Welcome to the New Year and the first January edition of The Africa Brief! This week, we’re spotlighting nine key topics and trends in politics, economics and technology we believe will shape the continent for better or worse in 2025.

1. Debt Relief or Déjà Vu?

Debt relief for developing countries, particularly in Africa, remains a critical issue as nations grapple with economic challenges exacerbated by global crises.

Why it’s important: Pope Francis called on political leaders of wealthy nations to cancel or significantly reduce the debts of the poorest countries. High debt levels hinder economic growth and development, making debt relief essential for sustainable progress.

What Africa could use: Global collaboration is necessary to address debt sustainability and provide financial stability for developing nations. But is it the best thing to do, or will it perpetuate questionable behavior?

Our prediction: Debt relief will likely be granted to a handful of African nations in 2025, but the amounts and conditions may fall short of providing long-term solutions. While debt forgiveness can alleviate immediate fiscal pressures, it risks being a temporary fix if structural issues, such as governance and fiscal mismanagement remain unaddressed. What Africa truly needs is not just financial relief but a shift in priorities: eliminating barriers that stifle entrepreneurship, supporting private sector growth and creating a business-friendly environment that attracts both domestic and foreign investment. Only by fostering conditions for companies to start and scale can African nations achieve sustainable development and reduce reliance on external aid.

2. Ethiopia’s Stock Exchange

Ethiopia plans to launch its first securities exchange, the Ethiopian Securities Exchange (ESX), in January 2025.

Why it’s important: This marks a significant development in Ethiopia’s financial history, providing a platform for trading shares, bonds and other financial instruments. The ESX aims to attract both domestic and international investors, facilitating capital raising for businesses and contributing to economic growth.

It could be a win or a flop: Establishing a well-regulated and efficient capital market ecosystem is crucial to building investor confidence.

Our prediction: Keep an eye on Africa’s sleeping giant. When they’re focused, they get things done. But make sure you have a local presence before plowing capital into Africa’s second-largest and the world’s 13th-largest country by population. It will take some time to work out the kinks in this newly opening economy.

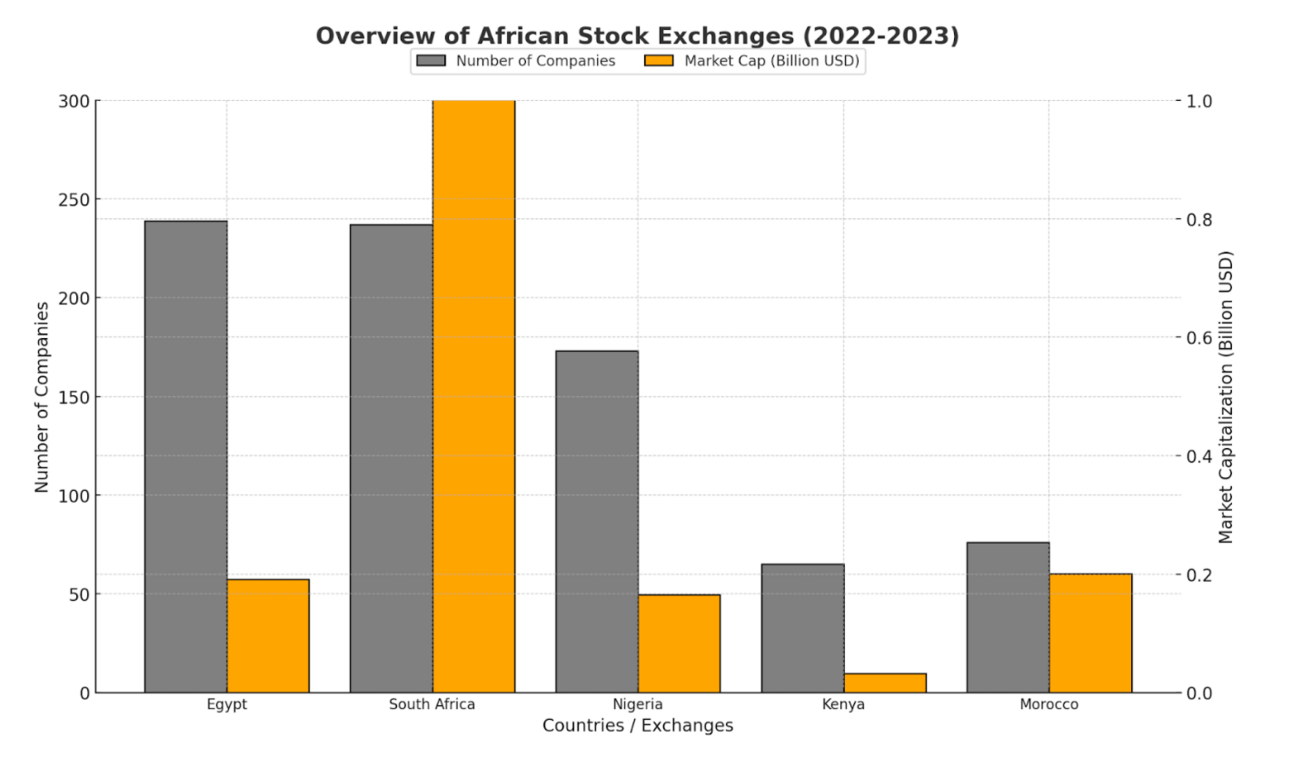

In context: African stock exchanges have a market capitalization of $1.6T, just 2% of the global total. The Africa Stock Exchanges Association (ASEA) represents 28 exchanges across 38 countries with more than 2,400 listed companies (Naira Metrics).

Small Stakes, Big Ambitions

Data from Statista, Africa Markets, Naira Metrics.

3. Ballots, Bets and Drama

Several African nations are scheduled to hold elections in 2025, which could lead to significant political shifts. See the table below.

Why it’s important: The conduct and outcomes of these elections will be pivotal in shaping the democratic landscape and governance structures in a number of West African countries. Optimists may highlight South Africa’s relatively smooth electoral process in 2024, while pessimists might point to the turbulence witnessed in Mozambique.

What we hope for: Peaceful, transparent elections that uphold regional stability and drive economic development.

Our prediction: Some elections will be contentious. Those that proceed smoothly will likely see economic rewards. We think Côte d’Ivoire is the one to watch. The 2025 presidential election will be a crucial test of its political stability as the country transitions into a new electoral cycle. Key players are likely to include President Alassane Ouattara, who may seek re-election if his party nominates him and potential challengers like Henri Konan Bédié or other figures from opposition parties. The election is significant due to Côte d’Ivoire’s regional role including being West Africa’s largest cocoa producer. Its history of election-related violence makes peaceful conduct all the more important for economic and regional stability. While tensions may arise, recent governance reforms and international observation could help ensure a more peaceful process than in past contentious elections. The country’s GDP growth in 2023 was almost double that of the West Africa region at 6.5%. Their macroeconomics are strong. If it’s a peaceful transition, growth will surely follow!

4. South Africa’s Presidency of the G20

South Africa assumed the G20 presidency on December 1, 2024 and will hold it through November 2025, marking the first time an African nation leads the group.

Why it’s important: South Africa’s leadership brings an opportunity to prioritize Africa’s development and foster inclusive dialogue among nations. The presidency will address overlapping crises, including climate change, underdevelopment, inequality, poverty, hunger, unemployment, technological changes and geopolitical instability.

What Africa hopes for: Recognition of Africa as an emerging region of influence and economic strength. South Africa aims to drive a progressive, Africa-centric and development-oriented agenda over the coming year.

Our prediction: South Africa’s presidency of the G20 presents a historic opportunity to amplify Africa’s voice on the global stage. By championing initiatives that showcase the continent’s economic and technological advancements, South Africa can foster international partnerships and drive sustainable development. However, there is a risk that entrenched geopolitical dynamics may reduce this platform to traditional appeals for financial aid, focusing predominantly on Africa’s challenges rather than its potential. The effectiveness of South Africa’s leadership will hinge on its ability to balance advocacy for support with a narrative that highlights Africa’s strengths and contributions to the global economy.

5. China, BRICS and Africa’s Sway

China continues to strengthen its presence in Africa through diplomatic engagements and investments, particularly in critical minerals and infrastructure projects.

Why it’s important: China’s top diplomat, Wang Yi, began his annual New Year’s tour of Africa, a tradition maintained for 35 years, emphasizing Beijing’s sustained commitment to the continent. China’s engagement focuses on securing critical minerals, expanding markets for its exports and enhancing infrastructure projects, despite a slowing economy.

What Africa may want: China’s consistent involvement contrasts with the less consistent engagement from the U.S. and EU, positioning Beijing as a reliable partner in Africa’s development trajectory. More countries are asking for membership in BRICS, which could signal to Washington that Africa continues to turn East.

Our prediction: This will be an interesting one to watch. Will China pull Trump into a trade war and will Africa and other BRICS nations get pulled in? Maybe. It could be the thing that gets the Trump Administration to start engaging Africa in a way that is far more commercial than prior administrations - which we think will be a good thing.

6. Startup Africa

Africa’s startup ecosystem is poised for growth, with increasing investments in technology-driven solutions across various sectors.

Why it’s important: Africa’s investment landscape is evolving, with opportunities in fintech, healthcare, logistics and agriculture. Early-stage funds are supporting startups with financing from pre-seed to seed stages, with typical check sizes of $150K. However, the ecosystem requires capital formation at higher stages to sustain growth and scale.

What Africa could do: The integration of new technologies is transforming industries, particularly fintech, which is reshaping financial services. Startups must prioritize operational excellence, as the funding landscape in Africa differs from Silicon Valley. Governments should focus on creating an enabling environment for entrepreneurs by removing barriers to business creation and foreign investment. Local investors should start backing local founders and international investors should get Africa Smart.

Our prediction: Fintech will remain the funding leader in 2025, but broader sectors will gain traction as local and global investors recognize Africa’s entrepreneurial potential. With lower barriers to entry, startups are well-positioned for growth but founders must see capital as a scaling tool, not a lifeline. Governments and VCs need to align efforts to nurture a thriving startup ecosystem.

7. Rare Earths, Big Stakes

Africa’s vast reserves of rare earth minerals are attracting global interest, positioning the continent as a key player in the critical minerals industry.

Why it’s important: Africa holds significant reserves of materials like lithium, tantalum, niobium, rare earth elements, graphite and gemstones, all crucial for modern industries. As AI and other tech sectors expand, Africa’s rare earth minerals will be in high demand, likely going to the highest bidder. With rising global demand for critical minerals, investments in African mining are expected to surge, unlocking resources vital for a sustainable and technologically driven future.

What Africa may do: Collaborations, such as the partnership between Critical Minerals Africa Group (CMAG) and APO Group, aim to elevate Africa’s critical minerals sector on the global stage. Legitimate practices and the use of technology to improve traceability could bolster Africa’s position as the preferred supplier to tech-driven industries. Building robust frameworks for responsible mining and trade will be key to capturing value in this lucrative sector.

Our prediction: Some countries will recognize the “gold mines” they are sitting on and quickly establish frameworks to attract global buyers, likely securing substantial investments, especially from Western players. Meanwhile, less organized nations may see increased activity from Chinese and Russian investors eager to capitalize on weaker regulatory environments. Either way, significant investments are coming.

8. Climate Cash or Crisis?

Climate change poses significant challenges to food security in Africa, necessitating adaptive strategies to ensure sustainable agricultural practices. Climate finance is increasingly viewed as the “new aid” for Africa, offering a pathway to address the continent’s climate challenges while promoting sustainable development.

Why it’s important: Africa faces significant climate-related challenges, including severe droughts, floods and food insecurity, which threaten livelihoods and economic stability. Traditional aid has been instrumental in addressing immediate needs but climate finance provides targeted funding to build resilience against climate impacts and support long-term adaptation strategies. Recent studies indicate that Africa requires a substantial increase in climate finance to meet its adaptation and mitigation goals. For instance, the Landscape of Climate Finance in Africa 2024 report reveals that climate finance flows to Africa grew by 48%, reaching $44B in 2021/2022, up from $30B in 2019/2020. However, this amount still represents only a quarter of the funding necessary to implement Africa’s Nationally Determined Contributions (NDCs) and achieve its climate goals for 2030.

What Africa may do: Develop Robust Climate Strategies - Formulate comprehensive national adaptation plans to attract and effectively utilize climate funds. Engage in International Negotiations - actively participate in global climate discussions to advocate for increased funding and favorable terms. Use their role as the president of the G20 to encourage investment and strengthening and promote private sector innovation, startups and investments. Attract private investments in green projects through incentives and supportive policies. Don’t ask for kickbacks and clear the way for approvals.

Our prediction: As global awareness of climate change intensifies, climate finance will become a central component of international aid to Africa. Nations that proactively develop and implement climate-resilient strategies are likely to attract more funding, facilitating sustainable development and reducing vulnerability to climate impacts. However, without adequate institutional frameworks and strategic planning, there is a risk that climate finance could mirror traditional aid inefficiencies, failing to deliver long-term resilience. The winners will see it as an opportunity and not just a crisis. They’ll encourage investment, innovation, startups and change - not handouts.

Read more: Landscape of Climate Finance in Africa 2024

9. Tech-Enabled Everything: Africa’s 4th Industrial Revolution

Africa is embracing the 4th Industrial Revolution (4IR) with advancements in AI, Blockchain, Fintech, IoT and other transformative technologies reshaping industries and societies.

Why it’s important: The 4IR is transforming Africa’s industries and societies, driving economic growth and creating innovative solutions to long-standing challenges. Africa’s AI market is projected to grow at a CAGR of over 28% through 2030, with applications in agriculture, healthcare and smart cities driving adoption. Mobile money platforms like M-Pesa, which accounted for over $800B in transactions in 2024, are evolving with AI-enhanced features like credit scoring and fraud detection. These advancements position Africa as a global tech innovation hub.

What Africa may do: Countries like Kenya and South Africa are leading blockchain adoption for decentralized finance (DeFi) and cross-border payments, while Nigeria is exploring stablecoins to mitigate currency volatility. Startups such as Zipline are leveraging IoT and AI-powered drones to revolutionize medical supply chains in Rwanda and Ghana. To fully capitalize on these opportunities, Africa must address infrastructure gaps, particularly in rural areas, by investing in subsea cables, satellite internet and affordable connectivity solutions.

Our prediction: In 2025, fintech will remain a leader in driving tech adoption, while applications of AI and IoT in agriculture, healthcare and logistics will gain momentum. Governments, startups and private sector players that focus on building digital infrastructure and fostering innovation will emerge as key players. While challenges like limited connectivity persist, the momentum of the 4IR will propel Africa toward becoming a major player in the global digital economy.

Read More:

Blockchain: Underpinning trust in Africa (Connecting Africa).

Africa 2025: Game On

Despite the recent naysayers (Economist: The Africa Gap), we believe 2025 holds incredible promise for Africa as the continent steps confidently into a new era of economic, technological and social transformation. From Ethiopia’s historic stock exchange launch to Côte d’Ivoire’s pivotal elections, South Africa’s leadership in the G20 and the rise of tech-enabled industries, Africa is positioned to be at the forefront of global conversations. With the 4th Industrial Revolution accelerating innovation and climate finance emerging as a new frontier for development, the opportunities are boundless for those ready to seize them.

The path forward requires focus, collaboration and strategic action. Governments must create enabling environments for startups and the private sector, investors need to think long-term and entrepreneurs must embrace their roles as ambassadors of a legitimate and respectable Africa. Africa’s youth, abundant resources and resilient spirit are its greatest strengths. If harnessed wisely, 2025 could mark the beginning of Africa’s defining decade, a time when the continent not only meets challenges head-on but transforms them into opportunities to lead the world.

We hope you enjoyed The Africa Brief! Share your ideas and your predictions here. Also, let us know what you are most interested to learn about in 2025. Let’s all get Africa Smart.

Reach out if you have ideas or feedback ([email protected]).