Friends of the Africa Brief,

If you are in DC, Atlanta or New York this week, I hope you haven’t been slowed by Kenyan President William Ruto’s motorcade! It’s exciting times for the U.S. and Kenya. More below.

TL;DR

AI - Italy is partnering with Egypt on an AI center in Cairo (GetFundedAfrica) & Microsoft plans to build a geothermal-powered data center in Kenya (Microsoft).

Critical Minerals - Report claims U.S. almost 100% reliant on ‘foreign entities of concern’ for vital critical minerals (USIP).

Kenya - U.S. named Kenya as first African non-NATO ally during D.C. visit (BBC).

Nigeria - Economic liberalization is still progressing in Nigeria (Bloomberg).

Rwanda - Africa CEO Forum discussed intra-continental trade; currently a fifth of African countries’ exports now stays within the continent (Economist).

South Africa Elections - Complex election dynamics mean some are already looking to 2029 (Economist).

Sudan - 80% of the world’s gum arabic, a food stabilizer, comes from a war zone (WSJ.com).

Graphic of the Week

Will Africa “Fuel” the Global EV Boom?

Source: UNCT

Africa’s Critical Minerals Output? $2T by 2050 - According to a United States Institute of Peace (USIP) report released in April, the United States is nearly 100% reliant on ‘foreign entities of concern’ - primarily on China - for vital critical minerals. Take cobalt which goes into long-range batteries: about 70% of the world’s production (est. ~ 50% of world’s reserves) is in DRC and 15 out of 19 of the cobalt mines in DRC are owned by China or other Chinese interests.

It’s clear, the world’s need for critical minerals and the balance of related power is a serious problem for world peace and economic balance. Same song, different verse: according to the report, the U.S. needs to update its Africa strategy and build mining and processing capacity with investment and donor dollars and open consulates and embassies in Africa’s mining centers, among other recommendations. U.S. Secretary of State Antony Blinken is talking about it. And further north, Canadian miners hold $37bn of assets in Africa, and according to some provide ethical leadership to the industry.

Climate in Africa

Africa is Dressing Up “Climate Smart”

With more than 90% of Kenya’s energy coming from clean sources, President William Ruto sought green investment for the country this week as part of his momentous U.S. tour. The U.S. is making efforts to bolster its geopolitical power in Africa, including making Kenya a partner in the U.S. Chips Act and naming Kenya Africa’s first major non-NATO ally. Two Renew Capital portfolio companies are in related news: Octavia Carbon (DAC) is in the Washington Post and ROAM Electric accompanied Ruto to the U.S. For the trip’s background: NYT.

Enjoy “Kigali’s Big Shift to Small Electric Motorcycles” a piece by the IFC. It’s got some good data and beautiful pictures, and highlights the country’s e-motorcycle leader, Ampersand. Ampersand has put more than 2,200 e-motorcycles on the road in Rwanda, employs 300 and has 26 charging stations.

Eswatini is banning single use plastic bags as of December 1, 2024, following 34 other countries on the continent that have banned them in one form or another, although many have struggled with implementation. Rwanda is seen as the continent’s shining star, having successfully banned them in 2008 and is now for this and other reasons deemed by some as the cleanest country on the continent.

Business & Finance in Africa

The Big 4 are Still the Big 4…But Who Will Be #5?

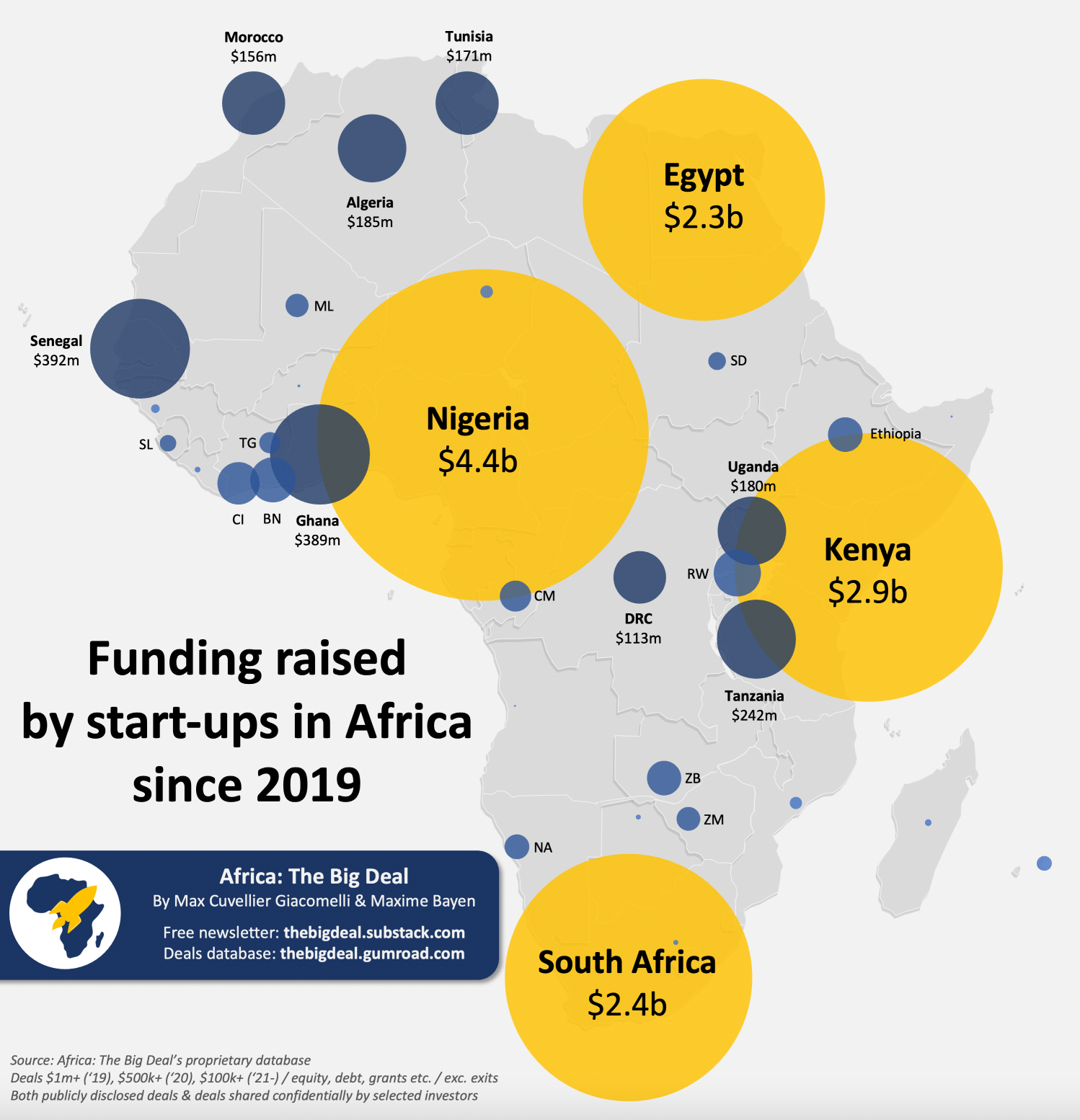

The Big Startup Picture from The Big Deal - “The most striking is obviously the relative weight of the Big Four, which have attracted 84% of all the start-up funding in Africa since 2019…” I think the runners up are what’s interesting: Senegal, Ghana, Tanzania, Algeria, Morocco and Tunisia! It’s a race to be #5!

BHA and Anglo America Fight it Out - The two mining companies still can’t seem to come to a deal. Meanwhile, and either way, who in the world is going to buy De Beers, now that “identical” lab diamonds can be made at a fifth the cost?

“Africa Inc is Ready to Roar” - The mood was high in Kigali at the Africa CEOs Forum May 16-17 week with practical discussion on intra-continental trade and building sustainable supply chains. The good news according to a McKinsey report is that revenues from exports that stay in Africa are now at $109B and nearly a “fifth of African countries’ exports now stay within the continent, up from just over a tenth two decades ago.”

Debt and Bonds In Africa

Debt Dilemmas: A Little Fiscal Discipline Goes A Long Way

Economic Liberalization Still Progressing in Nigeria - Nigeria has issued bonds to refinance $3.4 B owed to the central bank in a bid to spread out the burden of debt repayments. A story to watch is whether President Bola Tinubu can maintain enough support to continue his economic liberalization agenda, improve fiscal discipline, all while cleaning up his predecessor's economic messes. We are rooting for you, Nigeria.

Only 10% of Ethiopia’s Debt Paid - We are all wondering what Ethiopia will do ahead of the June IMF deal deadline. According to Finance Minister Ahmed Shide, the country has repaid 10% of loans ($52.1 M vs $512 M) that were due in the first nine months of the fiscal year. Sounds bad, but it’s part of a debt suspension agreement reached in 2023. The country’s total debt stands at $65.7 B, equivalent to about 40.2% of gross domestic product. Can the country work a miracle?

Fiscal Discipline May Pay Off in Morocco - Morocco, the best rated for Eurobonds on the continent, is considering offering an international bond in 2024 aimed at improving its investment grade and reducing its budget deficit. Other efforts by the country to support vulnerable citizens while curbing inflation are underway including reducing cooking gas subsidies while also offering a direct aid program for vulnerable citizens worth $2.5B. Inflation for 2024 is still projected at 2.2%.

China in Africa

China: The Center to West. U.S.: The Center to East. Kind of Ironic?

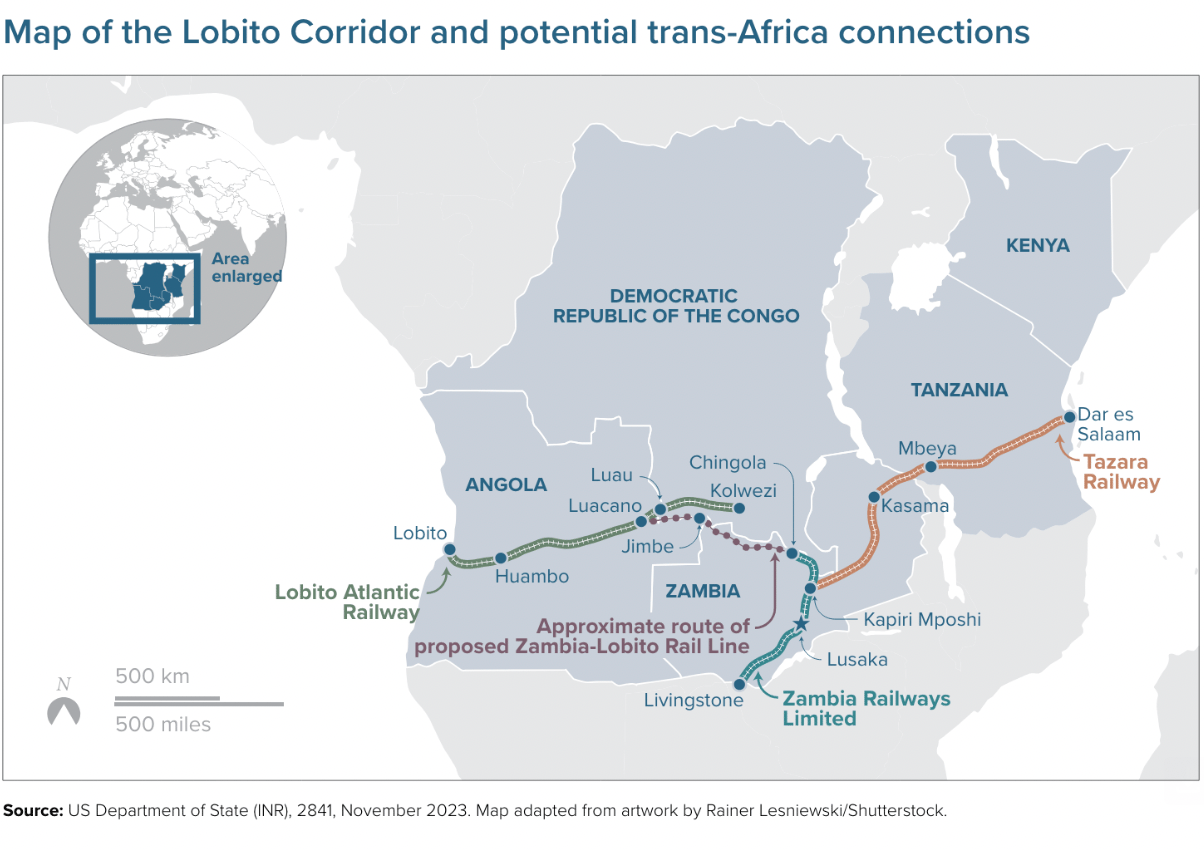

Another Railway Commitment - China has committed funds to invest in a railway project from Naivasha, Kenya to the Uganda border. It’s another example of a consistent Chinese strategy. The U.S. has announced it will try to compete with China on another railway, the 1,300 km Lobito Corridor to export critical minerals from central Africa. The WSJ claims in this video that the “$1.7B Railway Is U.S.’s First Challenge to China in Africa.” I wish I had more confidence.

U.S. in Africa

Can the U.S. Deliver? - My favorite long read this week: Getting Real: How the United States Can Deliver on Its Commitment to African Infrastructure by Katie Auth @ Carnegie Endowment for International Peace (15 minutes).

Democracy in Africa

All Eyes on South Africa - Today’s cover story in The Economist (How to Save South Africa) provides a good overview. Nearly a third of South African voters remain undecided ahead of next week's elections, according to a recent Afrobarometer poll, creating uncertainty over the outcome and the ruling African National Congress (ANC)'s chances of maintaining and/or having to share power. The country’s top court ruled former president Jacob Zuma cannot stand for parliament and therefore should not appear on the ballot as a result of his previous contempt of court charges that led to a sentence of 15 months in jail. But the former leader’s new party seems unswayed and election officials say the ballet won’t be reprinted. And let’s not overlook South Africa’s youth, some who are claiming that democracy is a pyramid scheme. Sounds like the May 29th results may be messy to untangle and The Economist thinks we should be looking to the 2029 elections!

Peace & Security in Africa

Gum Arabic Funding War

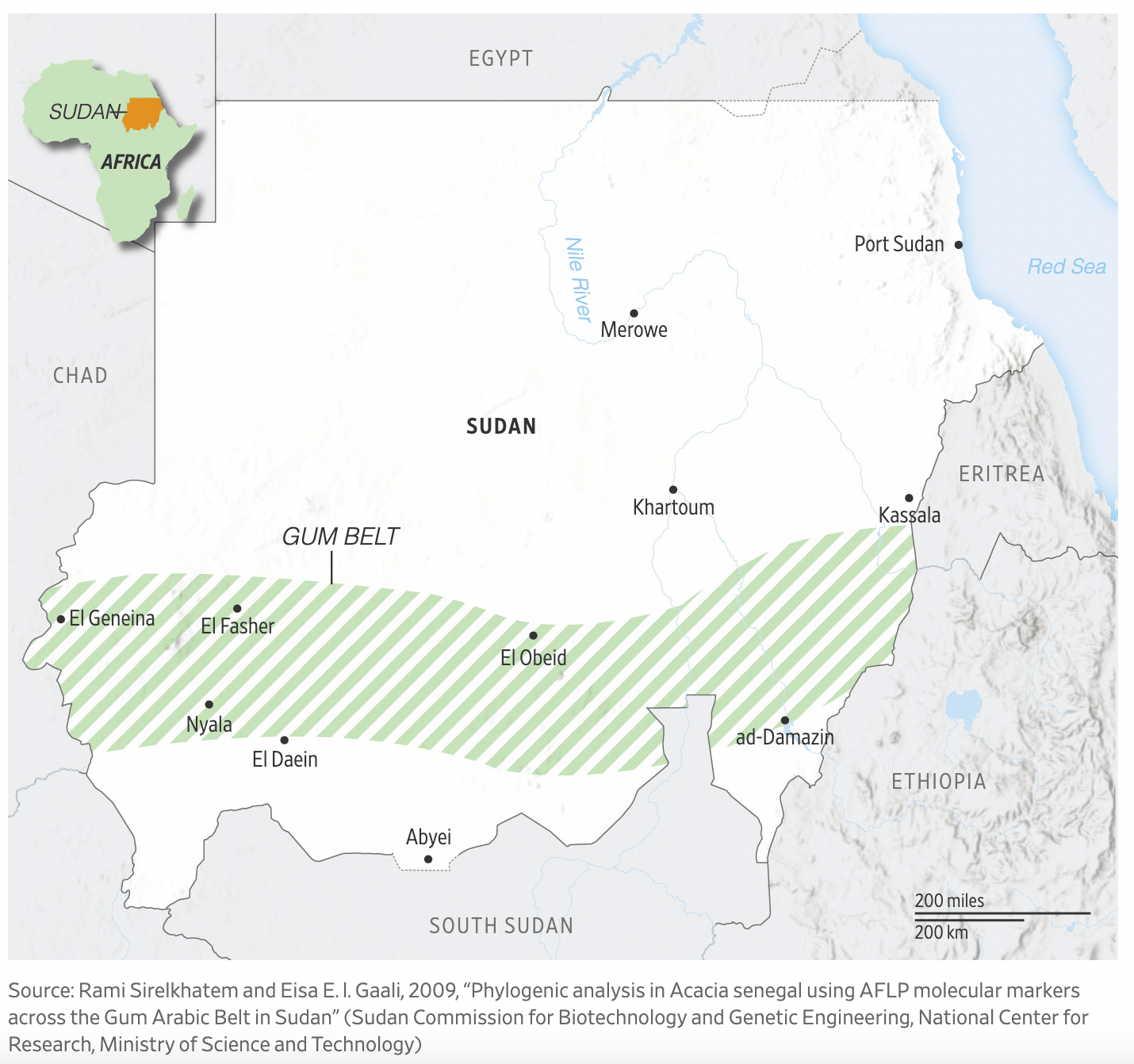

Source: WSJ.com

A Sticky Situation - According to an article in the WSJ today, Sudan produces 80% of the world’s gum arabic, a stabilizer used extensively in foods, drinks and cosmetics. Sadly, the gum arabic trade funds both sides of the Sudanese civil war that began in April 2023 displacing millions of Sudanese.

Tech & Society in Africa

AI: The Battle for Africa is On

Who is investing? Lots of AI Africa news these days…Italy and Egypt announced a partnership to establish an artificial intelligence (AI) center in Cairo. Microsoft and G42, a Dubai based group, plan to build a geothermal-powered data center in Kenya. South Africa opened the continent’s first AI defense research lab, and Iozera.ai, a U.S. startup says it’s building an AI data center in Morocco at a cost of $500 million. Google opened an AI lab in Ghana in 2019.

Which Countries are Taking AI Seriously? According to ICTworks.org, Mauritius leads Africa in AI readiness, followed by South Africa, Rwanda, Senegal and Benin. Is AI the latest frontier in the China-U.S. race for Africa? As of 2023, China leads the world with 61% of AI-related patents to the U.S.’s 20%, while the U.S. leads with 61 AI models compared to 15 models in China. (VOA - a worthwhile 10 minute read). And if you really want to dig deep on this one, check out Brookings Institute’s “How AI is Impacting Policy in Africa.”

P.S. This week’s edition of The Africa Brief is brought to you with input from my colleagues Antony Maina and Mary Ann Achieng in Nairobi, Kenya; Chukwudi Ofili in Lagos, Nigeria; Nihal Grii in Morocco, Emily Mahoney in Washington, D.C., among others. As always, thanks to Josh Parker Allen for editing from Oxford. This is Laura Davis, signing off from Washington, D.C. See you next week from Marrakech, Morocco.

About: The Africa Brief aims to provide accurate and insightful information and opinions related to Africa’s macro trends. We hope to stay apolitical and present information in a balanced and objective manner. If you have feedback for us, please email [email protected].

Disclaimer: This newsletter provides general information only and is not investment advice. It does not consider any subscriber’s individual investment objectives, financial situation or means. It does not offer investment recommendations or solicitations. Consult your financial, legal and tax advisors before acting on any information in this newsletter. The Africa Brief is not responsible for actions taken based on this newsletter. Opinions herein may change based on economic and market conditions. Data from third-party providers is obtained from what are considered reliable sources but accuracy cannot be guaranteed.