The continent is busy: $190B mobile money boost, space tech transforming agriculture, Spotify payouts doubling and F1 dreams roaring back. We don’t think it’s hype—we think it’s happening.

Africa Trivia

Graphic of the Week

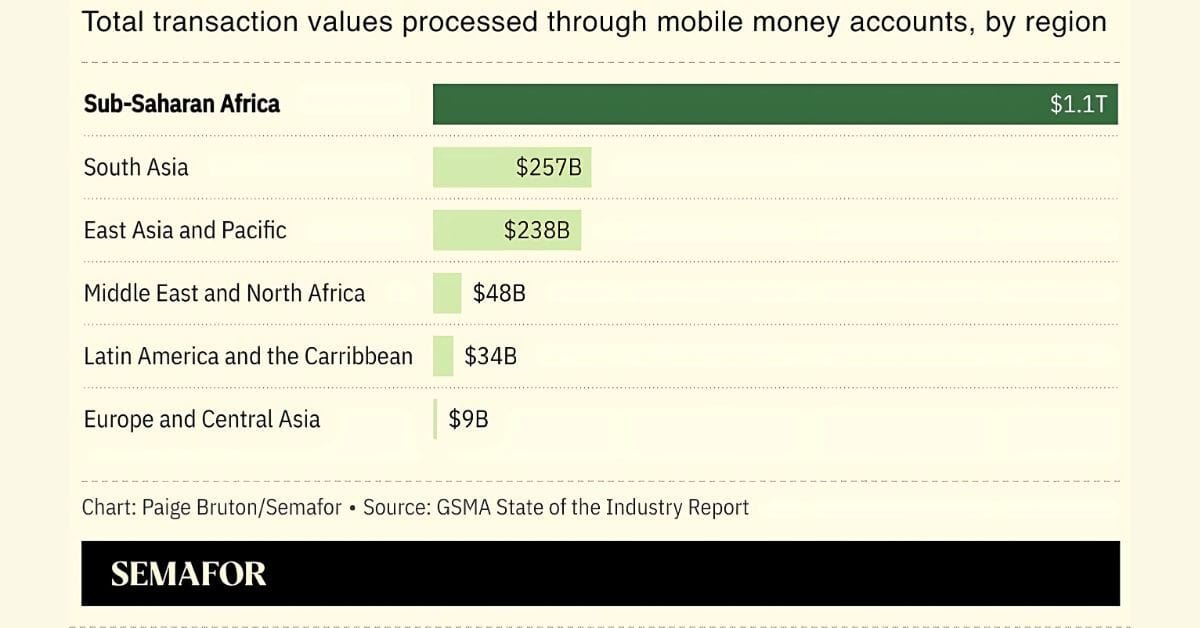

Africa Dominates Mobile Money Market

Source: Semafor

Mobile Money Is Africa’s Power Tool

Globally, mobile money hit 2.1 billion accounts and moved $1.7T in 2024.

Africa leads with 1.1 billion users, $1.1T in transactions and a $190B GDP boost.

Why it matters:

It’s no longer just about inclusion—it’s economic infrastructure.

In 2024, M-PESA drove 42% of Safaricom’s annual revenue.

Ecosystem use is booming: merchant payments, credit and remittances are surging.

The next frontier is closing gender and literacy gaps, as 60% of providers now invest in digital skills.

Source: GSMA

What We Are Reading

Africa: Afreximbank has allocated $3B to finance locally refined oil products in Africa, aiming to reduce the continent's $30B annual petroleum import costs and improve refining capacity (Reuters); The World Bank’s IFC is investing $100M in Raxio to expand data centers in Ethiopia, Angola, DRC, Ivory Coast, Mozambique and Uganda, boosting Africa’s digital backbone where it holds less than 1% of global data capacity despite soaring demand (Reuters); Germany has pledged $4.3B for green energy projects in Africa, aiming to support the continent's transition to sustainable energy sources and bolster economic development through renewable initiatives (Zawya).

Algeria closed its airspace to Mali after accusing it of repeated violations, including a downed drone, prompting Mali and its allies to recall ambassadors and impose reciprocal airspace bans (Bloomberg).

DRC's capital, Kinshasa, experienced heavy flooding, resulting in around 30 deaths, widespread damage to homes, infrastructure and disruptions to power and water supply (Reuters); Virunga National Park has seen at least 50 hippos die from anthrax poisoning of unknown origin, with recovery efforts ongoing to prevent further spread (BBC).

Ethiopia appointed Tadesse Worede as interim Tigray leader to ease tensions and guide the region through its transition ahead of the 2026 provincial elections (Bloomberg).

Kenya hopes to gain from lower U.S. tariffs compared to competitors but high local business costs and global recession fears may limit the benefits (Citizen Digital); Kenya will receive $750M in funding from the World Bank, contingent on economic reforms (Bloomberg).

Libya's central bank has devalued its currency by 13.3% to 5.5677 dinars per USD (Reuters).

Morocco will host GITEX Africa 2025 from April 14–16 in Marrakech to provide a platform for startups and industry leaders to connect and collaborate (Tech Africa News). If you are coming, look me up on LinkedIn.

Nigeria's central bank sold nearly $200M to stabilize the naira after President Trump's tariffs caused a drop in crude oil prices, impacting the country's economy (Reuters).

South Sudan: The U.S. revoked all South Sudanese visas after South Sudan refused to admit a deported individual from the Democratic Republic of Congo (Reuters); The U.S. and EU urge South Sudan to release Vice President Riek Machar, warning his detention risks derailing the 2018 peace deal (Bloomberg).

Tunisia began forcibly deporting sub-Saharan migrants after dismantling camps housing 7,000 people (Reuters).

Zimbabwe’s gold and foreign currency reserves backing the ZiG currency have risen to $629M, supporting its stability amid tight monetary policies to curb inflation and exchange rate volatility (Bloomberg).

Innovation in Africa

Africa Launches Up

Source: Spacehubs Africa

In the past two decades, Africa has started to enter the global space and satellite game. Currently 18 African countries have put 64 satellites into orbit, with dozens more planned. Satellites from Africa are now fueling precision agriculture, disaster response, climate tracking and even national defense. A few notable mentions:

South Africa launched SunSat-1 in 1999 and now runs 600+ global missions and real-time ocean monitoring via MDASat (NTU, Engineering News).

Egypt built Africa’s biggest satellite factory in Space City and launched NExSAT-1 in 2024 (Space in Africa).

Kenya is boosting crop yields by up to 20% using satellite data (Innovate UK).

Africa-wide, Earth observation tools like Digital Earth Africa sought to unlock $2B in annual value in 2024 (Digital Earth Africa).

Algeria uses Alcomsat-1 to connect 27,000 schools and 3,700 hospitals to the internet (SAMENA).

Morocco taps its Mohammed VI satellites to track crops, borders and disasters for both civil and military use (Morocco World News).

Business & Finance in Africa

Luxury Plans But Slow Openings

Source: Bloomberg

Africa’s Luxury Hotel Boom: I see it in my travels. Africa is seeing a surge in high-end hotel development—104,444 rooms under construction, up 13% YoY, led by global brands like Marriott and Hilton (W Hospitality Group).

Why it matters:

Luxury dominates: 75%+ of projects are upscale/luxury.

Tourism rebound: Africa was the #2 best-performing tourism region in 2024.

North Africa leads: 92% of projects in Egypt/Morocco are high-end.

Resorts rising: Leisure travel is outpacing business travel.

But… only 11% of pipeline hotels opened last year—execution lags behind optimism.

Big picture: Africa’s growing middle class, wealth and air connectivity are attracting global chains—but it may take longer than we hope.

Africa: Tourism pulled in $24.5B in 2024, projected to grow at 5% annually through 2028, with luxury travel leading the charge (African Leadership Magazine).

South Africa: Tourism = 8.2% of GDP, 1.46 million jobs in 2023; expected to hit 10.8% GDP and 2.23 million jobs by 2030 (Business Wire, Waterfront).

Morocco: Tourism = 7% of GDP, $10.5B revenue, 5% of workforce employed (Morocco World News),

Kenya: Tourism brought in $7.7B and supported 1.55 million jobs—1 in every 13 (WTTC).

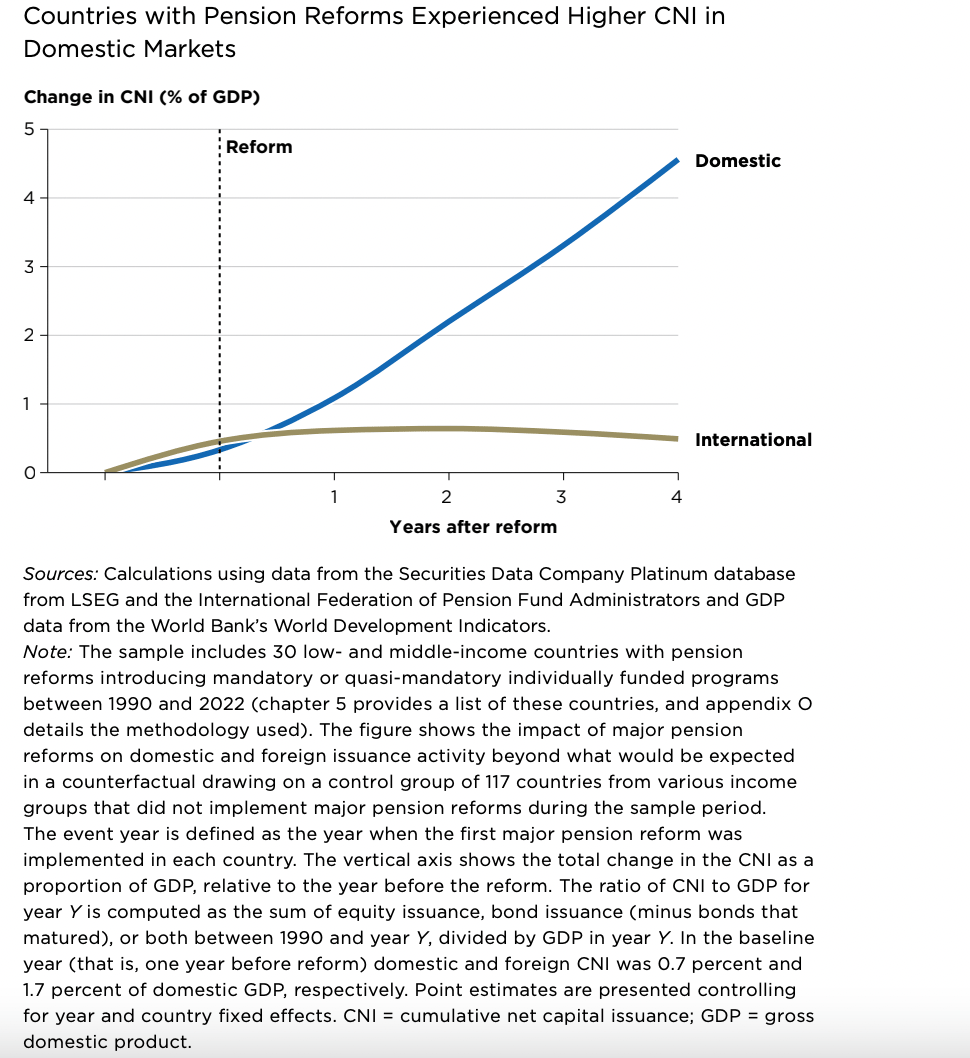

Pensions Power Markets

Africa’s Capital Market Momentum: According to an esoteric report by the IFC, African firms are tapping capital markets (funding via equity or bonds) like never before. From 1990 to 2022, capital issuance rose from <1% to ~6% of GDP in sub-Saharan Africa—a sixfold increase.

Why it matters:

Local rise: 50%+ of funds were raised in domestic markets, mostly in local currency. Reforming pension money is critical!

Equity-heavy: In low-income countries, equity dominates, making up ~two-thirds of issuances—not because debt is absent, but because equity is more accessible.

Growth impact: Firms that raised capital invested 16% more, hired more and boosted productivity.

Broader access: 13 low-income African countries accessed markets for the first time post-2000.

Policy wins: Pension reforms and better investor protection unlocked more local investment.

Zoom out: Africa’s capital markets are expanding beyond elite firms. According to the report, the key to sustaining this: deepen local markets, simplify access and match funding with high-growth firms.

Tech & Society in Africa

Afrobeats >> Print Money

Source: Musically

Streaming Pays—and Africa’s Starting to Cash In

Globally Spotify paid out $10B in 2024, the largest single-year payout in music history—10x growth over the past decade. Total lifetime payouts are now at nearly $60B.

Why it matters for Africa:

Nigeria and South Africa are edging onto the scene: Nigerian artists earned $37.8M, while South African artists brought in $20.9M—royalties more than doubled YoY. Still a ways to go for African musicians but progress!

Global takeover: Music from both countries reached more than one billion first-time listeners in 2024, with rising global demand for afrobeats and amapiano.

Local love too: Indigenous language songs saw skyrocketing royalties, showing global and domestic momentum.

Indie surge: $5B+ went to independent artists—Spotify now over-indexes in indie earnings vs. other platforms.

Mid-tier is real: The 100,000th artist earned nearly $6K—proof the platform is viable beyond the top 1%.

Bottom line: Africa’s music is increasingly valuable. With global reach, local loyalty and rising royalties, African artists are turning streams into sustainable careers (Musically, Reuters).

And if you want to dabble, try African Heat and Afro Hits from Spotify.

Explorations in Africa

F1 or Bust

Source: Bloomberg

Africa Wants F1 Back: Interesting read in Bloomberg: Africa is the only continent without a Formula 1 race but a wave of bidders—from tycoons to presidents—are hustling to change that.

Why it matters:

F1 is booming: $3.4B revenue, 1.6 billion viewers and a Brad Pitt movie coming in June 2025.

South Africa leads: Cape Town and Kyalami are front-runners, backed by Porsche execs and U.S. investors.

Big money, big rules: Hosting costs up to $50M, with strict demands on infrastructure, safety and luxury.

Geopolitics in play: Rwanda, Morocco and South Africa are all bidding but regional conflicts and funding gaps could shape who wins.

Symbolic return: South Africa hasn’t hosted since 1993; for many, bringing F1 back would showcase post-Apartheid progress and global relevance.

Bottom line: Africa’s F1 comeback is gaining traction, but as one bidder put it, "extremely difficult." Read the full story in Bloomberg.

Africa Trivia Response

Answer: C) 51%

If you are paying attention, you might be confused by the mobile money report, as compared to this 51% stat. Me too, but still wanted to share because it somehow captures the potential and the growth. According to World Bank data that admittedly is a bit old (2022), only 49% of adults in sub-Saharan Africa own a financial account (bank or mobile money), meaning 51% remain unbanked. The data comes out every three years from the World Bank’s Global Findex study, so hopefully we will have an update on the data soon that will match the GMSA mobile money report. It seems fintechs are rapidly pulling millions into the formal financial system and there’s still rooms for tons of growth. It looks like mobile money may truly be Africa’s power tool.

See you next week!

If you’re enjoying The Africa Brief, please share with your family and friends. We’d love to have them follow along with Africa’s macro trends too!

Email us at ([email protected]) if you have some scuttlebutt we should follow up on.