From President Trump’s planned Africa summit to Tah’s quiet rise at the AfDB, the continent is alive with strategic shifts. Nigeria’s reform brakes, Guinea’s mining crackdown and Zambia’s debt talks show a region juggling big moves and bigger risks. Meanwhile, Zambia’s king floats in an epic annual parade on a barge crowned with an elephant — a royal reminder that not all power plays happen behind closed doors. And yes, 140 years after the Berlin Conference, the map still matters.

Africa Trivia

What percentage of the world’s uncultivated arable land is estimated to be in Africa?

Graphic of the Week

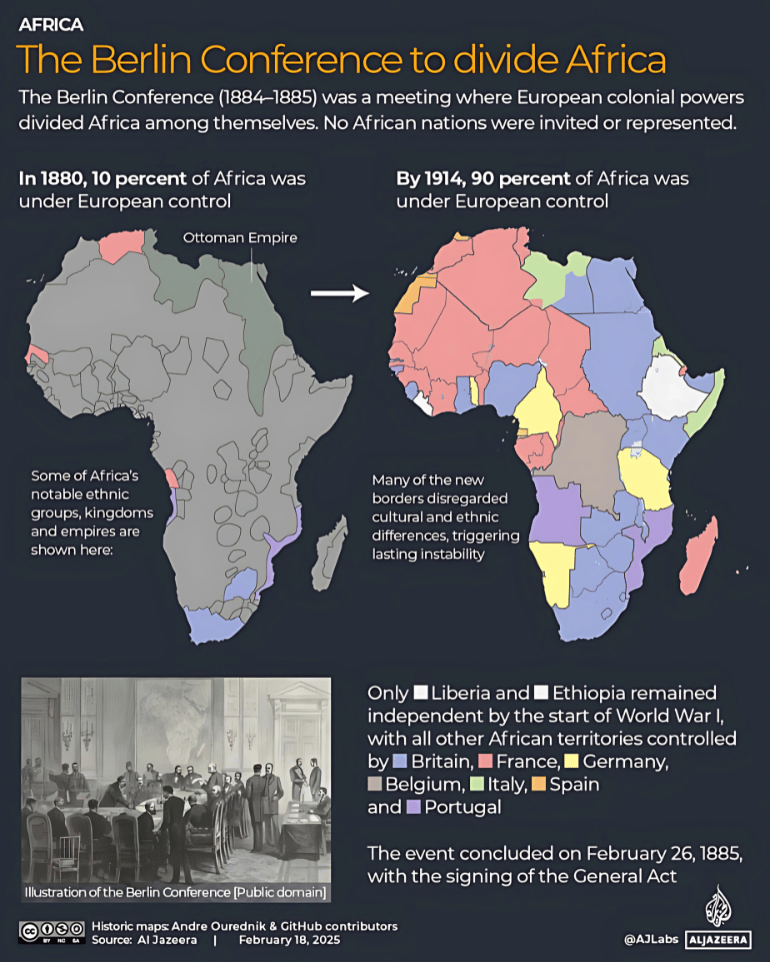

Africa's Borders: Made in Berlin

Source: Aljazeera

I hadn’t realized February marked 140 years. In 1884-85, European powers convened in Berlin to divide Africa among themselves, sidelining African voices entirely. This conference laid the groundwork for the colonization of Africa, leading to the arbitrary borders and exploitation that have had lasting impacts on the continent.

Conference Outcomes:

Effective occupation: European claims required actual control, prompting rapid colonization.

Free trade zones: Declared in the Congo Basin, benefiting European economies.

Ignored realities: African ethnic and cultural boundaries were disregarded, sowing seeds of future conflicts.

Lasting impact: By 1914, 90% of Africa was under European control. The imposed borders and systems continue to influence Africa's political and social landscapes.

Bottom line: The Berlin Conference's legacy is a testament to colonialism's enduring effects, emphasizing the importance of acknowledging and addressing historical injustices. Read more: Al Jazeera.

What We Are Reading

Africa: President Trump is planning to host a U.S.-Africa Leader’s Summit in New York later this year, focusing on trade and investment (The Africa Report); The African Development Bank will launch a carbon market facility to help African countries boost credit prices and attract more climate finance (Reuters).

DRC aims to finalize a deal with the U.S. by June, trading access to key minerals for investment and support in ending a Rwanda-backed rebellion, though major hurdles remain (FT).

Egypt is rapidly increasing its LNG imports to meet domestic demand, securing multiple import vessels and long-term supply deals (Bloomberg).

Guinea revoked four gold exploration permits from Endeavour Mining as part of a wider crackdown on inactive and non-compliant mining rights (Bloomberg).

Kenya backs Morocco’s Western Sahara autonomy plan and opens an embassy in Rabat (Reuters).

Mauritania’s Sidi Ould Tah clinched the presidency of the African Development Bank (The Guardian).

Namibia: The country marked its first Genocide Remembrance Day on May 28 to honor victims of Germany's colonial-era genocide against the Ovaherero and Nama people (BBC Africa).

Nigeria plans to open two Chinese-funded lithium processing plants this year, aiming to boost local value addition in the mining sector (Reuters); President Tinubu seeks approval to raise $24B in foreign loans over two years to fund infrastructure, health and agriculture projects (Bloomberg); Nigeria’s Dangote mega-refinery has reduced the country’s fuel imports, making South Africa—where refining capacity has declined—the new largest fuel importer in Africa (Bloomberg).

South Africa: Professional Fighters League Africa is preparing to host its first mixed martial arts tournament in Cape Town this July to grow the sport across the continent (Semafor).

Uganda will borrow $568M from Afreximbank, Ecobank and the Development Bank of Southern Africa to fund infrastructure, despite concerns over its rising $29.1B public debt (Reuters).

Zimbabwe’s President Mnangagwa has signed a law requiring all motorists to pay a $92 annual radio licence fee before getting vehicle insurance, sparking public backlash (BBC Africa).

Business & Finance in Africa

Tah Takes the Helm at AfDB

Source: The Guardian

Mauritania’s Sidi Ould Tah clinched the presidency of the African Development Bank, winning 76% of the vote in the final round. He beat four challengers to lead Africa’s top development lender.

Why it matters:

Tah takes over amid funding cuts (notably $555M from the U.S.), debt distress and climate shocks. His task: keep the AfDB relevant, effective and politically balanced in a volatile global environment.

What’s next:

Tah is expected to focus on governance reforms, private sector mobilization and building trust among African and non-African shareholders alike. Read more in The Guardian.

Tinubu Taps the Brakes

Source: Semafor

Nigerian President Tinubu is easing up on economic reforms as re-election prep for 2027 kicks off early and I am hopeful. Summarizing Semafor this week:

His shock moves—ending fuel subsidies, floating the naira—aimed to reset Nigeria’s economy but triggered massive inflation and hardship.

More than half of Nigerians live in severe poverty, yet macro indicators like revenue, deficit and FX reserves are improving.

With weak opposition, defections from rival parties and backing from global lenders, Tinubu looks politically secure.

Experts say reforms were painful but necessary; critics argue growth is weak and citizens are worse off.

Next target: tax reform to break Nigeria’s dependence on oil and central allocations and further cement Tinubu’s political grip.

Source: FT

I'm looking forward to my next trip to Lagos—hopefully in September. A recent Financial Times piece, “Power Dining in Lagos: An Insider Guide,” captured the wealth, energy and beauty in the city that is in definite contrast to some of the country’s challenges. If you have any favorite spots, I'd love to add them to my Lagos Google Map — send recommendations my way!

Africa By the Numbers

The World Bank produced a really meaty report called Africa’s Pulse No. 31, Spring 2025. It has lots of interesting information and graphics, I thought it was worthy of a slightly longer summary. Here’s the short version.

Economic Outlook:

Growth in sub-Saharan Africa is expected to rise from 3.3% in 2024 to 3.5% in 2025 and 4.3% by 2026–27. Not bad, not great!

Excluding Angola, Nigeria and South Africa, the region could grow up to 5.7% by 2027.

Growth is being driven by private consumption and investment, with inflation cooling and global financial conditions easing.

Risks and Constraints:

Downside risks include policy uncertainty, geopolitical conflicts (Sudan, DRC, Sahel), climate change and declining foreign aid.

Extreme poverty remains high, with minimal per capita income gains since 2015 and poverty projected to decline only marginally from 43.9% in 2025 to 43.2% in 2027.

Debt and Fiscal Pressure:

Governments are facing mounting debt service burdens, often outpacing spending on health and education.

50% of government revenue in sub-Saharan Africa now goes to debt servicing, largely owed to private creditors and China.

Governance and Reform:

Core governance failures—poor service delivery, weak rule of law, corruption—are driving unrest, coups and economic stagnation.

Reforms are needed in three areas:

Strengthening the fiscal contract (tax fairness + service delivery)

Enhancing market confidence (rule of law, independent courts)

Improving economic oversight (competition, fair regulation)

Conflict and Climate Threats:

120 million Africans face acute food insecurity, 80% in conflict-affected countries.

Extreme weather has cost governments up to 5% of GDP and diverted 9% of budgets.

Climate adaptation will cost $30B to 50B annually.

Regional Variance:

East and non-resource-rich countries are rebounding faster than large economies such as Angola, Nigeria and South Africa.

According to the report, business confidence is returning in places like Kenya, Zambia and Ghana.

Africa Still Leads but Needs Leverage

Source: Convergence

According to a recent report by Convergence, sub-Saharan Africa remains the #1 region for blended finance, attracting 48% of global deals and $6.3B in 2024. But local capital and leverage remain weak. If you are wondering about the definition of blended finance, it’s the use of catalytic capital from public or philanthropic sources to scale up private sector investment in emerging markets.

Key facts:

Deal size up: Median deal in Africa = $46M, below global median of $65M.

Top recipients: Nigeria ($2B), Kenya ($970M), Senegal ($1.5B).

Sectors: Heavy focus on finance (41%) and infrastructure (37%).

Local investors: Just 17% of capital, mostly commercial—not concessional.

No specific Africa leverage ratio given, but smaller deal sizes likely mean lower than global average (3.76x).

Why it matters:

Blended finance is still too donor-heavy and too fragmented in Africa. Without larger, standardized, de-risked vehicles, Africa risks missing out on private capital at scale. Read The State of Blended Finance 2025 Report.

US in Africa

Trump Plans Africa Summit

The U.S. will host an Africa trade summit by year’s end, marking a major pivot under President Trump toward commercial diplomacy over development aid. The plan was unveiled by Troy Fitrell, the State Department’s acting top Africa official, at an AmCham summit in Côte d’Ivoire.

Why it matters: Trump skipped Africa summits during his first term. This late 2025 gathering aims to reset relations as equal partners, focused on business—not just politics or security.

The plan:

Fitrell outlined a six-point strategy to boost U.S.–Africa trade:

Put commerce at the center of diplomacy

Dismantle top market barriers

Unlock private capital via infrastructure

Expand U.S. export outreach

Lead high-level business delegations

Reform trade promotion tools for speed and risk

Bottom line: The U.S. wants to catch up with China’s influence in Africa by competing deal for deal. Read more: The Africa Report.

Explorations in Africa

Zambia’s Wild Water Parade

Source: FT

Zambia’s Royal River Ritual: Kuomboka is the Lozi people’s annual festival marking the floods. The king (litunga) travels across the Barotse Floodplain in a giant barge topped with an elephant. According to a wonderful article in the Financial Times, the parade is a symbol of identity, heritage and harmony with nature. Some say it feels like Christmas. Tourists and diplomats fly in. The whole region transforms into a joyful and muddy spectacle. The pictures sure are intriguing! Read more: FT.

Source: FT

Africa Trivia Response

D) 60%. Africa is home to 60% of the world’s uncultivated arable land, positioning it as key to future global food security. Source: African Agribusiness.

This week’s brief was brought to you with the help of my researchers Ruth Ayalew and Shaynerose Magabi. Signing out from Addis. See you next week.

If you’re enjoying The Africa Brief, please share it. We’d love to have them follow along with Africa’s macro trends too! And email us at ([email protected]).