From billion-dollar port wars in Djibouti to cocoa beating Bitcoin, this week’s news proves the point: Africa doesn’t follow anyone’s script and the headlines only scratch the surface. Gold's up, inflation’s down (for some) and Kenya’s cutting deals in China while the Ivorian opposition’s presidential bid hits a nationalist snag. Behind the global AI boom? Invisible African labor. Behind your Easter chocolate? A challenging supply chain. Scroll on for the deeper context shaping this moment in Africa.

Africa Trivia

For our avid readers, which country did the IMF predict to have the fastest-growing economy in 2025, as mentioned in our last newsletter?

Graphic of the Week

Africa’s Billion-Dollar Club

Source: McKinsey and Company

Africa is home to at least 345 companies generating $1B+ in annual revenue, producing a collective of more than $1T. About 230 are homegrown, often founded by local entrepreneurs, and 52 are state-owned. While they span all sectors, 70% of revenue comes from just six: oil and gas, mining, retail, financial services, manufacturing and telecom. But the landscape isn’t uniform, 40% of these giants are based in South Africa, far outpacing countries like Nigeria (6.7%) and Egypt (9.6%), despite their large economies. Countries like Kenya and Ethiopia host a few big firms, perhaps due to smaller market size and weaker corporate ecosystems. Foreign-owned firms make up almost one-third of large firms, shaping key markets yet often disconnected from local economies.

Read more: Reimagining Economic Growth in Africa - McKinsey and Company (note: data based on available 2023 figures, hopefully new data comes out soon).

What We Are Reading

African funds raised $4B in 2024—double the year before—as local investors stepped up to fill a VC gap and fuel a maturing private capital market across startups and infrastructure (Bloomberg); Surging gold and falling oil prices are giving African nations like Ghana and South Africa a rare relief, easing inflation and supporting currencies (Bloomberg); Despite record cocoa prices, West African farmers see little benefit due to fixed pre-sale rates, poor harvests and limited recovery funds (Bloomberg).

DRC will prosecute ex-President Kabila for allegedly aiding M23 rebels after he entered rebel-held Goma from Rwanda (Bloomberg).

Egypt cut interest rates by 225 basis points to 25% to boost investment and ease debt costs, as inflation slowed to 13.6% (Bloomberg).

Côte d’Ivoire’s court ruled that Tidjane Thiam, former CEO of Credit Suisse, is ineligible to run for president due to his dual Ivorian-French nationality (AP News).

Kenya is set to overtake Ethiopia as East Africa’s biggest economy in 2025, with the IMF projecting Kenya’s GDP at $132B versus Ethiopia’s $117B after the birr’s sharp devaluation (Bloomberg); Kenya inked a $970M deal with China during President Ruto’s visit, securing major investments in manufacturing, agriculture and tourism to fuel its Bottom-Up Economic Transformation Agenda (Citizen Digital); Kenya reduced its tax revenue target by 3% and increased borrowing forecasts following protests that disrupted the economy (Bloomberg).

Mozambique launched a $2B Petrochemical City project in Inhambane to boost industrialization, create 10,000 jobs and add $1.1B to the economy (360 Mozambique).

Nigeria will offer 10 to 20-year tax credits to firms investing in key sectors like agriculture, energy and manufacturing to boost growth and attract big-ticket investments (Bloomberg).

South Africa's inflation hit a five-year low in March, boosting bets on a rate cut in May but economists warn trade tensions, a weaker rand and upcoming VAT hikes could delay easing (Bloomberg); South African President Cyril Ramaphosa and U.S. President Donald Trump have agreed to meet soon to address strained relations, amid tensions over international disputes and U.S. criticisms of South Africa's policies (Bloomberg).

Tunisia jails dozens more ex-politicians and journalists for up to 66 years in President Saied’s fiercest crackdown yet (Bloomberg).

Zambia’s inflation held steady at 16.5% in April as food prices cooled, giving the central bank room to pause rate hikes amid signs of recovery from a historic drought (Bloomberg).

Zimbabwe secured a key deal with the IMF for a staff-monitored program, its first big step toward restructuring $21B in debt and rejoining global capital markets (Bloomberg).

Innovation in Africa

Behind the Magic: The Humans Powering AI

Source: The Economist

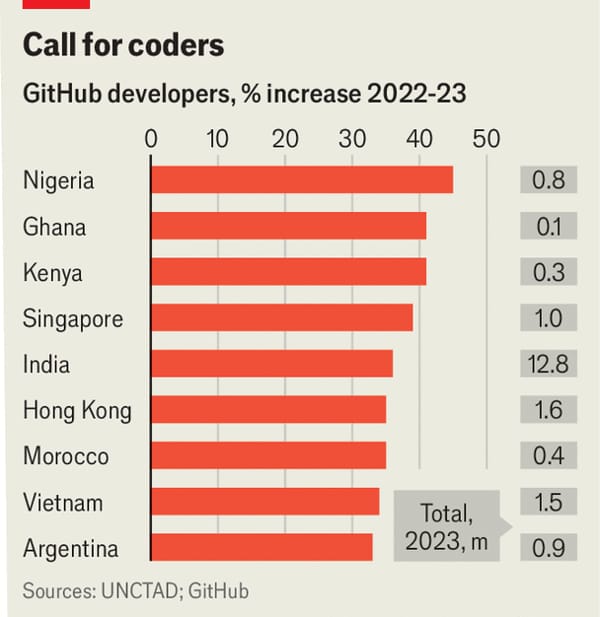

Loved this story from The Economist this week. Thanks Josh for sending it my way. AI might seem autonomous but it’s powered by a hidden army.

Millions of workers, often in lower-income countries, tag images, transcribe audio and train AI behind the scenes.

As models get smarter, annotation work is shifting—less rote labeling, more specialized tasks like fixing errors and verifying synthetic data.

Companies now seek higher-skilled workers—think coders and PhDs—as AI gets more complex and multilingual.

Despite automation, humans remain essential to refine, correct and ensure AI is accurate and safe.

AI may be the future but it still needs us humans to function.

Source: Rest of World

Another recent article talks more about the downside to some of the AI jobs. According to an article by Rest of World, big tech outsources AI training and digital work to hidden labor forces across 39 African countries—shielded by layers of intermediaries, weak local protections and secrecy that lets firms like Meta and OpenAI dodge accountability (Rest of World).

Business & Finance in Africa

Startups vs. GDP: Who’s Punching Above Their Weight?

Source: Africa: The Big Deal

Africa: The Big Deal recently compared African countries’ startup funding (2019–2024) against GDP (PPP) per capita and some underdogs are overachieving.

The big idea: Countries attracting more startup capital than their economic weight suggests are doing well.

Graph format: Funding on the y-axis, GDP (PPP) per capita on the x-axis. Look above the diagonal = outperformance.

Top example: DRC ranks #13 in total funding ($114M) despite being near the bottom in GDP per capita.

Startup stars aren't always the richest. Read more: Africa: The Big Deal

Cocoa > Bitcoin… Then Bust

Source: FT

According to an article in the FT, cocoa prices tripled in 2024, beating Bitcoin before crashing hard.

What drove the spike: failed harvests, aging trees, Ghanaian farmers switching to gold and price-fixing by state buyers.

Supply outlook: Global cocoa output may rise 7.8% in 2025, the first surplus in three years.

Country trends:

Côte d’Ivoire leads but faces a 40% mid-crop drop.

Ghana up 32% thanks to better farm practices.

Nigeria aims to double its output by 2026.

Cameroon sees modest growth.

Why it matters: Chocolate’s not just a treat, it’s a fragile commodity. Climate shocks, distorted markets and surging demand are pushing prices to extremes. The cocoa chain is cracking. Read more: FT

Democracy in Africa

Source: The Economist

Djibouti: Calm in a Global Storm

The stories keep coming. Amid Red Sea chaos, Djibouti has become the nerve center of a high-stakes global power struggle.

Why it matters: 12% of global seaborne oil trade passes through the Bab al-Mandab strait and everyone wants a piece of it.

Militarized zone: Djibouti hosts bases for the U.S., China, France, Japan and Italy—more than any other African nation.

Trade hit hard: Houthi missile attacks cut Red Sea cargo traffic by over two-thirds in 2024.

Region unravels: Sudan, Somalia and Ethiopia face collapse as foreign powers back rival factions.

Port grab intensifies: UAE, Turkey, Russia, Iran and others compete for Red Sea dominance.

Sovereignty slips: Fragile states are losing control to foreign militaries and billion-dollar port deals.

Big picture: The Red Sea is no longer just a trade route, it’s a battleground for global influence, with Djibouti as its linchpin.

Read More: A new smash and grab for Red Sea ports.

Explorations in Africa

South Africa: One Journey, Two Worlds

Source: New York Times

Luxury on Rails, Inequality on Display: A ride on South Africa’s Blue Train offers five-star views and service but also a stark look at a nation still shaped by deep inequality.

What’s happening: The 994-mile journey from Cape Town to Pretoria is pure opulence—white-glove butlers, marble bathrooms, open bars and velvet lounges.

But just outside: The train glides past shacks, trash piles and communities still reeling from Apartheid’s legacy.

Then vs. now: Once South Africa’s only desegregated train, it’s still mostly white passengers and Black staff—luxury unchanged, inequality enduring.

A tale of two countries: The $4K+ ticket buys breathtaking landscapes and gourmet meals, while kids wave from tin-roofed homes with no running water.

Bottom line: The Blue Train is both a window into South Africa’s beauty and a mirror reflecting its persistent divides. Read more and see more pictures: New York Times.

Source: New York Times

Africa Trivia Response

Answer: B. South Sudan. Read more.

See you next week!

If you’re enjoying The Africa Brief, please share it. We’d love to have them follow along with Africa’s macro trends too! And email us at ([email protected]).