Africa enters 2026 with a paradox on full display. Global risk appetite is creeping back, capital markets are reopening and tech debates are getting louder, yet purchasing power in some markets remains painfully thin. This week’s Brief looks at who really controls Africa’s digital rails, why Eurobond windows are suddenly open again, how China’s lending playbook is tightening and where economic pressure is still hitting hardest. Beneath the headlines, the story is about leverage, limits and who actually holds the switch. I hope it resonates.

Did You Know?

Africa’s five largest telecom operators serve nearly two-thirds of all subscribers, and none are U.S.- or China-based. Source: Africa Center for Strategic Studies

Graphic of the Week

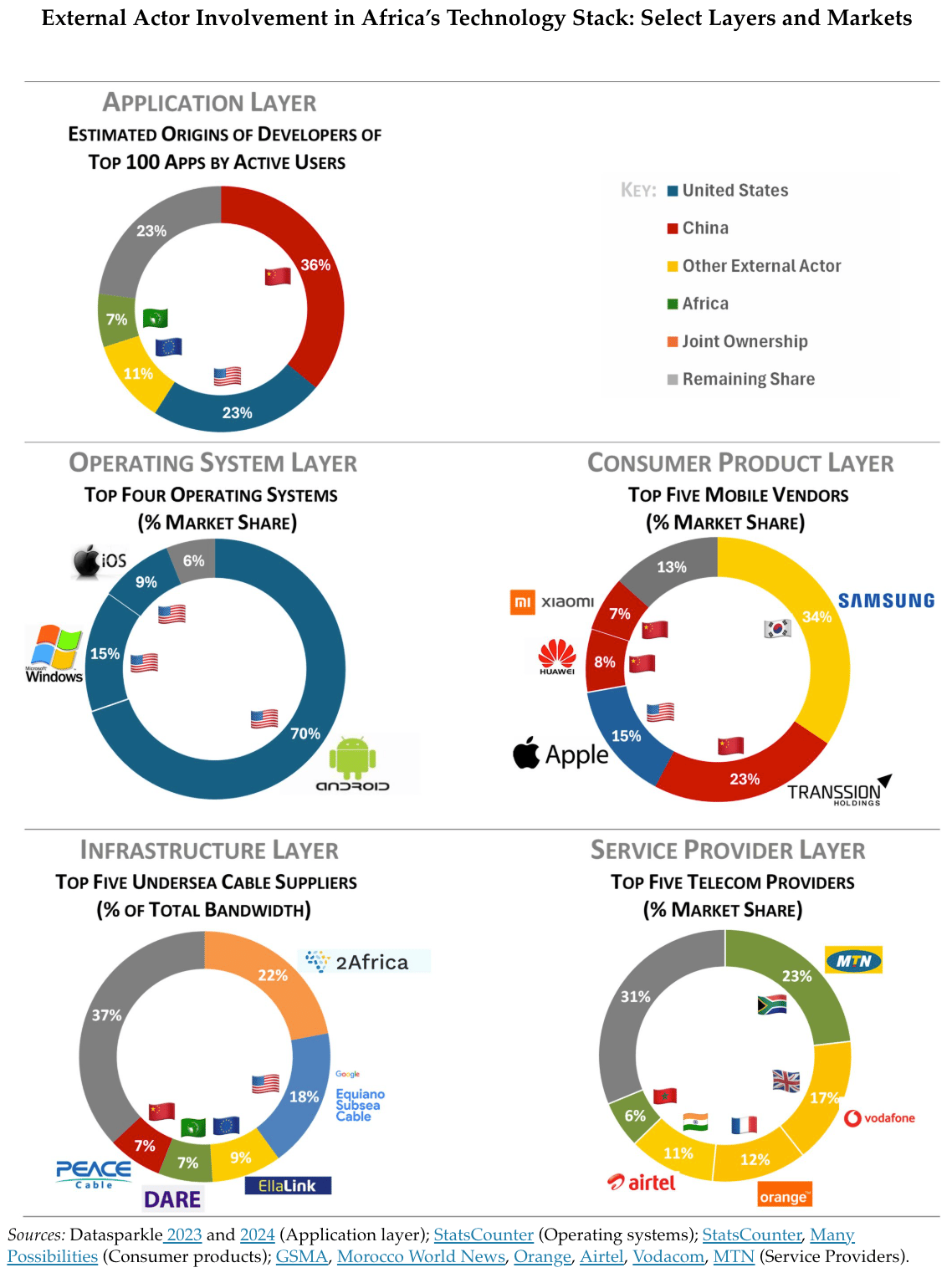

Who Controls Africa’s Tech Stack?

This week’s graphic comes from “Demystifying External Actor Influence in Africa’s Technology Sector” by Nate Allen, published in November 2024. It is not brand new data, but it is a clear breakdown of who actually controls each layer of Africa’s tech stack, from apps and operating systems to infrastructure and service providers. The piece cuts through the China vs. U.S. noise to show a more nuanced reality: external actors dominate some layers, but Africa retains meaningful agency in others, especially telecoms and applications. As debates over digital sovereignty, cybersecurity and foreign influence accelerate in 2026, I believe this framework still holds up and helps explain where the real vulnerabilities and leverage points sit. For those of us who are not native tech people, here is how the layers stack up.

What We Are Reading

Africa: Afreximbank ended its credit rating relationship with Fitch, saying it no longer reflects the bank’s mission and mandate (Afreximbank).

Cameroon is back in the Eurobond market, pricing a $750M five-year bond at 10.1% as investors’ appetite for riskier assets opens the door for African issuers (Bloomberg).

Côte d’Ivoire: President Ouattara appointed his brother as vice prime minister while keeping most senior ministers, signaling continuity after recent elections (Reuters).

DR Congo: S&P upgraded Congo’s outlook to positive on reform momentum and mining growth as the country plans a $750M debut Eurobond (Reuters).

Egypt: The parliament announced that it is drafting legislation to regulate children’s social media use to curb digital harms following calls from President Sissi and examples from Western countries (AP News).

Ethiopian authorities declared the Marburg outbreak over after 42 days with no new cases following 14 confirmed infections and nine deaths (AP News).

Kenya announced its plans to raise $969M in short-term loans for road projects, to be refinanced later with bonds backed by a fuel levy (Bloomberg); Nairobi Securities Exchange announced its plans to use mobile money platforms like M-Pesa to attract millions of new retail investors after ending a decade-long IPO drought (Semafor); Moody’s upgraded Kenya’s debt to B3 from Caa1, citing lower near-term default risk, as dollar bonds rallied ahead of a planned $2B eurobond sale (Bloomberg).

The Malian government took a 51% stake in a new industrial explosives venture with China’s Auxin to control mining inputs and boost local industry (Reuters).

Morocco and Senegal agreed Monday to strengthen their diplomatic and economic partnership and boost trade by signing 17 cooperation deals in Rabat, putting recent Africa Cup final tensions behind them (AP News).

Mozambique: TotalEnergies announced it is restarting its $20B LNG project in Cabo Delgado, aiming to begin exports by 2029 and boost the country’s role in the global gas market (Bloomberg).

Nigeria’s United Bank for Africa is preparing a $50M working-capital facility to help Congolese trader Buenassa bid for the copper-cobalt producer Chemaf, part of a broader push by African banks and companies to position for U.S.-aligned critical minerals deals in the Democratic Republic of Congo (Semafor); InfraCredit announced its plans to triple naira guarantees over four years to unlock long-term infrastructure funding amid lower rates and stable forex (Bloomberg).

The South African treasury said government debt will stabilize relative to GDP for the first time in nearly 20 years and show a third consecutive primary surplus (Bloomberg); Surging metal prices and a stronger rand push the stock index to a record high with gains expected to continue in 2026 (Bloomberg).

The Zimbabwean diaspora remittances rose 14% to $2.45B in 2025, led by the UK and South Africa (Bloomberg).

Business & Finance in Africa

Risk Window Opens

Source: Bloomberg

Africa’s sovereign risk premium has dropped to its lowest level since 2018. Markets are paying attention.

What Happened

Benin sold a $500M seven-year Eurobond at about a 6.2% yield, including an inaugural dollar-denominated sukuk which is a Sharia-compliant security where an investor owns part of an asset and earns income from its use.

Days later, Cameroon followed with a $750M five-year bond at a 10.1% yield.

Both deals landed as investors rotate out of the U.S. and into riskier assets.

Read more: Bloomberg.

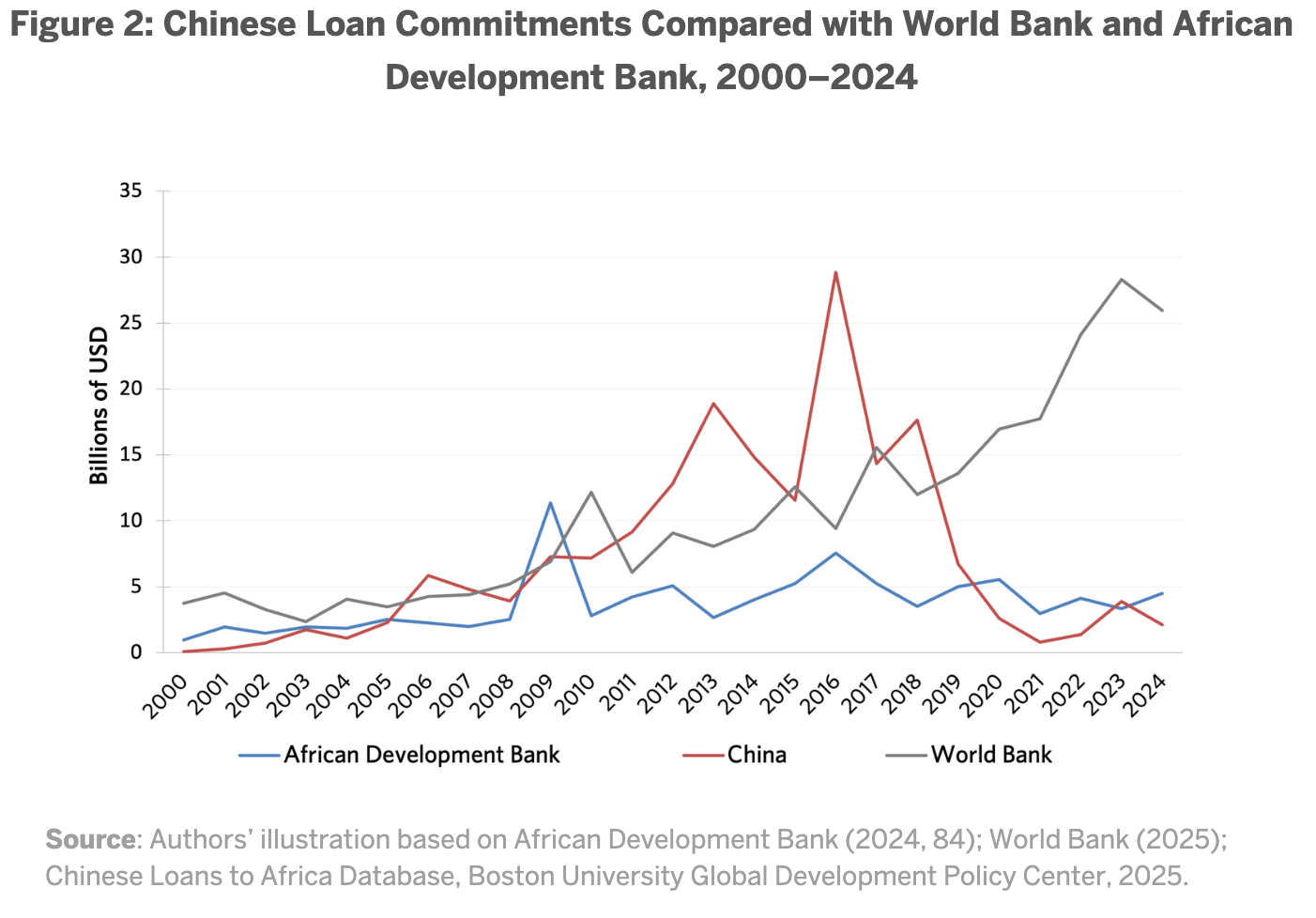

China Lending, Recalibrated

China’s lending footprint in Africa is shrinking and getting more selective:

New data from the Boston University Global Development Policy Center shows Chinese lenders signed $180.9B in loans to Africa from 2000 to 2024.

In 2024, new commitments fell to just under $2.1B across only six projects.

What Changed

Chinese lending now seems to be concentrated in familiar markets, led by Angola.

Big, fossil-fuel and ICT projects have largely stopped.

China is shifting toward grid infrastructure, transport, RMB-denominated loans, SME on-lending and FDI.

The era of easy, large-scale Chinese sovereign loans seems to have ended. African governments now face tighter terms, fewer projects and more market-driven financing. Read more: Boston University Global Development Policy Center

Tech & Society in Africa

Buying Power, Barely

Source: Business Insider

This chart does not need much explaining. Purchasing power in many African cities remains painfully low, and the consequences are far-reaching. Low incomes leave households spending almost everything on essentials like food, fuel and shelter, with little room for savings or discretionary spending.

Why It Matters

Small businesses struggle when consumers cannot spend.

Domestic markets fail to deepen, limiting job creation and diversification.

Even modest inflation or currency swings hit harder, amplifying economic stress.

The Bigger Picture

When purchasing power stays low, poverty and inequality become self-reinforcing, and economic vulnerability turns into social and political risk. Read more: Business Insider Africa.

Explorations in Africa

The Long Solar Road

In 2024, two riders traveled from Kenya to South Africa on Roam Air, powered only by the sun. In full disclosure, Renew Capital is an investor in Roam Electric (which means some of you are investors), but that aside, I am genuinely excited about this story for its beauty, ambition and innovation.

Recharging Hope is a seven-part documentary series launching in March. It is not just a story about electric mobility. It is about the people met along the way, the hope sparked and the future being built on African terms. If this kind of Africa story resonates, watch the trailer and be sure to subscribe on Youtube so you don’t miss the first episode.

Thanks for reading. Don’t miss our growing resource hub: Graphics of the Week, Reports, and soon an Africa Calendar tracking key elections, summits and moments that matter.

See you next week!