Africa is the center of gravity in my world, even if Washington still hasn’t caught up. To me the opportunity speaks for itself. This week we see that China is locking up minerals, capital is flowing but unevenly, and great powers are colliding across the Sahel, the Red Sea and beyond. From Morocco hosting AFCON to Ethiopia chasing sea access to Mozambique climbing governance rankings, Africa is shaping global energy, security and supply chains in real time and too many outsiders are still playing catch-up.

Did You Know?

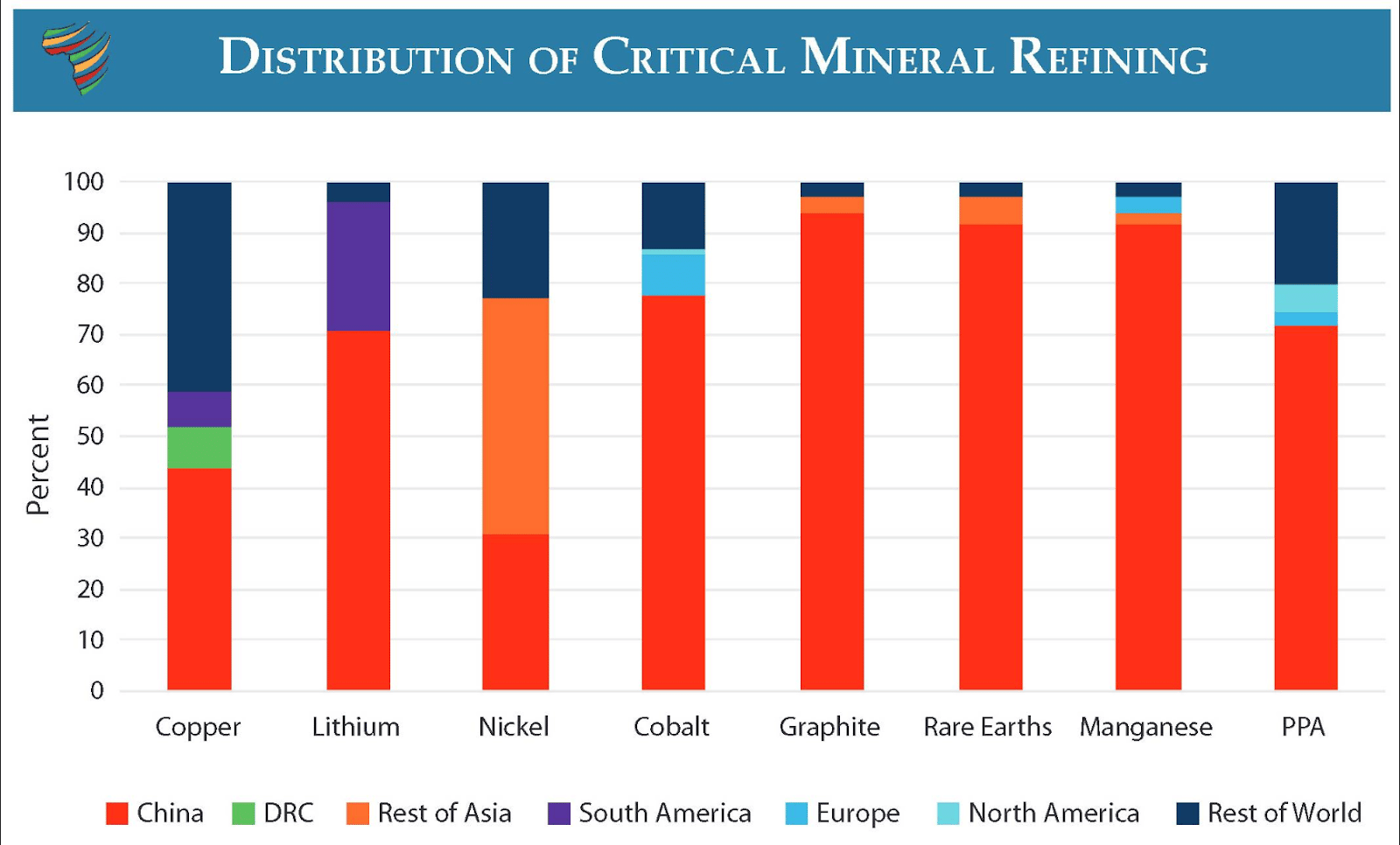

China processes 87% of the world’s critical minerals.

Graphic of the Week

Mineral Power Play

China controls the critical minerals that run EVs, AI, defense and clean energy. Think 87% of refining, 70% of rare earths and a buying spree across Africa’s lithium, cobalt, copper and nickel belts.

What’s Happening

Chinese state-owned enterprises grab mines, fund rail and port corridors and lock in offtake agreements.

BYD secured six African lithium mines through 2032.

Chinese banks pushed $24.9B in mining loans in the first half of 2025.

Why it Matters

Africa holds the minerals but stays stuck at the bottom of the value chain.

Toxic spills, weak oversight and opaque resource-backed loans deepen the gap.

At least 13 countries are now restricting raw exports to capture more value.

The question: Can Africa turn mineral wealth into power before China locks in the future? Read more: Africa Center for Strategic Studies

Africa Trivia

According to local tradition, what ancient Christian artifact is located in the church of St. Mary of Zion in Aksum, Ethiopia?

A) Ark of the Covenant

B) Burial Shroud of Jesus

C) True Cross

D) Holy Grail

What We Are Reading

Africa: Extremist groups are merging across the Sahel and Nigeria, creating a vast insurgency corridor and driving record violence as state capacity weakens (Bloomberg).

Angola: Corporacion América Airports won a 25-year bid to run Angola’s new $3B Luanda airport, beating a Chinese rival (Bloomberg).

Benin: Nigeria and ECOWAS troops intervened to stop a failed coup against President Talon, raising investor concerns ahead of April elections (Bloomberg).

Burkina Faso: Eleven Nigerian military officers were briefly detained after their aircraft made an emergency landing, sparking an airspace dispute (BBC Africa).

Côte d’Ivoire: President Ouattara was sworn in for a fourth term after winning the October election amid low turnout (AP News).

Egypt: Defense firms showcased drones and counter-drone technology at EDEX expo as Egypt aims to become a regional military manufacturing hub (Reuters).

Ethiopia: The country’s drive for big projects and Red Sea access is escalating regional tensions even as internal conflicts and rising poverty undermine Prime Minister Dr. Abiy’s development ambitions (AP News); IMF reached staff-level agreement on a $3.4B lending program, unlocking $261M pending board approval (Reuters).

Ghana: GDP growth slowed to 5.5% in Q3 as industry and services cooled, while inflation eased to 6.3% (Bloomberg).

Guinea-Bissau: The military junta enacted a 12-month transitional charter barring the interim president and prime minister from the next elections (Reuters).

Kenya: Airtel Money rose to 10.3% market share as M-Pesa slipped below 90% for the first time, signaling growing competition in mobile money (The Kenyan Wall Street).

Mali cleared $554M in domestic arrears after recovering $1.6B from mining companies under its new mining code (Bloomberg).

Morocco announced plans for a nearly $1B LNG import hub at the Nador West Med port to boost gas supply and reduce reliance on dirtier fuels (Bloomberg); New businesses rose 17.5% in the first eight months of 2025, far outpacing company closures (Morocco World News); A new measure allows exchange offices to accept international bank cards for foreign currency purchases and issue dirham-loaded cards (Morocco World News).

Nigeria: Aliko Dangote’s foundation pledged ~$800M to fund STEM education, girls’ schooling and teacher training for 1.33 million students over the next decade (Bloomberg).

Mozambique jumped 20 spots in the Basel AML Index, signaling progress in anti-money-laundering, transparency and governance reforms (360 Mozambique).

South Sudan: Rebels seized Heglig oil hub but exports continued amid uncertainty over future flow (Bloomberg).

Tanzania kept Independence Day calm by locking down Dar es Salaam and deploying security forces to deter protests after October’s deadly election unrest (Reuters).

Uganda: The U.S. agreed to a $1.7B health financing deal with Uganda tied to boosting local health spending and expanding disease-tracking and digital medical record systems (Bloomberg).

The Zimbabwean government announced its plan to begin constructing a 600-megawatt floating solar project on Lake Kariba in 2026 (Bloomberg).

Business & Finance in Africa

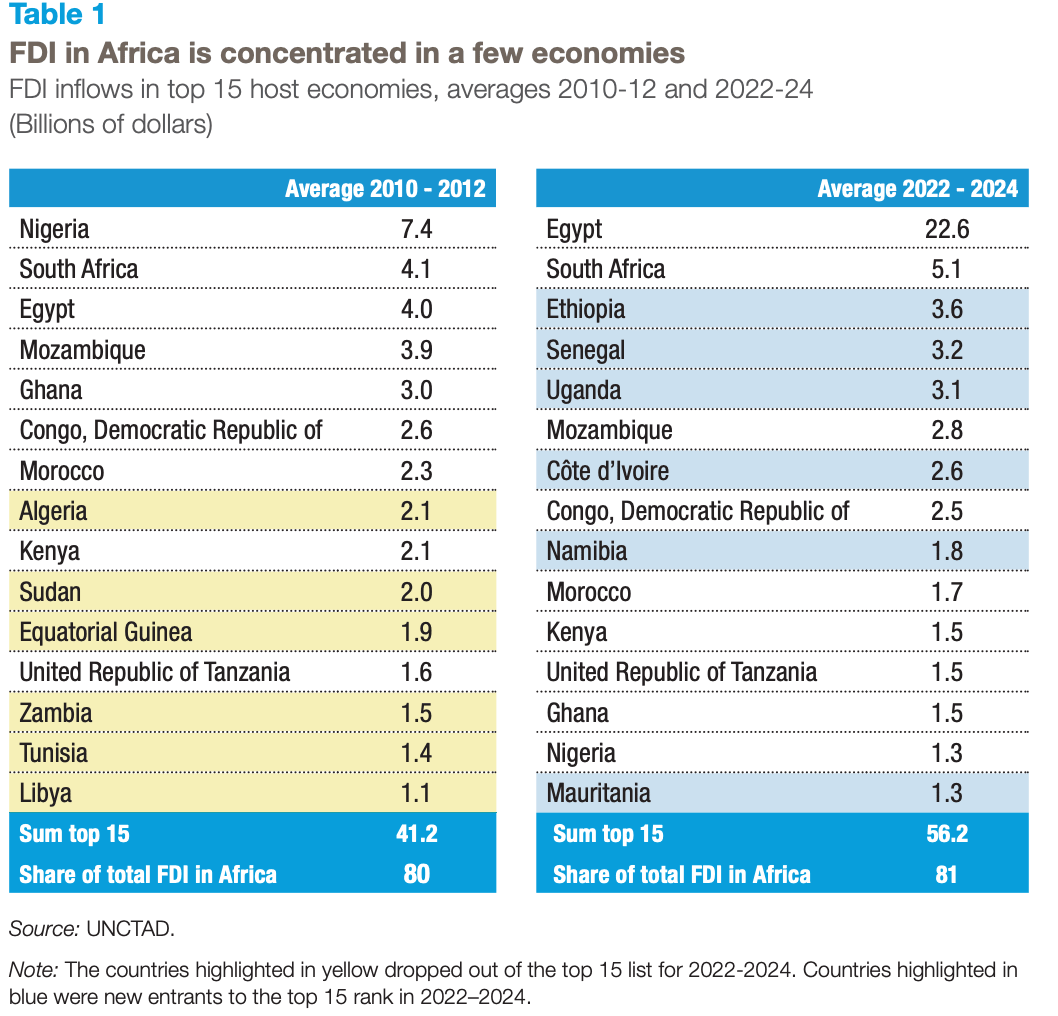

Africa’s FDI Reality

Source: UNCTAD

UNCTAD’s 2025 Investment Trends Monitor shows Africa attracting more capital but still trapped by costly financing and uneven growth.

What Happened

FDI into Africa rose about 75% last year, but most of it went to a small group of countries.

28 of 29 rated African countries remain sub-investment-grade, with many paying interest rates higher than their GDP growth.

New hotspots like Ethiopia, Senegal, Uganda, Namibia and Mauritania are drawing more investment into renewables and digital services.

Why It Matters

High borrowing costs make it hard to build the infrastructure and industries Africa needs to compete.

Concentrated FDI means most countries are still stuck exporting raw goods, not moving up value chains.

Without cheaper finance and stronger institutions, Africa risks missing the upside of shifting global supply chains even as investor interest grows.

Read more: UNCTAD

Source: UNCTAD

Africa’s Capital Squeeze

Source: BCG

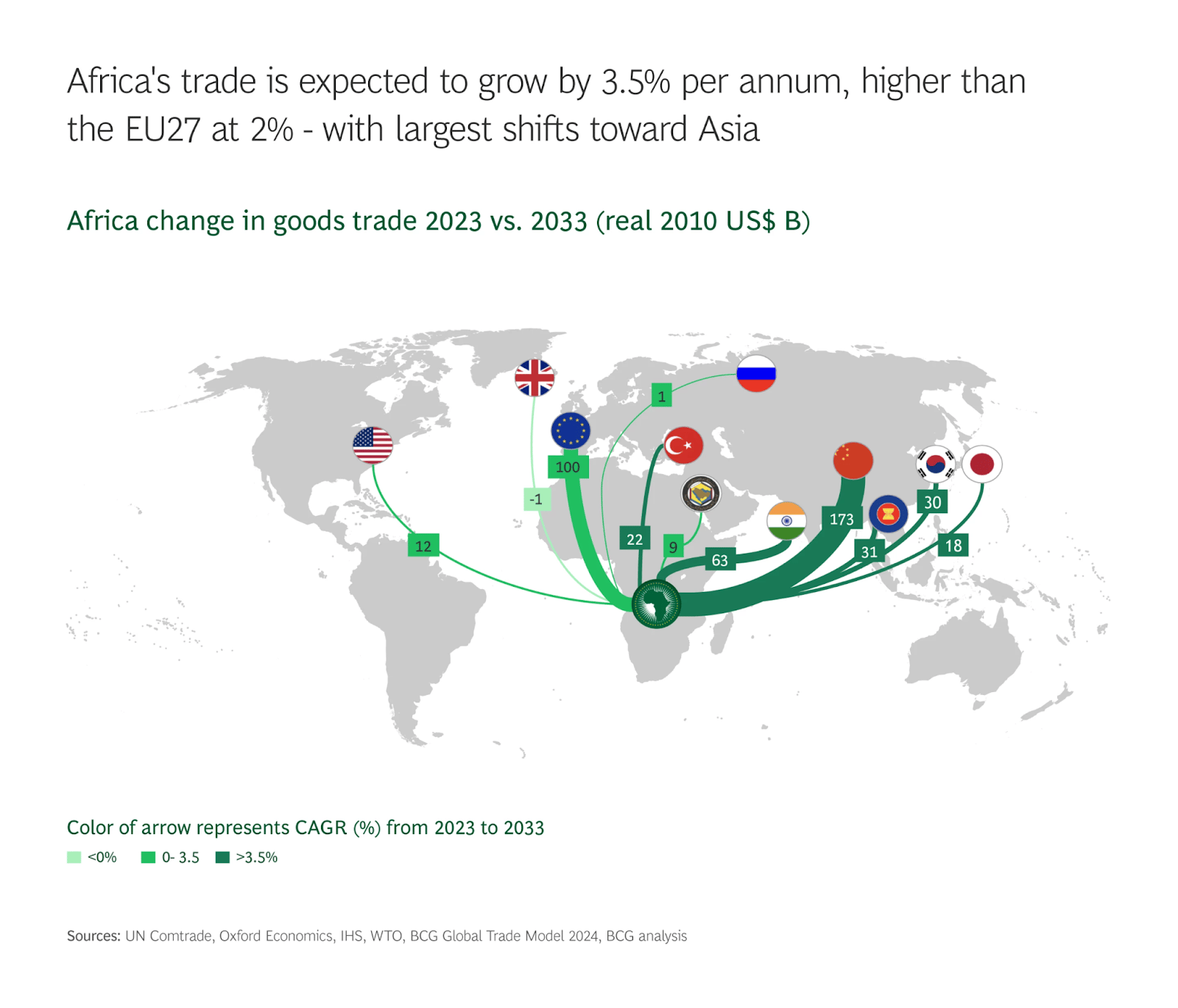

BCG’s new Africa Unleashed report says what we all know. The continent faces rising geopolitical shocks, shrinking aid and higher debt costs just as trade shifts accelerate toward China and Asia. Yet FDI resilience and strong long-term fundamentals show Africa can still shape the next decade.

The Overview

FDI has grown 10% a year since 2019, with renewables driving 56% of recent greenfield flows.

Tariffs, falling aid and debt stress are tightening capital: Africa has $539B available vs. $1.3T needed by 2030.

Africa-China trade is set to expand by $173B by 2033, deepening import-heavy dependencies.

Business leaders are uneasy: 77% say geopolitical tensions are high and 66% feel direct impact.

Why It Matters

Capital is getting more expensive and less available just as Africa needs to industrialize and compete.

Trade shifts risk locking Africa into raw-material roles unless export capacity and value addition grow.

AfCFTA remains the biggest lever, but delivery, not design, will determine whether Africa captures global supply chain shifts.

Read more: BCG Note: Africa’s FDI picture is consistent across this and the UNCTAD report: UNCTAD captures last year’s 75% spike, while BCG shows a steadier 10% growth trend since 2019.

U.S. Missing Africa

Source: BCG (Same report as above! Great graphics)

I shake my head about this virtually every day, watching Africa’s opportunities surge while the U.S. still treats the continent as an afterthought. This week in Bloomberg, Hal Brands writes that Africa is now the arena where global power plays collide: Russia pushes for a Red Sea base, China builds influence through trade and infrastructure, Middle Eastern states export their rivalries, and India and Europe scramble for minerals and markets. With a growing middle class, huge energy reserves and the world’s fastest-growing population, Africa is shaping the future, yet Washington keeps lagging as others move fast. If you are a longtime reader of the Brief, this is nothing new to you.

Why It Matters

Africa is central to global energy, supply chains and demographics.

Great powers and middle powers are gaining ground while the U.S. plays catch-up.

A multipolar world will be shaped in places like Djibouti, Congo, Sudan and the Sahel, not just in Washington and Beijing.

Read more: Bloomberg

Explorations in Africa

AFCON Fever Starts

Source: ESPN

One of Africa’s biggest tournaments, Africa Cup of Nations, kicks off Dec. 21 in Morocco, with the hosts facing Comoros in Rabat. Twenty-four teams will battle through six groups, a round of 16 and single-leg knockouts until the Jan. 18 final. And it will all be good preparation for co-hosting the World Cup in 2030!

What to Know

Format stays the same: top two in each group advance plus four best third-place teams.

Rabat hosts the opener and the final across four stadiums.

Six host cities, including Casablanca, Tangier, Marrakech, Fes and Agadir.

The Groups

A: Morocco, Mali, Zambia, Comoros

B: Egypt, South Africa, Angola, Zimbabwe

C: Nigeria, Tunisia, Uganda, Tanzania

D: Senegal, DR Congo, Benin, Botswana

E: Algeria, Burkina Faso, Equatorial Guinea, Sudan

F: Ivory Coast, Cameroon, Gabon, Mozambique

Read more: ESPN

Africa Trivia Answer

Answer: A) Ark of the Covenant. Source: Britannica

I am newly arrived in the U.S. and excited for the holidays. Heads up that the Africa Brief will be taking holidays on Dec. 26 and Jan. 2. In the meantime, take a look back at last week’s graphic on Harbors on the Move, and email us at [email protected]. Happy holidays!