The 2025 season of dense but important reports continues, and we have several short summaries to help decode Africa’s macro landscape. For one, IFC’s latest analysis shows its emerging market equity investments outperformed public markets by 16% over six decades. Plus, WSJ takes a deep dive into Africa’s most enigmatic billionaire, Aliko Dangote, and his $20B oil refinery gamble—a project poised to transform Nigeria’s energy sector if he can outmaneuver the system. Meanwhile, the Field Museum’s "Africa Fashion" exhibition puts the continent’s global style influence in the spotlight. Let’s dive in.

Africa Trivia

Who is currently the longest-serving president in Africa?

Graphic of the Week

Accelerators or Illusions?

Source: IFC

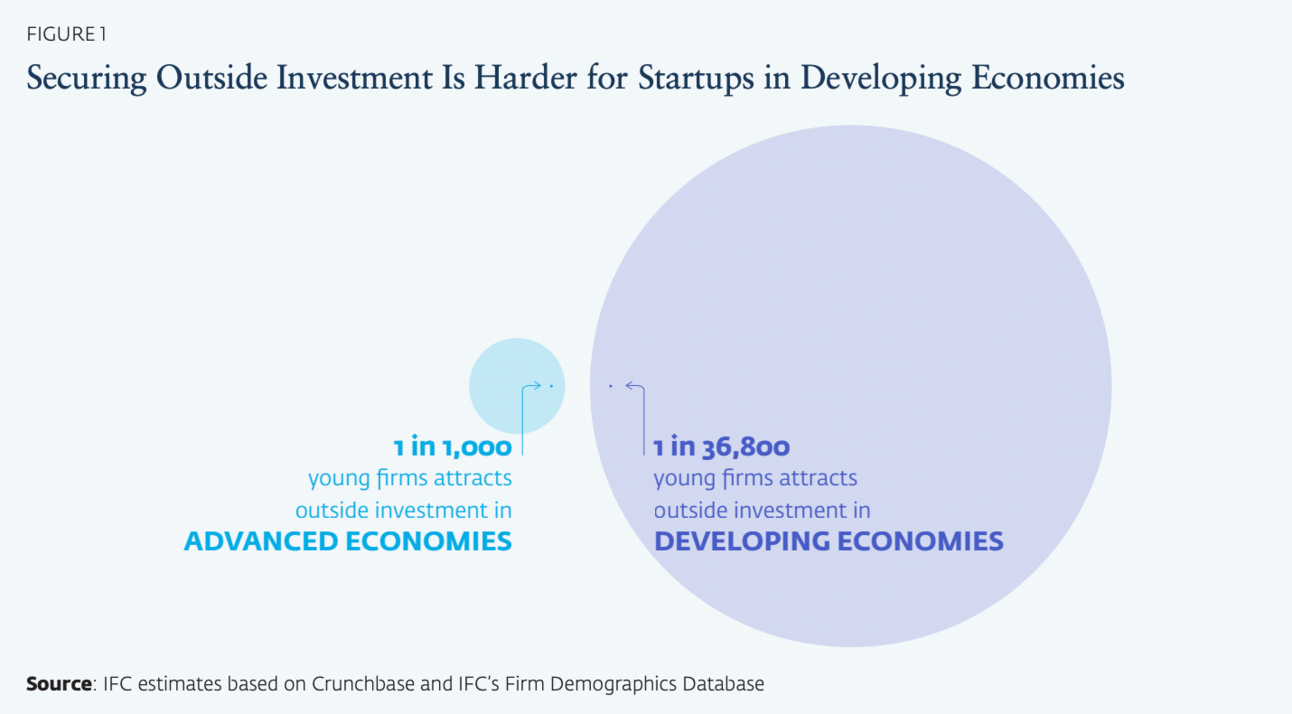

Those are rough numbers. I am skeptical of some accelerator models but an IFC report has some compelling numbers. It says that business accelerators in emerging markets can significantly enhance startup success. Research indicates that accelerated startups are more likely to secure venture capital, with 44% obtaining follow-up investments in high-income countries, compared to 34% in developing countries. Additionally, these startups experience revenue growth rates 2.7 times higher than their non-accelerated counterparts. Accelerators provide critical mentorship, networks and funding, effectively bridging gaps in business environments and fostering economic development.

What We Are Reading

Africa faces a health funding shortfall due to reduced U.S. aid, but addresses it through external support from China and South Korea, the newly established African Epidemic Fund and efforts to boost local vaccine manufacturing (Bloomberg); All African countries excluded from the updated U.S. 2025 Visa Waiver Program (VWP) (Imperial Citizenship).

Algeria's Sonatrach signed an $850M hydrocarbon development deal with China's Sinopec (Reuters).

The Democratic Republic of Congo suspended cobalt exports for four months to address oversupply and falling prices, a move expected to impact global markets (Bloomberg).

Kenya: Received 17 critically endangered mountain bongos from a U.S. conservation center as part of efforts to restore the species (BBC); BII has committed $100M to KCB Bank Kenya to support climate-focused projects and women entrepreneurs to drive green growth and financial inclusion (Weetracker).

Malawi's traders blocked Parliament in Lilongwe, protesting high living costs as inflation stayed above 20% before the budget speech and elections (Bloomberg).

Morocco: Hyundai Rotem secured a $1.54B contract to supply double-decker trains to Morocco's state-owned rail operator ONCF (Reuters).

Mozambique extended a VAT exemption on essential goods to ease consumer burdens and curb inflation-driven protests following post-election unrest (Bloomberg).

Namibia is facing severe food insecurity due to a prolonged drought that has disrupted farming, depleted food reserves and left over 40% of the population reliant on state aid and imports (Bloomberg).

Nigeria's museum commission will retrieve artifacts from Europe (that originated in southern Nigeria) known as the Benin Bronzes to restore cultural heritage (Reuters).

Senegal reassured investors by ruling out debt restructuring, leading to a bond market surge, while exploring alternative financing and energy subsidy reforms (Bloomberg).

Sudan: The army ended a nearly two-year siege by the Rapid Support Forces (RSF) on the key city of el-Obeid, marking a significant military advance amid the ongoing war that has displaced millions and devastated the country (BBC).

South Africa is seeking compensation from Google and Meta for their use of local news content, potentially amounting to millions in payments to publishers (Bloomberg).

Zimbabwe's mandate for companies to report in ZiG has raised concerns over hyperinflationary accounting, regulatory challenges and increased business costs amid the currency's instability (Bloomberg).

Economics in Africa

Africa’s Slow Climb

I’m in learning mode this week in Abidjan—my first time visiting the seat of the AfDB. As I dive into the city’s energy and influence, this weighty 2025 report landed on my desk. It’s worth a scan—but in case you just want the summary, here it is:

Africa’s economic growth remains fragile amid global and domestic challenges.

AfDB projects real GDP growth to rise from 3.2% in 2024 to 4.1% in 2025 and 4.4% in 2026, still below the 7% needed to reduce poverty.

Inflation, high debt and geopolitical instability continue to erode economic gains.

Regional Growth Disparities

East Africa leads, with 5.3% growth in 2025.

South Sudan is projected to be the world’s fastest-growing economy, rebounding from -26.4% to 27.2% due to resumed oil production.

West Africa is expected to grow at 4.6%, driven by oil and gas investments in Senegal and Niger.

North Africa will expand to 3.9%, fueled by economic rebounds in Libya, Egypt, and Morocco.

Southern Africa is set for 3.0% growth, signaling a modest recovery.

Central Africa is projected to hold steady at 4.0% growth.

Debt and Inflation Concerns

Debt-to-GDP ratio at 60% (2024), with 9 countries in debt distress and 11 at high risk.

Inflation remains high, averaging 18.6% in 2024 and projected to decline to 12.6% in 2025 to 2026.

Fiscal deficits remain a challenge, worsened by global shocks and structural weaknesses.

AfDB's Key Recommendations

Coordinated monetary and fiscal policies to curb inflation.

Investment in productive infrastructure to drive innovation.

Strategic debt restructuring to prevent defaults.

Stronger economic governance to improve domestic resource mobilization.

While Africa’s growth outlook is improving, bold structural reforms and investments will be essential for long-term sustainability.

Dangote’s Refinery Gamble

Source: WSJ

In an interesting piece by the WSJ, Africa’s richest man, Aliko Dangote, is once again making headlines. His $20B Dangote Petroleum Refinery is his biggest bet yet—but Nigeria’s oil politics aren’t making it easy.

The vision: Dangote, worth $28B, sees himself as Africa’s Rockefeller, determined to transform the continent by building, not just exporting.

The refinery: The largest in Africa, capable of refining 650,000 barrels per day, enough to exceed Nigeria’s fuel needs by 150%.

The problem: The government-owned NNPC isn’t supplying enough crude, forcing Dangote to import oil in dollars while selling fuel locally in a collapsing naira.

The stakes: Dangote quintupled his group’s revenue to $30B, but corruption and bureaucracy threaten long-term gains.

The reality: Despite its promise, the refinery hasn’t lowered fuel prices as expected—Nigeria’s oil "mafia" plays by different rules.

Dangote’s takeaway? He wouldn’t build another refinery: "I would think twice." Read more:WSJ

IFC's Equity Outperformance

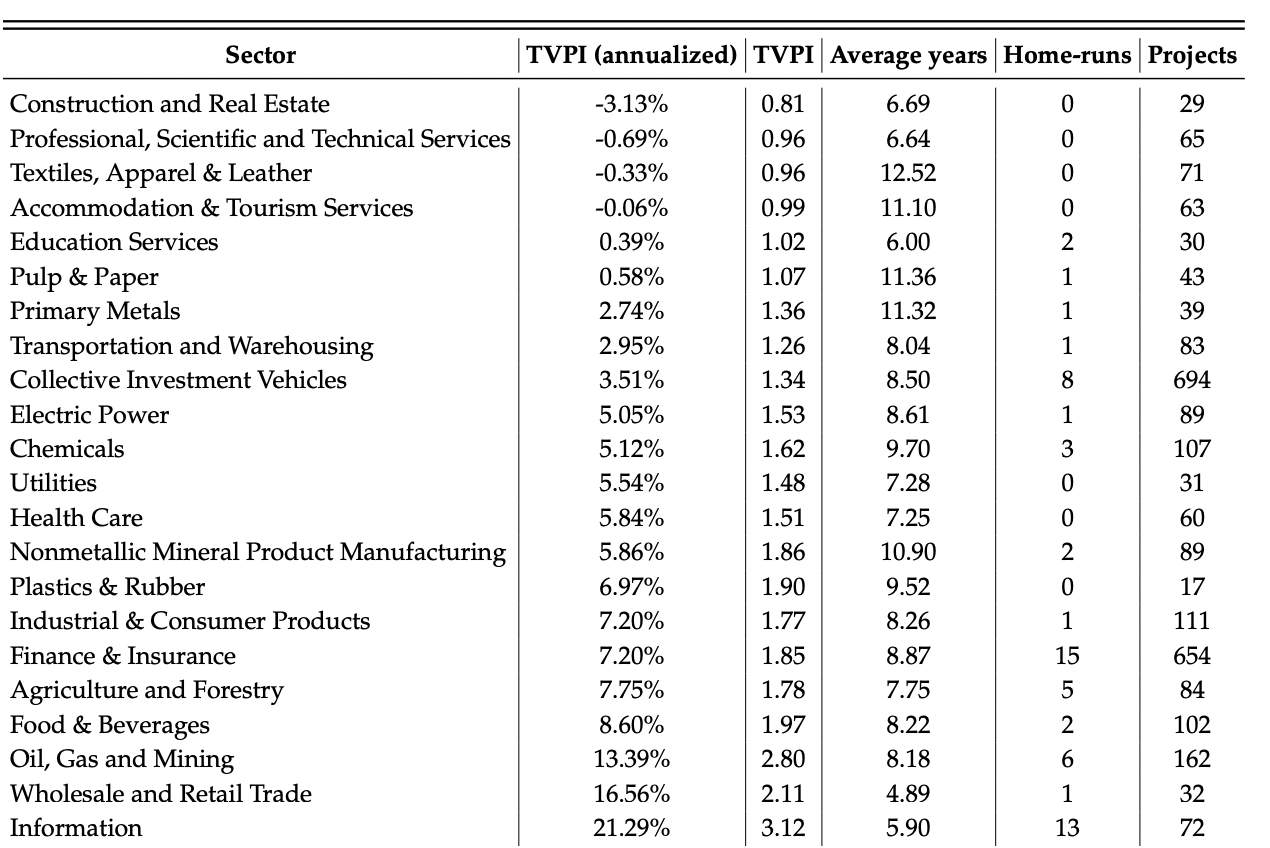

A recent analysis of the International Finance Corporation's (IFC) equity investments in emerging markets over the past six decades reveals key insights into private equity returns in emerging markets and developing economies (EMDEs):

Outperformance: On average, IFC's equity investments have yielded returns 16% higher than public market benchmarks, such as the MSCI Emerging Markets Index.

Sector Variability: Sectors like technology and finance have demonstrated particularly strong performance, while others show more modest returns.

Firm-Specific Dominance: Firm-specific factors account for approximately 83% of return variability, surpassing the influence of country (6.5%) and sector (4.3%) factors.

Macroeconomic Influences: Real exchange rate depreciation negatively impacts returns, with a 10% depreciation leading to a 6.71 percentage point decrease in median returns. Conversely, GDP growth positively correlates with higher returns.

Investment Characteristics: Direct investments exhibit a wider range of returns, including more "home run" outcomes, compared to fund investments, which offer more stable returns.

And while the report includes investments from all the emerging markets of the IFC, the firm matters much more than the country! Read more: Mapping Returns of Private Equity Investments in Emerging Markets (World Bank).

Tech & Society in Africa

Democracy's Youthful Skeptics

Source: The Economist

I hope the world starts paying attention to Africa’s youth in a meaningful way. The Economist generation hustle series continues…

“Unlike everywhere else in the world, young people across the continent are no more likely to be in salaried jobs than their parents, even though they are better educated…In 2024 the Africa Youth Survey…found that 60% of young Africans think “Western-style democracy” is not a good fit for their countries. ‘I shocked myself by having the thought that maybe we just need a [Paul] Kagame,’ says the Ugandan civil-society worker, talking of Rwanda’s autocratic president. Youngsters fed up with collapsing infrastructure are impressed by Mr Kagame’s apparent effectiveness in improving things like access to household electricity. With no memory of the region’s most brutal military regimes, some have even cheered military coups.”

Africa’s Urban Trends

Jeffrey Paller’s piece titled "Five Trends that will Shape Urban Africa in 2025," offers his thoughts on the key factors influencing the continent's urban development. For those who’ve been to Addis Ababa in the past six months, you’ll likely agree that the transformation there could rub off on other African leaders. And while painful, it’s undeniable that the city does look much better these days.

Explorations in Africa

African Fashion's Global Ascent

Source: Field Museum

African fashion is increasingly influencing global trends, with designers and artists from the continent gaining international recognition. The late Virgil Abloh, for instance, made history as Louis Vuitton's first Black artistic director for menswear, leaving a lasting impact on the fashion industry (People.com).

In 2025, Africa Fashion International (AFI) became the first African partner of The Met Gala, underscoring the continent's growing prominence in the global fashion scene (Africanfashioninternational.com).

According to Statista, the Apparel market in Africa is expected to reach approximately $73.59B in 2025, with an annual growth rate (CAGR) of 4.77% from 2025 to 2029 (Statista.com).

Today the Africa Fashion exhibition at the Field Museum in Chicago opens with 180 pieces from 20+ African countries. The event celebrates the impact of African fashion worldwide (Field Museum). There are some great fashion events on the continent this year and it looks like as African designers continue to blend traditional aesthetics with contemporary styles, the continent is poised to lead and redefine global fashion trends.

Africa Trivia Response

Answer: B) Paul Biya - Cameroon

Read more: Visual Capitalist.

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too!

Email us at ([email protected]) if you have some scuttlebutt we should follow up on.