From untapped trillions to tapped-out airlines, it’s been a week of big contrasts. Students are chasing global classrooms while U.S. policy pulls back. Cape Town’s lifestyle boom is testing its limits. Meanwhile, African architects are building a better future. And a quiet shift in global power? Look to BRICS+.

Africa Trivia

Which country is the world’s largest producer of cobalt, a crucial material for electric vehicle batteries?

Graphic of the Week

Sitting on Trillions

Africa doesn’t lack capital. It holds an estimated $4T in domestic savings, largely untapped.

But much of this sits in pensions, insurance funds and banks, and doesn’t reach long-term infrastructure, industrial investment and for sure not PE/VC.

$1.1T – Institutional capital (pension funds, insurance companies, sovereign wealth funds and public development banks)

$2.5T – Commercial banking assets

$470B+ – External reserves

Pension fund assets in Nigeria and Kenya grew by 15%+ CAGR from 2017 to 2022 but remain underallocated to growth-driving sectors.

Ghana is hopefully acting as a trendsetter in a positive direction by directing a mandatory 5 % allocation of pension fund AUM into domestic VC/PE by 2026.

Why it matters:

Tapping even a fraction of these domestic funds in new ways could transform Africa’s financing landscape.

Policy reforms, better risk-sharing and blended finance are likely key to unlocking this capital. Without it, Africa stays over-reliant on volatile foreign flows.

Let’s hope Africa leaders prioritize rewiring the financial systems and mobilize domestic capital in new ways. Thanks, Africa Finance Corporation, it’s a treasure trove.

What We Are Reading

Africa: Ambassador Troy Fitrell, the U.S. State Department’s acting head of African Affairs, will retire mid‑July leaving Jonathan Pratt at the helm and Massad Boulo—a President Trump family insider—as the administration’s most senior Africa official (Semafor); Saharan heat is sweeping into Europe, carrying dust and triggering storms after a dry spring across the region (Bloomberg); Russia is expanding its military presence in Africa by delivering weapons and advanced equipment to West African countries, bypassing Western sanctions (AP News).

DRC: The World Bank has committed $1B to revive the Inga III hydropower project in the DRC, aiming to increase electricity access in Africa (Bloomberg).

Kenya: Bitcoin is being used for payments and savings in Nairobi’s Kibera slum through an initiative by AfriBit Africa, a fintech startup (AP News).

Nigeria: Naira hits two-month high as oil prices rise and investor concerns over U.S. trade tariffs ease (Bloomberg).

Rwanda: The U.S. is trying to broker a deal requiring Rwanda to pull its troops from eastern Congo before a peace agreement is signed, a move Kigali is resisting as talks inch forward under U.S. and Qatari mediation (Reuters).

South Africa: A severe cold front with heavy snowfall has caused road closures and power outages in several provinces (Reuters); President Cyril Ramaphosa has formed a 31-member panel, including a rugby captain and business leaders, to shape national dialogue on the country’s development and unity (Bloomberg); South Africa's export industries face threats from carbon border taxes (Bloomberg).

Sudan: The Sudanese army withdrew from a strategic border zone after accusing Libyan commander Haftar and Sudan’s RSF of staging cross-border attacks and using the corridor for arms transfers (Reuters).

Togo: President Faure Gnassingbé faces growing protests and calls to resign after a recent constitutional change allows him to rule indefinitely (AP News).

Zambia: Economy expected to grow at least 6% in 2025, the highest since 2021, driven by better rainfall and increased copper output (Bloomberg).

Zimbabwe: The global gold rally has turned Zimbabwe’s informal mining towns into hotspots of cash, construction and luxury (Bloomberg).

Democracy in Africa

BRICS+ Is No Joke

Source: Visual Capitalist

A graphic shared by Alex Peyriere this week sparked a rabbit hole for me. It showed the GDP trajectory of BRICS+ vs the G7. So I went digging for a source and what I found was even more provoking. The Shift:

G7 still dominates in nominal GDP (~$45T–$50T).

But BRICS+ is catching up now ~$30T–$32T, with Africa in the mix.

And by purchasing power parity (PPP)? BRICS+ already leads, topping $60T vs G7’s ~$47T

Why it matters:

BRICS+ now includes 11 members, with South Africa, Ethiopia and Egypt flying the African flag.

China and India drive scale, but Africa’s growth and alliances are starting to reshape the map.

This is no longer just about economic theory—it’s geo-political gravity shifting in real time.

The animated chart (below) brings it home. BRICS+ isn’t coming. It’s here.

Source: Visual Capitalist

Business & Finance in Africa

Airline Payments Still Grounded

Now this report made me laugh: Visa’s 2025 Airline Payment Maturity Index. Some might say a little self-serving, but hopefully valuable to a few airline CEOs that could make all our lives better. African airlines are losing revenue and trust due to outdated and inefficient payment systems. Yep, all true.

Source: VISA

Compared to global peers, they face lower transaction approval rates and higher payment decline rates especially for high-value purchases.

Advanced, compliant payment systems can drive billions in new airline revenue through seamless transactions, fraud reduction and better retailing.

The fix: Airlines need to upgrade payment architecture, align teams, monitor KPIs and embrace data-driven decisions. The future is here!

Bottom line: Africa’s aviation sector can’t fly far without first fixing how passengers pay.

Tech & Society in Africa

Travel Ban Blowback

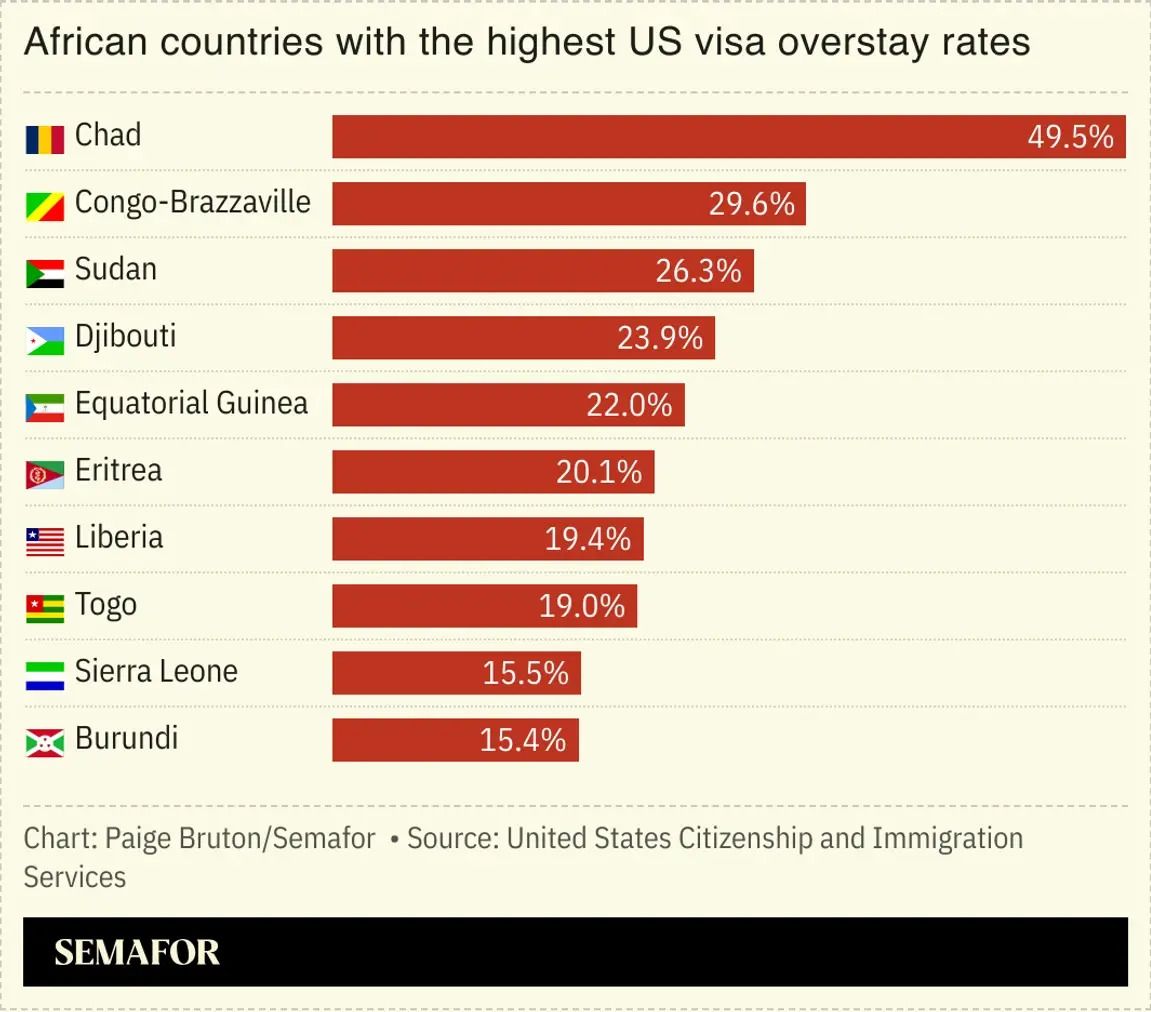

Source: Semafor

The U.S. has imposed a new travel ban on 7 African nations (including Chad, Sudan and Somalia) under an order from President Trump.

Burundi, Sierra Leone and Togo face partial restrictions.

The African Union warns the ban could hurt diplomatic and commercial ties.

Chad has already retaliated by halting U.S. visa issuance.

The U.S. cites high visa overstay rates among migrants from the targeted countries.

The bottom line: America’s latest travel restrictions continue to strain U.S.-Africa relations—AGAIN (Semafor).

Chasing Global Classrooms

Source: Carnegie Endowment

African students are applying to U.S. MBA programs in record numbers, rising from 4% in 2019 to 27% of all international applicants in 2024. Schools like Georgetown and Michigan Ross have seen a sharp uptick, especially from Nigeria and Ghana.

Why it matters: For many, U.S. MBAs offer global networks, better job prospects and a launchpad for impact back home. African alumni fuel the cycle—mentoring, advising and opening doors for new applicants. But obstacles loom: visa rejections, sky-high tuition and now President Trump-era policies threaten to slow the pipeline.

By the numbers:

76% of West African student visas were denied in 2023.

92% of VC money to Nigerian startups in 2021 went to founders with foreign degrees. Dang!

60% of African MPower loan recipients couldn’t get visas in 2022.

But at the same time, African students are turning to emerging destinations like Türkiye (61,000 African students), Northern Cyprus (17,400 Nigerians), Poland and Hungary for their affordable fees (as low as $5,000/year), lower living costs and high visa approval rates (The PIE News).

Source: Bloomberg

Sector Spotlight

Opportunity: Modernizing Mobility

The Problem: For decades, Africa’s intercity transport has run on guesswork. No firm schedules. No seat guarantees. No parcel tracking. Just show up, hope for the best and bring cash.

Source: Transport Africa

The Shift: The African bus market alone is valued at $2.25B (2024). Startups are seeing the opportunity and working on solutions that are adding real value. Consumers can now: book seats online, track trips in real time and send parcels securely, among other services while delivering trust, transparency and time savings. Here is a sample of African mobility startups I know of:

Afrikonekta (Kenya) - Seamless, cashless bus travel

Buupass* (Kenya, Uganda and South Africa) - Online ticketing for buses, trains and flights

Enakl* (Morocco) - Shared minibus platform for urban and intercity commutes

GIG Mobility (Nigeria/Ghana) – bus network and mobile‑booking app

Iabiri (Kenya) - Route info + digital payments

Safiri App (Tanzania) Smarter intercity bus bookings

Swvl (Egypt, Nigeria) – ride-pooling and bus-booking platform

Why it matters: Mobility fuels opportunity. Made in Africa solutions are coming.

*Disclosure: Buupass and Enakl are Renew Capital portfolio companies.

Climate in Africa

Built For Now

Source: The Economist

As featured in The Economist, a wave of African architects is redefining global design—low-tech, climate-smart and beautiful.

Burkina Faso’s Diébédo Francis Kéré, the first Black Pritzker winner, leads a movement rooted in local materials and passive cooling.

From termite-inspired air flow to desert-designed museums, these buildings are affordable, sustainable and rooted in place.

Why it matters:

These architects are challenging global norms—and winning commissions from Las Vegas to Belgium.

They’re proving that tradition + innovation beats glass-and-steel mimicry.

As climate and cost pressures mount, the world may start looking more to Africa for the blueprint.

Explorations in Africa

Cape Town Crunch

Source: FT

According to an article in FT, Cape Town’s Atlantic Seaboard paradise has drawn remote workers, foreign investors and Joburgers, and sent property prices soaring.

With the population up 27% since 2011 and property prices up 160% since 2010, the city is now one of the world’s most congested.

Locals are getting priced out, while foreign buyers and internal migrants scoop up homes.

Mayor Hill-Lewis says it’s not the nomads, but “semigration”—middle-class South Africans relocating—that’s driving the spike.

High-end tax hikes and infrastructure plans aim to balance growth with equity but housing strain, sewage issues and gentrification persist.

The big picture: Cape Town’s lifestyle boom is fueling its economy—and stressing its foundations.

Africa Trivia Response

Answer: D. Democratic Republic of Congo. Read more.

This week’s brief is brought to you with my fellow fact diggers Ruth Ayalew and Shaynerose Magabi. This is Laura Davis at Renew Capital—still in Accra this morning but headed to Washington. See you all next week.

The Africa Brief is a publication of Renew Capital. If you are enjoying The Brief, please forward it to friends and colleagues and email us at [email protected] with ideas or leads.