Africa’s having a moment. AfCFTA could supercharge intra-African trade by 45%—yes, forty-five—and shift the continent from raw exports to real industrial power. Fingers crossed! Nigeria’s markets are rallying, Côte d’Ivoire is rewriting the West African growth story and even Comoros is getting in on the action. Sure, climate change poses a costly problem and the Horn is messy. Yes, the future will have friction, but quite a few places are gaining momentum!

Africa Trivia

Which African country is experiencing a tectonic shift that could eventually split the continent into two?

Graphic of the Week

Africa’s Hot Decade

The World Meteorological Organization put out some troubling data on weather patterns across Africa.

Temperatures have risen 0.3°C per decade since 1991, surpassing the global average. Morocco hit 50.4°C, the highest recorded temperature in 2023 in Africa.

Rising Seas: Coastal sea levels are climbing at a rate of 3.4 mm/year, with the Red Sea rising the fastest at 4.1 mm/year.

Economic Impact: Climate-related disasters cost African countries 2-5% of GDP annually, forcing some to spend up to 9% of their budgets on disaster response.

Call to Action: According to the report, Africa needs $30-$50B/year for climate adaptation, including investments in early warning systems and hydrometeorological infrastructure.

Bottom Line: Climate extremes are escalating. Based on the past decade of data, Africa bears a heavy economic and humanitarian toll.

Read more: WMO – State of the Climate in Africa

Source: FT

What We Are Reading

Botswana is using social media influencers to promote its natural diamonds to young Americans, aiming to boost its economy (Bloomberg).

Comoros: On March 18, the Africa Finance Corporation (AFC) welcomed Comoros as its 44th member (AFC).

Congo's export ban on cobalt—essential for batteries—has hit Chinese companies hard (Bloomberg).

Côte d’Ivoire: Vitol Group has agreed to purchase a $1.65B stake in Eni SpA’s oil and gas projects in Côte D’Ivoire and the Democratic Republic of Congo, expanding its portfolio after a record period of profits (Bloomberg).

Ethiopia: A coup attempt and other military activity in Ethiopia’s Tigray region raises tensions (The Economist) but PM Abiy says he’s not going to war with Eritrea (Reuters); Ethiopian Airlines and AfDB will partner on a $7.8B airport near Addis Ababa, boosting capacity to 60 million passengers by 2040 (Bloomberg).

Ghana’s Cocoa Board is reviewing its $2B debt as it struggles with financial issues, failing to secure foreign loans for the first time in 30 years (Bloomberg).

Kenya's failure to meet IMF obligations has led to halted funding, prompting the government to seek alternative loans amid growing debt concerns (Bloomberg).

Morocco's central bank cut interest rates to 2.25% to support the economy, expecting inflation to stay around 2% despite global trade challenges (Bloomberg).

Nigeria plans to launch a $40M fund, backed by the Japan International Cooperation Agency (JICA) and the Nigeria Sovereign Investment Authority (NSIA), to support early-stage tech startups under the 2022 Nigeria Startup Act (Semafor); Nigeria's President Tinubu declared a state of emergency in Rivers State, suspending its leadership due to pipeline vandalism and political instability (Reuters).

Rwanda: President Kagame (Rwanda) and President Tshisekedi (DRC) met with Qatar’s Emir Sheikh Tamim ibn Hamad Al Thani in Doha to discuss a ceasefire and political dialogue with M23 rebels, amid ongoing conflict and international sanctions from the EU and U.S. (Bloomberg).

South Sudan: Locals fear another civil war after a recent attack on a UN helicopter by militia (The Economist).

Tanzania's shilling is the world's weakest currency this year despite the country's fast-growing economy (Bloomberg).

The Gambia signed a (troubling) deal with Saudi Arabia to send women as domestic workers, offering a $200 monthly salary, despite concerns (Bloomberg).

Zambia is facing a severe environmental crisis after a major acid spill from a Chinese-owned copper mine contaminated the Kafue River, killing wildlife and endangering millions of people (AP News). Really, really sad.

Business & Finance in Africa

Intra-African Trade Potential

Source: UNECA

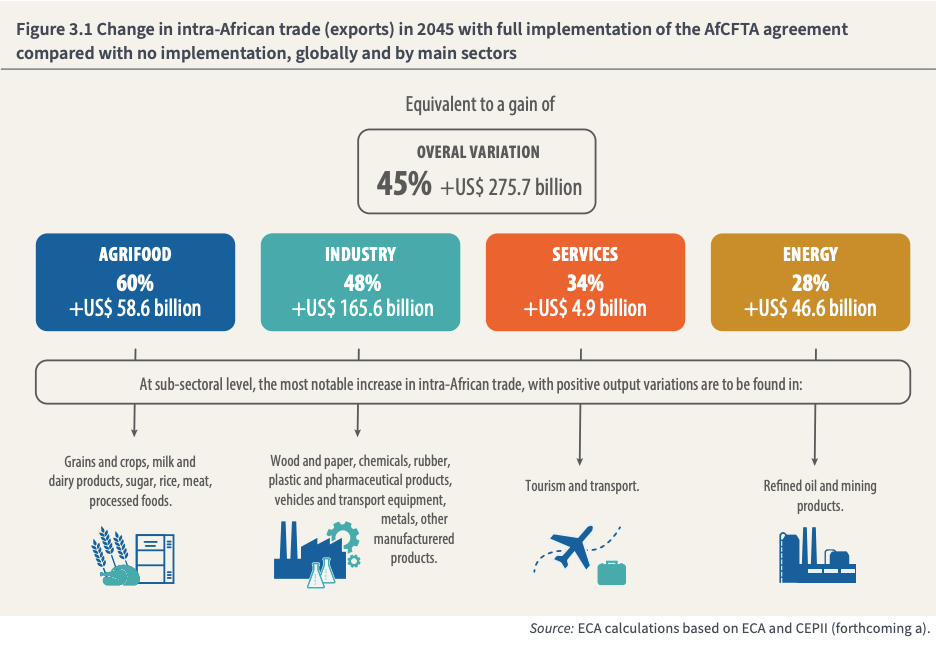

According to the UN Economic Report on Africa 2025, the African Continental Free Trade Area (AfCFTA) could boost intra-African trade for the world’s largest free trading block by 45% by 2045 and increase Africa’s GDP by 1.2%. Frankly, I’d expect the projected GDP impact to be a bit higher and likely it will be for some countries. For those that want a quick rundown:

Industrialization Push: AfCFTA aims to move Africa beyond raw materials by fostering manufacturing, agro-processing and regional value chains, positioning the continent as a global growth hub.

Trade Barriers Drop: Full implementation requires eliminating tariffs, cutting non-tariff barriers and streamlining customs to create a seamless trade environment.

Digital & Infrastructure Gaps: Africa needs $121B in transport investments by 2030 and expanded digital trade infrastructure to unlock AfCFTA’s full potential.

Climate & Energy Play: AfCFTA can support Africa’s green transition, with renewable energy investments projected to rise by 5-12% by 2045.

Bottom Line: AfCFTA implementation is key for economic transformation, but bold policies, strong institutions and cross-border cooperation are not a given.

Countries expected to benefit from trade gains after implementation:

Cameroon: +141% in industrial exports

Ethiopia: +104% in industrial exports

Namibia: +66% in industrial exports

Zimbabwe: +59% in industrial exports

Mozambique: +32% in industrial exports

Nigeria’s Market Rally

Source: PWC

Happy to see some more analysis on Nigeria’s rebound in FT this week. Here’s the summary:

Foreign investors are back, chasing 20–25% yields in Nigeria.

The naira has surged 7% since November—one of the world’s best performing currencies.

Reforms: Fuel subsidies scrapped, naira floated, rates raised to 27.5%.

Stocks up 4% in USD terms, beating many larger markets.

Why It Matters

Nigeria is seen as a hedge amid U.S. trade war jitters.

Some say it’s the “next Turkey”—a risky rebound bet with big upside.

But inflation is 23%, reserves dipped to $38.5B, and naira stability is still fragile.

The bet only holds if reforms stick and inflows continue.

Read more: FT and for those that want to dig in deeper, here’s PWC’s 2025 Nigeria Budget and Economic Outlook.

The Ivorian Growth Story

Source: Britannica

The Economist story on Côte d’Ivoire feels accurate after our recent trip there. The country is defying regional trends with 7% average growth since 2012, low inflation (3.8%) and youth unemployment at just 5%. With $2.9K GDP per capita, it's West Africa’s economic standout. Private investment is surging, especially in banks, fintech and industry.

What’s Driving It: The country has diversified beyond cocoa, backed by smart policies—tax breaks, infrastructure upgrades—and a leap in electricity access (from 34% to 94%). A $10B oil and gas project signals even more growth ahead.

What Could Derail It: But cracks remain: a skills gap, climate concerns and rising political tension as 83-year-old President Ouattara eyes a possible fourth term, with ex-rival Gbagbo returning to the fray.

Finger’s crossed for the election in October!

Read more: The Economist or ETK’s report Côte d’Ivoire: Africa’s Economic Powerhouse to Watch in 2025.

Explorations in Africa

Africa Trivia Response

Answer: B) Ethiopia. See above!

See you next week!

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too!

Email us at ([email protected]) if you have some scuttlebutt we should follow up on.