Debt, tea and donkeys. It’s birthday week in my family and I am currently on a flight to Ghana. Busy but the world still turns. This week’s Brief spans IMF guardrails, Kenya’s climate-battered brews, Africa’s $300B SME crunch and even the continent’s donkey trade. Flight attendants, take your jump seats. Let’s go.

Africa Trivia

Which African country has the world’s largest donkey population (nearly 10 million) making it central to the booming hide trade for China’s e-jiao industry?

A) Sudan

B) Ethiopia

C) Nigeria

D) Chad

Graphic of the Week

The Discipline Dilemma

Source: IMF

Fiscal rules—numerical limits on spending, deficits and/or debt meant to keep public finances in check are now in place for more than 120 countries globally. But the IMF (Sept. 2025) finds compliance wanting: 40% of advanced economies and nearly two-thirds of emerging markets, including many in Africa, exceed their own limits.

The fix

Anchors: The West African Economic and Monetary Union (WAEMU) sets a 70% debt-to-GDP cap—clear but often breached, underscoring the need for risk-based, credible targets.

Correction triggers: Pre-set plans to restore discipline can cut borrowing costs by up to 75 basis points.

Institutions: Rwanda and South Africa link rules to medium-term frameworks, boosting credibility.

Why it matters: Many African states are ~25% of GDP above their own debt ceilings, leaving thin buffers for shocks. Still, bright spots exist: WAEMU’s shared anchor, Rwanda and South Africa’s stronger frameworks and wider adoption of flexible rules show the continent can build fiscal guardrails that work.

Source: IMF

What We Are Reading

Africa: South Africa, Nigeria, Burkina Faso and Mozambique are expected to be removed from the Financial Action Task Force gray list in October after meeting anti-money laundering reform requirements (Bloomberg); China signed a $1.4B deal with Zambia and Tanzania to revamp the Tanzania-Zambia railway, quadrupling its capacity to 2 million tons yearly (Bloomberg); Gulf of Guinea states urged to build self-reliant naval force as piracy risks persist (ISS Futures).

Cameroon: Opposition challengers seek to unseat 92-year-old President Biya in the October 12 election (Reuters).

DR Congo: Former President Kabila was sentenced to death in absentia by a military court for war crimes, treason and crimes against humanity linked to the M23 rebellion (Reuters).

Gabon: Interim leader Gen. Brice Oligui Nguema, who seized power in a 2023 coup, won the first post-coup presidential election with 90% of the votes, according to provisional results (AP News).

Egypt: The central bank cut overnight rates by 100 bps to 21% deposit and 22% lending, its fourth reduction this year, as inflation eased to 12% and Q2 growth accelerated to 5% (Reuters).

Ethiopia: Officials opened formal talks in Paris to restructure the country’s $1B Eurobond after last year’s default, though negotiations are stalled over whether Ethiopia needs a 20% debt cut for solvency or simply more time for liquidity (Reuters).

Kenya: The NSE secondary bond market hit a record KES 2T turnover, surpassing last year’s total with three months of the year remaining (The Kenyan Wall Street).

Madagascar: President Rajoelina dissolved the government after youth-led protests over water and power cuts left at least 22 dead, according to the UN, figures disputed by authorities (Reuters).

Mali: Barrick Gold CEO Mark Bristow stepped down after disputes over the Loulo-Gounkoto mine, government seizures, weak share performance and board tensions (Reuters).

Mozambique: The central bank cut its benchmark rate to a record low of 9.75% to support the recession-hit economy while banking on LNG exports for recovery (Bloomberg); Exxon’s CEO is seeking security assurances from President Chapo before deciding on a $30B LNG project in Cabo Delgado, where violence from jihadist insurgents has intensified (Financial Times).

Namibia: The government deployed 500 soldiers and helicopters to contain a massive fire that has burned a third of Etosha National Park, threatening wildlife and biodiversity (RFI).

Nigeria: With Chinese support, Nigeria will build Africa's first insulin production facility (China Daily); Despite being oil-rich, Nigeria is rapidly adopting solar mini-grids to provide reliable electricity amid chronic power outages and high generator costs (Financial Times).

South Africa: Canal+ completed its $1.9B takeover of MultiChoice (The Kenyan Wall Street); State-owned utility Eskom reported its first profit in eight years (Reuters); Goldman Sachs said mining stocks and a weaker dollar will help drive South African equities higher, forecasting a 6.3% gain in the FTSE/JSE Top40 Index over the next year after a 44% rally so far in 2025 (Bloomberg).

Sudan: Preservationists struggled to restore looted and damaged cultural treasures after two years of civil war (Reuters).

Zimbabwe: The government ordered spending cuts, freezes hiring and tightens contracts to stabilize the economy and support the ZiG currency (Bloomberg).

Business & Finance in Africa

Case to Keep It Onshore

Source: Momentus Global

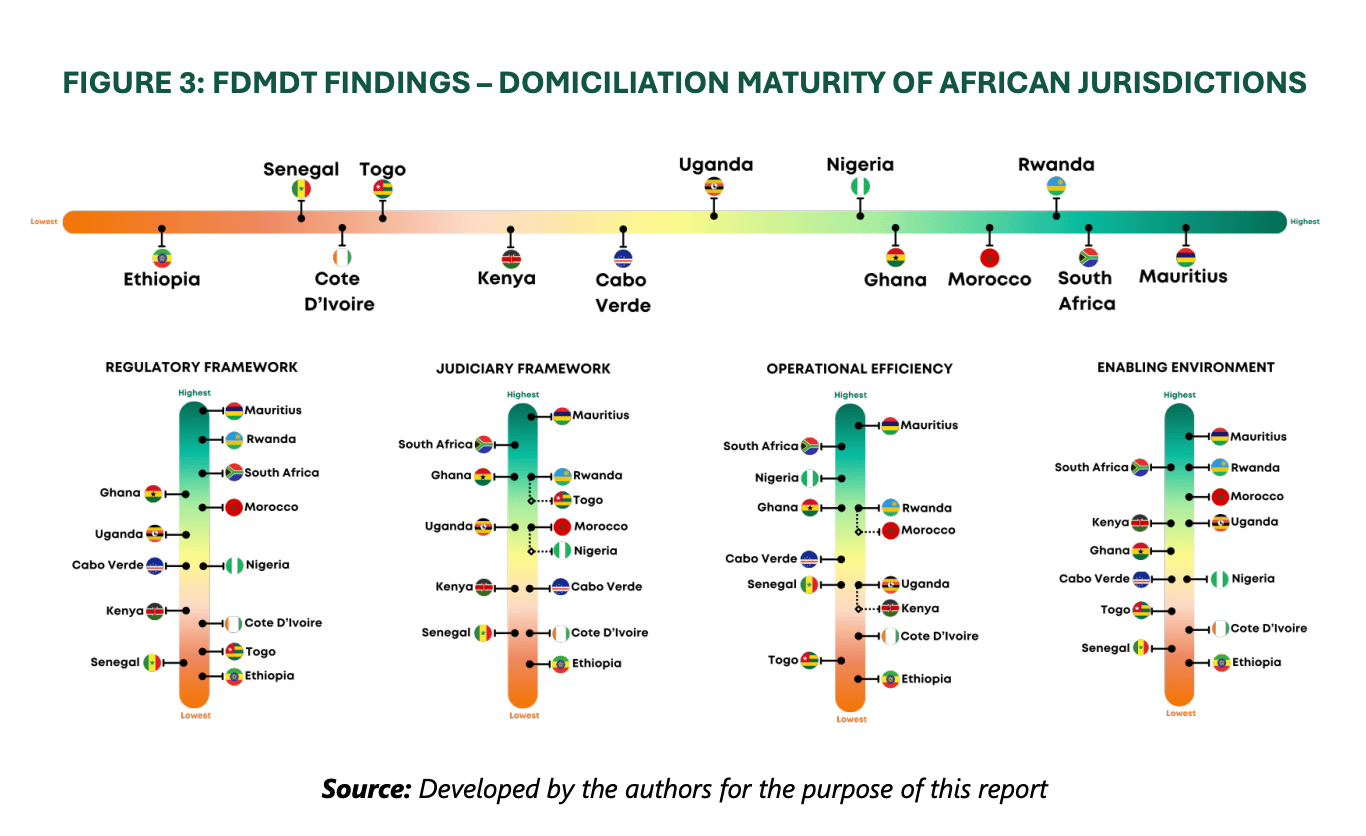

The Fund Domiciliation in Africa Report 2025 makes the case that keeping Africa-focused funds onshore can unlock local pension and retail capital, attract global investors and build deeper ecosystems.

Key findings

Domiciliation gap: Most African funds still register offshore.

High-potential markets: Mauritius sets the benchmark; South Africa, Nigeria, Kenya, Morocco and Ethiopia can mobilize domestic pools; Rwanda, Ghana, Cabo Verde and Uganda show reform momentum.

Investor concerns: Legal certainty, tax competitiveness and dispute resolution remain decisive.

Local unlock: Pension funds are underused but could drive growth if frameworks improve.

The roadmap - The report lays out three steps:

Reform national legal, tax and regulatory regimes to meet global standards.

Build credible institutions (courts, regulators, fiscal councils) to enforce rules.

Integrate regional markets and harmonize policies to boost competitiveness.

Why it matters: Onshore domiciliation won’t close Africa’s capital gap alone but it could channel billions into SMEs, spur jobs and deepen financial markets, if governments deliver reforms and credibility.

Missing Middle Money

Source: Making Finance Work for Africa

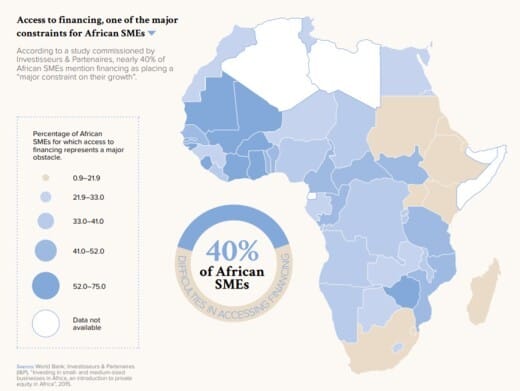

I’m always interested by studies on SMEs — the backbone of Africa’s economies. A slightly dated report finds they generate 40% of GDP and 60% of jobs, yet face a $300B+ financing gap with 40% locked out of credit.

Fintech promise: Digital tools promised to fix costly KYC and credit checks. They’ve helped but fintechs have yet to topple banks. According to the report, loans remain pricey, funding is scarce and algorithms still need some work.

Bank advantage: Some banks are “internalizing fintech,” digitizing credit processes and using cheap deposits and branch networks to expand SME lending. Rwanda’s banks cut 70+ hours per SME credit assessment.

Why it matters: The SME “missing middle” won’t close overnight but as banks and fintechs improve data, processes and risk analysis, lending will grow more profitable, sustainable and likely central to Africa’s growth story.

Agriculture in Africa

Bitter Tea Truth

Source: Independent

Kenya’s 600,000 smallholder tea farmers — who supply half the UK’s daily brews — are being squeezed by climate change, low prices and policy missteps. Yields are down 25%, hailstorms and landslides batter crops and oversupply keeps prices flat.

Why it matters: Tea is Kenya’s top export, but most farmers earn below a living wage, forcing debt and hardship. Fairtrade offers lifelines with better practices, diversification, and premiums — yet less than 1% of tea produced at some factories is sold as Fairtrade. Without stronger buyer commitment, the cuppa that fuels Britain rests on unsustainable foundations. Read more: Independent.

Explorations in Africa

Cross of Fire

Source: BBC

Ethiopian Orthodox Christians marked Meskel Demera in Addis Ababa with hymns, rituals and massive bonfires including the one at Meskel Square, led by Patriarch Abune Matias, Mayor Adanech Abiebie, top officials, ambassadors and pilgrims. Meskel, celebrated for centuries, is one of Ethiopia’s most vibrant outdoor religious festivals and was recognized by UNESCO in 2013 as Intangible Cultural Heritage. Read more: MSN.

Africa Trivia Answer

Answer: B) Ethiopia — home to almost 10 million donkeys, more than any other country, though bans and smuggling have shifted parts of the trade elsewhere. Poor donkeys. Now what is E-jiao one might wonder? Well, it’s a traditional Chinese medicine and health/beauty ingredient made by boiling donkey skin collagen (donkey-hide gelatin). The trade is booming enough that the African Union has debated continent-wide restrictions. If you are into donkeys, don’t miss this piece: Reuters.

Missed last week? Check out our take on the UNGA 80 reform push. We hope the Brief adds value to your life! Please share it and send tips, ideas or feedback to [email protected]. We love hearing from you. Happy Friday!

See you next week!