Friends of The Africa Brief,

After a short hiatus, we're happy to be back in your inbox, rejuvenated and supported by an expanded team, including fresh muscle from Renew Capital, a firm that shares The Brief’s mission to help the world see Africa beyond its legacy brand. Our desire to deliver insightful regular briefs and occasional deep dives on Africa remains steadfast. We want you to stay informed and connect the dots on macro trends at the intersection of 21st-century geopolitics, investing, innovations, climate change, leadership and a little bit of the continent’s beauty.

At The Africa Brief, we believe in the continent’s potential. If you agree and find value in this newsletter, spread the word: Africa is moving.

The Africa Brief Team

Now for The Brief…

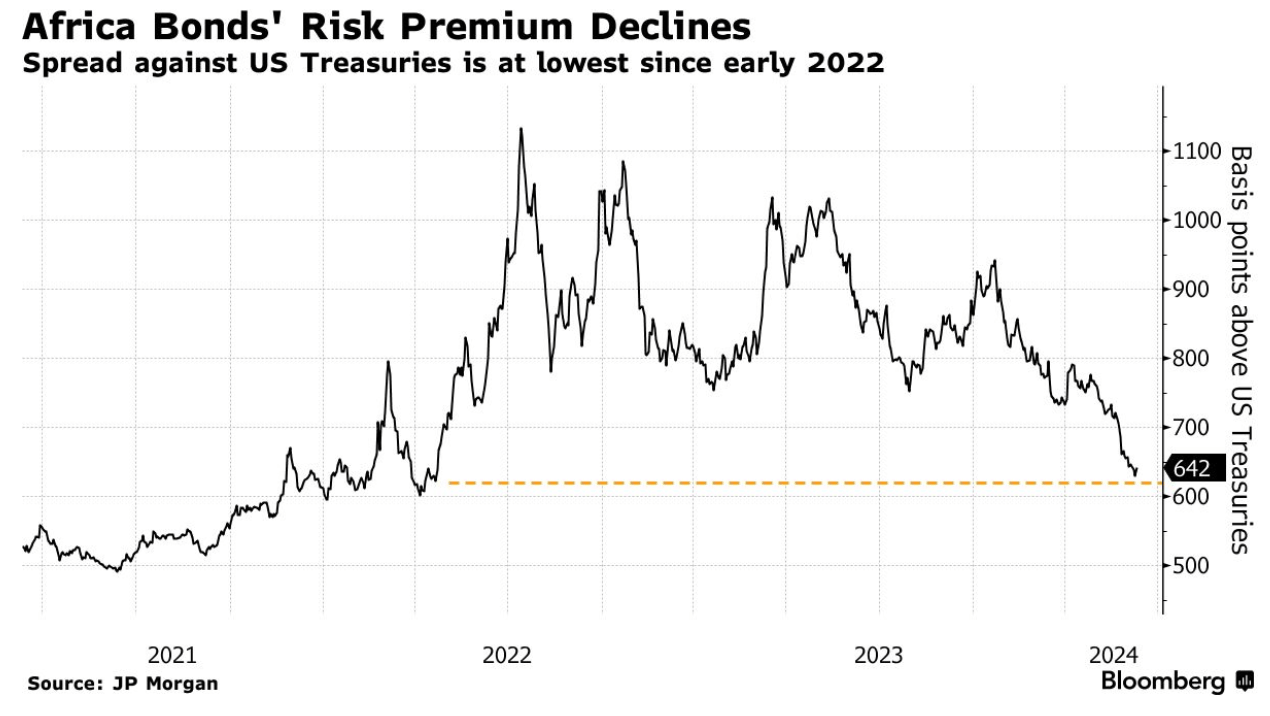

Africa Bounces Back: A Surge in Liquidity Marks a Promising 2024 - In the first quarter, several sub-Saharan African nations are seeing lower borrowing costs, improved access to capital markets and currency stability as indicated by bond premium declines. Benin, Cote D'Ivoire and Kenya saw high demand for their Eurobonds already this year, indicating growing investor confidence. The spread between African Eurobond premiums and U.S. Treasuries declined to 2022 numbers, reducing perceived lending risks. This boosts Africa's economic stability and attractiveness to investors, already surpassing Goldman Sachs' bond sales predictions for the entire year. Another theory we have heard verbalized is that as China and other developed markets cool, some of that capital is flowing to Africa. Time will tell if Africa is becoming less risky or if investors are just spooked by China.

Yet International Banks Pull Out? Is There an Antidote to Multinational Entry and Exit? - The recent positive upturn in investor confidence is not unanimous: BNP Paribas announced this week that it is pulling out of South Africa following Barclays, Standard Chartered, and Societe Generale SA in years past, each citing market complexity and instability. Efosa Ijomo of Clayton Christensen’s Institute writes regular warnings about the ~ ten year cycles of multinational companies (4.5 minute read) lured by Africa’s potential and pulling out, disillusioned with limited infrastructure, corruption and other predictable chaos. Why are we surprised when the average per capita government spending is $500 versus $24,000 to $41,000 in places like France, the U.S and Norway? BUT he says there is an answer to successfully operating in Africa: 1) change your expectation and 2) be a “market maker”, a concept championed in the book Prosperity Paradox. If you haven’t read it, consider putting it on your summer reading list.

Why Does It Matter? Our Take…

Risk premium declines and other factors indicate that the macro fundamentals are strengthening as many countries on the continent continue to benefit economically from post-COVID recovery. At the same time, mismatched expectations leave international banks and companies disillusioned. Thankfully, every challenge presents an opportunity, and in this case the need for financial services provides a significant opportunity for domestic brick and mortar banks, as well as neobanks like TimeBank, Kuda and others - including our portfolio company, Affinity. The lesson? An old one the world’s business legend’s all understand: Be a market maker!

Also On Our Radar…

African Travel is on the Rise - Nine months into the company’s fiscal year ending June 2024, Ethiopian Airlines CEO claims the company is on track to service 30% more passengers than last year’s 13.9M. The airline operates 146 planes, has 70 on order from Boeing and plans to double its fleet and routes by 2035. This year’s revenue is projected to be $7.3B, according to Reuters. Meanwhile, EgyptAir, one of the oldest airlines in the world, celebrated 92 years of service this week and reported 2.8M passengers in the first quarter, a 6% increase over the same period last year. Maybe they can splurge on more cushioning for their seats?

U.S. Influence is Waning in Africa - According to a recent study released by Gallup, when measuring approval between U.S., Germany, Russia and China, Russia's approval increased the most from 2022 to 2023, while the U.S. dropped slightly behind China. There are many factors behind the continent-wide numbers, including interesting country-level surges or declines in approval ratings depending upon the visibility of investments, trade policies and sanctions, physical presences such as Russia’s Wagner Group in the Sahel, and many other ever-changing dynamics. Read more (3 minute read).

#DiscoverMyAfrica, a partnership between Google, YouTube and the Africa Union aims to highlight the continent’s creatives as they showcase African life, like music, innovation, art, food, and fashion during May’s Africa Month.

Addis Ababa’s skyline.

Picture It - The Addis skyline indicates that the economy is somehow surviving despite several turbulent years. New skyscrapers continue to rise. Some are hopeful as efforts are made to liberalize coffee, trade and retail sectors. The Africa Development Bank Report (page 11) recently highlighted Ethiopia in the top 15 performers on the continent for 2023 GDP growth at 7.1%. We took this photo recently from the top of the Commercial Bank of Ethiopia (CBE), the tallest building in East Africa and also home to Marcus Samuelsson’s latest restaurant, a partnership with Hyatt Hotels. Our quick review: the food is decent to good and the view makes it worth the price! On your next trip to Ethiopia, reach out for more recommendations.

Thanks for reading.

P.S. Laura Davis here, your editor this week and co-CEO of Renew Capital, a pan-Africa venture capital firm with a presence in 14 countries. This is my 13th year living in Africa, and me and my team are committed to shedding more light on Africa’s ever-changing and improving outlook. We love the Africa Brief, and want to help grow what our friend Josh Nott started. I first came to Africa 26 years ago at 18 and since then have had a front-row seat viewing this dynamic landscape. I live here with my husband - the co-CEO of Renew Capital, and our well-traveled five-year-old daughter. I am an entrepreneur, experience creator and founder of a company that aims to change the image of Africa the world over. We invest in startups and build and operate our own. Hope to see you next week.

About: The Africa Brief aims to provide accurate and insightful information and opinions related to Africa’s macro trends. We hope to stay apolitical and present information in a balanced and objective manner. If you have feedback for us, please email [email protected].

Disclaimer: This newsletter provides general information only and is not investment advice. It does not consider any subscriber’s individual investment objectives, financial situation or means. It does not offer investment recommendations or solicitations. Consult your financial, legal and tax advisors before acting on any information in this newsletter. The Africa Brief is not responsible for actions taken based on this newsletter. Opinions herein may change based on economic and market conditions. Data from third-party providers is obtained from what are considered reliable sources but accuracy cannot be guaranteed.