I am back online after a happy Fourth of July—and the continent didn’t miss a beat. Gulf powers are flooding East Africa with billions, President Trump is threatening BRICS allies with new tariffs, and Kenya’s protests have turned deadly. M-PESA’s losing ground, Morocco’s IPOs are on fire, and Africa’s PE world is stuck in exit limbo. Plus: gender wins and a wild ride through Madagascar’s lost forests. Let’s dive in.

Africa Trivia

How many hours do women in sub-Saharan Africa collectively spend each year collecting water?

A) 4 billion

B) 10 billion

C) 40 billion

D) 100 billion

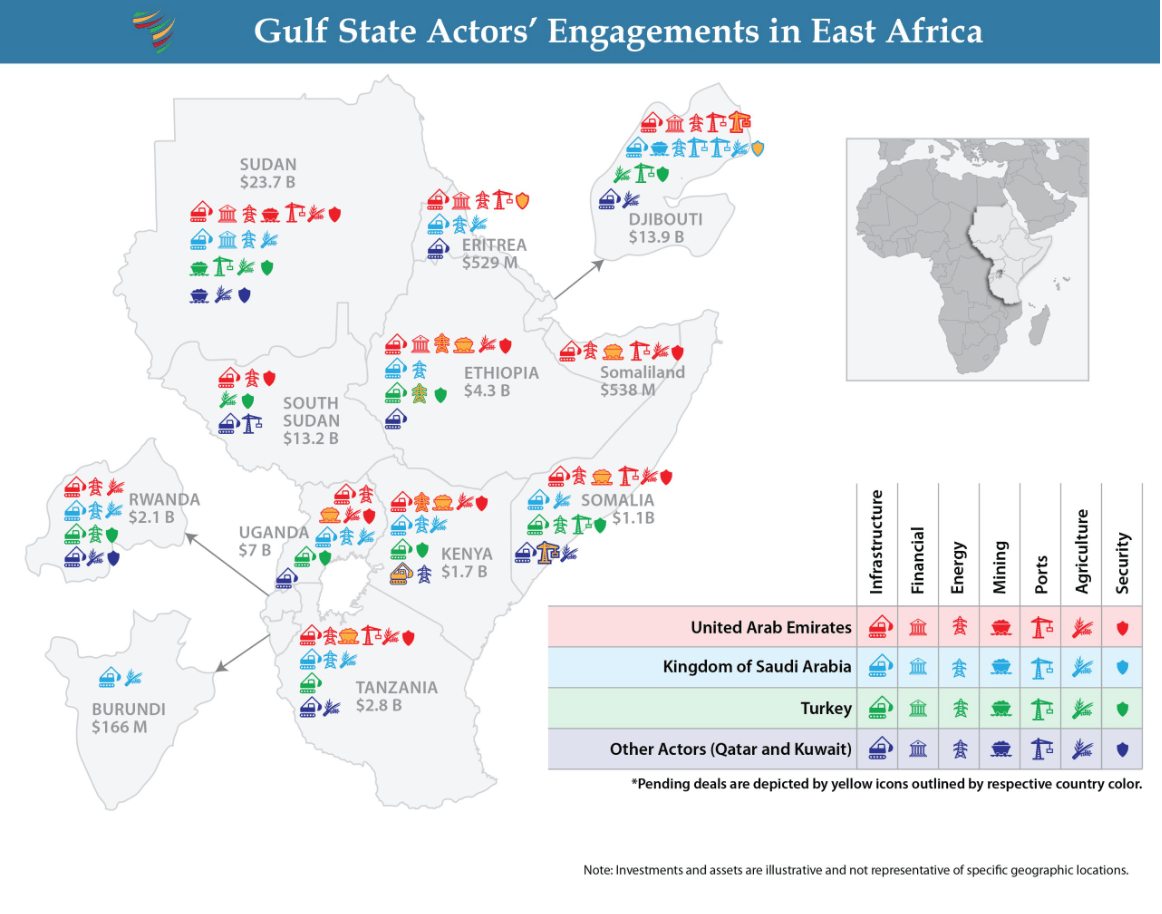

Graphic of the Week

Ports, Power & Proxy Wars

What’s happening: Gulf states and Turkey are reshaping East Africa’s political and economic map with $75B+ in investments spanning infrastructure, ports, agriculture and security. It’s not new but it’s interesting to see it quantified.

The UAE leads the charge with $47B invested across all 12 East African countries especially in energy, ports and agriculture.

Saudi Arabia is betting big on Djibouti, committing $13B to oil refineries, trade hubs and military negotiations.

Turkey’s niche is security—building bases, training forces and supplying drones in eight countries.

Flashpoint—Sudan: The region’s rivalries are spilling into conflict zones. In Sudan, Gulf powers are backing opposing sides in the war, turning investment influence into a military balancing act.

Big picture: East Africa is emerging as a strategic battleground not just for capital, but for control of Red Sea routes, critical infrastructure and regional alliances. Read more: Africa Center for Strategic Studies.

What We Are Reading

Africa: President Trump threatens an extra 10% tariff on countries aligning with BRICS’ "anti-American" policies, without detailing what those are (Reuters); A new malaria drug for infants has been approved in Switzerland with plans to roll it out in African countries, where 95% of global malaria deaths occur, mostly among children (AP News).

DRC: A leaked UN report accuses Rwanda of backing M23 rebels to smuggle critical minerals like coltan from Eastern Congo at unprecedented levels despite a recent U.S.-brokered peace deal (AP News).

Egypt: French utility Engie has completed Africa’s largest wind farm ahead of schedule and is prioritizing rapid renewable energy expansion across the Middle East and North Africa (Reuters).

Ethiopia secured a $1B financing deal from the World Bank to support economic reforms, stabilize its financial sector and boost growth (CNBC Africa).

Ghana: The IMF approved a $367M disbursement to Ghana after a successful program review, bringing total support to $2.3B as reforms, gold prices and fiscal discipline stabilize the economy (Bloomberg).

Kenya: At least 10 people were killed in Nairobi as police clashed with protesters during anti-government demonstrations over corruption, police brutality and the high cost of living (AP News); President Ruto’s repressive rule, economic mismanagement and ethnic division are fueling mass protests and eroding trust in democracy (The Economist).

Nigeria: The Central Bank ended pandemic loan waivers and is now requiring banks to submit capital restoration plans to strengthen financial stability (Bloomberg); The U.S. has reduced most Nigerian non-immigrant visas to single-entry, three-month validity (BBC Africa).

Senegal: Singer Akon's $6B futuristic city project has been scrapped and replaced with a state-backed $1.2B tourism resort after he failed to deliver on development promises (Bloomberg).

South Africa is set to be removed from global money laundering watchlist after stepping up crime crackdowns (Financial Times); President Trump’s 31% tariff on South African citrus threatens the $2B industry’s U.S. market access, risking jobs, exports and long-term sustainability (Bloomberg).

Tunisia: Opposition leader Rached Ghannouchi has been sentenced to 14 years in prison for allegedly conspiring against state security, amid claims of political persecution (AP News).

Uganda is hosting eight nations for the 2025 Rugby Africa Cup from July 8 to 19, a key qualifier for the 2027 Men’s Rugby World Cup (Rugby Afrique).

Geopolitics in Africa

Trump vs. BRICS

Source: Bloomberg

President Trump warned he’d impose an additional 10% tariff on any country aligning with the “anti-American policies of BRICS,” escalating trade tensions just days before the U.S. tariff moratorium expires.

Global impact:

Emerging market currencies dipped: South Africa’s rand led losses, followed by India’s rupee and China’s yuan.

BRICS nations (Brazil, Russia, India, China, South Africa) condemned U.S. and Israeli strikes on Iran and called for a Gaza ceasefire, prompting President Trump’s backlash.

Trade countdown:

The U.S. plans to send tariff letters to dozens of countries, which started on July 7, with levies possibly kicking in on August 1.

The U.S. Treasury may offer three-week extensions to countries still negotiating deals.

Bigger picture:

BRICS is pushing for global governance reforms and exploring a cross-border payment system to reduce reliance on the U.S. dollar.

President Trump has previously threatened 100% tariffs if BRICS countries ditch the dollar.

Bottom line: President Trump’s warning is a clear shot at the growing influence of BRICS and a signal that his second-term trade playbook could get even tougher.

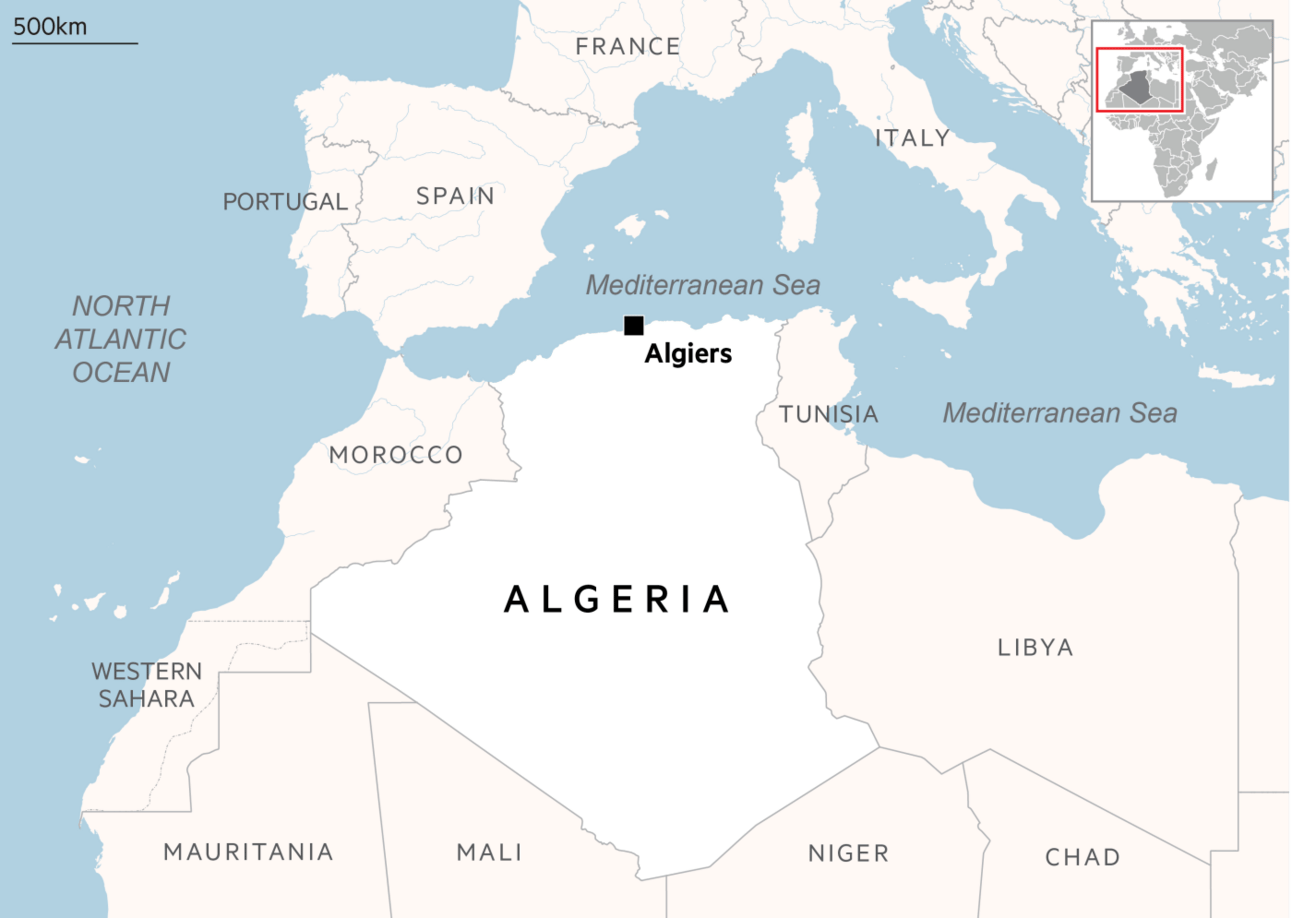

Algeria’s Diplomatic Tightrope

Source: Financial Times

The UK’s recent backing of Morocco’s Western Sahara autonomy plan deepens Algeria’s isolation, with the U.S., France, and UK now supporting Rabat.

Shifting alliances:

Algeria sees the UK move as a blow to its decades-long support for Sahrawi independence.

Morocco’s normalization with Israel (via the Abraham Accords) earned U.S. recognition and fueled Algeria’s anger.

The UAE opened a consulate in Western Sahara, backed a massive $25B gas pipeline through Morocco and is now building a drone factory there.

Fallout with France:

Macron’s pivot to Morocco led Algeria to recall its ambassador, freeze security cooperation and cancel a state visit.

The feud deepened over migration tensions and the jailing of a French-Algerian author.

Regional pressure builds:

Russian mercenaries in the Sahel have weakened Algeria’s southern influence.

Algiers lashed out on state TV at the UAE, calling it a “factory of division” and “artificial statelet.”

Bottom line: Algeria’s regime is sticking to its principled, anti-colonial stance but finds itself increasingly boxed in—outpaced by Morocco’s diplomacy and surrounded by assertive rivals.

Business & Finance in Africa

Africa’s Exit Bottleneck

Source: BCG

Africa’s Exit Problem and Potential: According to Deals to Dollars: Navigating Successful Private Equity Exits in Africa (BCG, April 2025), Africa’s PE scene is booming with deals but struggles to cash out, making exits the continent’s billion-dollar bottleneck.

What’s holding PE back?

71% of LPs cite weak exit climates as the top challenge to investing in Africa.

Exit volumes fell by nearly 50% from 2022 to 2023 (82 to 43 deals).

Exit values declined 26% annually (2021–23), while new investment surged 25%.

Standout stats:

Trade sales drive 47% of PE exits—corporates remain king.

IPOs are rare (10%), but Morocco’s market is heating up—Akdital’s IPO was 29x oversubscribed, with a 289% gain in two years.

Majority positions exit twice as often as minority stakes (58% vs. 27%).

African PE’s average hold is 6.4 years—longer than global (5.7), North America (5.3), or Asia (5.8).

Small exits (<$100M) make up 80% of deals; buyers disappear above $300M.

Buyouts from founders were the top entry point for successful exits (46%).

Regional and Sector View: Most exits occur in Nigeria, South Africa, Mauritius and Egypt; mining, industrials and financial services have the highest exit rates; health and education exits lag due to capex-heavy models and longer time to maturity.

According to the report, here’s how to win in Africa:

Plan the exit from day one—assume a trade sale.

Control matters—majority stakes boost odds.

Avoid oversized assets—the sweet spot is $50M to $300M.

Show early wins—LPs want cash back, fast.

Treat exits like entries—rigor, prep, buyer alignment.

Use IPOs sparingly, unless targeting Morocco or Egypt.

Bottom line: Africa isn’t short on deal flow but the liquidity trap is real. Smart exits take strategy, speed and a lot of prep. Read more: Deals to Dollars: Navigating Successful Private Equity Exits in Africa (BCG, April 2025).

Climate in Africa

Where Heat Hits Hardest

Source: Climate Central

Africa’s heat risk isn’t just about temperature: According to the report Climate Change and the Escalation of Global Extreme Heat, 2024 was globally the hottest year ever recorded. Climate change added 30+ extreme heat days for nearly half the planet and Africa ranks among the most vulnerable.

Africa’s heat story:

A December 2024 heatwave from Senegal to South Sudan was made 15x more likely by climate change, the most extreme attribution recorded in Africa.

In South Sudan, February’s heat hit women and girls hardest, straining water access, schooling and maternal health.

Figure 2: Africa doesn’t lead in heat-day counts but ranks among the worst-hit due to high exposure and low resilience.

Source: Statista

Global context: 4 billion people saw 30+ extra heat days; 195 countries had climate-driven heat spikes but few regions combine intensifying risk with such limited adaptive capacity as Africa. Bottom line: Africa may not be the hottest but it’s where heat hurts most. Read more: Climate Change and the Escalation of Global Extreme Heat.

Tech & Society in Africa

Africa’s Mobile Leap

Source: GSMA

What’s new: According to the recent The Mobile Economy 2025, sub-Saharan Africa will account for 25% of the world’s 800 million new mobile internet users by 2030—more than Latin America and MENA combined.

Regional snapshot:

Africa has the lowest mobile internet penetration (46%) but the fastest growth.

Nigeria, Ethiopia, Tanzania, DRC and Egypt are among the top global markets for new users.

5G adoption will hit 17% by 2030.

Smartphone use will jump from 55% to 81%.

Why it matters:

Mobile drives 5.8% of global GDP, rising to 8.4% by 2030.

Africa’s usage gap (45%) is 9x the coverage gap, highlighting affordability and digital skills as key hurdles.

Operators are investing in AI, enterprise services and green infrastructure.

Bottom line: Africa isn’t just catching up—it’s where mobile growth is accelerating fastest, with millions coming online for the first time and rewriting the digital future. Read more:The Mobile Economy 2025.

Interoperability Weakens M-PESA’s Edge

Source: Tech Cabal

M-PESA’s Lead Narrows: M-PESA’s market share fell to 90.8% in Q1 2025, down from 97% in late 2023—its sixth straight quarterly drop—as Airtel Money climbs to 9.1%.

Why it’s shifting:

Interoperability broke Safaricom’s lock-in.

Airtel’s edge: lower fees, cashback and retail partnerships.

Agent networks are expanding: 417,000 total, with Airtel growing fastest.

Still dominant: M-PESA handles 30 billion transactions worth $296B annually but momentum is tilting.

Bottom line: Kenya’s mobile money space is getting competitive and M-PESA’s grip is loosening. Read more: Tech Cabal.

Africa’s Women Mean Business

Source: World Economic Forum

Sub-Saharan Africa has closed 68% of its gender gap—nearly matching the global average (68.8%) and outperforming its income group by a wide margin.

Economic power players:

Botswana ranks #1 in the world for women’s economic participation (87.3%).

Nigeria: Women’s labor force participation is a massive 80.7%—one of the highest globally.

Burkina Faso: 70% of senior roles are held by women (vs. global average ~32%).

20 African countries are in the global top 100 for gender parity.

What stands out? Africa’s gender gap is closing fastest in economic and political domains. Many African countries outperform richer peers on key indicators. Progress is being driven from the bottom-up—women entrepreneurs, political leaders and local systems. Lest we celebrate too soon, we all know the gender gap still exists. Education and health parity remain below global averages. The region slipped slightly in overall score (–0.2%) and though I don’t find these calculations too useful, the numbers show that full equality is still 107 years away at our current pace.

Bottom line: Africa is a gender parity disruptor in the making. Countries like Botswana, Nigeria and Burkina Faso are proving that opportunity doesn’t have to wait for wealth. Read more: World Economic Forum: 2025 Global Gender Gap Report 2025.

Explorations in Africa

Where the Lemurs Watch

Source: Financial Times

Madagascar’s last ark: In a stunning FT travel piece, writer Mike Carter journeys deep into Madagascar’s Tsingy de Namoroka National Park—a surreal, barely reachable slice of limestone spires, giant chameleons and ancient lemurs.

Why it matters:

90% of Madagascar’s forests are gone, most cleared by “tavy” (slash-and-burn farming).

The biodiversity is unmatched: 90% of species there live nowhere else on earth.

One man is building an ark of sorts: Welsh conservationist Ed Tucker-Brown opened the first eco-lodge in the area, employing 150 locals and fighting forest loss with firebreaks, jobs and €50/night conservation levies.

Also worth seeing in Madagascar: Carter then hops to Nosy Boraha, a dreamy rainforest island where hotel legend Philippe Kjellgren has built a solar-powered barefoot luxury resort—complete with pirate cemeteries, whale migrations and reforestation efforts.

My take: I’ve never been to Madagascar but I’ve always wanted to. This story made it feel like a pilgrimage not a vacation. Fragile, wild and otherworldly. A beautiful place trying to save itself with or without us. Read more: Financial Times.

Africa Trivia Response

Answer: C) 40 billion (Stanford University Study)

See you next week!

Big thanks to my fellow Renew Capital researchers Ruth Ayalew and Shaynerose Magabi for the Africa Brief. This is Laura Davis at Renew Capital signing out. If you are enjoying the brief, please share it with your friends and family. See you all next week.

Email us at ([email protected]) if you have some scuttlebutt we should follow up on.