After all the travel, I am happy to be home in Addis Ababa. But as I grapple with all the changes to this great city — all the widening streets and missing souks, all the murmurs of lost properties mixed with glimmers of pride that certain parts of the city ARE looking better — this summary of Tom Gardner’s upcoming book The Abiy Project provides an enlightening perspective. (Mail & Guardian)

Too Long; Didn’t Read

Angola - Angola's oil exports are at their highest level in nearly four years. (Bloomberg)

Egypt - Cabinet reshuffle boosts investor confidence and bond gains. (Bloomberg)

Ethiopia-Somaliland - Tensions remain as Turkey mediates disputed port deal. (BBC)

HIV - New injectable prevention drug provides total protection, trial in Uganda and South Africa finds (NYT)

Kenya - Protests continue, IMF blamed, 39 dead. (BBC)

South Africa - New cabinet announced, economic reforms anticipated.(Bloomberg)

Tech in Africa - African startups raise $780M in H1 2024, the lowest since 2020. (Africa The Big Deal)

Democratic Republic of Congo - US seeks to break China's monopoly on critical minerals with a controversial new deal in DRC. (FT)

West Africa - Cocoa futures decline due to favorable weather boosting crop yields. (Bloomberg)

Wildlife - Discovery of giant salamander-like predator fossil in Namibia challenges evolution timeline. (NYT)

Graphics of the Week

Are IMF Policies To Blame for Unrest?

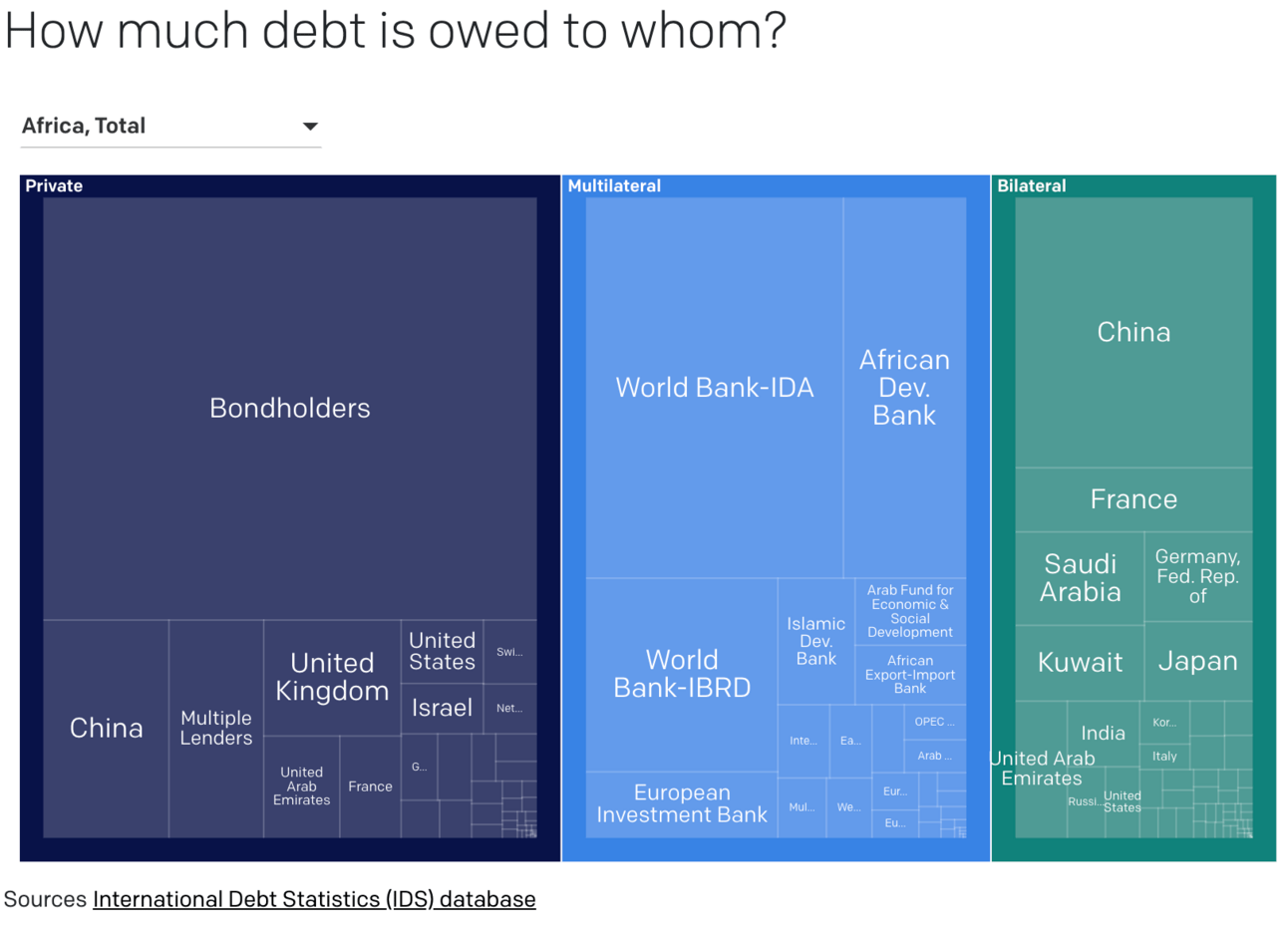

In Context: Africa’s debt has been exasperated by COVID-19, Russia’s invasion of the Ukraine, climate change and inflation. Countries like Kenya and Nigeria face unrest as citizens protest IMF-driven austerity measures amidst economic crises and limited government services. Kenya's anti-tax riots, sparked by a $2B tax bill, highlight anger towards the IMF's influence on fiscal policies. Similar sentiments are seen in Nigeria, where IMF-prescribed reforms have led to strikes. Critics, including the FT Editorial Board, argue that these measures, while aimed at economic stability, exacerbate inequality and poverty. This tension underscores the broader struggle for African nations to balance fiscal discipline with public welfare under international financial pressures (FT). Not surprising, Ruto and other African leaders have called for IMF reforms such as adjustments to lending instruments and mechanisms to address debt distress. Though 20 African countries are in debt distress or worse, the overall debt to GDP ratio seems to be improving. (Data ONE)

Business & Finance in Africa

Africa lost $88.6B due to illicit financial activity in 2023. Emphasizing the impact on the continent's economic stability, Economic and Financial Crimes Commission Chairman Ola Olukoyede cited Nigeria’s recovery of $311M of the Abacha loot in 2020 as a success, underscoring the need for stronger legal frameworks, international cooperation and advanced technologies to combat Illicit Financial Flows. (The Will) In Context: $88.6B is about 2.86% of Africa’s $3.1T GDP. Back of the napkin calculations for illicit financial activity as a percentage of GDP for India equalled 3.21% and for China, 3.72% with 2017 numbers. (The Economic Times and World Bank Data and Statista)

Egypt's Cabinet Reshuffle Boosts Gains

Egypt's cabinet reshuffle, including the appointment of ex-World Bank economist Ahmed Kouchouk as finance minister, has led to significant gains in the country's dollar bonds. This move aims to address the economic crisis, curb inflation, boost private sector growth and enhance sustainable development. The new cabinet also includes business executives and former bankers in key positions, signaling a shift towards stronger economic management and improved investor confidence. (Bloomberg)

Nigeria's Food Delivery Boom

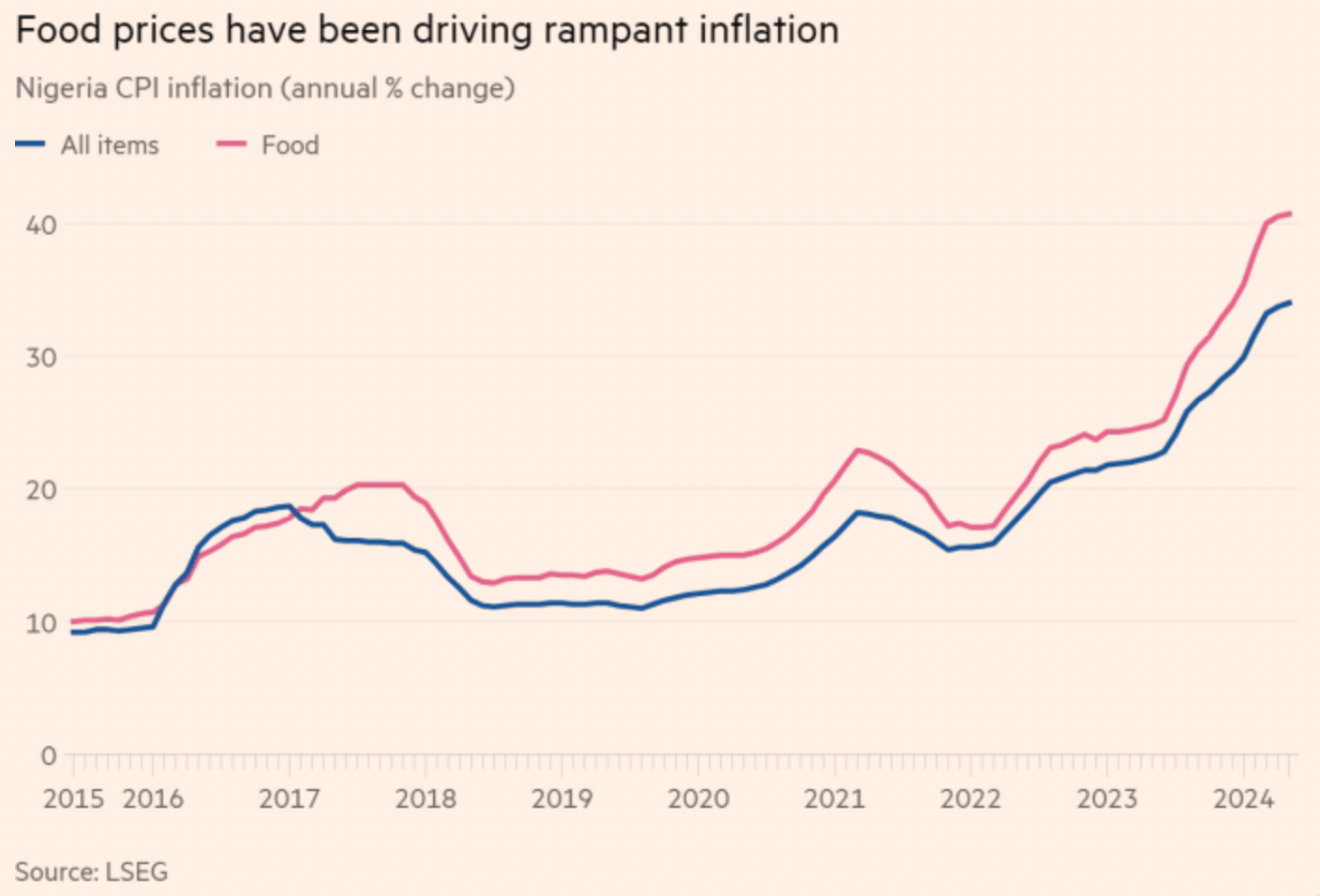

Despite record food inflation, FT projects Nigeria’s food delivery market to double to $2.4B by 2031, with a nearly 11% annual growth rate. Startups like Chowdeck, FoodCourt and Glovo, supported by investors including Y Combinator, are capitalizing on the growing demand despite 40.7% food inflation and the naira having lost 70% of its value against the U.S. dollar in the last year. Chowdeck recently secured $2.5M in funding and aims to expand beyond its current eight cities. Glovo has invested more than $100M in Africa, entering Nigeria in 2021. (FT)

Angola’s OPEC Exit Paying Off

Angola is expected to export the most oil in nearly four years, when in August, shipments will reach 1.23 million barrels a day. Prior to Angola leaving OPEC in December, the organization capped the country’s production at 1.1 million barrels a day. Angola’s GDP growth has been somewhat stagnant in recent years. (Bloomberg) Despite this the IMF projects that GDP will grow by just 2.4% in 2024. (IMF)

Cheap Chocolate

Cocoa futures in New York are set for their longest losing streak in two years due to favorable weather in West Africa, which is expected to boost crop yields. Prices fell 2.3% on Thursday, marking a sixth consecutive decline as rains support the current and upcoming mid-crop. Despite recent declines, concerns over supply shortages persist, keeping the market volatile. (Bloomberg) The crop contributes approximately 15% to Ivory Coast's GDP and 2-3% to Ghana's GDP, so growth and forex revenues are meaningfully correlated. (Forbes)

Quiet H1 for African Start-Ups

African start-ups raised $780M in H1 2024, the lowest since late 2020, marking a 31% drop from H2 2023 and 57% from H1 2023. Two-thirds of this funding was equity, with a significant one-third in debt. Kenya alone secured a third of the total funding. Transport & logistics led in funding, with fintech leading in the number of start-ups raising over $1M. Female-founded ventures received only a small fraction of the funding. (Africa The Big Deal)

Peace & Security in Africa

The situation in Kenya remains troubling as President William Ruto's initial populist appeal has faltered. Ongoing protests have left 39 dead (BBC) and indicate that not only did Ruto underestimate public anger over the proposed taxes, but that Kenyans are losing patience amid rising living costs and continued corruption. There’s tons of coverage out there, but I recommend Ken Opalo’s big picture analysis, including a proposed way forward: commit to competent service delivery and accountability. (An African Perspective and also in Bloomberg). Ruto has also frozen planned pay increases for government officials. (BCC)

Ethiopia-Somaliland Deal: Turkey Steps In

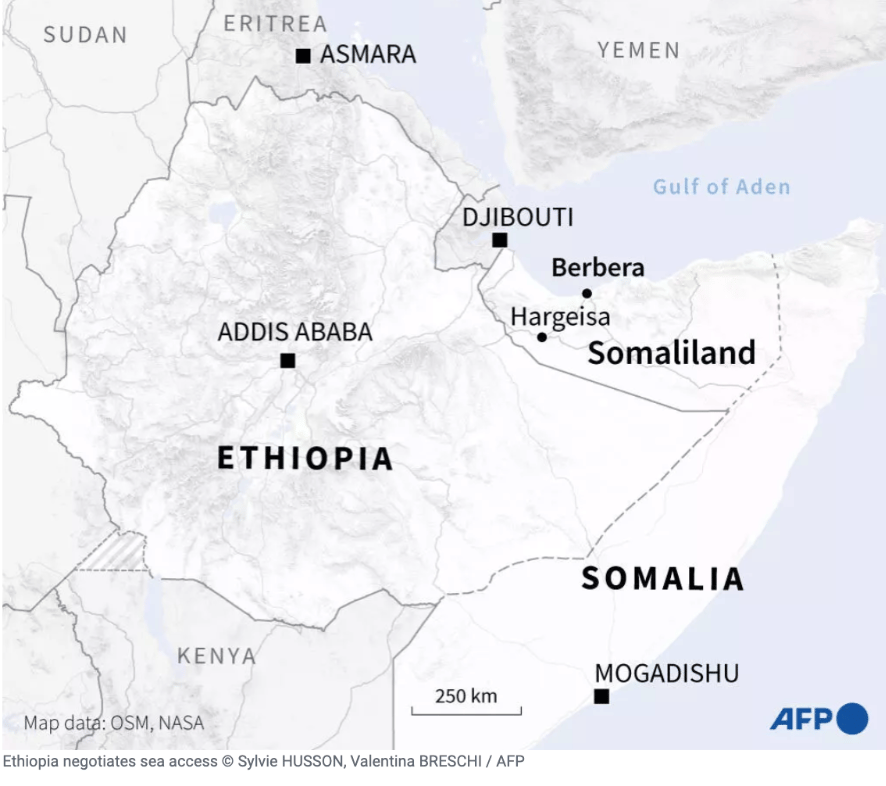

This week, Turkey hosted negotiations aimed at resolving the Ethiopia-Somaliland port deal, which has angered Somalia. Ethiopia and Somalia met but refused direct talks, agreeing to reconvene in September. Somalia deems the deal, involving the lease of Somaliland's coastline and potential recognition of its independence by Ethiopia, as illegal and aggressive. Ethiopia lost its ports when Eritrea seceded in the early 1990s. With a population of more than 100 million, Ethiopia is the most populated landlocked country in the world.The African Union, US and other international bodies have urged calm to prevent further regional instability. (BBC)

18 Killed in Bombings in Nigeria

At least 18 people were killed and dozens injured in multiple suicide bombings by female attackers in Gwoza in northeastern Nigeria. The attacks targeted a wedding and a funeral. The blasts, reminiscent of Boko Haram's tactics, underscore ongoing security challenges in the region. (NYT) In Kano, Nigeria, two claimants, Emir Sanusi and Emir Aminu, vie for Nigeria’s Kano throne amid political tension. This conflict, with Sanusi backed by the local state government and Aminu supported by the federal government, mirrors broader political struggles ahead of the 2027 elections. Their battle underscores the influence and symbolic power of traditional leadership in Nigeria's political landscape. (NYT)

Democracy in Africa

SA’s Cabinet Positive for Investors + Gangster

Overall, investor sentiment has continued on a positive trajectory as South African President Cyril Ramaphosa unveiled a new cabinet on July 1. The cabinet reveal indicates a focus on economic growth and included business-friendly opposition politicians while retaining Enoch Godongwana as finance minister, a signal that debt-curbing fiscal policy will remain on track. The announcement led to a 1% rally in the rand, a drop in government bond yields, and a rise in the FTSE/JSE Africa All Share Index, reflecting optimism about economic reforms and stability. (Bloomberg) Ministries now led by the Democratic Alliance (DA) include home affairs, basic education and agriculture. In Context: In SA, home affairs controls immigration and public works while agriculture is dominated by white farmers and corporations. The most debated issues seem to be healthcare policy and black economic empowerment program and the ANC retains control of mines, trade and land reform which are key to related policies. (BBC) For an overview of the cabinet, read Bloomberg’s who’s who. One of the most controversial new ministers is Patriotic Alliance leader Gayton McKenzie, a former gangster and bank robber turned nightclub owner and opposition politician, appointed as South Africa's new sports, arts and culture minister. (BCC)

Health in Africa

Breakthrough - HIV Drug Trial Shows Total Protection

A new drug, lenacapavir, provided total protection from HIV in a trial in Uganda and South Africa involving young African women. A form of pre-exposure prophylaxis (PrEP), which aims to prevent HIV infection, the new drug is given as an injection twice a year. The trial showed superior results compared to current daily oral drugs, with none of the 2,134 women who received lenacapavir contracting HIV. While currently-available oral PrEP is highly effective, stigma and discrimination, access issues and side-effects have presented difficult roadblocks to widespread and consistent uptake amongst those most vulnerable to HIV infection. Lenacapavir presents a hugely promising and exciting means of reducing HIV incidence, but the challenge remains making the drug affordable and accessible in low-income countries, as well as operating and institutionalizing successful and regular injection campaigns. (NYT)

Tech & Society in Africa

The Gambia has registered one million people with digital birth certificates and national health insurance. (All Africa) Only 1.7 million to go. And Gabon launched a new national ID system, the National Electronic Identity Card (CNIE) spearheaded by President Oligui Nguema to provide all Gabonese with a modern, biometric- based government-issued ID for accessing services and enhance regional integration. (Biometrics Update) In case you missed it, read last week’s deep dive: Digital ID: Boon or Big Brother for Africa's Economies?

Climate in Africa

Toyota Aligns with Nigeria's Green Goals

Toyota Nigeria will launch three hybrid electric vehicles (Toyota Cross, RAV4, and Land Cruiser Prado) over the next three years to support Nigeria's ambitious goals to net zero by 2060. Toyota Nigeria will also use its workshop network to aid the government's campaign for compressed natural gas-powered vehicles through conversions. (Punch) EVs are supposed to constitute 60% of the market by 2050.

As South Africa grapples with balancing energy needs and emission reduction commitments, the country is negotiating to delay decommissioning of three major coal-fired power plants until March 2030. This move may undermine the credibility of the Just Energy Transition Partnership, a $40B program. (Bloomberg)

US in Africa

US Desperate to Break China’s Mineral Monopoly

The US attempted to facilitate a deal for Swiss trading house Mercuria to acquire copper-cobalt mines Kazakh-controlled Eurasian Resources Group in the Democratic Republic of Congo (DRC), contingent on lifting sanctions against Israeli billionaire Dan Gertler. This effort underscores the US's strategic interest in securing critical minerals for clean energy, amid competition with China. Several Chinese companies had already expressed interest in acquiring the mines. No deal has closed to this point, but the US government is still interested. (FT) In Context: Dan Gertler, sanctioned in 2017 for alleged corruption in the DRC, may receive around $300 million if he sells his remaining mining interests in the Congo. The negotiations, aimed at benefiting US-friendly companies, has faced criticism for potentially enriching Gertler further despite past allegations. (FT)

Explorations in Africa

Eritrea's Biniam Girmay made history as the first Black rider to win a Tour de France stage, dedicating his victory to all Africans and highlighting the significance of their participation in major races. (Bloomberg) The win is important to the future of African cycling, which is on the rise bolstered by races such as the Tour de Rwanda, Cape Town Cycle Tour and the Migration Gravel Race among others.

Fossil Discovery Shakes Theories

A giant, salamander-like predator, Gaiasia jennyae, was discovered in Namibia, recently challenging existing beliefs about the timeline for vertebrate evolution. This find suggests early tetrapods adapted to diverse environments sooner than thought and underscores the importance of Southern Hemisphere fossil studies. (NYT)

P.S. Thanks for reading. Email us @ [email protected]