Banked? Barely. Peace? Maybe. Growth? Definitely. This week’s Africa Brief dives into the new data dump: Banking access is up—but use still lags. Congo cuts a U.S.-backed ceasefire. Visa makes a $57M play. Ghana holds the line. Oh, and Africa might quietly lead the world in gender-inclusive VC. It's fast. It's bold. One spot’s epically erupting. And it’s never boring.

Africa Trivia

Deep Roots of Bling - What geologic feature brought most of Africa’s diamonds to the surface?

A) Rift valleys

B) Kimberlite pipes

C) Glacial moraines

D) Subduction zones

Graphic of the Week

Africa’s Banking Inclusion Gap

Half banked. Barely used: Out last week, the Global Findex Database 2025 is packed with sharp data on how Africans actually access, use and trust financial services. Only thing better? Layering it with the GSMA and IFC Fintech reports we featured earlier. Maybe Shayne and Ruth can dig into that another time. In one line: Africa is getting more banked but most people are still just cashing in and out.

55% of adults in sub-Saharan Africa now have a financial account but 1 in 3 use it only for basic deposits and withdrawals.

33% use mobile money, the highest rate globally. But just 10 countries (incl. Kenya, Ghana, Côte d’Ivoire) account for 60% of global mobile money users.

40% of unbanked adults own a mobile phone but still lack financial access.

Smartphone = gatekeeper. Without one, most people can’t access digital services even if they have a SIM or basic phone.

Rural women are hit hardest. The gender gap is widest in rural areas, where financial infrastructure and connectivity are weakest.

Only 38% of adults can reliably come up with emergency funds, the lowest resilience rate globally.

Source: Statista

What We Are Reading

Africa: 500 Global opens Abu Dhabi office to invest up to $300M in startups tackling challenges across emerging markets including Africa (Semafor); UK slashes foreign aid by 40% (BBC Africa).

Botswana: Citi expects further currency devaluation as diamond revenue drops and fiscal pressures mount (Bloomberg).

DR Congo and M23 rebels sign U.S.-brokered ceasefire but doubts linger as mineral stakes and political tensions remain high (Semafor); Australia’s AVZ Minerals locked in a billion-dollar arbitration over Congo’s Manono project, says Kinshasa’s new deal with KoBold Metals, a U.S. firm backed by Bill Gates, undermines its legal claim to one of the world’s largest lithium deposits (Reuters); Signs $46M sponsorship deal with FC Barcelona to promote tourism despite ongoing conflict (Al Jazeera).

Egypt: Current account deficit fell to $2.1B in Q1 2025, driven by higher remittances and tourism revenue (Reuters); Government offers free train rides to help Sudanese refugees return home as Khartoum slowly recovers after being recaptured by the Sudanese Armed Forces from its rival, the paramilitary Rapid Support Forces in May (AP News)

Namibia: Government launches plan to hit 7% growth and regain upper-middle-income status by boosting green hydrogen and manufacturing (Bloomberg).

South Africa: President Ramaphosa dismissed the education minister to ease coalition tensions and secure support for the national budget (Bloomberg); Vodacom’s service revenue rose 11.4% in Q1 driven by strong growth in Egypt and financial services (Reuters); Canal+ got anti-trust approval to buy MultiChoice in a $3B deal creating Africa’s biggest pay-TV and streaming firm (Bloomberg).

Uganda: MTN Uganda will split off its fintech unit into a separate firm and plans to list it locally within five years (Reuters).

Zimbabwe: Spodumene exports (hard, crystalline lithium-bearing mineral) jumped 30% in H1 2025 despite collapsing global prices, as Chinese firms poured more than $1.4B into Zimbabwe and began local refining (Reuters).

Business & Finance in Africa

Fast-Tracking AfCFTA

Source: IOA

What’s happening: U.S. tariffs, up to 50% in some places like Lesotho are pushing African leaders to fast-track AfCFTA. Only 24 countries are trading under the pact, despite 49 ratifications. The good news is that intra-Africa trade rose 12.4% to $208B in 2024, but barriers persist. The roadblocks:

$100B+ infrastructure gap

Border delays and red tape

Dollar dominance inflates payment costs

Weak governance, especially in smaller economies

“We are on our own,” says AfCFTA chief Wamkele Mene.

"We have a generational chance to build value chains that keep wealth on the continent, develop competitive industries and create millions of jobs while shaping global supply chains from a position of strength," Kenya’s President, William Ruto said earlier this month. Read more: Reuters.

Data, dollars and digital dominance

Source: Trading Views

Visa’s $57M Africa Bet: The company has launched its first African data center in Johannesburg, marking a major step in its $1B commitment to the continent. The R1 billion ($57M), South African investment will roll out over the next three years. Key highlights:

The new facility joins Visa’s core data hubs in the U.S., U.K. and Singapore.

It expands VisaNet, the backbone of 100B+ transactions annually in 200+ countries.

South Africa is now a launchpad for digital payment solutions across the continent.

60%+ of face-to-face payments in South Africa are now contactless.

The move reduces reliance on overseas infrastructure and boosts local data sovereignty.

Why it matters: Visa’s doubling down on Africa’s digital boom, projected to hit $1.5T by 2030 with infrastructure to match its ambition. I like to see this trend! Read more: Reuters.

Ghana – Holding the Line

Source: Semafor

The central bank held an emergency meeting on July 17 to review economic data but delayed a rate decision until its scheduled session from July 28 to 30. What’s happening:

Inflation dipped to 13.7% in June, lowest since 2021.

Cedi surged 40% YTD, boosting confidence.

Trade surplus hit $5.6B; current account at $3.4B in H1.

Reserves rising but fiscal deficits and global volatility remain threats.

FX pain persists: Importers say USD isn’t available at the official ₵10.3/$ rate. Many are paying ₵11.5+ on the black market, fueling inflation risk.

Read more: Semafor

Source: Bloomberg

For the Policy Nerds

The World Bank’s Country Policy and Institutional Assessment (CPIA) quietly guides billions in aid and investment but it’s dense. It scores how well African governments manage money, services and reforms.

Source: The World Bank: 2025 CPIA Report

This year:

Scores flatlined at 3.1, dragged down by weak governance.

Debt stress has doubled since 2012, 53% of countries are now at risk.

Best part? The charts. Worst? You’ll need coffee to get through any of it. But if you are brave, read more: The 2025 Country Policy and Institutional Assessment (CPIA).

Source: The World Bank: 2025 CPIA Report

Tech & Society in Africa

Africa’s Gender Signal

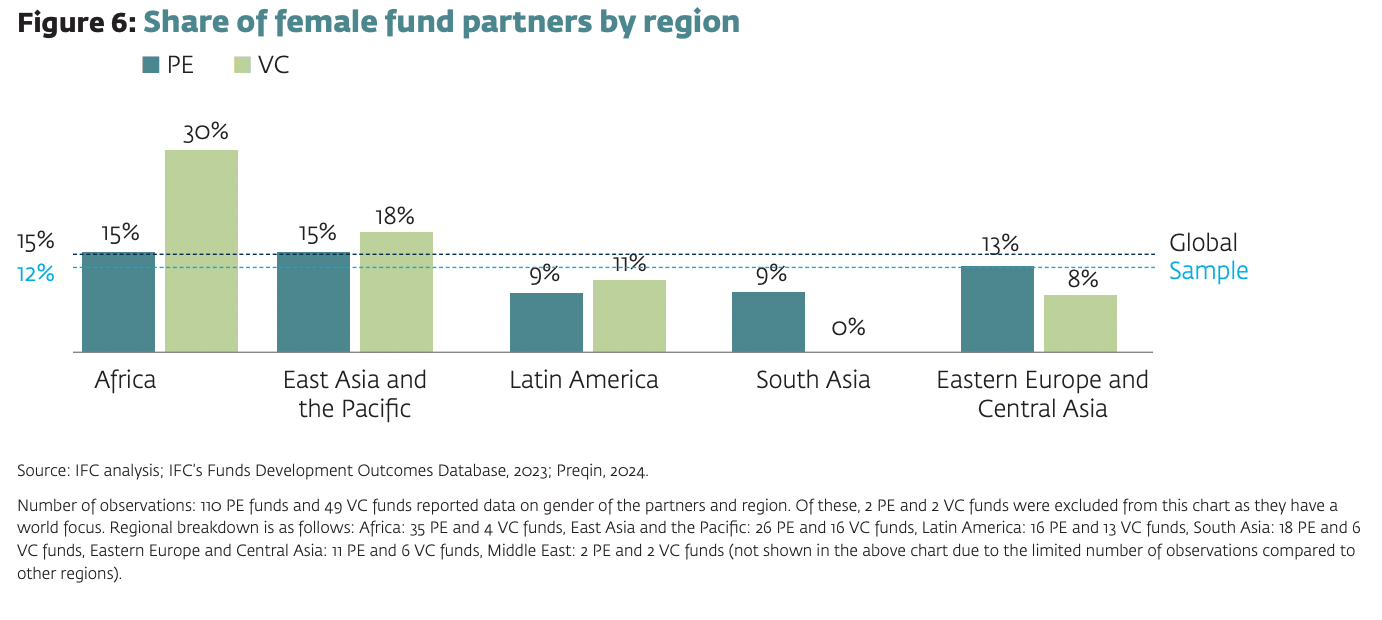

According to a new IFC report, Africa stands out as the most gender-inclusive region in private capital.

63% of VC investment staff are women. The highest globally, 33% in PE, also the top share

At the partner level, Africa leads VC with 30% female partners and ties for top spot in PE at 15%

Source: IFC

But a big caveat: Sample sizes for the study were small and I am not sure why. I think the data is available if they ask the right people/groups like Mark Kleyner at Dream VC or Women in African Investments (WAI) a wonderful networking group I am in or The African Private Capital Association (AVPA) for that matter.

Bottom line: Africa may be setting a quiet precedent for gender parity in capital. Read more: Expanding Opportunities for Women Through Private Equity and Venture Capital.

Explorations in Africa

Afar’s Fiery Spectacle

Volcanic eruptions lit up Ethiopia’s Afar region this week, from four sites near the Erta Ale crater, one of the planet’s most active geological zones. The eruptions have been mild but dramatic enough to attract curious tourists to the Danakil Depression.

Key points:

Eruptions began Tuesday within a 15-km radius of Erta Ale.

The region has faced months of earthquakes, prompting 58,000+ relocations in January.

Tremors have reached magnitudes of 5+ and were felt as far as Addis Ababa.

Read the current volcanic news: GoobJoog. And if you are curious about visiting the Danakil Depression which includes Erta Ale crater at some point, I recommend a travel piece in Condé Nast Traveler from 2019.

Africa Trivia Response

Trivia Answer: B. Kimberlite pipes, named after Kimberley, South Africa are ancient volcanic conduits that brought diamonds from the deep mantle to the surface. (Source: Wikipedia)

Thanks for reading. Thumbs up, Shayne and Ruth for this week’s research! My encouragement for myself and this community this weekend (borrowed from Axios): “Be curious, not judgmental.” And shout out to my Dad, Ed Grazier, who has long taught me the value of curiosity.

Source: Tom Pounder

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too! Email us at ([email protected]) if you have some scuttlebutt we should follow up on.