

Source: UNCTAD

Africa’s Port Play - The Review of Maritime Transport 2024 highlights Africa’s growing role in global shipping. To summarize quickly:

More port calls: Since 2018, container ship calls rose 20% in Africa, tanker calls 38% — faster growth than Asia.

Green hydrogen hubs: Africa is positioning ports (Djibouti, Egypt, Kenya, Morocco, Namibia, South Africa, etc.) as export gateways for Europe’s clean energy demand.

Weak infrastructure: Many African transport networks run at just 20–50% of global quality benchmarks, slowing trade to and from hinterlands.

Why it matters

Africa is becoming a key growth zone for shipping and energy transitions.

But poor inland connectivity risks bottlenecks, keeping trade costs high.

Strategic investment could turn African ports into global clean-energy and trade corridors.

Middle East in Africa

African Bloc Power

Source: E Times Pakistan

This last week, leaders from across the Arab League and the Organization of Islamic Cooperation (OIC) convened over Israel’s attack on Qatar. Al Jazeera provided context on Africa that’s important to understand.

Africa in OIC

More than a quarter of OIC members are African: from Egypt, Nigeria, Sudan, Algeria, Morocco to Uganda, Mozambique, Benin, Togo, Ivory Coast, Mauritania, Gabon and more.

Some aren’t Muslim-majority, underscoring Africa’s diverse ties to the bloc.

OIC vs. Arab League

Arab League: 22 states tied by Arabic language/culture; Africa’s members are mainly North Africa + Horn (e.g., Egypt, Morocco, Somalia).

OIC: Religion-based, wider net — embracing Arab and non-Arab African states.

Why it matters

Africa’s wide OIC footprint strengthens its voice in debates on Palestine, sovereignty and solidarity.

Dual memberships show Africa’s layered diplomacy: Arab identity in one bloc, Islamic solidarity in another.

Peace & Security in Africa

Junta Intel Game

Source: Washington Post

The Washington Post reports this week that the U.S. is quietly supporting Mali’s Russia-friendly junta — sharing intelligence to fight Islamist extremists despite the regime’s repression and mercenary ties. Here’s where things are at:

President Trump’s administration reversed former President Biden’s distancing, betting on counterterrorism over democracy concerns.

Mali’s leader, Assimi Goïta, remains close to Moscow, raising risks that U.S. intel could leak.

Extremist violence surged: 10,000+ deaths in the Sahel last year; al-Qaeda affiliate Jama’at Nusrat al-Islam wal-Muslimin (JNIM) staged thousands of attacks since 2019.

Why it matters

The Sahel is currently one of the world’s deadliest conflict zones.

Working with Mali may slow extremist gains but risks U.S. credibility, civilian harm and blowback.

As one analyst put it: every move here is a “minefield.”

Climate in Africa

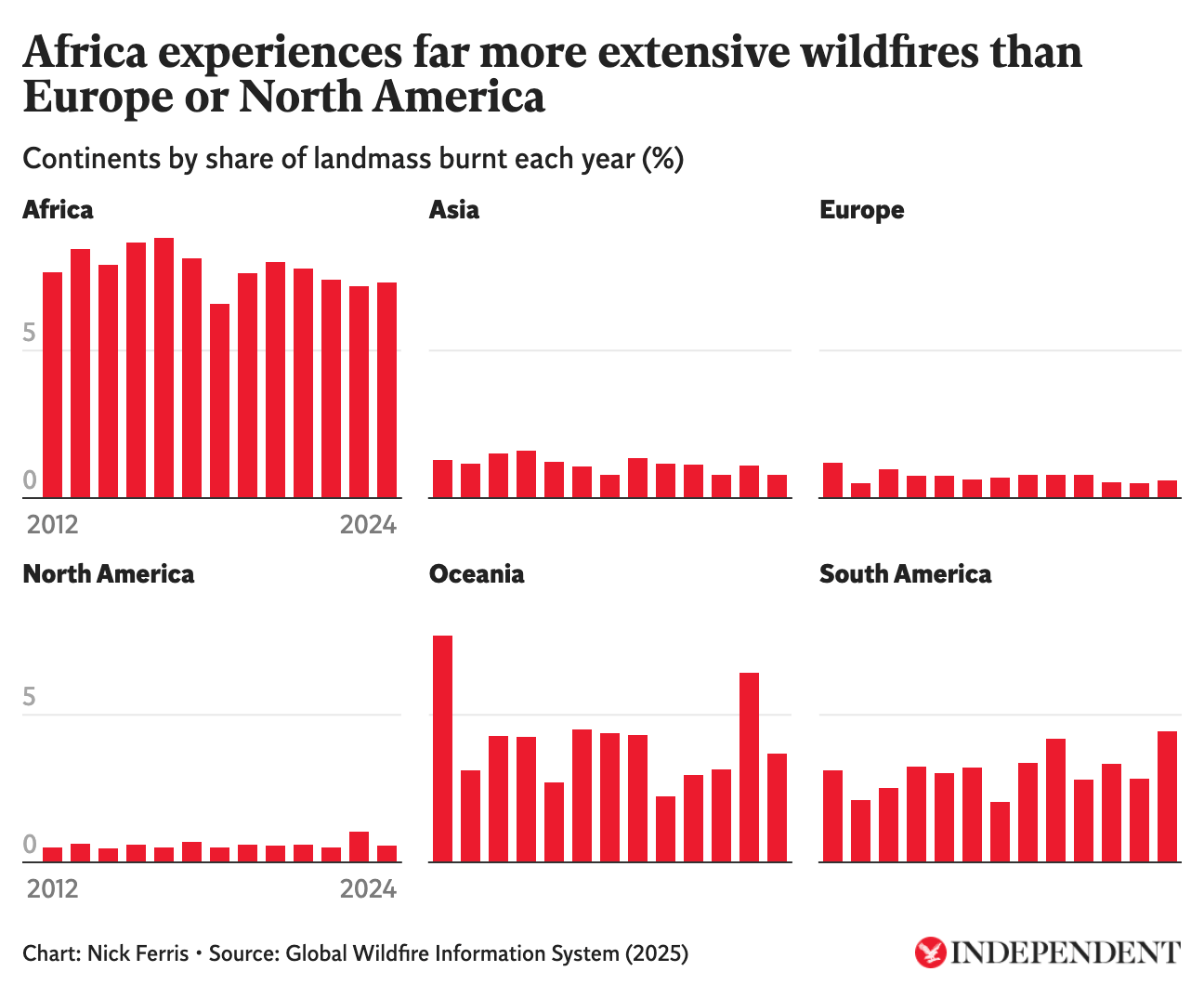

Africa Outburns The World

Source: The Independent

I had no idea the problem was so significant. The Independent, this week, reports that Africa suffers the world’s worst wildfires.

What’s happening

In 2024, 7.3% of Africa’s landmass burned — compared to 0.6% in Europe and the U.S.

Notably, fires scorched DRC, Madagascar and South Africa’s Table Mountain this year.

African wildfires emit 2.4 billion tons of CO₂, more than the continent’s fossil fuel output.

Why it matters

Western nations pool planes and crews to respond but infrastructure in Africa is limited.

Only 40% of African states have early-warning systems; informal settlements face the highest risks.

Explorations in Africa

Impressive Status Symbols

Source: The Economist

Africa has only 26 skyscrapers taller than 492 feet, and almost half are brand new.

Egypt’s Iconic Tower (1,292 ft) and the Ivory Coast’s Tour F (1,381 ft) are at the top of the list.

Ethiopia’s Commercial Bank of Ethiopia HQ (687 ft) and Morocco’s Mohammed VI Tower (820 ft) are major examples.

Why it matters

Governments pitch these as efficiency or prestige symbols but cost and debt risks are real.

Egypt’s Iconic Tower sits in the new capital, a project expected to cost $58B, mostly debt-financed from China.

Regardless of the sensibility, they are impressive.

Africa Trivia Answer

Answer: A) Morocco Read more: Daba Finance

Missed last week? Check out our take on Africa’s stablecoin play. If the Brief adds value to your week, please share it with a colleague or friend.

Send tips, ideas or feedback to [email protected] — we love hearing from you. Big thanks to for the added muscle this week Shayne and Ruth. Catch you next week!