Last week, you heard our Africa predictions on themes and defining topics for 2025. We want to hear yours.

Africa Predictions

What do you think will be the biggest defining (positive) factor for Africa in 2025?

Graphic of the Week

The Urban Boom

Source: The Economist

This week, we bring you an oldie, but a goodie for the Graphic of the Week. Population growth and urbanization on full display. Here’s the skinny:

Africa’s urban population has grown rapidly since the 1950s.

By 2015, half of Africans lived in cities, expected to reach 70% by 2050.

Small towns under one million people drove growth, doubling the number of urban areas from 1990 to 2015.

Why It Matters:

Urban Clusters Emerge: Cities merge into mega-regions, crossing national borders.

Economic Hubs: Small towns and urban clusters spur migration, trade and regional integration.

Read More: The Economist

Too Long; Didn’t Read

Benin: The country seeks to sell $750M in bonds, but rising yields are creating challenges (Bloomberg).

Comoros: Voters elected a new parliament amid opposition claims of fraud and authoritarianism, with results expected by January 17 (Reuters).

Egypt: The country is turning to solar power to address energy shortages and rising LNG costs, with AMEA Power's $500M solar project offering cheaper electricity than gas, despite regulatory challenges (Reuters).

Ethiopia. The Ethio-Djibouti Railway achieved its first profitable quarter in late 2024, with CEO Takele Uma crediting strategic planning, employee dedication and regional collaboration for this turnaround (EBC).

Ghana: Spotify and Sony Music hosted a publishing camp in Ghana to empower African musicians, producers and songwriters with creative insights and tools for global promotion (Music in Africa).

Ivory Coast: Starting this month, France will withdraw 600 troops from Ivory Coast, reducing its military presence in West Africa (Financial Times).

Kenya: Negotiating with the UAE for funding to extend its railway to Uganda and South Sudan after China withdrew support, with both countries planning a feasibility study to boost regional trade and integration (Reuters).

Mali: Barrick Gold suspended operations at its Loulo-Gounkoto mining complex in Mali after the government seized gold, escalating a dispute over revenue sharing under a new mining code (Financial Times).

Mauritius: The U.K. and Mauritius are planning to finalize a deal over the Chagos Islands and its military base before Donald Trump becomes president on January 20, 2025 (Financial Times).

Morocco: Emerged as the most visited destination in Africa, attracting 17.4 million visitors in 2024, surpassing Egypt, which welcomed 15.7 million tourists last year (Bloomberg).

Mozambique: On January 15, 2025, Daniel Chapo was sworn in as president amid contested election results and nationwide unrest (Bloomberg).

Nigeria: AWS accepts naira payments to make cloud services more affordable and compete with Nigeria's local providers (Tech Cabal).

Rwanda: The U.S. State Department called on Rwanda to stop jamming GPS signals in the eastern Democratic Republic of Congo, where millions displaced by conflict are in urgent need of aid (Bloomberg).

Somalia. The president visited Ethiopia to restore diplomatic ties after tensions over a proposed Ethiopian naval base in Somalia's breakaway region, signaling a new era of cooperation (Reuters).

South Africa: The economy is projected to grow by 1.7% in 2025 after a decade of stagnation (Bloomberg).

Zambia: The Securities and Exchange Commission (SEC) fined Standard Chartered for mis-selling Sino-Ocean bonds and failing to disclose key risks (CNBC Africa).

Innovation in Africa

African Startups Hope 2025 is a Better Year

Source: Africa: The Big Deal

2024 was a challenging year for African startups. They raised $2.2B in equity, debt and grants, a 25% drop from the $2.9B raised in 2023.

Despite this, there were notable milestones: 188 ventures raised $1M or more, and 22 exits were made public, slightly up from the 20 exits in 2023.

The year began slowly, with just under $800M raised in the first half, primarily due to a sluggish start.

However, a significant rebound occurred in H2, with $1.4B raised in H2, the second-best semester since mid-2022. The numbers were driven by the deals of Moniepoint and Tyme Group in Q4, which resulted in two unicorns.

The YoY decline in funding is mainly due to a decline in debt funding, with equity levels stabilizing after taking the hardest hit in 2023 (Africa: The Big Deal).

Business & Finance in Africa

AWS Opens the Door to Naira Payments

Global tech companies like Amazon Web Services (AWS) and Apple historically did not accept local currency payments for their services creating a huge issue for African startup founders and their consumers. But perhaps, the tide will turn. On January 14, 2025, AWS, a global leader in cloud computing, announced it will now accept payments in Nigeria's local currency, the Naira (Techcabal).

Why does this matter?

Affordable Cloud Costs: Paying in naira will help Nigerian businesses avoid extra currency conversion charges, ultimately saving money.

Less Stress: Nigerian companies have faced high cloud costs due to the naira's devaluation and challenges in accessing dollars.

Fair Competition: Local cloud providers such as Nobus, Layer3 and Okra's Nebula have been attracting customers with naira-based pricing, making AWS's move essential to stay competitive (Techcabal).

Wouldn’t hurt for more global tech companies to change their tune towards Africa in 2025!

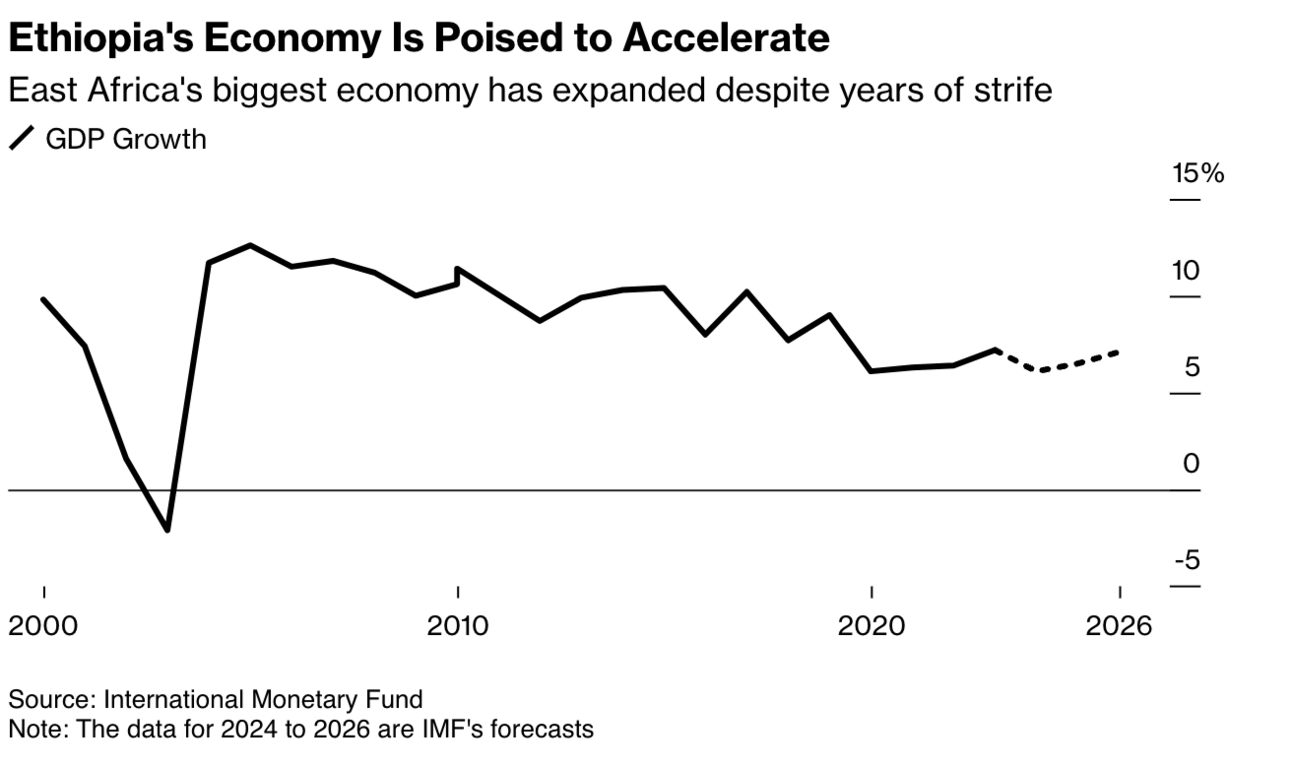

Ethiopia's Economic Leap

Source: Bloomberg

On January 10, 2025, Prime Minister Dr. Abiy Ahmed inaugurated Ethiopia's first securities exchange in over 50 years (Reuters).

Current Status: Wegagen Bank is the sole listed company on the Ethiopian Securities Exchange (ESX). CEO Dr. Tilahun Kassahun anticipates approximately 90 companies joining within the next decade (Reuters).

Key Economic Reforms:

Foreign Exchange Liberalization: In July 2024, Ethiopia floated its currency, the birr, transitioning to a market-based exchange rate. This move was pivotal in securing a $3.4B extended credit facility from the IMF (Reuters).

Privatization Initiatives: The government plans to privatize 10% of state-owned Ethio Telecom, one of Africa's largest telecom operators, to stimulate the domestic equity market (Reuters).

Banking Sector Opening: In December 2024, Ethiopia allowed foreign banks to establish local subsidiaries, aiming to attract foreign investment and enhance the financial sector (Financial Times).

Financial Goals: Over the next four years, Ethiopia aims to secure up to $27B in financing and investment, equivalent to 16% of its GDP, from entities including the IMF, World Bank, China and the United Arab Emirates (Financial Times).

Outlook: These reforms are designed to modernize Ethiopia's economy, foster private sector growth and integrate the nation into the global financial system.

Ethio-Djibouti’s Railway to Profitability

On January 13, 2025, Ethiopia-Djibouti Railway S.C., CEO Takele Uma, announced that the company achieved profitability in the last quarter of 2024, marking the company’s first profitable quarter since its launch (EBC).

This achievement sets the stage for a three-year strategic plan to transform the company into a profitable venture. The railway, a joint venture between Ethiopia, Djibouti and China, spans over 750 kilometers and connects Addis Ababa to the port of Djibouti.

The project, financed by China Exim Bank, was managed by the China Railway Construction Corporation until May 2024.

In regards to the existing debt issue, Ethiopia owes China around $14B of which $4B is dedicated to the Ethio-Djibouti Railway. In August 2024, China agreed to restructure Ethiopia's loans, including the loan for the railway, extending the loan from 10 years to 30 years.

Tech & Society in Africa

Internet Shake-Up

Source: Rest of The World

Love or hate him, Elon Musk is doing what he does to change landscapes. Here’s the latest landscape for Starlink costs vs. local providers. Once again, competition seems good for consumers. Next week, let’s see what the Department of Government Efficiency (DOGE) has in mind for the U.S. government!

Climate in Africa

Lights (still) Out in Africa

Source: IRENA Report, Page 24

In December 2024, the Financial Times published an article “African electricity debate pits speed against scale.”

The Hard Reality: Sub-Saharan Africa’s energy access declined for the first time in a decade as population growth outpaced electrification. There’s that theme again. Population growth.

The World Bank launched Mission 300 in April 2024, pledging $20B to electrify 250 million people by 2030, focusing on off-grid solar.

But there's a real tension between quick wins and long-term growth.

Projects like Senegal’s energy efficiency project to replace outdated incandescent bulbs with modern LED lighting in 700,000 homes and 80,000 businesses announced this week at a cost of EUR 8.51M seems like a bit of a distraction. But hopefully, I am wrong.

I am hoping we see some interesting new ideas out of Mission 300 Accelerator. For more data on this opportunity, read our previous Africa Brief story.

Democracy in Africa

Chapo’s Rocky Start

Source: France 24

What Happened: Daniel Chapo was sworn in on January 15, 2024 as Mozambique's next president after a disputed election. The opposition alleged widespread rigging, which sparked protests that have resulted in over 300 deaths since October.

Why It Matters: Chapo, who represents the Frelimo party, faces pressure to stabilize the country and tackle unemployment, health and education. Low ceremony turnout and heavy security signal lingering tensions.

Read More: Reuters

Curated Content from Africa

Source: The Economist

I mentioned it briefly last week, but I am personally dismayed at some of the Economist's portrayal of the continent’s current state. That said, sometimes we have to face the hard facts to find true opportunities. So if you have a moment this weekend, be sure to sit with and sift through the special report: The Africa Gap. What is clear: The continent presents a different game than VCs, corporates and other global private sector players are used to playing. You have to modify your playbook for Africa!

But in the words of the report’s author John McDermott “..there is no reason to catastrophise or give up hope. If other continents can prosper, so can Africa. It is time its leaders discovered a sense of ambition and optimism. Africa does not require saving. It needs less paternalism, complacency and corruption—and more capitalism.” Amen.

P.S. We hope you enjoyed the Brief! Reach out if you have ideas or feedback ([email protected]).