Hello from Ghana. This week: Debt, deals and disruption. Nigeria’s economy might be turning a corner, but Africa’s debt battle is far from over. Tourism is booming and migration patterns are shifting fast. Meanwhile, the AU’s big trade push is running into reality—and some says the financial system needs a reset.

This week: Who really owes who? Where is Africa's money moving? And the battles shaping the continent’s future. Let’s dive in.

Africa Trivia

Which African country is the largest producer of gold?

Graphic of the Week

Stay, Struggle or Shift?

Fewer Boats, More Footsteps - Relevant piece by Africa Center for Strategic Studies. Here’s the short version:

Off-continent African migration dropped 48% in 2024 as EU-funded crackdowns and Yemen’s war tightened borders.

Mali led the migration to Europe (16,500 people), reflecting a junta-driven economic decline.

Intra-Africa migration surged 25% over the past decade, mostly for jobs.

Why It Matters

Europe’s doors are closing, shifting migration pressure to African cities and job hubs.

Côte d’Ivoire, Ghana, Nigeria and South Africa are top labor destinations.

Expect more movement as Africa’s population booms.

This week The Economist highlights how climate change-induced sea-level rise is submerging African coastal communities like Nyangai, Sierra Leone, forcing residents to relocate to cities ill-prepared for their arrival.

What We Are Reading

Congo (DRC) is offering the U.S. exclusive mineral access in exchange for security help. China won’t be thrilled (Bloomberg); Cobalt exports have been suspended for three months due to low global prices (FT); Mystery disease linked to bats killed 60 people in Equateur province (Wall Street Journal).

Gabon’s coup leader Gen. Nguema is running in April’s election. Critics of course say the system is rigged in his favor (BBC).

Ghana’s illegal gold mining, known locally as "galamsey," has led to a 20% drop in cocoa yields last year, contributing to global chocolate shortages (FT); President John Mahama has expressed intentions to renegotiate the existing $3B IMF program to better address the country's current economic challenges (FT).

Guinea-Bissau’s President Embaló clashed with a West African mission on delayed elections, threatening to expel them. Seems diplomacy is out of vogue, the world over (Bloomberg).

Libya launched its first oil and gas tender in 17 years to attract investors, but political instability looms (Bloomberg).

Namibia will start visas on arrival on April 1 to attract investors and tourists. I am a huge fan of visas on arrival! (Bloomberg).

Nigeria’s economic growth surged 3.4% in 2024, the fastest in three years. Fingers crossed the economy is turning a corner! (Semafor).

Senegal: Dollar bonds tanked after S&P downgraded its credit rating to junk (Bloomberg).

Sierra Leone: Rising sea levels threaten homes, part of a broader African climate migration crisis (The Economist).

Somalia is negotiating with Ethiopia for Indian Ocean port access, with a deal expected by June (Bloomberg).

Sudan: RSF signed a constitution aiming to form a parallel government (Reuters).

Tunisia: Trial of 40 opposition figures criticized as politically motivated (AP).

Zimbabwe says the country has enough foreign currency to meet demand, despite concerns over the ZiG stability (Bloomberg).

Business & Finance in Africa

Intra-Africa Trade or Bust

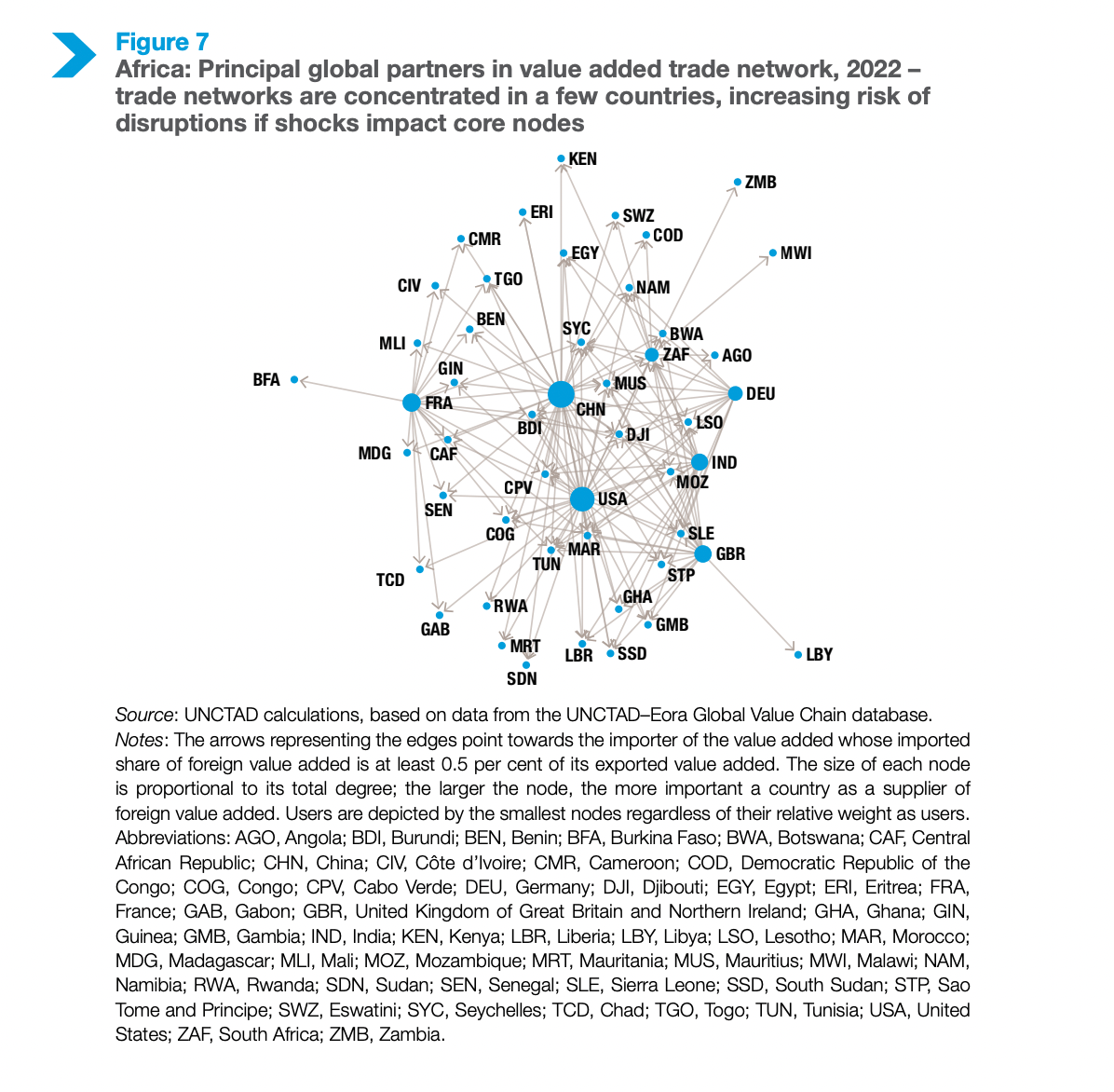

The Context on Africa Trade - As the world braces for trade wars, this UNCTAD report is timely. Folks are skeptical it will change much, but on February 13, 2025, the African Union launched the operational phase of the African Continental Free Trade Area (AfCFTA), aiming to boost intra-African trade by reducing tariffs and fostering economic integration. Here’s the takeaway from the UNCTAD report on trade:

Shipping is expensive: Africa’s transport costs are still 115% above pre-pandemic levels.

Stuck in the dirt: Oil, gas and/or minerals make up 60%+ of exports in many countries.

Trading with everyone but Africa: Only 16 of 54 nations source even 0.5% of their imports from the continent.

FDI fizzle: Foreign investment dropped 3%, while debt costs keep climbing.

Bad roads, bad deals: Weak infrastructure, power cuts and bureaucracy kill competitiveness.

Why It Matters

Global shocks = Africa’s headaches. The continent is too exposed to commodity swings.

AfCFTA or bust: If intra-African trade doesn’t grow, economies will keep playing the same losing game. I hope the new AU leader can pull a trick out of his hat!

Diversify or die: Some believe the only way forward is less reliance on raw exports, more regional trade. I, of course, believe tech startups can help with that!

Read More: Economic Development in Africa UNCTAD

Africa’s Debt: Who Really Owes Who?

Source: Data.one.org

On African Debt - The African news cycle is constantly full of headlines about the looming debt crisis in countries across the continent and I, myself, want to understand more. How did we get here? I hope to spend more time unpacking issues around Africa’s debt, but for now here’s some context at the intersection of the debt, climate adaptation costs and the case for change:

Over half of Africa is either already in default or at high risk, with nations like Ghana, Zambia, Ethiopia and Malawi struggling to stay afloat. Debt service eats up more than healthcare budgets in 30+ countries on the continent.

Africa’s borrowing costs are absurdly high. 10-15% interest rates vs. near-zero for the U.S. and Germany. That’s not just risk—some would say it’s a rigged (or outdated) system. The IMF’s models label Africa as high-risk, inflating borrowing costs and deepening the debt trap.

Meanwhile, the world’s top polluters—China, the U.S. and Europe—borrow cheaply while dodging what some experts estimate as a $36T climate debt owed to Africa.

The Double Standard by the Numbers

Africa pays more: Eurobond yields hit double digits, while Western nations borrow at 1-3%.

Climate injustice: Africa contributes <4% of global emissions but suffers the worst climate damage, yet climate finance has fallen far short of the promised $1.4T.

China pulls back: After lending $170B since 2000, China is scaling down African financing—leaving many nations scrambling for alternatives.

The Bigger Fight

Moral pressure alone won’t fix this. Pope Francis’ Jubilee debt forgiveness call is powerful but lacks teeth. President Kagame and other African leaders say Africa needs leverage, not charity—whether through minerals, trade partnerships and/or a debt reset.

What’s clear: A system that keeps Africa paying for its debt AND the West’s pollution is not going to work. If the financial rules don’t change, expect a louder push for debt-for-climate swaps, Special Drawing Rights (SDR) reallocations (the process of redistributing IMF-issued reserve assets from wealthier countries to lower-income nations) and a financial system that actually works for Africa.

Read more: African Arguments; data.one.org

And one encouraging headline to draw your attention to is on Nigeria.

Nigeria’s Economy: Turning a Corner?

Source: Semafor

Nigeria is seeing its fastest growth in 3 years: GDP grew 3.4% in 2024, driven by a 5% surge in services.

Reform payoff? Tinubu’s fuel subsidy removal and naira float initially fueled inflation but may now be stabilizing the economy.

Petrol + currency steady: Fuel prices and the naira’s exchange rate have held firm in recent weeks, cooling inflation fears.

Why It Matters

A trillion-dollar dream? Tinubu wants to push the Nigerian GDP past $1T by 2033, but analysts warn sustaining reforms is key.

Wait-and-see mode: Critics say inflation remains painful and the naira’s stability may be artificially propped up.

Oil + exports = missing link: Growth won’t truly take off without boosting productivity, crude oil output and exports.

Read more: Semafor

Explorations in Africa

Marrakech’s Artful Escape

Source: FT

The FT’s travel writers and photographers continue to inspire me. This week, they featured “Four great African adventures” and a look at Jnane Rumi, a stunning new house-hotel in Marrakech owned by Dutch art lawyer Gert-Jan van den Bergh. Since I’m heading back to Marrakech for GITEX soon, I had to share.

The bigger picture: Africa’s tourism is growing. International arrivals hit 96% of pre-pandemic levels in 2023, per the UN Tourism (UNWTO). Morocco alone saw a record 15.9 million tourists in 2024, showing its strategy is working (Reuters).

Africa’s travel industry is on the rise and travelers are taking notice.

Have a great weekend. Signing out from Accra!

Africa Trivia Response

Answer: B) Ghana.

Read more: The Conversation.

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too!

Email us at ([email protected]) if you have some scuttlebutt we should follow up on.