From high-speed highways to high-stakes finance, I think Africa’s momentum is undeniable. This week, we dive into why road quality leads to wealth, how fintechs are shifting from hype to sustainability and what France’s military exit means for security in the Sahel. Plus, Nigerian farmers are breeding climate-smart cows and a designer in Cairo is turning sailing into art.

Let’s get to it.

Africa Trivia

Which African startup joined the unicorn list at the end of 2024?

Graphic of the Week

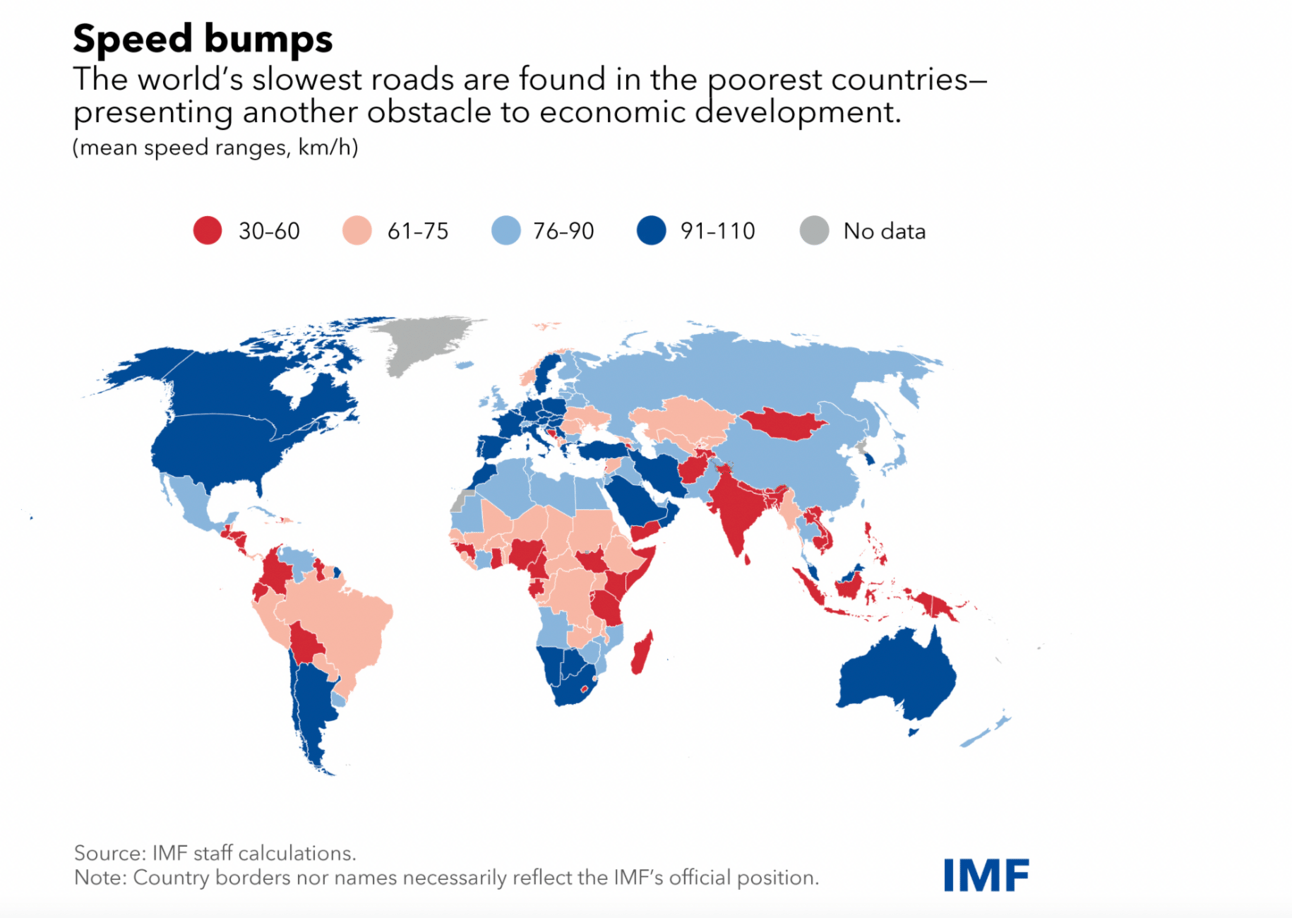

Speed >> Wealth

Source: IMF

Infrastructure matters! Duh. We all know it and yet it's fascinating to see a novel (to me) dataset back it up.

The Context: Not surprising–the world's fastest roads are found in richer economies like the U.S., Saudi Arabia and Canada, while the slowest are in developing countries.

Road quality is highly correlated with travel times and therefore easily measurable with Google Maps data.

After roadtripping in Morocco this week (and through many other countries on the continent), my experience lines up with that data.

Read more: IMF.

The Headlines

DRC urges the EU to cancel its minerals deal with Rwanda over allegations of rebel-backed smuggling and regional instability (Bloomberg).

Ethiopia: Addis Ababa is standardizing addresses to improve navigation services and emergency response through digital integration (The Ethiopian Herald).

Ghana: Inflation dipped to 23.5% in January (still far above the central bank’s 6% to 10% target), driven by slower non-food inflation, though food prices remain high (Reuters).

Guinea: Simandou’s iron-ore project aims to start production by December, expected to reach full capacity of 60 million tons annually within two years (Bloomberg).

Kenya’s internet advertising market is projected to be the fastest-growing in the world, expected to reach $365M by 2028, according to PwC (The Kenyan Wall Street); Safaricom applied to the Communications Authority of Kenya (CA) for approval to land and operate the country's first telco-owned submarine cable (TechPoint Africa).

Mauritius welcomes President Trump’s review of the UK-Mauritius Chagos sovereignty deal, as concerns grow over its impact on U.S. security and China’s regional influence (Reuters).

Mozambique: The UK is seeking legal advice on withdrawing $1.15B in funding for TotalEnergies' $20B LNG project due to security concerns and climate commitments (FT).

Rwanda: Coffee exports are set to recover in 2025 due to rising prices, increased farm gate rates and expanded production efforts (New Times).

South Africa: President Trump threatened to cut U.S. funding to South Africa over a 2024 land expropriation law (BBC).

Uganda begins testing of a vaccine for the Sudan strain of Ebola after a recent outbreak (BBC).

Zimbabwe: The UAE became Zimbabwe's top export partner, investing $1.4B since 2022 mainly in gold, real estate and trade, offering economic lifelines amid debt and currency struggles (Bloomberg).

Business & Finance in Africa

Financial Markets in Motion

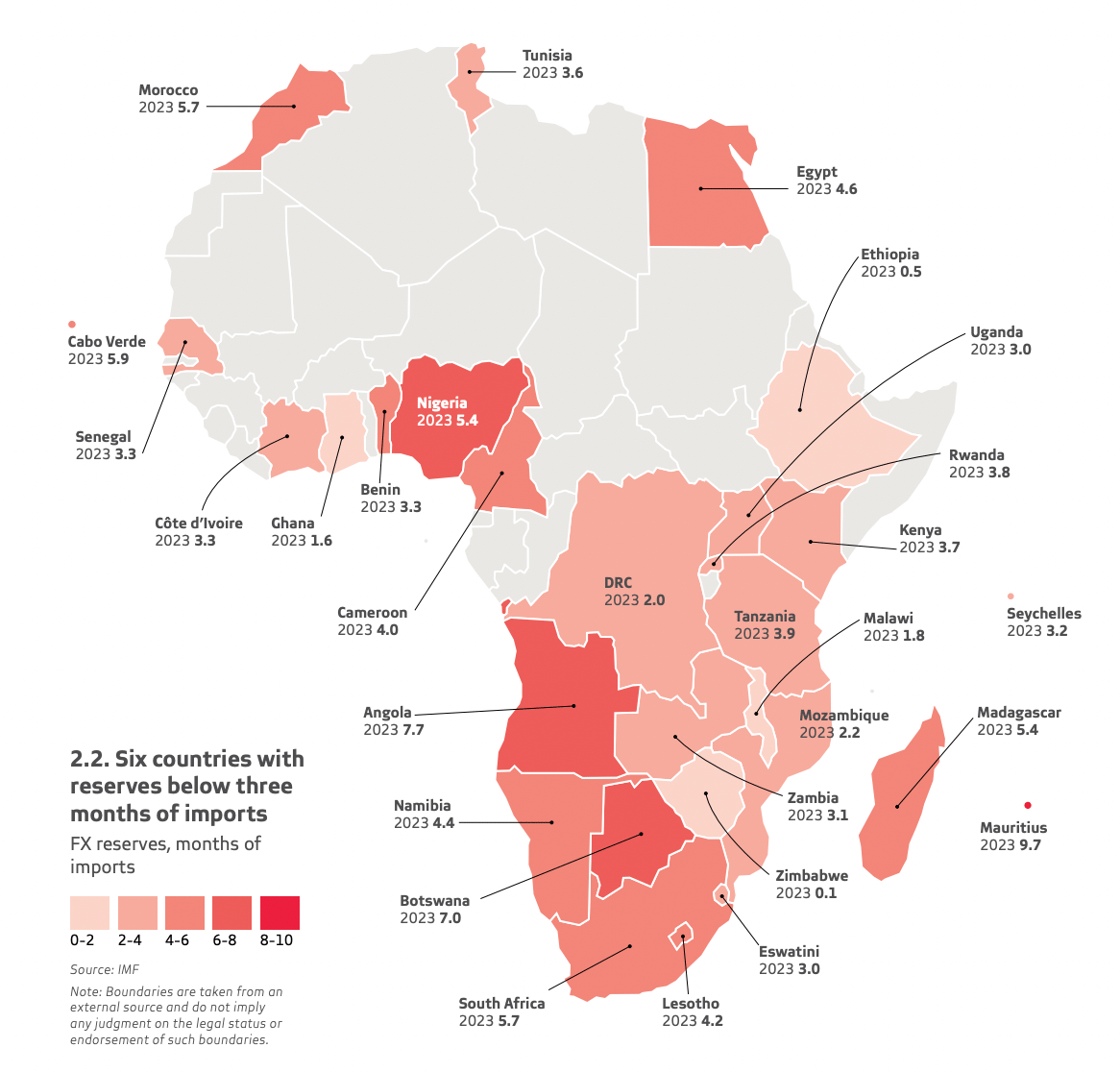

This report adds value: Absa Africa Financial Markets Index 2024. The graphic shows reserve challenges and countries the index covers. According to the report, “The widespread and long-term progress made in developing financial markets, despite the global shocks experienced in recent years, bodes well for Africa’s resilience and investment prospects.” Page 7 provides a really good summary of the most significant 2024 economic events in the markets the index covers. If you are working in more than one market on the continent, don’t miss this report.

Report Summary

South Africa leads Africa in overall financial market development (87/100), not just foreign exchange access.

Top 10 in FX access: South Africa, Madagascar, Mauritius, Kenya, Botswana, Egypt, Uganda, Morocco, Cabo Verde and Tanzania.

FX market reforms: Egypt, Ethiopia, Nigeria moved to market-driven currency regimes.

Biggest FX liquidity gains: Madagascar and Morocco.

IMF support: Boosted reserves in Ghana, DRC and Malawi.

Low reserves: Six countries, including Ethiopia and Zimbabwe, have under three months of import coverage.

Africa's FX market is shifting—some nations are improving liquidity, while others still struggle with convertibility risk.

Ethiopia's float and Zimbabwe's ZiG currency could reshape regional FX dynamics—if sustained.

Bottom 10 in FX Access: Ethiopia (41), Zimbabwe (33), Malawi (46), Mozambique (47), DRC (48), Tunisia (49), Senegal (50), Côte d'Ivoire (50), Benin (50), Eswatini (50).

For a full breakdown, check out: Absa Africa Financial Markets Index 2024.

Regulating the Hustle

Source: Renew Capital

The Big Picture: Across the continent, the increasing recognition of startups as vital drivers of economic growth is creating a more favorable atmosphere for entrepreneurship.

In Context:

The continental startup ecosystem is gaining traction, with some nations enacting or considering startup acts to promote innovation and entrepreneurship.

Tunisia was the first to pass a Startup Act (in 2018), followed by Senegal, Nigeria and Ivory Coast.

The laws often provide tax advantages, facilitated procedures and financial assistance to help startups gain traction. Currently Kenya, Ethiopia and Ghana are working on comparable frameworks.

Here's a quick rundown of startup act statuses:

Côte d'Ivoire adopted a Startup Act in November 2023 (ITC).

Egypt doesn't have a singular, comprehensive startup act like some other African countries but the government has implemented several initiatives and policies aimed at supporting startups and fostering innovation within the ecosystem (The Out).

Ethiopia: The Ethiopian Startup Act, also known as the Startup Businesses Proclamation, has been in draft format for several years and is yet to be officially enacted (Shega). Recent feedback dialogues that Renew Capital has participated in indicate formal adoption may come any day.

Ghana: The Ghanaian Innovation and Startup Bill project is a joint initiative by Ghana’s private sector and the Government to enhance the startup ecosystem through co-created legislation. The bill has been drafted but is yet to be ratified (Ghana Startup Bill).

Kenya: President William Ruto signed the Startup Bill in 2022 and is currently in the final stages of the legislative process (Kenyan Parliament). Rumors on the ground indicate that the startup community is not fully bought into everything that’s in the current draft. One example is the 100% Kenyan ownership requirement, as Kenya’s tech ecosystem owes much of its success to a blend of local expertise and foreign partnerships and investments.

Morocco: While there have been several initiatives aiming to support startups in Morocco, there is no official startup act yet (WeeTracker). Although there is no concrete release date of a startup act, the government is working on it as part of the Morocco Digital 2030 plan.

Nigeria: The Nigerian Startup Act was officially signed into law by President Muhammadu Buhari in October 2022 (Startup Nigeria).

Rwanda’s Startup Act was launched in 2021 with the aim of fostering innovation and entrepreneurship in the country. The law is at its final stages of completion (Afrikan Heroes).

Senegal: The Senegalese Startup Act was formalized in 2020 and ratified by President Macky Sall in 2021, paving the way for innovation and encouraging high-growth startups in the country (Government of Senegal).

South Africa: While South Africa doesn't have an official startup act yet, there's a strong movement pushing for its establishment, named The South Africa Startup Act Movement (South Africa Startup Act). This is being championed by a diverse set of founders, investors and policymakers who see the impact this will have in the ecosystem.

Tanzania: The Tanzanian Startup Policy is under development, aiming to address challenges faced by startups and foster innovation (The Citizen).

Tunisia: The Tunisian Startup Act, launched in April 2018, was designed to support and foster the growth of the country's startup ecosystem (Startup Tunisia). In practice, challenges remain—startups struggle with foreign currency restrictions and slow regulatory processes. There’s quiet talk of a potential revamp of the act but nothing is official.

Uganda: Startup Act Uganda is a collaborative effort between the Ugandan tech startup ecosystem, Private Sector Foundation Uganda (PSFU) and Mastercard Foundation. It is still under discussion and hasn't been drafted yet (All Africa).

Zambia: A startup bill is under development by the government, focusing on creating a supportive environment for innovation and entrepreneurial ventures (ZANIS). And from experience we know they are reaching out to stakeholders in the ecosystem for feedback!

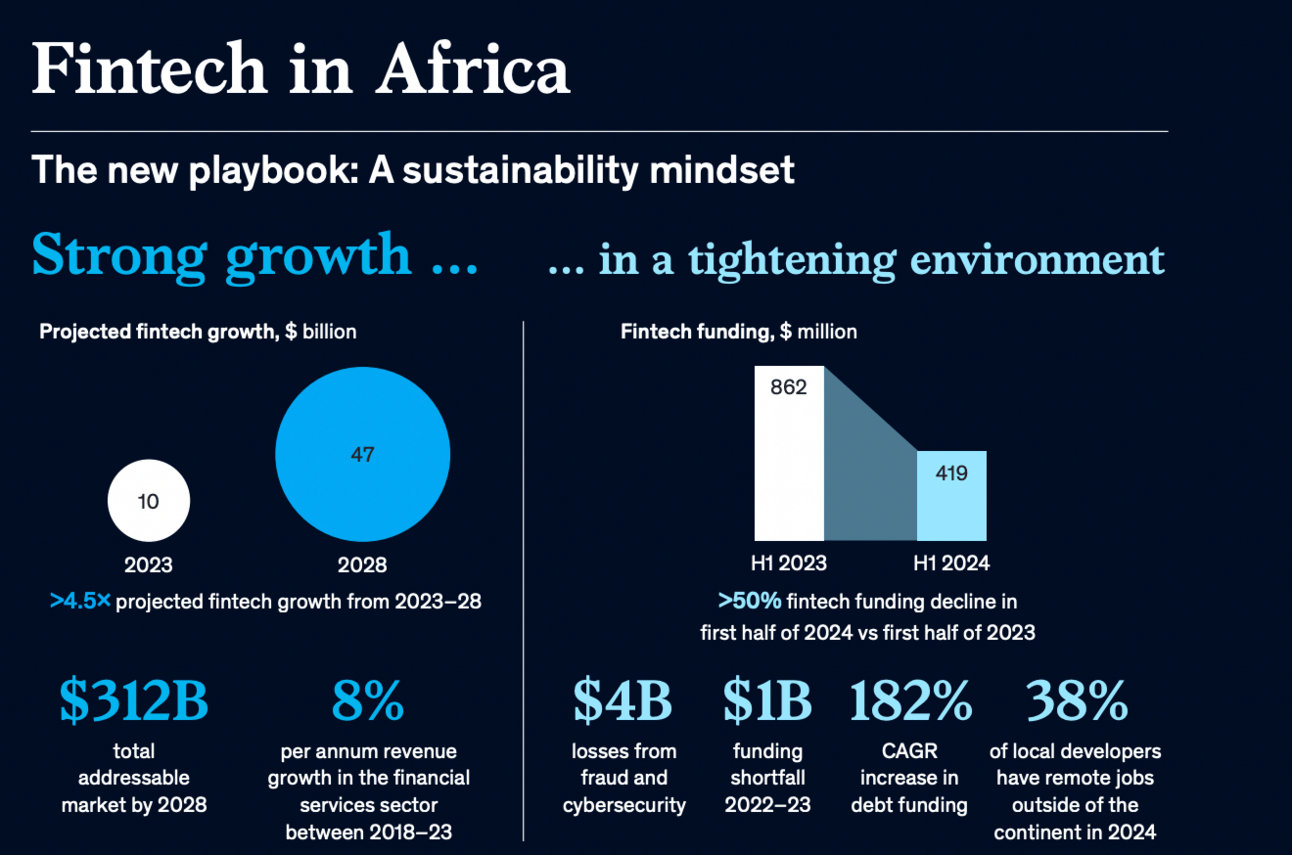

Africa’s Fintech Shift

Source: McKinsey

Another good report, this one by McKinsey.

The Highlights:

Africa’s fintech industry is maturing, shifting from rapid expansion to sustainability-focused growth.

Funding squeeze—fintech funding dropped 51% in H1 2024 vs. H1 2023.

Top players survive—fintechs with clear paths to profitability and diversified revenue streams stand out.

Market consolidation—M&A is increasing as startups merge or shut down under capital pressure.

Regulatory shifts—cross-border payments, AI and cybersecurity are shaping fintech’s next phase.

Why It Matters

The old growth-at-all-costs model is fading—profitability now rules.

Africa’s financial services market could hit $312B by 2028, with fintech revenue growing nearly 5x to $47B.

Investors are cautious but fintechs that are integrating into new sectors (health, logistics and energy) show promise.

The best fintechs are focusing on value creation, vertical expansion and policy engagement to stay ahead, though the fragmented regulatory landscape remains a challenge.

Read more: Redefining Success: A New Playbook for African Fintech Leaders (McKinsey – January 2025).

Climate in Africa

Hot Cows, Cool Milk

Source: Bloomberg

The Story: Nigerian farmers are breeding a new generation of heat-resistant Girolando cows to withstand tropical temperatures and produce more milk. They are importing bull semen from the heat-resistant Girolando breed from Brazil.

The Context: The goal is to increase the supply of animal protein to a continent where the population is growing rapidly but remains price sensitive. African cows make up only 4% of global milk production and contribute to about a tenth of enteric methane emissions.

An interesting approach to combat climate change: Two Girolando cows vs four local cows (Bloomberg).

Europe in Africa

France Ghosts Africa

Source: The Economist

What Happened

France is ending its military presence in West Africa, closing all bases except Djibouti by 2025. The move signals a major shift in France’s ties with its former colonies. The decision follows worsening relations, especially after Mali hired Russia’s Wagner Group in 2022.

Sahel power shift: Mali, Burkina Faso and Niger formed the Alliance of Sahelian States (AES) to counter ECOWAS.

French troops will be reduced to a small rotating force, reporting to a new Africa command in Paris.

Why It Matters

Ends France’s post-colonial military footprint, once seen as neo-colonial overreach.

Leaves a security vacuum—who fills it? Russia, China or regional forces?

Signals a "normalization" of France-Africa ties but future influence remains uncertain.

Explorations in Africa

Nile Beauty Sails On

I have a deep-seated belief that beauty can change the world. Once again this week, FT brings us a slice of Africa’s incredible beauty, this time from Egypt’s magical Nile River.

The story…

Goya Gallagher is an entrepreneur and artist whose journey blends adventure with a deep appreciation for history, culture and design. She founded the lifestyle brand Anūt Cairo, which celebrates Egyptian culture through locally made products like linens, pottery and glassware.

Her journey is closely tied to her boat, Nanusa, which she designed by incorporating elements from ancient Egyptian art and architecture.

Now she’s offering sailing residencies to artists. Sign. Me. Up.

Read more: FT.

Africa Trivia Response

Answer: A) Moniepoint. Read More: Africa: The Big Deal.

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too!

Email us at ([email protected]) if you have some scuttlebutt we should follow up on.